- Home »

- Insights »

- CIO View »

- Investment Traffic Lights »

- Investment Traffic Lights

- In April most asset classes suffered sharp losses. Bonds suffered a historically bad start to the year.

- The war in Ukraine has further troubled markets that were already anxious about inflation and interest rates. Supply chains, too, are continuing to struggle, with the war and Chinese lockdowns a further negative.

- We continue to foresee uneasy markets in which concerns about inflation may slowly give way to concerns about growth.

to read

1 / Market overview

April 2022 won’t go down as a very gentle month. Most parts of capital markets took serious hits. Data deteriorated: inflation, headline and core, and producer prices, were still worse. Forecasts for this year's central bank interest rate moves were therefore further revised up by the market. In addition, global purchasing managers' indices signaled a further slowdown in growth. And meanwhile Russia's war against Ukraine raged on, keeping upward pressure on many commodity prices. But some April changeability was evident in the reduced surprise effect. No longer shocked, the market is now trying to distinguish more precisely between short- and long-term developments.

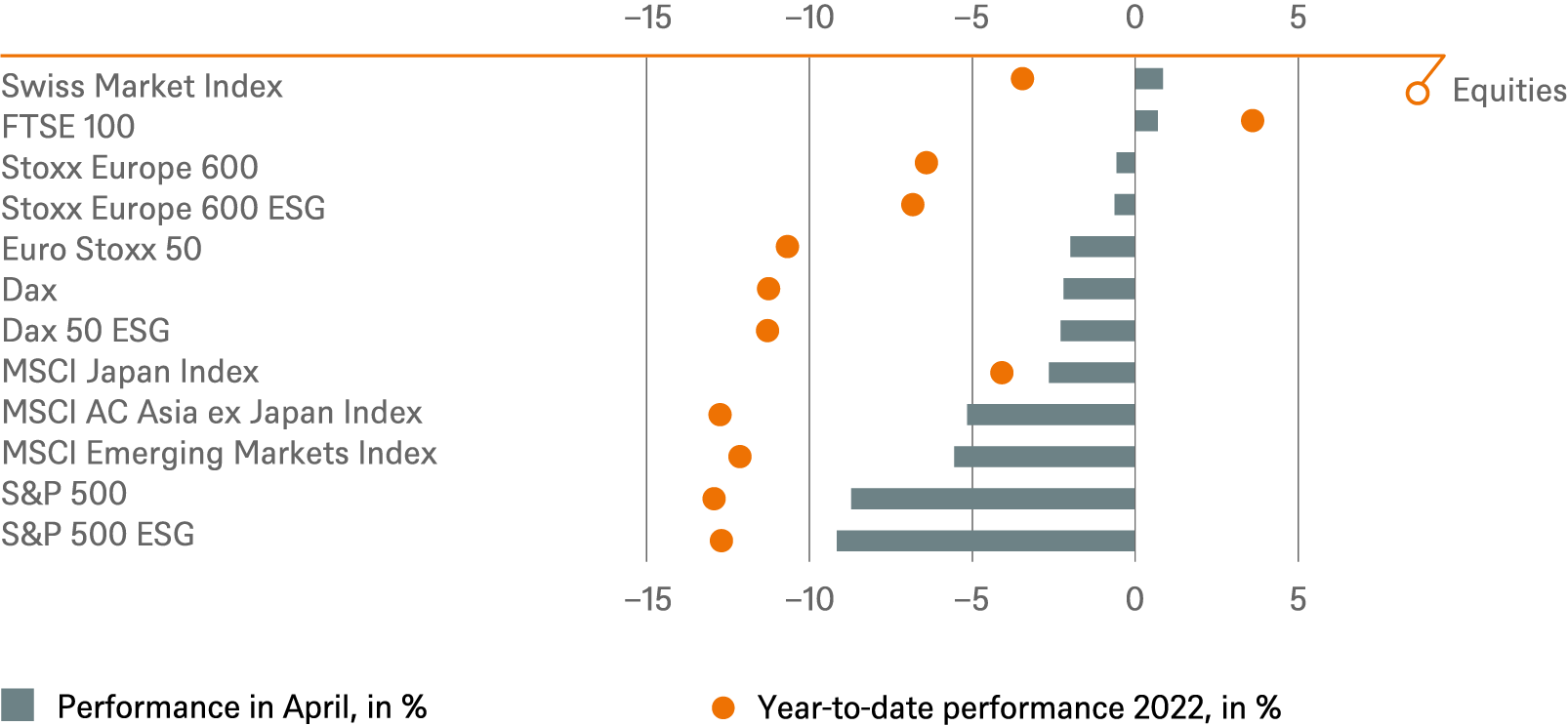

The stock markets had managed to recover in the course of March, not least because the excessive price jumps in commodities had eased. But this recovery was then followed by another correction in April, with the MSCI AC World falling again below its low in early March. It is difficult to say to what extent this can still be attributed to the war. On the one hand, Russia has closed off the gas pipeline to Poland and Bulgaria, and the EU has launched an oil embargo. Also, Russian rhetoric is becoming even more strident: tactical nuclear strikes, World War III, general mobilization. On the other hand, the Russian invasion is stalling in the Donbas, the Moskva, the flagship of Russia's Black Sea Fleet, was sunk, Ukraine attacked targets on Russian territory, and the West's arms deliveries to Ukraine gained momentum. Thus, the war continues to have the potential for further escalation. But in the short term it does not seem certain to steer the market in any direction. In Western politics, at least one potential trouble spot was defused after Emmanuel Macron won the French presidential election. The victory of the Liberals in the Slovenian parliamentary elections was also generally perceived as a boost for Europe.

