- Home »

- Insights »

- CIO View »

- Investment Traffic Lights »

- Investment Traffic Lights

- In September the market again showed investors its ugly side, with both bonds and equities continuing to go downhill amid high volatility.

- The turbulence in the UK capital market has shown that investors are once again looking at the macroeconomic data of countries at a time of high inflation, high interest rates and restrictive central banks.

- We think that inflation in Europe has not yet peaked and that not all the negative effects of fast-rising interest rates have yet become apparent. But we believe you can find good investment opportunities after the market corrections, provided you expect only a mild recession.

1 / Market overview

1.1 United Kingdom - outlier or typical example?

Despite everything that happened around the world last month, September was dominated by the United Kingdom. The country was united as rarely before by the death of the Queen, and divided, as has been the case most of the time since Brexit, in day-to-day politics. The most recent rifts did not even require the opposition. The prime minister, Liz Truss, who has been in office since September 6 thanks to the votes of the party base and despite not being the choice of Conservative MPs, took less than a month to turn her inaugural honeymoon period into a disastrous row, helped by her finance minister, Kwasi Kwarteng. Following publication of what was called a "mini" budget, the yields on 10-year UK government bonds (Gilts) shot from 3.5 to over 4.5% in just three trading days and the pound plunged to an all-time low of 1.035 U.S. dollars before the Bank of England (BoE) felt compelled to intervene.

The most controversial part of the budget, reducing the top tax rate from 45% to 40%, has since been scrapped by the Truss/Kwarteng team. The BoE’s “unlimited” (at least according to the announcement) purchase of 30-year Gilts has so far helped reduce the 10-year Gilt yield to a little below 4% and stabilize the pound at close to USD 1.14. But more than the bank’s short-term fix is likely to be necessary to guarantee stability. The mini budget surprised even Conservative politicians by providing broad relief for top earners and enterprises and optimistically expecting 2.5% growth in the medium term thanks to these policies. That the tax cuts were to be funded from increased borrowing unsettled markets. But it was probably the entire environment that contributed to this deficit budget blowing up in Kwarteng's face. The pound had been weak for some time, British inflation has been high for some time and interest rates have been soaring since early August. Add to that a BoE meeting one day before Kwarteng's speech which resulted in an interest rate hike of only 50 basis points when the ECB and Fed had raised by 75 basis points. In addition, the BoE stuck to its plan to run down the bond holdings accumulated through quantitative easing. The plan is to reduce around 10% of the portfolio, around 80 billion pounds.

Since the jump in Gilt yields immediately spread to other European and U.S. government bonds, it is not unreasonable to assume that investors were no longer concerned solely with the British budget but feared the U.K. might exemplify the concerns of all those countries that had enjoyed a loose monetary policy for many years and now have to fight high inflation rates. This threatens further increases in government debt as the so-called cost-of-living crisis is having to be countered in many cases with fiscal aid packages. In other words, since September politicians have had to come to terms with the fact that budget deficits and public debt ratios are once again being scrutinized more closely by the capital markets. The media are talking about the return of the "bond vigilantes". Italy's new government, which is probably not offended by being called right-wing, populist and EU-skeptic, is also feeling the pressure. The risk premium on Italy's government bonds over Bunds shot up to its highest level since early 2020, despite eager ECB purchases. But the fact that central banks are beginning to accompany their rate rises with bond sales rather than purchases is creating a dangerous mix.

