- Home »

- Insights »

- CIO View »

- Investment Traffic Lights »

- Investment Traffic Lights

- Finally, one of the worst year in modern capital market history has drawn to a close. Both equity and bond markets ended the year in deep red territory.

- December’s performance has been anything but reassuring for the start of the year, especially as bond yields were rising again.

- We are looking ahead at 2023 with slight optimism. But risks too abound.

1 / Market overview

One of the worst years for financial markets in history, but with some impressive winners

The year ended almost the way it started, at least when looking at global equities: the MSCI World AC was down some 5% in January, as well as in December.[1] The context, though, could hardly be more different. 2022 started with hopes for a reopening boom and receding inflation. It then saw the return of largescale warfare in Europe, which delivered sharp spikes in commodity prices, notably for food and energy, hitting some of the world’s poorest hardest. Overall, 2022, which had started on such a hopeful note, saw some of the worst financial market returns in decades.

Of course, there are also similarities: just as 12 months ago, investors are once again hoping for reopening dynamics – this time in China. And many, including us, are once again expecting inflation, at least at the headline level, to decline in the coming 12 months. How best to recap what happened in between January and December 2022? The year will surely go down in history as one of the toughest periods not just for investors but for society at large. Consumers, businesses, governments, and central banks have all had to come to terms with one calamity after another. Vladimir Putin’s latest war of aggression and the resulting energy crisis showed just how shortsighted European foreign, not to mention energy policy had been for the past two decades. Tough elections in Italy and Brazil, as well as the U.S. midterms kept investors on edge. Many countries, especially in emerging markets saw large scale demonstrations and civil unrest in the wake of the global cost of living crises and record-high inflation (at least compared to developed market levels since the early 1980s). Still, central banks had little choice but to keep hiking interest rates to an extent few had foreseen at the start of the year. Incidentally, the same could also be said about the fluid Covid situation in China, except that there, the political U-turn towards reopening in December took place in a matter of weeks, rather than months.

Not only did the year keep throwing nasty surprises, but the trends also kept changing directions, something financial markets do not appreciate. From the end of cheap money sounding the death knell of the decade long bond bull market, to imploding crypto and more. Then, there were twists in timing of usual seasonal patterns, notably when it came to the much hoped for year-end rally. For most equity markets, the fourth quarter started off well enough, only to lose steam in December as year-end approached. Typically, you tend to see the reverse.