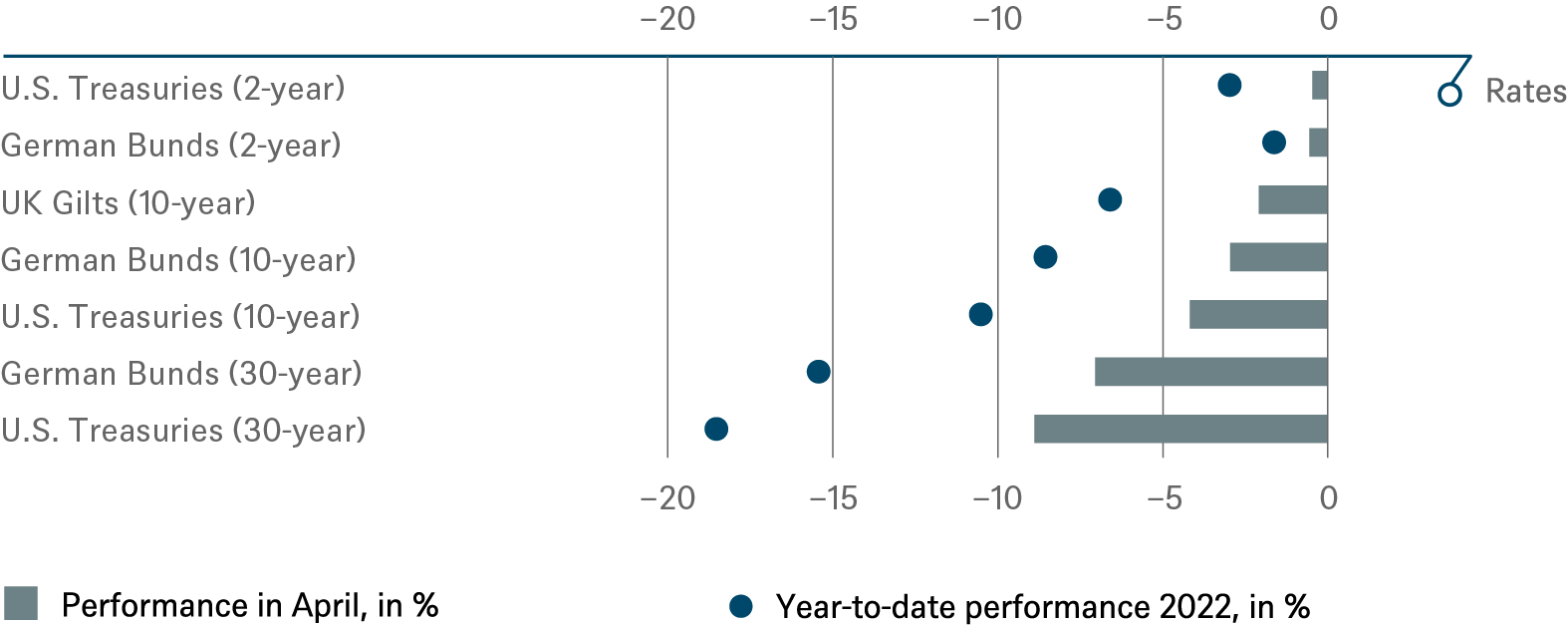

In the markets, however, interest rates seemed to be April’s main driver. The clear loser was government bonds, above all U.S. Treasuries. As in the previous month, they fell by 3.1%; on a monthly basis, it is 18 years since they did as badly. Looking at the year-to-date performance, it is also the worst start to the year for U.S. bonds since records began. Other government bonds were also unable to escape. By the end of April, ten-year U.S. yields had risen fast to just below 3%, from less than 2% in early March, and the corresponding Bund yields, still negative in early March, to just below 1%. The Fed’s announcement of a 50-basis point rate increase at the beginning of May was seen as moderate by the markets, which had feared 0.75 percentage points. Rising nominal yields also pushed up real yields. In the US yields of 10-year inflation-linked