1.2 Bad week, bad month and bad quarter

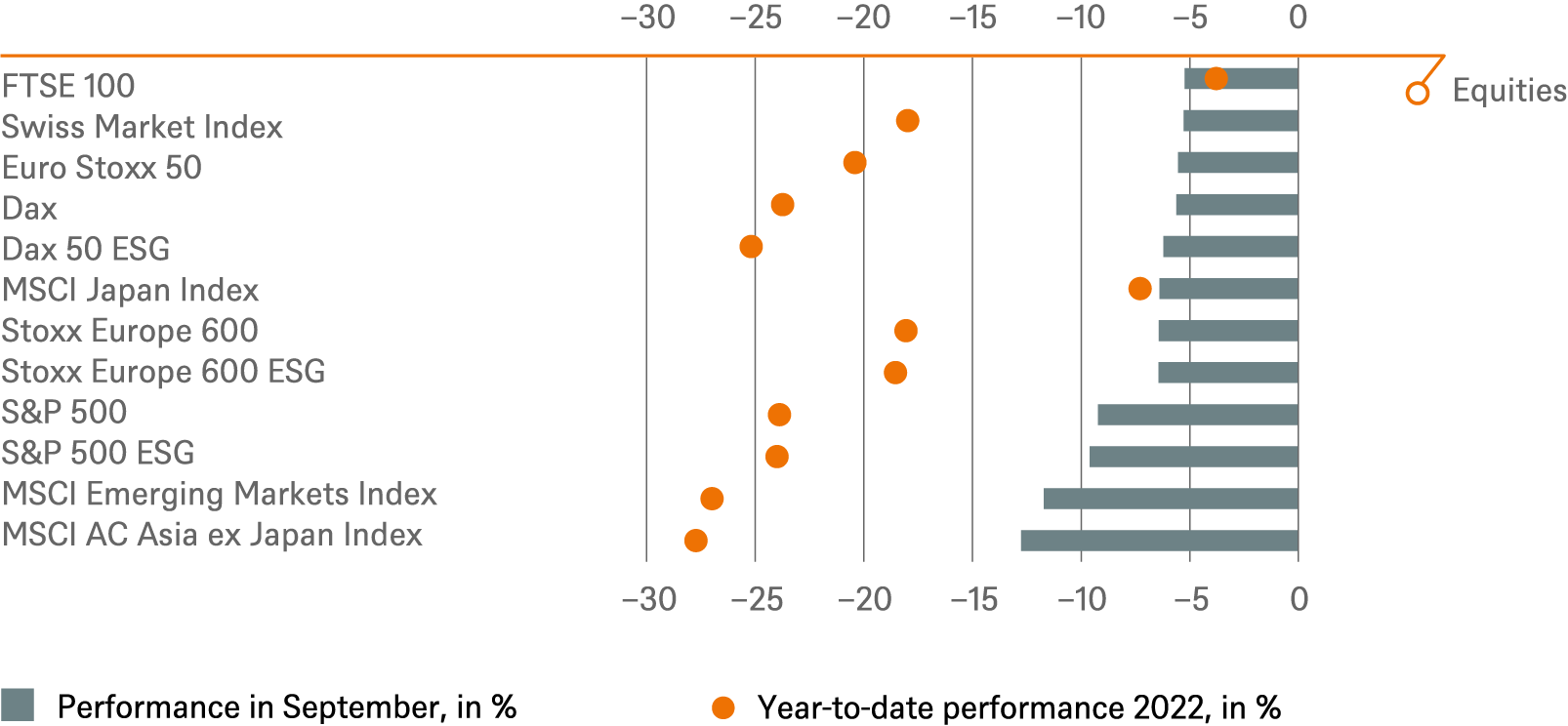

The month of September ended with a bang, for stocks, bonds and pretty much all currencies that weren't called the U.S. dollar. The third quarter was split into two. The bear market rally enjoyed good momentum until mid-August, but then sentiment tipped and both equities and bonds fell to new lows. The fact that bonds lost as much as equities at the global level, around 7% for the quarter as a whole, is likely to be of little consolation to bondholders. The annus horribilis just won't stop for them: Since the beginning of the year the Bloomberg Global Aggregate Bond Index has lost a fifth of its value. But given the previous low absolute level of yields, the unabated hawkishness of central bankers and the further upward surprises in inflation figures, this can't really come as a surprise.

The Eurozone posted the first double-digit inflation rate in its history - 10.0% consumer price inflation for September - and in the U.S., core inflation just won't go down - in August, it rose from 5.9 to 6.3%. With these numbers, it's understandable that investors are torn between despair and joy when they see bad macro numbers: lamenting the weaker growth but encouraged by the hope that it leads to lower inflation. At the beginning of October, for example, weak purchasing managers' indices for U.S. manufacturing cheered the markets. But there is still little evidence of any downturn in the labor market, either in the U.S. or Europe.