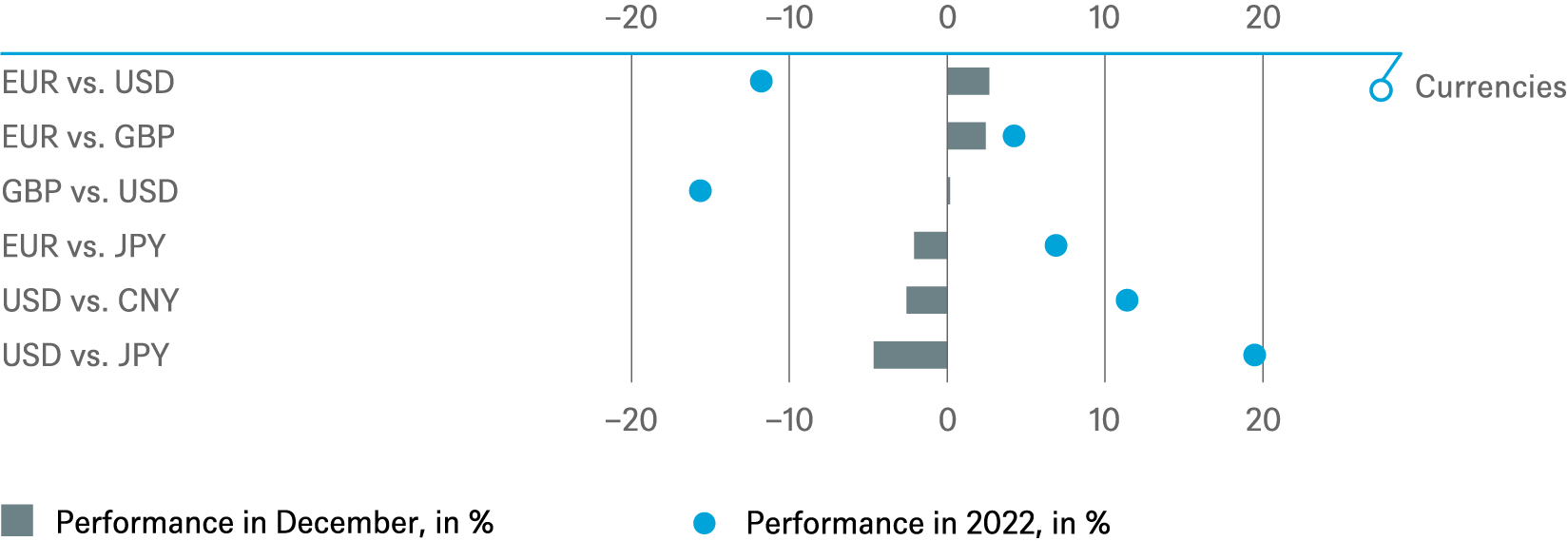

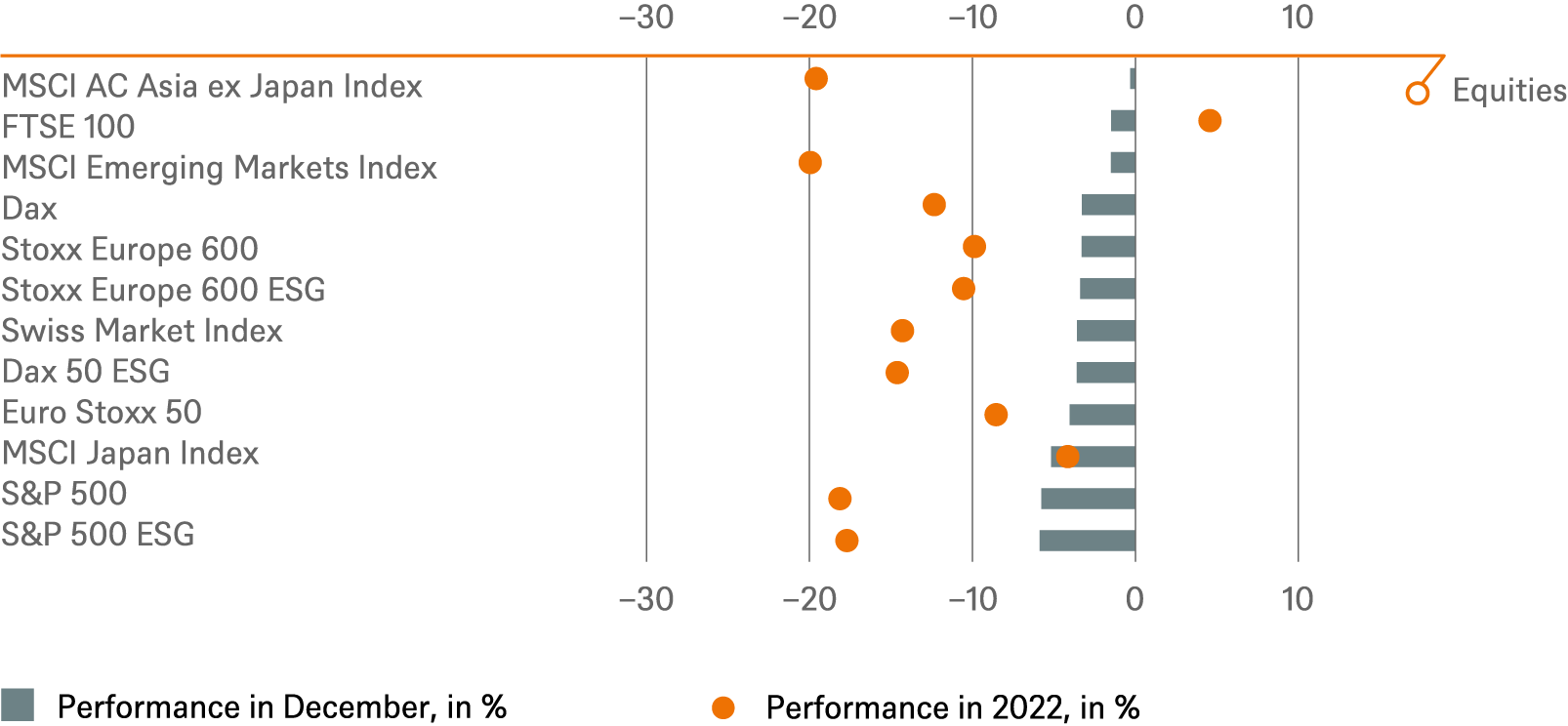

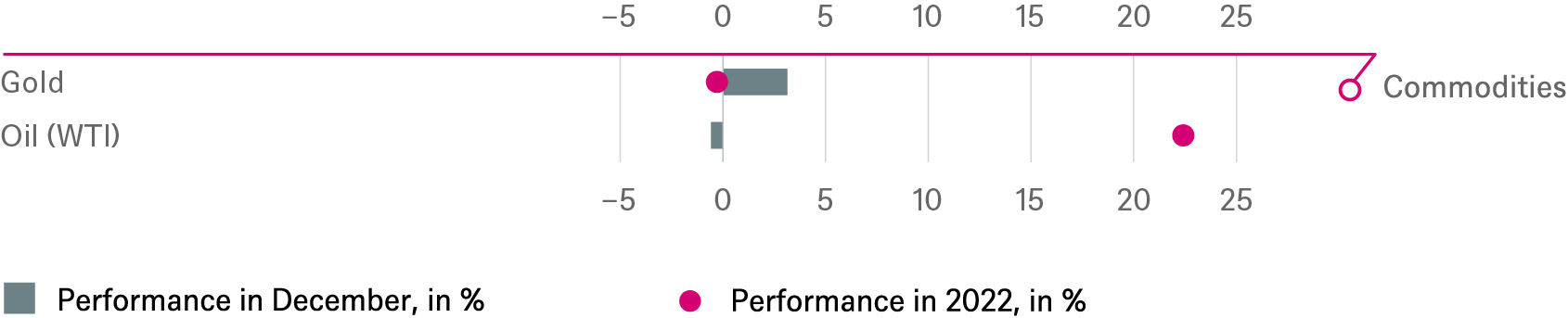

Look more closely, however, some asset returns tell rather more mixed and intriguing stories than you might suspect by just glancing at the heavy beating delivered for the most commonly used overall portfolio configurations. There was an energy crisis, yet Brent crude is now roughly trading where its price in dollars was a year ago. There is a war with no end in sight, but gold is down roughly 1%. The war takes place in Europe, yet stocks there managed to outperform those in the U.S. The Euro Stoxx 50 is down only around 10%, half of the S&P 500’s loss.[2] Yet it is in Europe where recession fears loom largest for 2023, while the U.S. might manage to escape such an outcome in 2023. Incidentally, the U.S. already reported two consecutive quarters of negative economic growth in the first half of 2022, serving a reminder that to some extent, recession risks are always a matter of national definitions and statistical quirks, rather than underlying economic realities. With the Fed hiking rates and moving faster than other central banks, the U.S. Dollar was a major outperformer for much of 2022. Overall, the greenback strengthened against every other major currency over the year, delivering its biggest average annual advance since 2015.[1]

And then there was the UK. The country that saw three prime ministers within three months as a result of serious political and financial market troubles ends the year up, at least when looking at the FTSE 100 in local currency (it was down 10% in dollar terms). Looking at the more domestic oriented FTSE 250 tells a more realistic story though of the state of affairs: down 20%. As did bond markets. 30-year sovereign yields exploding from under 3% to over 5% within a month, providing the trigger for a sharp reversal in British fiscal policy and an end to the short-lived premiership of Liz Truss.

