- Home »

- Insights »

- CIO View »

- Investment Traffic Lights »

- Investment Traffic Lights | Quarterly Edition

- New Omicron virus mutation and a hawkish Jerome Powell turned Novem-ber into a rather negative month for most asset classes.

- Whether this is considered a good entry point largely depends on one’s assessment of Omicron and inflation.

- At this point we see no need to revise our forecasts for the coming year. Moderate interest yield increases and further economic growth again speak for equities.

to read

1 / Market overview

This issue of Investment Traffic Lights is once again a quarterly edition in which the focus is on strategic forecasts rather than tactical ones. In this year-end issue we present the full-year forecasts for 2022. But before we look forward to the outlook, a little look back.

It took until the last trading day of November for the S&P 500 to join the fate of most other stock indexes and slide into negative territory for the month. New Covid-19 worries, especially the appearance of the Omicron variant, were part of it. But Fed Chairman Jerome Powell also did his bit to alarm investors, announcing at a Senate hearing that the word "transitory" was no longer appropriate when talking about the current inflation trend. And he added, for good measure, that if necessary, Fed asset purchases could be scaled back more quickly than previously communicated.

The two late-month shocks were not the first of November’s surprises. The markets became more volatile. The S&P 500 gyrated, according to the Vix volatility index, more than at any time since March, and the U.S. bond market, as measured by MOVE, fluctuated more than at any time since March 2020. Unlike a year ago, when a new U.S. president was elected after a fractious election campaign, politics played only a subordinate role. The coalition agreement that helped form a future German government was noted with a shrug of the shoulders while in Washington wrangling over the debt ceiling and fiscal packages proved tiring rather than inspiring. Higher corporate taxes were put off the table, seemingly, for now.

Higher corporate taxes were put off the table, seemingly, for now.

The corporate reporting season was rather good. Apart from that, three factors set the nervy tone. First, the latest accelerating wave of Covid infections provoked new restrictions in many countries, even before Omicron appeared. Second was the further rise in inflation. And third came the reaction of the central banks whose communication skills faced a particularly severe test. The challenge was to make it clear to the public that they were taking the record-high inflation figures – a 30-year high of 6.2% in the U.S. and the highest inflation since the introduction of the euro, 4.9%, in the euro zone – sufficiently seriously without frightening markets into believing that tighter monetary policy was going to kill growth.[1] All in all, communication did not go badly, but there were some slips, such as the Bank of England's hike-no hike back and forth.

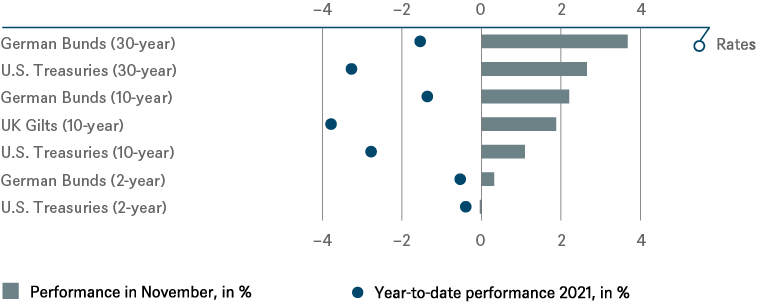

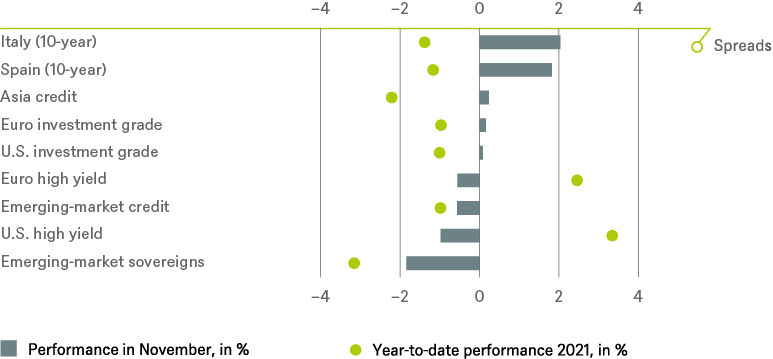

The ultimate result was a retreat from risk and flight to safety. Bund and Treasury yields ended their rally despite increasing inflation concern as government bonds were again sought after as safe havens. In contrast, risk premiums on corporate, peripheral and emerging market bonds widened. With a drop of 1%, U.S. high-yield bonds had their worst month since September 2020.[2]

