- Home »

- Insights »

- CIO View »

- Chart of the Week »

- That perennial de-dollarization debate

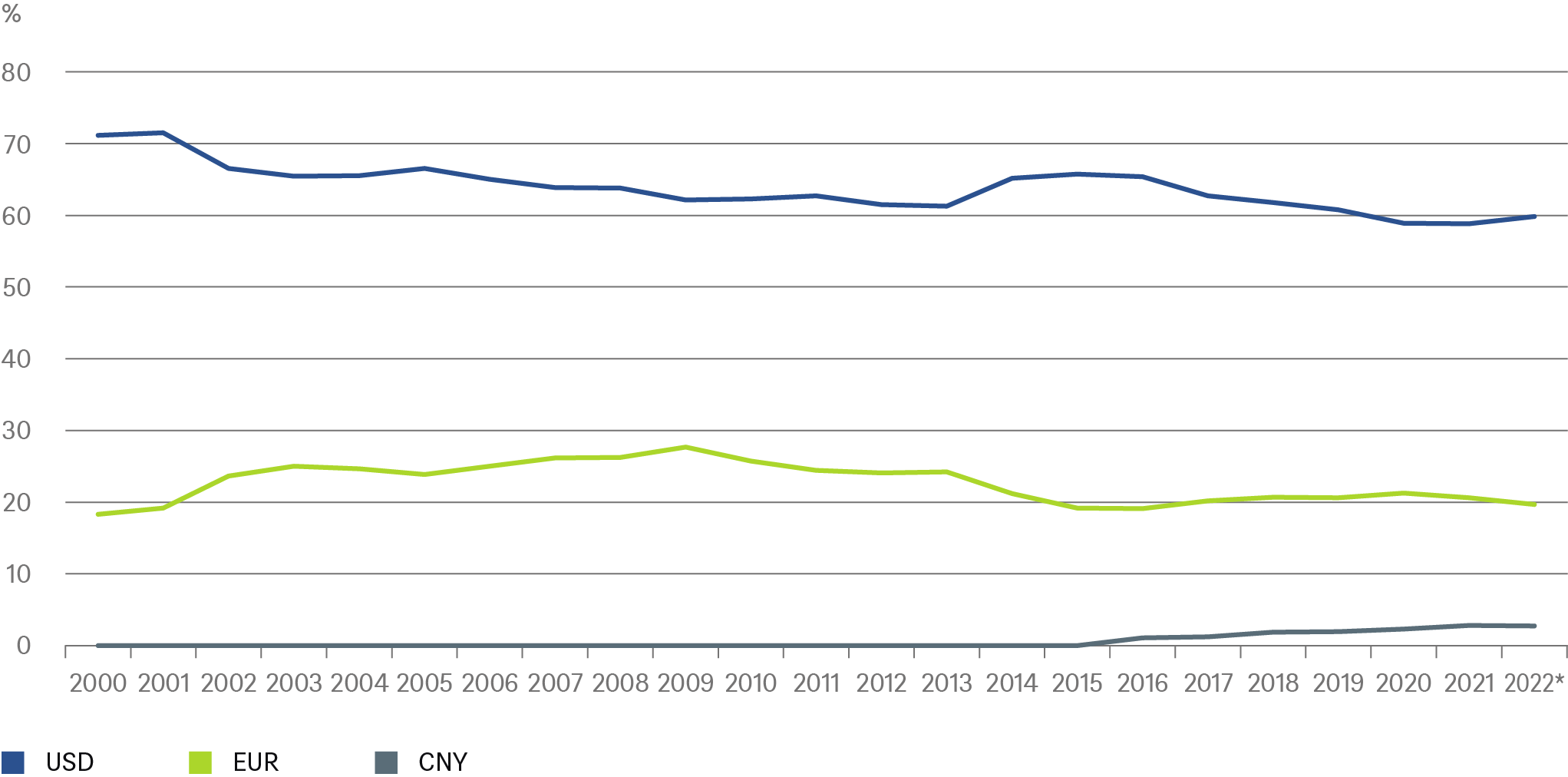

A reassuringly boring picture of world’s central banks’ dollar holdings

* Data until Q3 2022

Sources: Bloomberg Finance L.P., IMF, DWS Investment GmbH as of February 2023, as of 5/2/23

Given how entrenched the greenback’s position is in international trade and finance, though, we would strongly caution against any trying to identify particular events as sudden triggers. Take Western sanctions against Russia after the Russian invasion in Ukraine and resulting changes in inflation, interest rates and currencies since February 2022. This seems to have caused many central banks to dramatically rebalance their portfolios – but probably in quite a mechanical fashion, rather than deliberate policy changes. Otherwise, why would the counterbalancing “real” increases (after adjusting for price changes) to offset the “real” decline in the dollar’s share mainly show up in the shares of Euro and Yen?

In any case, most would-be global reserve currencies, notably China’s Yuan, would have to see dramatic changes in domestic policies to enable them to fulfill the world’s needs for safe assets currently (mainly) served by U.S. treasuries. There is an interesting twist, however. It does appear that more and more emerging market central banks have continued to increase the share of gold in their reserves, mainly at the expense of dollar-denominated bonds. It would be interesting to know how much of this recently acquired central bank gold is actually held within the countries in question. The experience of the Baltic states in the last century are instructive in this regard[1]. For one thing, it underlines the wisdom of keeping some central reserves – in whatever form - safe from foreign invaders by storing them in stable and wealthy democracies, especially for small democracies in fear of powerful, autocratic neighbors.