The recent UK experience may turn out to be far more than just a parochial news story of limited global interest. The fact that the bond and currency markets reacted in such a nervous, and for many of today’s generation of investors even outlandish way, to the prospect of an ill-conceived U.K. budget should remind policymakers all over the world that investors are finally starting to be wary of high deficits and fiscal profligacy. That means capital markets in 2023 can neither count on central banks nor on governments to help them go through slumps. Over time, basing investment strategies on such hopes has tended to work rather well at least for U.S. investors in recent decades, going back all the way to October 19, 1987 – also known as Black Monday – when the Dow Jones Industrial Average fell by 508 points, or by 22.6%, within a single day. Unfortunately, that collective experience has also left today’s investors ill-prepared to adjust their mindset to events that, from a longer-term perspective, do not look all that unusual. Few of the events, from a declining, recidivist European power waging an ill-conceived, imperial war on a seemingly weaker neighbor, to recent data on, say, inflation, bond yields, or bond market returns would have come as such a surprise to a 20th century investor familiar only with the economics of politics of the period from 1900 to 1980. Though today’s low rates of unemployment in much of the developed world certainly would, especially when set against the simultaneous sense of gloom.

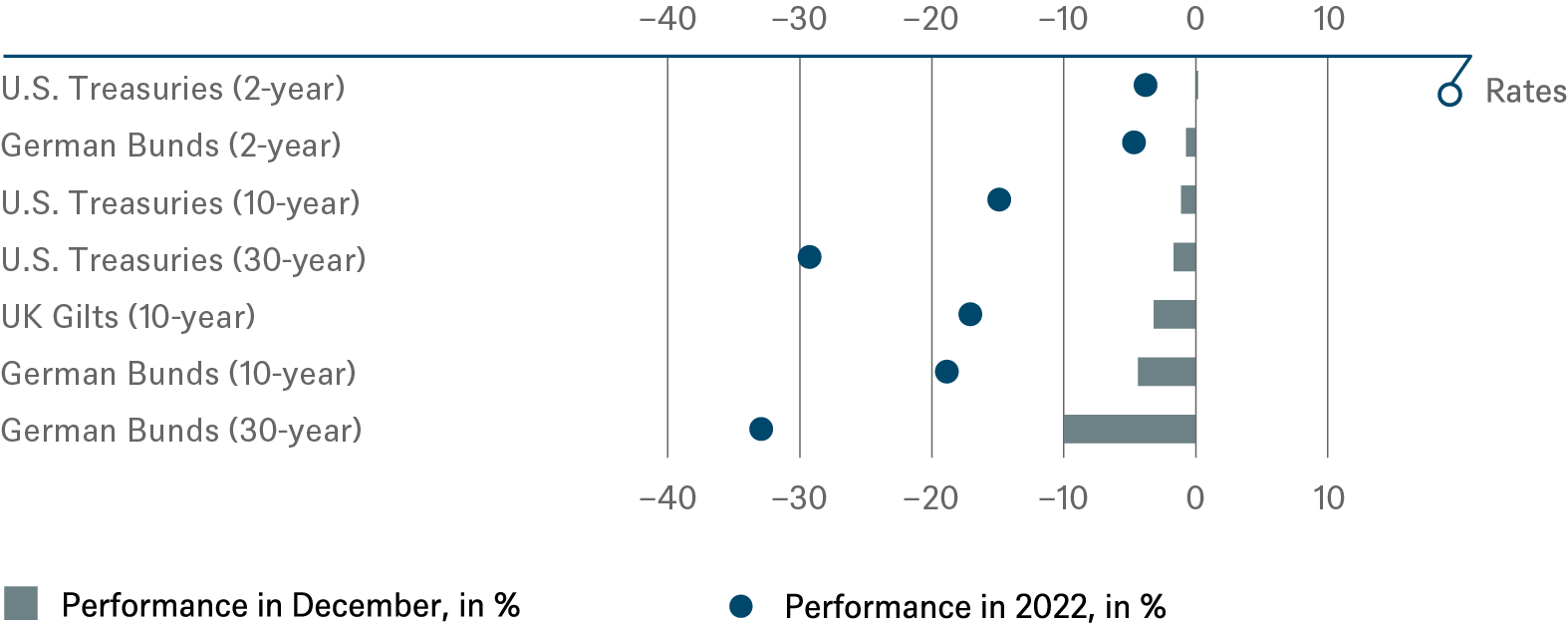

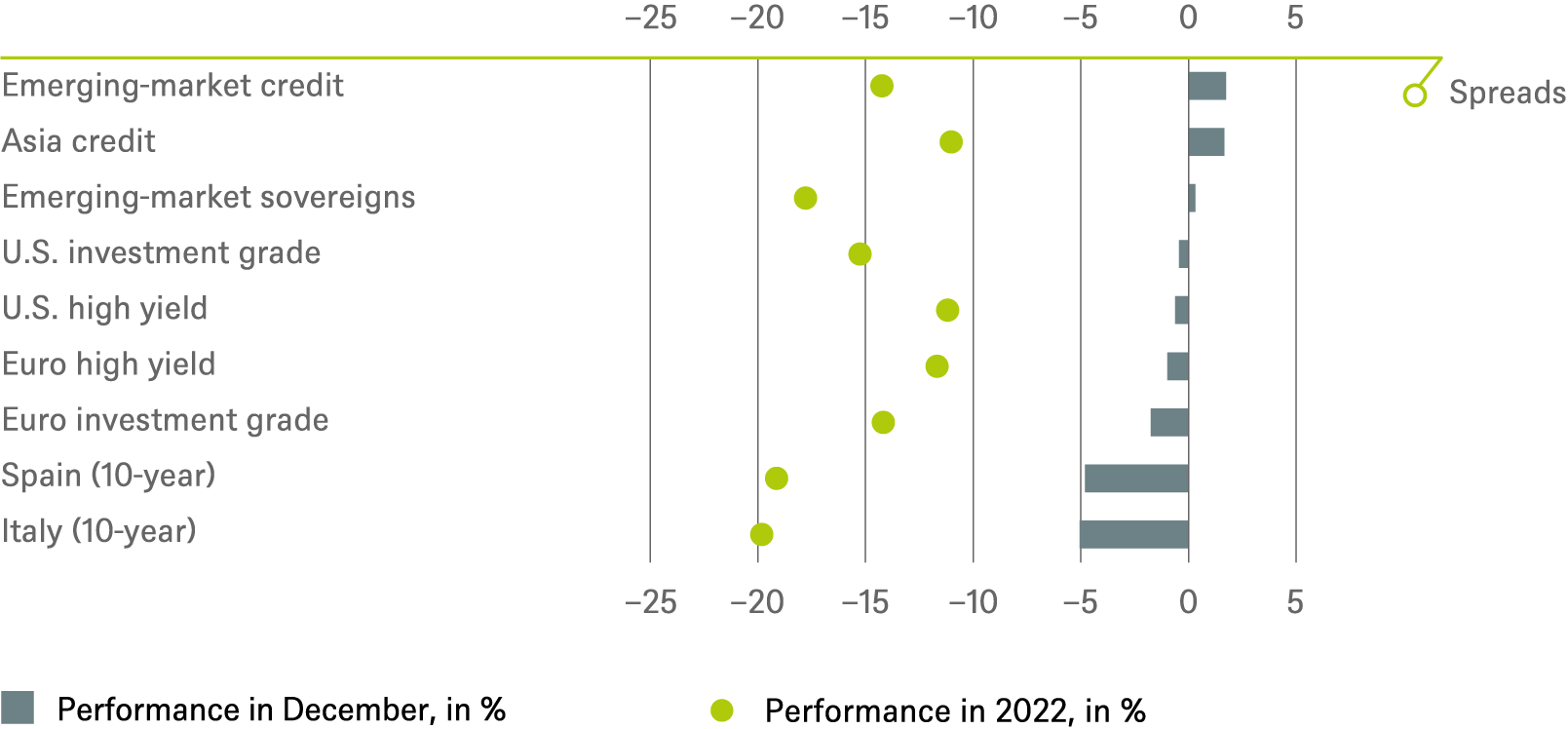

Be that as it may, after years of almost free money, debt sustainability is high on the agenda again, as the ECB also demonstrated when introducing the so called “Transmission Protection Instrument”, primarily aimed at keeping the interest load for Italy low. Talking about Italy: the country’s 30-year Treasury Bonds (BTPs) generated a total loss of 40% in 2022.[1] But that has little to do with the elections or some underlying “Italian disease”. Instead, it mainly reflects the rapid yield rises in Europe, as the loss of 47% of Germany 30-year Bunds underlines. For high-yield corporate bonds, the year wasn’t quite that bad, also thanks to their much shorter duration and some positive carry to begin with, they returned a minus of around 10% in Europe and the U.S., and, on the plus side, now once again deserve their moniker. And 2-year Treasuries even managed to lose nothing - they had a flat performance.