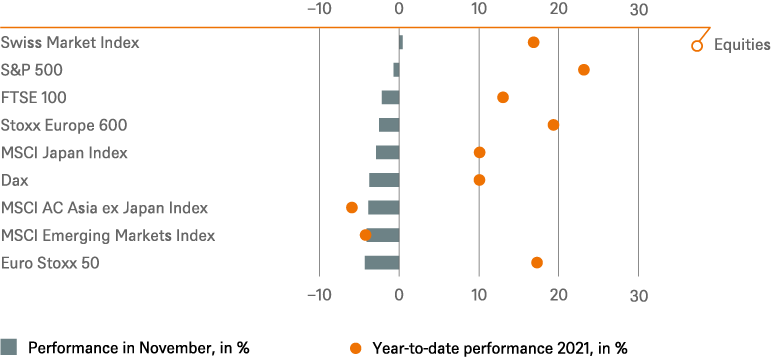

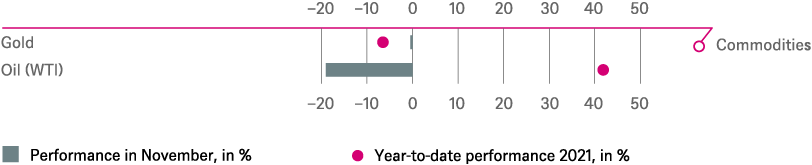

On the stock markets, the nervousness triggered by Omicron helped to ensure that growth stocks once again clearly outperformed cyclical stocks. This ultimately also explains why the Nasdaq, as least, was able to end the month in positive territory. Once again, however, it was commodities that proved most turbulent. The Brent crude oil price fell by 16.4% in the month, its biggest plunge since March 2020.[1] And coal was kicked down a mineshaft, not least by COP26, with its price falling by almost half.

After its volatility and weak finish, November could be read in two ways by shareholders. Either markets have taken a breather before launching forward in a cherished year-end rally. Or they have been forced into a longer-lasting and perhaps long overdue reassessment of current risks.

Our view is that the year-end rally is unlikely to be a foregone conclusion this year. It would take some intrepid investors to make it happen.

2 / Outlook and changes

As the following asset class forecasts are strategic (for end 2022) and were put together in the third week of November, they are not intended to give tactical responses to the new Omicron variant of Covid, or to Jerome Powell’s recent testimony to the Senate in which he chose to drop the word "transitory" when describing current inflation. While the data on Omicron is not yet sufficient to make a thorough assessment, we would assume that it will not derail our forecasts significantly.

2.1 Fixed income

Though 2022 is shaping up to be another year of low yields and persistent monetary support, at the margin we believe this support will be decreasing. We therefore expect more volatility in rates markets. In short, we stick to our short duration bias with focus on higher yielding credit which should offer an attractive carry and some spread tightening potential. The U.S.-Treasury curve should gradually flatten with yields at the short end increasing slightly faster than longer term yields. Higher Eurozone periphery spreads are expected due to less ECB buying.

Starting with short rates and central bank policy, we expect rate hikes by the Fed and the Bank of England, but no hikes by the Bank of Japan and the ECB. The Fed’s tapering will be finished, in our view, by July 2022 at the latest. In 2023 we see as many as three further hikes following. The Fed estimates the terminal rate to be 2.5%, our estimate is slightly lower.