bonds dropped close to zero in April and May then began with positive real yields. This increase in nominal and real bond yields was not supportive for equities. They also suffered from ongoing supply chain problems, fueled by China's Covid lockdowns of entire cities. The quarterly reporting season failed to provide any significant impetus to the markets, as companies were bruised by rising costs. The S&P 500 suffered its biggest monthly loss since March 2020, falling 8.7 percent, while the Nasdaq 100 lost as much as 13.3 percent, its worst performance since 2008.[1]

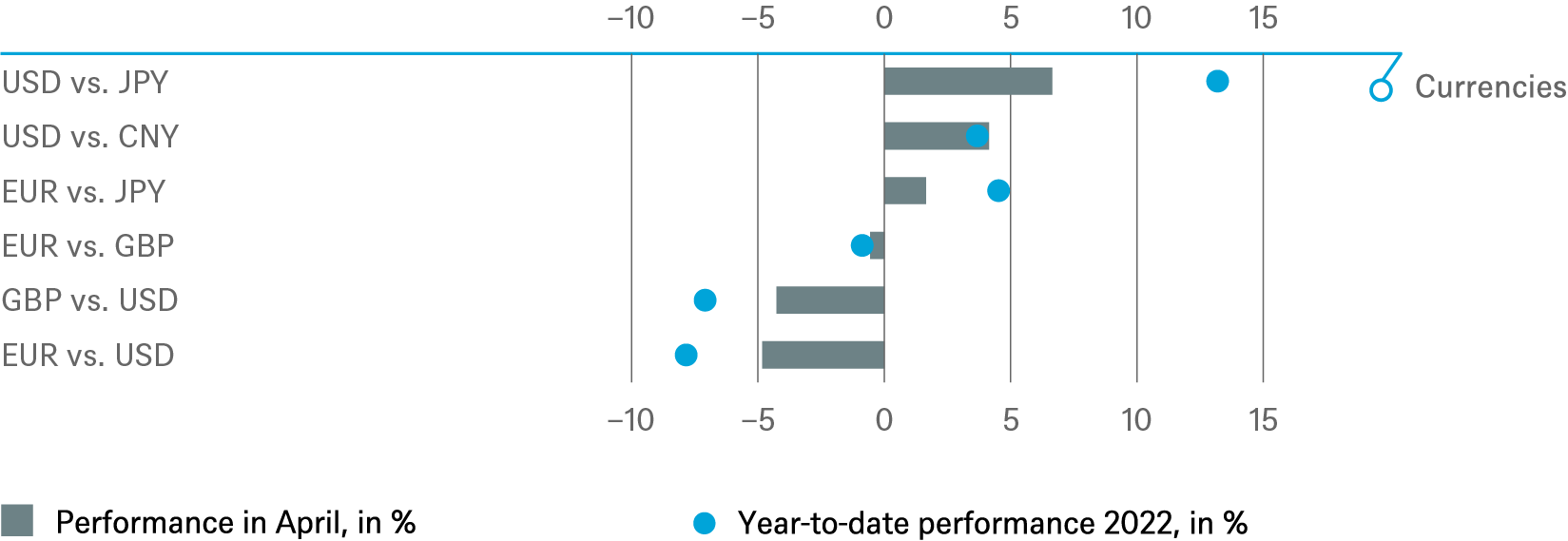

April also provided a storm in the foreign exchange market. The dollar[2] posted its best monthly performance since January 2015, gaining 4.7% against a basket of currencies and rising to $1.05 per euro. The Japanese yen weakened against the dollar particularly badly, losing 6.2%.