Within equities there was even a wider bifurcation, as one sector even managed to make substantial gains: the MSCI AC Energy returned a total gain of 34.5%,[1] while the three worst sectors (IT, Consumer Discretionary and Communication Services – all comprising some of the big U.S. tech and internet companies) all lost more than 30%. Looking at single stocks, there were more winners in 2022: amongst the 21 companies of the Stoxx 600 that managed to have a total return of more than 50% the highest number of companies came from defense companies (of which one gained 127%), followed by banks and then energy. Within the S&P 500, roughly a third of the companies managed to end the year with positive total returns, of which 18 saw gains of more than 50%, the majority being energy companies. Another way to show equities bifurcation is to look at the total return of the Dow Jones Industrial with a mere minus of 6.9% compared to the minus 32.4% of the Nasdaq 100. Growth stocks were hit by the double whammy of declining sales and margins, often reflecting operational difficulties, at the same time as yields on supposedly risk-free government bonds were rising. (Mechanically, higher “risk free” rates lead to earnings far in the future being discounted more heavily. All else equal, that tends to hurt, say, an expensive, fast growing biotech company years away from being able to return money to its shareholders more than, for example, a staid, old energy company already generating lots of surplus cash. Though precisely why most investors had been so willing, for so long, to apply this so mechanically in the long years of near-zero or negative nominal interest rates explicitly designed to get inflation going again is a bit of a mystery that will probably keep financial and economic historians busy for decades to come.) Within growth stocks, the pain was most acute among some of the main “Covid winners” but also sectors such the Electrical Vehicle space.

But the thing that 2022 will probably be most remembered for is the simultaneous heavy losses of equities and bonds. In that respect, last year has seen the worst performance since at least the second world war for most developed markets. This was also made possible by some quirks in the sequence of events. Global equity markets hit their peak just at the turn of 2021/22, just when bond yields began to rise. Equities did not end this year on a very reassuring tone either – no year-end rally - as equities were down all over the world in December, except for China and Hong Kong, where the reopening was raising hopes. And bond yields also crept higher again, with 10-year Bund yields not only hitting a new high of the year, but a new high of the past 11 years, at 2.56%. Though, to be fair, you would probably have a tough time to explain why this should be such a dangerous level to a veteran German bond investor who retired in, say, 2010. Based on the previous forty years of market experience, it would have appeared hard to imagine that 10-year Bund yields could stay below 3% for very long.

2 / Outlook and changes

With the expected time-lag, higher central bank rates are now unfolding their powerful impact on the real economy: Activity is slowing in Europe and the U.S.. These days managers are talking about cost cutting, excess inventory, and the risk of order cancellations; construction activity is already falling significantly, consumer spending on goods is shrinking. China’s Covid situation is likely to get worse for a couple of weeks, before it gets better. Recent infection waves might crest after the heavy travel activity during Chinese New Year around January 22 and many investors might be tempted to see through this. We would caution, however, that the dynamics of the rapid infection spreading might cause unforeseen events. And that more generally, one of the most common sources of investment errors in recent years, has been to try to “see through” some seemingly short-term issue, without considering that the future landscape might well start to look very different once the dust settles. Against this backdrop, we believe it is best to approach any outlook assessment with a combination of humility and nimbleness.

2.1 Fixed Income

To see how swiftly things can change, look no further than recent events in fixed income markets, which you may have missed. For European high yield (HY), for example, we had expected relatively calm markets during the holiday season, with patient investors being rewarded with coupon clipping. Well, that’s broadly been true, if you held your nerves, but December also saw some unusually wide swings in both directions for this time of the year. The messages coming out of the European Central Bank (ECB) turned out to be more hawkish than expected as they explicitly indicated that they do not view the current rates to appropriately price in their future path. This resulted in more pressure in the European fixed income markets overall. That remains in line with our longer-term view that while we are still constructive, we believe investors need to be prepared to cope with high volatility and market swings, and not just in European high yield.