For the Eurozone, we expect the Pandemic Emergency Purchasing Program (PEPP) to end in the spring, though it will be partly replaced by an augmented Asset Purchase Program (APP). The net result should be that ECB quantitative easing (QE) in 2022 will be at about half its 2021 level. We do not expect interest rate rises during the next two years. In the UK we expect the first rate hike already in 2021, with two further steps to follow in 2022.

For longer rates we expect the economic recovery and continuing inflation pressures to push the 10-year U.S. Treasury yield to 2.0% amid higher volatility, driven by the Covid news flow and geopolitics. We have raised our 10-year Bund target from zero to 0.2% and see slightly higher spreads in the EU periphery given the likely reduction in the ECB's QE.

Credit

While the valuations of U.S. and Euro Investment Grade and High Yield bonds cannot be described as cheap, they continue to benefit from solid fundamentals, carry, lower supply and ongoing investor demand. In our view their default rates may decline and they may also have some slight spread tightening potential, and therefore offer the possibility of a positive strategic return.

On emerging markets, we remain positive despite Chinese weakness. Sovereign bonds should continue to benefit from elevated commodity prices and the fact that many countries still have fiscal and monetary flexibility. Among the roughly 80 countries in the EM universe, relatively few are particularly exposed to idiosyncratic risks – such as Argentina and Turkey, and the pressures from US-China-Taiwan and Russia-Ukraine tensions. We have increased our spread forecast by 20 basis points (bp) to 320 bp but this leaves an attractive absolute return potential on a 12-month horizon. The EM corporate sector has been negatively affected by Chinese property sector weakness and a sell-off in respective high-yield credits. Other areas are less affected. We again remain positive and expect the index spread to remain unchanged at 290 bp.

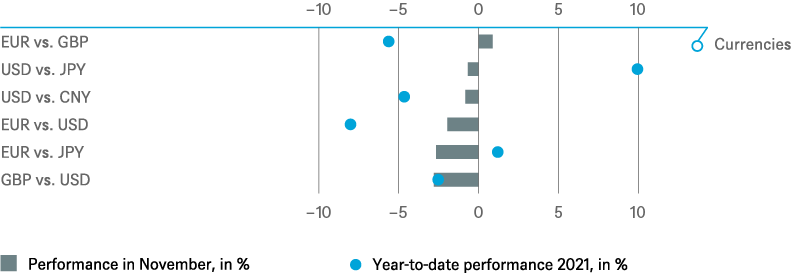

We also see the EUR/USD exchange rate remaining little changed at 1.20. In the short run the euro could weaken but in the medium term the shrinking growth differential between the US and the Eurozone should work in the Euro's favor.

2.2 Equities

2021 has been a pleasant surprise for equity investors with year-to-date (YTD) returns reaching over 15% in USD terms globally.[1] We believe the earnings growth of MSCI World stocks will probably rise by 45% in 2021 – double the amount expected at the start of the year. Economic reopening, stimulus, rising commodity prices and digital transformation have provoked stunning upward revisions of earnings per share (EPS) results during the past three reporting seasons.

As a result of this extraordinary growth, we believe 2022 price earnings (PE) valuation levels are unlikely to rise further. Instead, they should remain stable in our view but at the record-high levels to which extraordinary fiscal and monetary policy and negative real interest rates pushed them already in 2020. Similarly, unprecedented differences in valuations within the equity market have not normalized during 2021. This is exemplified by the persisting 50% valuation discount of "value" versus currently far more popular "growth" stocks.[1]

Financial markets will have to go through something of a detox – a multi-year, gradual reversal of ultra-loose monetary and fiscal policy. The Fed has so far communicated this very cautiously.

Equity markets have been on steroids – massive monetary and fiscal stimulus – for many years. This will start to change in 2022. Financial markets will have to go through something of a detox – a multi-year, gradual reversal of ultra-loose monetary and fiscal policy. The Fed has so far communicated this very cautiously. Financial markets are already discounting a completion of tapering by mid-2022 and one or two interest rate hikes by December 2022. In 2022 and beyond we still expect negative real rates to persist while forward PE multiples decline slowly. Exceptional policymaking and extremely loose financial conditions will stay for quite some time; thus TINA[3] will remain equities’ best friend.