2 / Outlook and changes

Several, partly opposing trends will shape the coming months on the capital markets. The economy is still in the post-Covid upswing: Pent-up corporate investment plans and consumer spending, especially on services, continue to support demand. At the same time, China's Covid measures, the Ukraine war, incessant high inflation and the central banks' response to it are weighing on sentiment, as is already clearly evident in deteriorating financial conditions. We expect concern about inflation to give way to increased worry about growth in the course of coming months.

2.1 Fixed income

Bond yields continued to move higher across all maturities in April, but we believe they are likely to take a breather, especially at the longer end. We are therefore Neutral on 10-year Treasuries and Bunds. After Jerome Powell all but ruled out rate hikes of 0.75% after the Fed meeting in early May, investors' concerns about tightening might have peaked, at least in the U.S.. We are therefore moving back from Negative to Neutral on short-end, 2-year Treasuries. Nevertheless, the market should no longer doubt the Fed's will to do what is necessary. Therefore, the uncertainty now stems essentially from the actual inflation trend. If there is no easing in the second half of the year, investor nervousness will again worsen. In the Eurozone, the ECB has yet to demonstrate that it has not only recognized the warning signs from inflation and the bond markets but is going to act accordingly. The market expects the first 0.25% rise in the deposit rate in July.

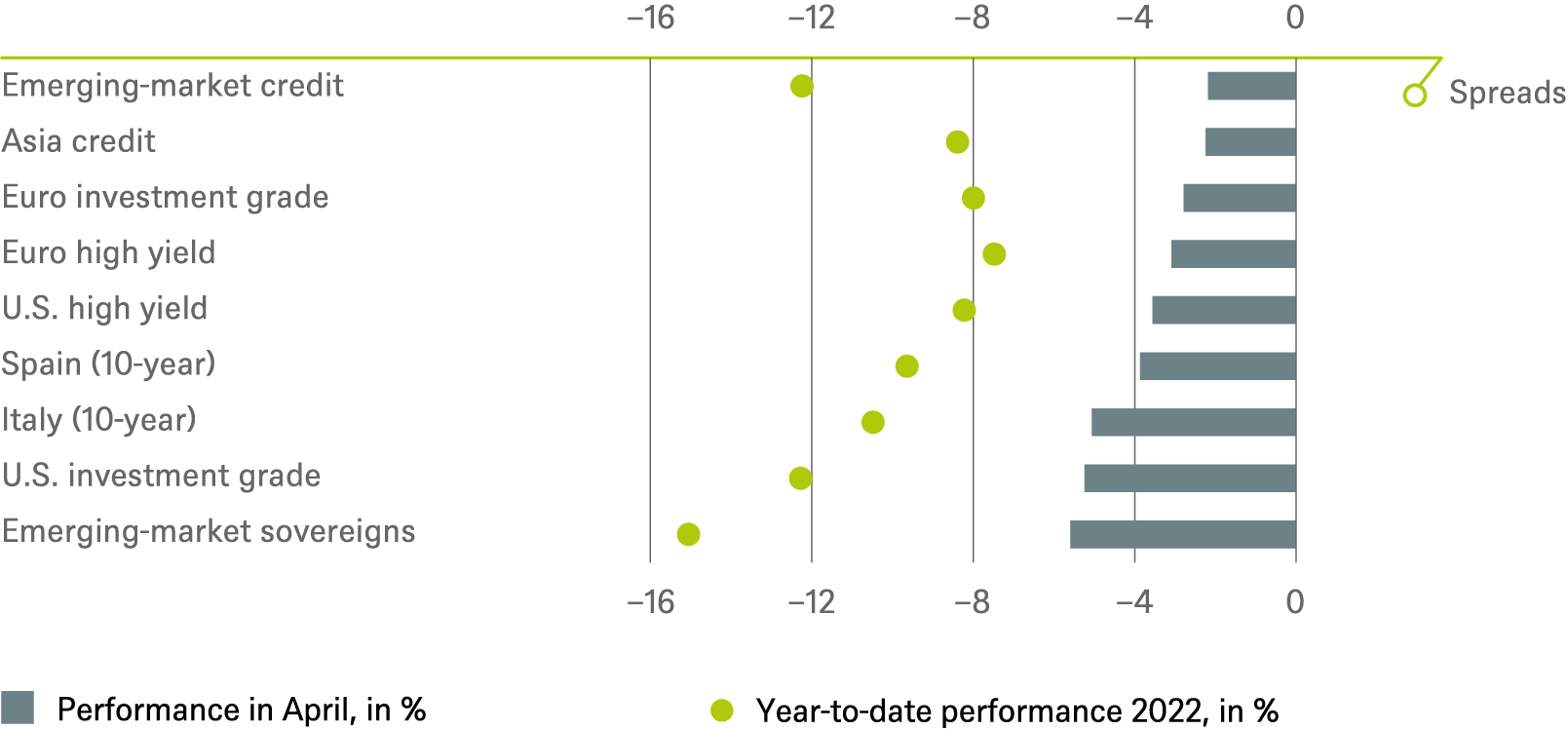

The post-meeting drop in concern about an even more aggressive Fed is also one of the reasons why we are moving back to Neutral on emerging markets after an interim downgrade. In addition, we think concerns about China's economy may have peaked, especially after the government announced a new set of stimulating measures at the end of April. We are now Neutral across the board on corporate bonds, having become more cautious on European high-yield bonds. Price inflation, supply chain issues and higher refinancing costs are likely to be increasingly reflected in the figures of some issuers, in our view.

On the currency front, we do not expect the dollar to extend further its rally, especially against the euro, but rather to consolidate.

2.2 Equities

We believe the coming months could continue to be quite volatile for equities. The strongest headwind will come from interest rates. The expected end of the period of negative real yields in the U.S. weakens the case for equities. By our calculation, every 10-basis point increase in real yields drags the S&P 500 down by 1% and the tech sector by 2% – a major blow to TINA, the “There is no alternative” argument that has long supported equities. In addition to interest rates and the risks already mentioned above, European equities in particular are threatened with further adversity if gas supplies from Russia fall. We therefore remain cautious overall and maintain our overweight in the defensive healthcare sector.