Elsewhere too, the interplay between macro-economic developments, central bank reactions and investor uncertainty of what to make of it all on any given day or in any given week look set to continue to dominate fixed income markets in coming months. The Bank of Japan (BoJ) provided its own version of a holiday surprise a few days before Christmas, by widening the trading range for 10-year Japanese bond yields. It has since had to conduct a series of unscheduled bond purchases, to put a lid on the resulting surge in yields caused by more and more investors betting the BoJ will pivot away from its ultra-loose monetary policy.[3] If and when it does, that would almost certainly be a tumultuous event for global bond markets, but chances are this will still take a while providing us with plenty of opportunities to return to the topic in the course of 2023.

Patience is also likely to be required to detect clear trends of inflationary pressures finally easing on either side of the Atlantic. We tend to remain on the sideline for now, as far as German government bonds are concerned, with higher Bund issuance volume to come. Moreover, the ECB looks set to reduce reinvestments under its Asset Purchase Programme (APP) from March onwards, partially removing a source of support and potentially increasing market nervousness. The later could impact Bunds in a variety of hard to predict ways.

For U.S. Treasuries, we fear that markets remain prone to ignore hawkish warnings from Fed officials, potential increasing the scope for disappointment around the Federal Open Market Committee (FOMC). That could start with the one on January 31st and February 1st, making it quite likely it will dominate these very pages in a month’s time.

In the meantime, solid cases can be made to suggest that many of the higher risk fixed income instruments remain attractive and offer compelling return potential from a longer-term perspective. There are exceptions, to be sure. For example, U.S. investment grade could face some pressure in the first quarter of 2023. Many credit issuers in this segment foresee a slowdown in consumer activity. Still, a similar logic to what we described above for European HY also holds for U.S. HY has solid return expectations and will likely deliver excess returns over Treasuries and European investment grade. In all these instances, markets have already priced in a substantial weakening of the economy and most companies have strong fundamentals.

Emerging markets bonds too offer very attractive yields, but selection, as always, remains key in this area. Meanwhile, risks and rewards are starting to look fairly balanced for government bonds in Europe’s periphery. The spread for the BTP-Bund Spread seen with further volatility. The rightwing governing coalition may put up some popular but expensive measures. Higher yields offer good carry, but also typically reduce debt sustainability longer term.

Currencies: For most of the currency pairs December was a quiet month with low trading activities. As we had been expecting, the U.S. dollar losing some of its previous oomph throughout the fourth quarter. Overall, the month gave us little reason to make any big readjustments. For now, we remain neutral on most major currency pairs.

2.2 Equities

Despite various risks, three factors give us some comfort that equity markets might churn out positive nominal returns in 2023: first, we believe that economic weaknesses, both in the U.S. and in other developed markets, are likely to prove short-lived and shallow mainly because of a robust labor market; second, most investors appear to be prepared by now: in expectation of the now-unfolding macro conditions, defensive stocks have been favored on equity markets all of last year; and finally, consensus expectations for equity market returns over the coming 12 months are very cautions, which is the complete opposite of the situation one year ago. In that respect, our own index targets (S&P 500 of 4.100 by December 2023, DAX 15.000) are not much different from consensus. Given the already bearish market sentiment, we believe the downside risk to equities might be less pronounced than we had previously feared.

Still, in the near-term, we believe investors might find attractive alternatives outside the equity market. Our tactical equity signals remain unchanged with a cautious bias: we expect the S&P500 to weaken first before reaching our index target. We also expect further consensus earnings-per-share (EPS) cuts (one reason for downgrading the U.S. industrials sub-sector recently). We only see low-single digit EPS growth in Information Technology, which we rate neutral. Gone are the times of steady double-digit profit growth. Mobile phone and semi manufacturers are likely to see their earnings decline in 2023.

Not all is gloomy, though. We stick to the overweight call for health care, just as we do for pan-European equities. While the MSCI China has gained more than 33% since early November[1], we remain tactically optimistic, even though the reopening process is developing a chaotic dynamic.