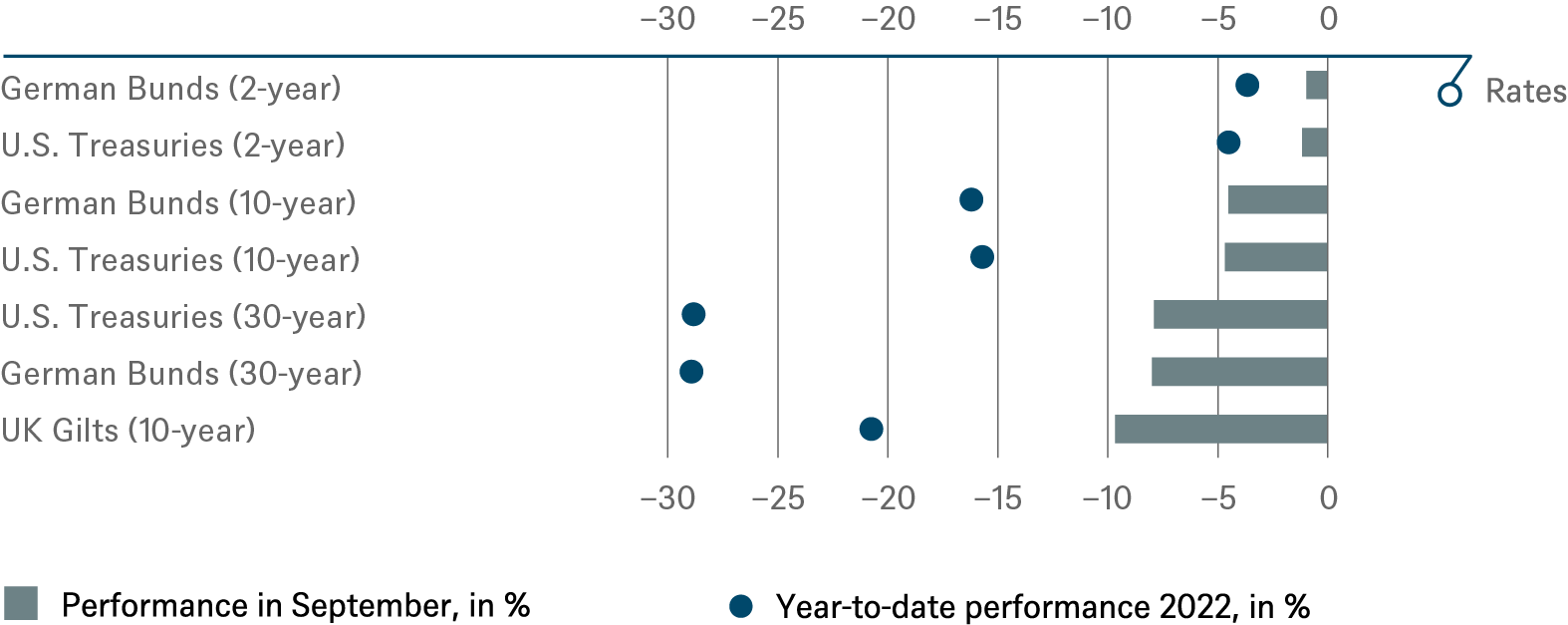

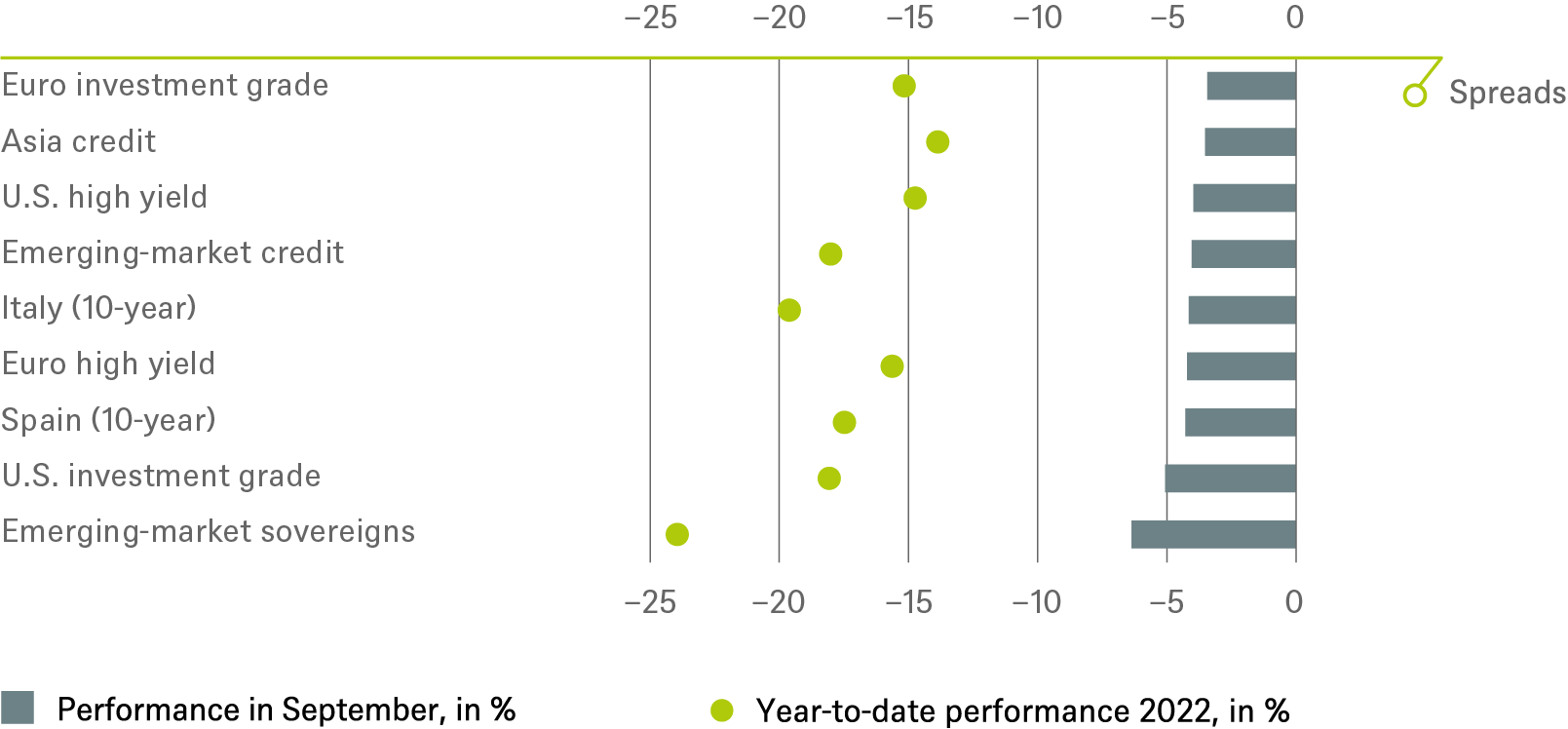

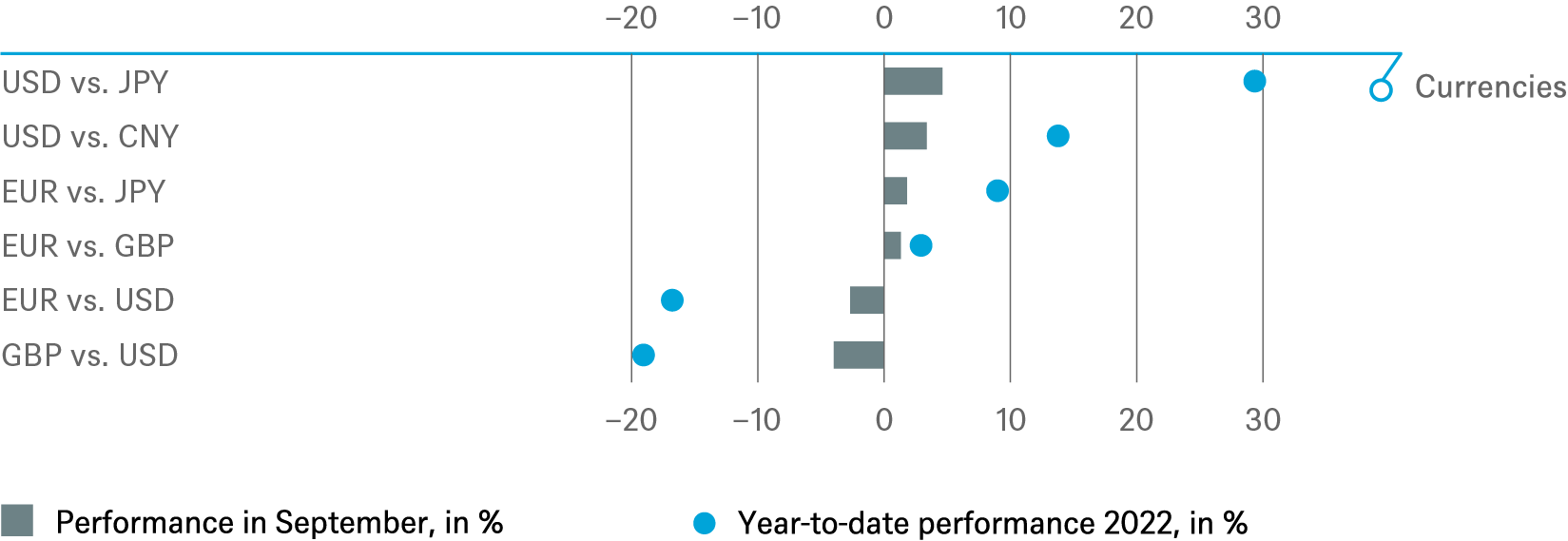

Other notable price movements in September were in German Bunds: 2-year and 10-year Bund yields both jumped above 2%. Inflation-indexed 10-year Bunds briefly ventured into positive territory, so there was something to earn in real terms for the first time since 2014. Other 10-year bonds also broke through big figures: Italian and British bonds jumped at one point to over 4.5%, while U.S. bonds "only" rose to 3.99%, but the 2-year maturities yielded 4.3%. The dollar also went through the roof, with the dollar index gaining almost 10% within the third quarter. Last but not least, corporate bond yields also leaped in September. High yield bonds are living up to their name and currently yield almost 10% in the U.S. and over 8.5% in Europe. And that might not be the peak yet, given just how nervous investors are.

2 / Outlook and changes

From a tactical point of view, we remain cautious on most asset classes for the time being, even though we believe that positive returns should be achievable on a 12-month horizon. As we had suspected earlier this year, the second half of 2022 is proving very challenging. Investor nervousness, which we think may cause volatile markets and fresh lows for some time to come, springs from several sources. First, there is the uncertainty about the persistence of inflation and central banks’ reactions to it. That they want to raise interest rates as