At the sub-sector level, we are remaining with the commodity cycle theme, i.e. overweight the oil services sector and the entire agribusiness value chain, as the tough sanctions on Russia sanctions and associated high commodity prices are likely to persist. We recently downgraded the U.S. transportation sector within industrials as freight rates decline, reflecting a subdued economic outlook. We also downgraded the metals & mining sub-sector. After a very good run this year, we think that current valuation levels no longer adequately reflect the short-term risks from cost inflation and the slowdown in growth. European financials, on the other hand, now look better placed than their international peers due to the combination of a supportive interest rate environment, low exposure to Russia and favorable valuations.

We are surprised that consensus earnings for equities have not yet been revised downward. This is likely to change. Particularly in Europe, some companies are already scaling back their expectations for the first quarter reporting season.

2.3 Alternatives

Investors will continue to focus on commodities in coming months. So will politicians, as rising energy and food prices are one of consumers’ biggest concerns, not only in emerging economies but also in developed ones. In the short-term commodity price developments will continue to be strongly influenced by three factors: the war in Ukraine (including sanctions on Russia), China's Covid lockdowns, and the global growth environment. Although investors have already attached significant risk premiums to commodities with significant levels of Russian supply, this is likely to remain an area of pronounced price volatility. In addition, the war is likely to have a greater impact on supply than on demand, and global supply was already lagging because past investment has proven insufficient. In general, we expect supply growth for most commodities to be limited and unlikely to be sufficient to meet demand, even given the expected slowdown in global growth. In our view, this should lead to a further tightening of supply/demand fundamentals for all commodities in the medium to long term.

In real estate the European logistics sector has recently significantly outperformed other segments of the market in terms of rental growth and total returns. However, we are now moving to a more selective and cautious stance. Initial yields are at record low levels, while the fundamental situation of some tenants could soon deteriorate. In other words, risks are rising. We continue to favor the urban logistics sector with its limited supply and look in particular to niche players such as cold storage, which we believe have greater pricing power.