Our year-end 2022 targets are 5,000 for the S&P 500 and 17,000 for the DAX40. We expect meaningful valuation discounts between most markets and the U.S. to remain in place. Global earnings growth should moderate from the stunning 45% we mentioned above in 2021 towards a more pedestrian 7% in 2022, most of which should be driven by price increases and a recovery in cyclical demand. Unlike in 2021 we see little room for additional gains in margins given the elevated profitability levels already achieved. As the political debate remains inconclusive, we no longer assume that taxes on S&P earnings will rise.

REGIONS

It would be tempting to bet against the U.S. market given its multi-year outperformance. But we nevertheless enter 2022 without a preference for any particular region as the U.S. focus on shareholder value and innovation, and companies’ willingness to buy back shares, remains unmatched elsewhere. To diversify portfolios from the U.S. mega-cap platforms we have recently upgraded U.S. small caps to overweight, attracted by their over-representation of cyclical, commodity, and financial sector exposure.

We forecast high single-digit German, European and Japanese earnings growth in 2022. And yet we struggle to identify triggers that would excite investors and make these markets outperform the S&P 500. For emerging markets, we feel that the worst should be over, with monetary and fiscal loosening pending in China and Japan, regulatory uncertainty fading in China, and Asian economies reopening for tourism. In addition, structural reforms in India are beginning to have a beneficial impact.

SECTORS

We stick to our sectoral barbell strategy: overweighting IT as the global digital transformation is still ongoing as well as overweighting cyclical sub-sectors, such as automotive, commodity chemicals and oil services, as the coming quarters should benefit from easing supply chain constraints. However, an expected slowing of economic activity towards a more normal potential growth rate in 2023 might force a repositioning toward more defensive sectors in the second half of 2022.

We believe that companies with favorable ESG scores or those that help mitigate climate change risks should continue to receive investor attention in 2022. As a new post-Covid growth theme we believe that focusing on the "next generation" of consumers, who are buying better quality and sustainable goods and are shopping more online may be a viable consideration.

RISKS

When it comes to generating returns, we think there will continue to be no good alternative to equities. But that does not mean they are without risks. It might even be argued that the benign base-case scenario that we see is the least likely to occur, and that the probability of a severe deviation to the downside or the upside in 2022 is higher than usual.

In our opinion, interest rates and inflation will remain the key factors. Inflation is affecting equity returns in various ways. Most companies pass rising input costs on to customers and see the potential for higher revenues and probably profits, too. Therefore, we feel that picking stocks with operating leverage and pricing power will be key in 2022. The impact of potentially more persistent inflation on PE multiples is, however, less clear. Higher inflation expectations create the risk of volatile and rising interest rates which could result in pronounced PE compression for long-duration stocks, in, for example, IT, communication, regulated utilities, and listed infrastructure.

Furthermore, we are concerned by the lack of fundamental anchors for valuations in many crypto and EV-car assets. Momentum, fear-of-missing-out and retail exuberance might persist for quite some time. It is difficult to know when these bubbles might burst. But we see them as an accident in the making.

2.3 Alternatives

We expect oil to trade sideways, yet volatile, in the coming 12 months, as supply is likely to adapt swiftly to demand. Supply from almost all regions can be increased, which we mostly expect in the second half of 2022 to happen. We expect gold to decline. While real interest rates are likely to remain negative, we expect the combination of rising nominal rates, an improving macroeconomic climate and tapering of asset purchases by the Fed to drive investor allocations away from gold over the next 12 months, causing the gold price to fall slightly from its current level to USD 1750 per oz.

For other alternative investments the economic and monetary backdrop appears to be more favorable in our view. The infrastructure segment continues to attract investors thanks to its good ability to adapt to rising prices. And we also continue to see many interesting niches in real estate. In addition to the logistics space, this includes, in particular, affordable, sustainable housing close to major cities.

