- Home »

- Insights »

- CIO View »

- Chart of the Week »

- What U.S. interest rates are (and aren’t) telling us

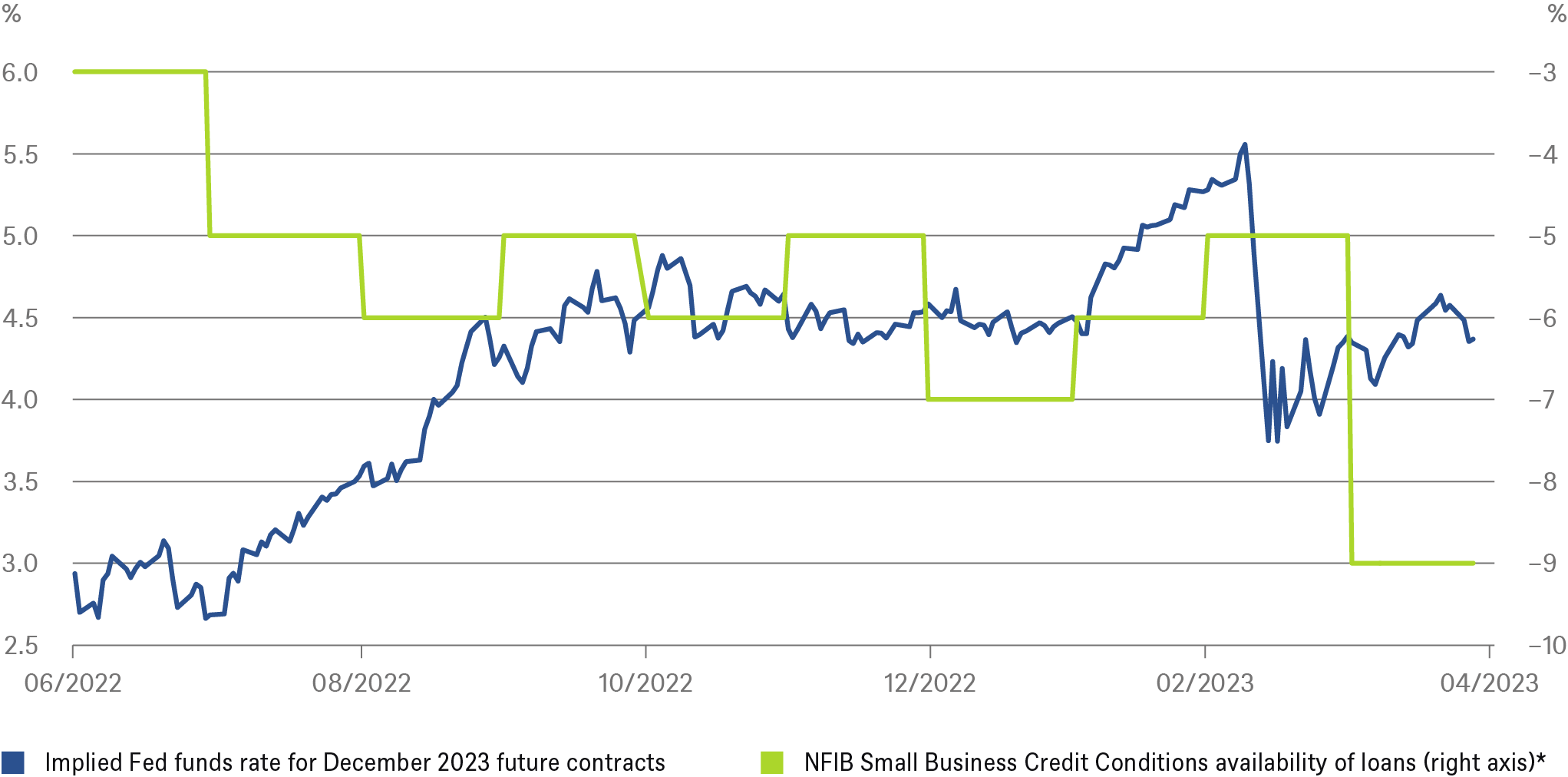

After a few volatile months, interest rate expectations are back to former levels, while lending is becoming more restrictive

* Index from "The National Federation of Independent Business"

Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 4/26/23

It is true, of course, that the banking turmoil in the U.S. has not left markets unaffected. Although the S&P 500 is higher today than it was before the collapse of Silicon Valley Bank on March 8, stock market volatility is lower and bond market volatility is at the same level as at the beginning of March. Still, 10-year U.S. Treasury bonds are yielding more than 50 basis points less, the KBW banking index[1] is down a fifth, and the gold price is about $200 higher than it was in early March[2].

What is the market saying? One message is that it does not consider the systemic risk to be over. The other message is less straight forward, as the 4.4% represents a probability-weighted outcome of various scenarios. For sure, investors now see a higher risk of recession – because credit will tighten even faster now, or has already begun to do so, as the chart shows. This tightening is also likely to be reflected in the level of the Fed funds rate by the end of the year. The market’s view that the rate will fall ultimately reflects the assumption that recession will come sooner, with tightening credit conditions doing some of the Fed's work. But the market may also be factoring in the residual risk of another bank collapse or other major disruption in the financial market, which could then prompt the Fed to cut rates. And finally, of course, the intensifying risk of a budget impasse, with the debt ceiling potentially not raised by Congress in time, is also not leaving market participants indifferent.

From this perspective, we can certainly see the possibility of a year-end Fed funds rate of 4.4%. But our core scenario is that the Fed will not be distracted by some degree of pain in the markets and will keep inflation as its priority. We expect another interest rate hike by the Fed after May. And Treasury yields therefore have more room to go up than go down.