3 / Past performance of major financial assets

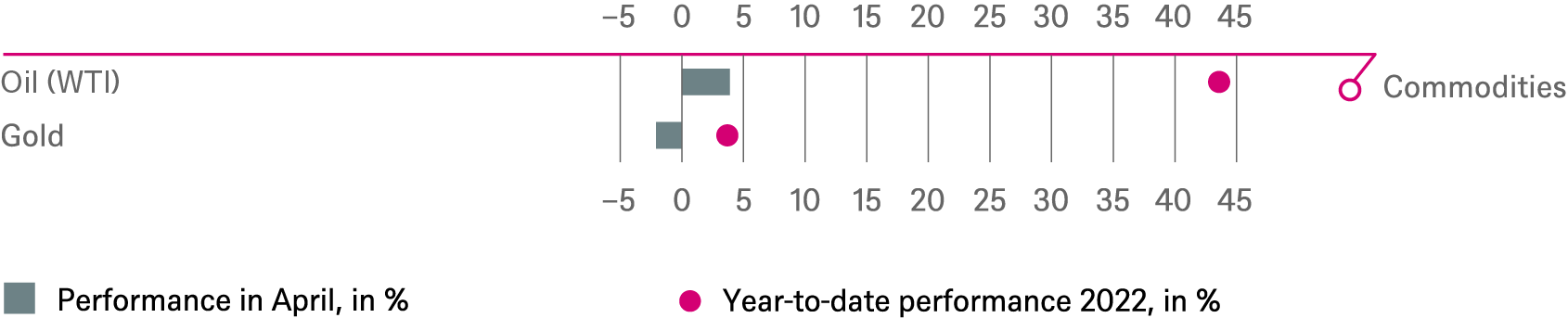

Total return of major financial assets year-to-date and past month

Past performance is not indicative of future returns.

Sources: Bloomberg Finance L.P. and DWS Investment GmbH as of 4/30/22

4 / Tactical and strategic signals

The following exhibit depicts our short-term and long-term positioning.

4.1 Fixed Income |

||

|---|---|---|

Rates |

1 to 3 months |

until Mar 2023 |

| U.S. Treasuries (2-year) | ||

| U.S. Treasuries (10-year) | ||

| U.S. Treasuries (30-year) | ||

| German Bunds (2-year) | ||

| German Bunds (10-year) | ||

| German Bunds (30-year) | ||

| UK Gilts (10-year) | ||

| Japan (2-year) | ||

| Japan (10-year) |

Spreads |

1 to 3 months |

until Mar 2023 |

|---|---|---|

| Spain (10-year)[3] | ||

| Italy (10-year)[3] | ||

| U.S. investment grade | ||

| U.S. high yield | ||

| Euro investment grade[3] | ||

| Euro high yield[3] | ||

| Asia credit | ||

| Emerging-market credit | ||

| Emerging-market sovereigns |

Securitized / specialties |

1 to 3 months |

until Mar 2023 |

|---|---|---|

| Covered bonds[3] | ||

| U.S. municipal bonds | ||

| U.S. mortgage-backed securities |

Currencies |

||

|---|---|---|

| EUR vs. USD | ||

| USD vs. JPY | ||

| EUR vs. JPY | ||

| EUR vs. GBP | ||

| GBP vs. USD | ||

| USD vs. CNY |

4.2 Equities |

||

|---|---|---|

Regions |

1 to 3 months[4] |

until Mar 2023 |

| United States[5] | ||

| Europe[6] | ||

| Eurozone[7] | ||

| Germany[8] | ||

| Switzerland[9] | ||

| United Kingdom (UK)[10] | ||

| Emerging markets[11] | ||

| Asia ex Japan[12] | ||

| Japan[13] |

Style |

||

|---|---|---|

| U.S. small caps[25] | ||

| European small caps[26] |

4.4 Legend

Tactical view (1 to 3 months)

- The focus of our tactical view for fixed income is on trends in bond prices.

- Positive view

- Neutral view

- Negative view

Strategic view until March 2023

- The focus of our strategic view for sovereign bonds is on bond prices.

- For corporates, securitized/specialties and emerging-market bonds in U.S. dollars, the signals depict the option-adjusted spread over U.S. Treasuries. For bonds denominated in euros, the illustration depicts the spread in comparison with German Bunds. Both spread and sovereign-bond-yield trends influence the bond value. For investors seeking to profit only from spread trends, a hedge against changing interest rates may be a consideration.

- The colors illustrate the return opportunities for long-only investors.

- Positive return potential for long-only investors

- Limited return opportunity as well as downside risk

- Negative return potential for long-only investors