quickly as possible to their supposed high for this interest rate cycle is now the market consensus. When the central banks will stop raising rates and even reverse course is the next question on investors’ minds. Secondly, despite, or even because of, the Ukrainian army’s military victories, Moscow's possible reactions are a growing worry. Thirdly, the corporate reporting season that is now beginning should, in our opinion, lead to a further reduction in consensus estimates for 2023. Finally, not the least of the worries is that the recent rapid rise in interest rates and bond yields is yet to have its full impact on the economy and households. This impact could lead to further turbulence in the capital markets.

2.1 Fixed Income

We have largely watched the September turbulence in the bond market from the sidelines. We continue to expect government bond yields to rise slightly, especially at the short end, as in our view investors tend to bet too soon on a central bank turnaround and over-interpret individual signals (such as the BoE's intervention in the U.K. Gilt market or the lower-than-anticipated interest rate hike by the Royal Bank of Australia).

At the same time, however, yields have already moved, for the most part, towards our strategic price targets. In corporate bonds, we have become somewhat more cautious tactically and have downgraded the investment-grade segment in Europe. Given a combination of what we see as an economic cycle that is moving into recession with risk-averse investors and the absence of the ECB as a price-insensitive bond buyer, we envisage that yields will rise further (and prices fall accordingly). Emerging market bonds are also suffering. Investors are avoiding them due to the strong dollar and high yields in the U.S. market. At the same time, we think the dollar might at least take a breather after its strong rally. In the short term, we see the euro in particular as being able to regain ground

2.2 Equities

We have made no changes in the equity segment, either geographically or in sectors. We enter the upcoming reporting season with mixed feelings. Analysts will probably revise down further their earnings estimates for 2023 but some companies could deliver figures that are solid enough to positively surprise equity markets that have recently been very risk averse. From a tactical point of view other factors might speak in favor of a stronger fall – apart from the seasonal factor itself, which historically has been advantageous. One is that institutional investors are very pessimistic, according to surveys and positioning in the derivatives markets. Secondly, stock market valuations (measured by the price-earnings ratio) correlate closely, and negatively, with stock volatility and real returns. As neither volatility nor real yields should continue to move upwards as fast as in recent months, the omen for valuations could be good. And another consideration is that higher bond yields mean it is no longer the case that equities have "no alternative".