The infrastructure segment continues to attract investors thanks to its good ability to adapt to rising prices.

2.4 ESG developments

The COP26 climate summit in Glasgow in November was important not just for Environmental Social and Governance (ESG) issues but also for financial markets broadly. In our opinion the outcome achieved more than expected, but less than needed. The private sector, too, must act and not merely wait for government initiatives.

Within finance some useful programs have begun. One is called the Net Zero Asset Managers Initiative (NZAM), which DWS joined in December 2020. The initiative now consists of 220 asset managers representing over $57 trillion in assets under management.[4] The project has clear ramifications. Of DWS’s total assets under management some 35.4% fulfil the conditions to be managed towards net-zero emissions.[5] For these assets, DWS is seeking to achieve a 50% reduction in weighted average inflation-adjusted financial carbon intensity (WACI adj.) related to Scope 1 + 2 emissions by 2030, compared to the base year, 2019.[6] DWS utilizes the Science Based Targets Initiative (SBTi) framework, which is considered a credible and robust foundation, providing clear guidance on expected assets in scope and target ambition levels.

3 / Past performance of major financial assets

Total return of major financial assets year-to-date and past month

Past performance is not indicative of future returns.

Sources: Bloomberg Finance L.P. and DWS Investment GmbH as of 11/30/21

4 / Tactical and strategic signals

The following exhibit depicts our short-term and long-term positioning.

4.1 Fixed Income

Rates |

1 to 3 months |

until Dec 2022 |

|---|---|---|

| U.S. Treasuries (2-year) | ||

| U.S. Treasuries (10-year) | ||

| U.S. Treasuries (30-year) | ||

| German Bunds (2-year) | ||

| German Bunds (10-year) | ||

| German Bunds (30-year) | ||

| UK Gilts (10-year) | ||

| Japan (2-year) | ||

| Japan (10-year) |

Spreads |

1 to 3 months |

until Dec 2022 |

|---|---|---|

| Spain (10-year)[7] | ||

| Italy (10-year)[7] | ||

| U.S. investment grade | ||

| U.S. high yield | ||

| Euro investment grade[7] | ||

| Euro high yield[7] | ||

| Asia credit | ||

| Emerging-market credit | ||

| Emerging-market sovereigns |

Securitized / specialties |

1 to 3 months |

until Dec 2022 |

|---|---|---|

| Covered bonds[7] | ||

| U.S. municipal bonds | ||

| U.S. mortgage-backed securities |

Currencies |

||

|---|---|---|

| EUR vs. USD | ||

| USD vs. JPY | ||

| EUR vs. JPY | ||

| EUR vs. GBP | ||

| GBP vs. USD | ||

| USD vs. CNY |

4.2 Equity

Regions |

1 to 3 months[8] |

until Dec 2022 |

|---|---|---|

| United States[9] | ||

| Europe[10] | ||

| Eurozone[11] | ||

| Germany[12] | ||

| Switzerland[13] | ||

| United Kingdom (UK)[14] | ||

| Emerging markets[15] | ||

| Asia ex Japan[16] | ||

| Japan[17] |

Style |

||

|---|---|---|

| U.S. small caps[29] | ||

| European small caps[30] |

4.4 Legend

Tactical view (1 to 3 months)

- The focus of our tactical view for fixed income is on trends in bond prices.

- Positive view

- Neutral view

- Negative view

Strategic view until September 2022

- The focus of our strategic view for sovereign bonds is on bond prices.

- For corporates, securitized/specialties and emerging-market bonds in U.S. dollars, the signals depict the option-adjusted spread over U.S. Treasuries. For bonds denominated in euros, the illustration depicts the spread in comparison with German Bunds. Both spread and sovereign-bond-yield trends influence the bond value. For investors seeking to profit only from spread trends, a hedge against changing interest rates may be a consideration.

- The colors illustrate the return opportunities for long-only investors.

- Positive return potential for long-only investors

- Limited return opportunity as well as downside risk

- Negative return potential for long-only investors