DWS’s Sustainable Investments team seeks to create strategies with the potential for attractive financial returns while promoting measurable social and/or environmental outcomes for investors.

Sustainable Investments in numbers

- Global team located across four continents; fluent in 10+ languages

- Direct investment experience, supported by rigorous due diligence and social and environmental monitoring/metrics

- Integration of ESG/SI research and investments

- Diversity of product offering across private debt/equity investments and corporate sustainability solutions

- Solutions target global issues encapsulated in the United Nations’ Sustainable Development Goals (SDGs)

- Long-term leader on key ESG/SI initiatives – among the lead signatories of the UN Principles for Responsible Investing (UNPRI) in 2008, Investor’s Council Member of the Global Impact Investors Network (GIIN)

- Leader and active participant in numerous other key industry associations and networks, including;

For informational purposes only.

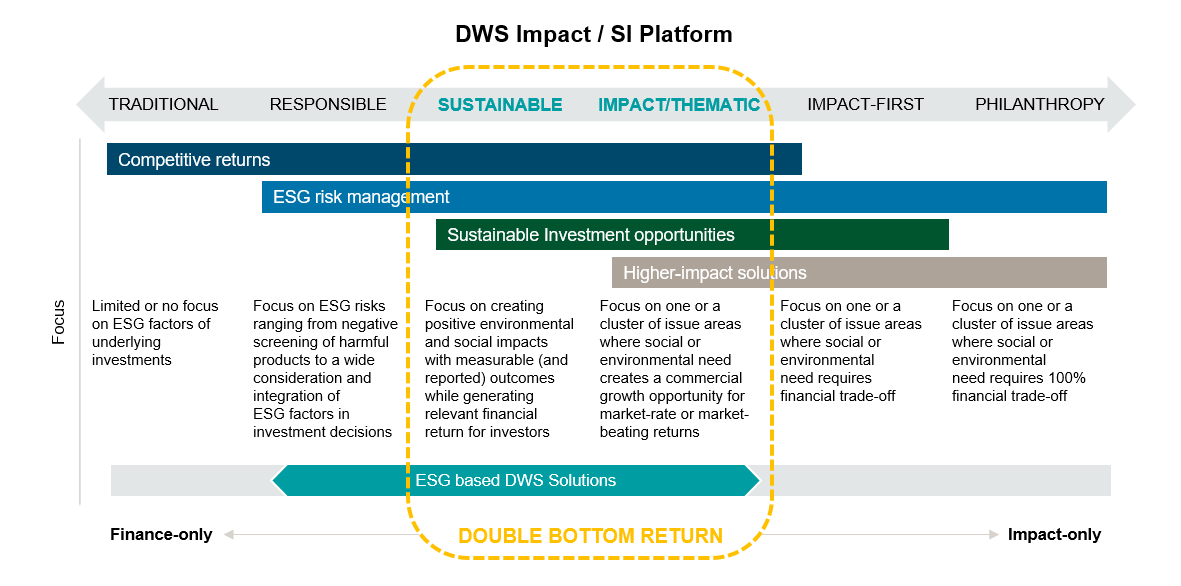

There is a wide spectrum of capital and investment categories for ESG and sustainable/impact investing. Strategies range from largely return-focused ESG risk management to pure philanthropy.

DWS offers the full spectrum, including sustainable investments and social impact investment products, spanning private as well as public funds.

- Our in-house proprietary investment capability and several decades of experience is a key differentiator among our competition

ESG Spectrum of investment categories

Focus on impact and financial return at scale

DWS offers the full spectrum of ESG, while DWS Impact SI focuses on double bottom return and scalability

Our team

Perspective library

Additional Alternatives

Get in touch

Your Sustainable Investments specialist

For general contact information, please visit our Contact us page under Profile

louise.moretto@dws.com

Louise Moretto

Alternatives Coverage Specialist