2.3 Alternatives

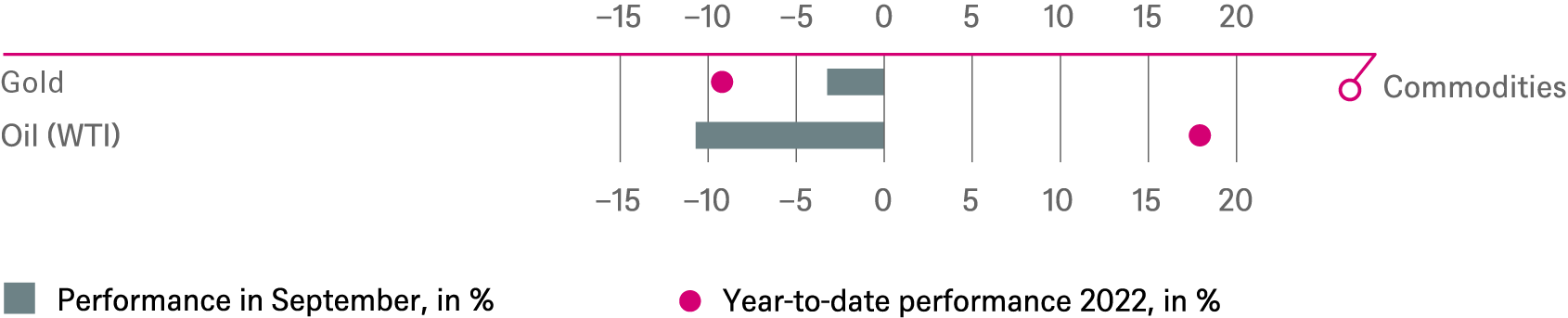

The disciplined approach of the OPEC+ group and the prospect of imminent replenishment of the U.S. strategic oil reserve (with which the U.S. has been flooding the market for a long time), suggest to us that the oil price will be supported at its current level until the end of the year.

Gold has been under pressure since March, because of the strong dollar and the significant rise in real interest rates. These factors should stabilize but we believe they are not enough to provide fresh impetus for gold.

3 / Past performance of major financial assets

Total return of major financial assets year-to-date and past month

Past performance is not indicative of future returns.

Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 9/30/22

4 / Tactical and strategic signals

The following exhibit depicts our short-term and long-term positioning.

4.1 Fixed Income

Rates |

1 to 3 months |

until Sep 2023 |

|---|---|---|

| U.S. Treasuries (2-year) | ||

| U.S. Treasuries (10-year) | ||

| U.S. Treasuries (30-year) | ||

| German Bunds (2-year) | ||

| German Bunds (10-year) | ||

| German Bunds (30-year) | ||

| UK Gilts (10-year) | ||

| Japanese government bonds (2-year) | ||

| Japanese government bonds (10-year) |

Spreads |

1 to 3 months |

until Sep 2023 |

|---|---|---|

| Spain (10-year)[1] | ||

| Italy (10-year)[1] | ||

| U.S. investment grade | ||

| U.S. high yield | ||

| Euro investment grade[1] | ||

| Euro high yield[1] | ||

| Asia credit | ||

| Emerging-market credit | ||

| Emerging-market sovereigns |

Securitized / specialties |

1 to 3 months |

until Sep 2023 |

|---|---|---|

| Covered bonds[1] | ||

| U.S. municipal bonds | ||

| U.S. mortgage-backed securities |

Currencies |

|

|

|---|---|---|

| EUR vs. USD | ||

| USD vs. JPY | ||

| EUR vs. JPY | ||

| EUR vs. GBP | ||

| GBP vs. USD | ||

| USD vs. CNY |

4.2 Equity

Regions |

1 to 3 months[2] |

until Sep 2023 |

|---|---|---|

| United States[3] | ||

| Europe[4] | ||

| Eurozone[5] | ||

| Germany[6] | ||

| Switzerland[7] | ||

| United Kingdom (UK)[8] | ||

| Emerging markets[9] | ||

| Asia ex Japan[10] | ||

| Japan[11] |

Style |

1 to 3 months |

|

|---|---|---|

| U.S. small caps[22] | ||

| European small caps[23] |

4.4 Legend

Tactical view (1 to 3 months)

- The focus of our tactical view for fixed income is on trends in bond prices.

- Positive view

- Neutral view

- Negative view

Strategic view until September 2023

- The focus of our strategic view for sovereign bonds is on bond prices.

- For corporates, securitized/specialties and emerging-market bonds in U.S. dollars, the signals depict the option-adjusted spread over U.S. Treasuries. For bonds denominated in euros, the illustration depicts the spread in comparison with German Bunds. Both spread and sovereign-bond-yield trends influence the bond value. For investors seeking to profit only from spread trends, a hedge against changing interest rates may be a consideration.

- The colors illustrate the return opportunities for long-only investors.

- Positive return potential for long-only investors

- Limited return opportunity as well as downside risk

- Negative return potential for long-only investors