What might be the next steps? Investors will probably reposition portfolios once they see the peak of central bank rates approaching. This could be the time to downgrade defensive sectors like staples or health care and upgrade more cyclical sectors like industrials, a rotation that would likely continue to favor value investors. On the other hand, we suspect that the “shallow recession” will be followed by a “shallow recovery”, but not a boom. Therefore, the cyclical earnings rebound could prove very short-lived. Instead, we believe growth stocks with re-set and more realistic earnings expectations might have a comeback during the second half of 2023.

Despite near-term caution we see plenty of reasons for longer term optimism on equities. Historically equities have offered a certain inflation protection and have proven to be liquid, even in periods of stress. Perhaps most importantly, equities carry an embedded option on innovation, though to be sure, predicting which companies or countries or sectors may benefit most is hard, and not all the potential winners are listed. All that, however, we believe is more of a reason for careful, longer-term research rather than staying out of the listed equities space during periods of turmoil. Innovative business models remain badly needed to cope with the challenges that 8 billion inhabitants of planet earth are facing. From overcoming resource scarcity, handling health issues, securing peace to providing simply fun and pleasure.

2.3 Alternatives

Energy: Liquidity across commodity markets tends to be low towards year-end, and the energy sector has not significantly bucked this trend in 2022, which is why we would not tend to overinterpret recent price gains. For oil, the two most significant factors that could drive changes to short term marginal demand expectations are China’s COVID situation and the rate at which the U.S. replenishes its depleted strategic petroleum reserves (SPR). On the natural gas side, we believe short term price swings will continue to be driven by weather related adjustment to demand expectations. Medium term price paths will depend on wide range of factors, from Russia’s response to European sanctions to continuing, but tricky to predict, demand substitution effects. In the longer term, more natural gas production is expected to come onstream globally. Recent increases in capital commitments may weigh on natural gas price in 2H2023 and beyond.

Gold: In the near-term, we expect gold to trade in a narrow range until the terminal rate from Fed policy becomes clearer. During this period, gold may exhibit less sensitivity than one might expect to geopolitical headline news, inflation and movements in real rates and the U.S. dollar. Some recent market narratives also underline how creatively market patterns can sometimes be interpreted. For example, some now argue that hotter-than-expected inflation data has actually dampened demand for inflation hedges, such as gold! The somewhat convoluted reasoning is that it has resulted in aggressive actions by central banks which have reduced expectations for future inflation. Be that as it may, inverted yield curves now suggest that the fixed income market has largely priced-in aggressive Fed tightening, which could support the price of gold. Additionally, gold may find additional support from a weaker U.S. dollar. In the medium to longer-term, we believe the fundamental case for the metal as a portfolio diversifier remains intact as global economic uncertainty remains. We currently favor gold exposure through a combination of gold miners and royalty companies, with a preference for royalty companies given recent headwinds to gold prices, over exposure to platinum, palladium, and silver miners.

Real Estate: With inflation likely to remain sticky and unpredictable, both listed and non-listed real estate look like increasingly reasonable alternatives to other asset classes. Volatility in coming months could continue to provide attractive entry points. Globally, balance sheets of listed real-estate companies generally remain solid but for some European ones, they look stretched. We expect equity raises in Europe where debt levels are unsustainable at current levels of interest costs, diluting the stake of existing shareholders – and potentially putting further pressure on share prices. For non-listed real estate, longer-term fundamentals look quite healthy overall, but correctly identifying structural, cyclical and micro-dynamics within segments and regions remains critical.

3 / Past performance of major financial assets

Total return of major financial assets year-to-date and past month

Past performance is not indicative of future returns.

Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 12/31/22

4 / Tactical and strategic signals

The following exhibit depicts our short-term and long-term positioning.

4.1 Fixed Income

Rates |

1 to 3 months |

until Dec 2023 |

|---|---|---|

| U.S. Treasuries (2-year) | ||

| U.S. Treasuries (10-year) | ||

| U.S. Treasuries (30-year) | ||

| German Bunds (2-year) | ||

| German Bunds (10-year) | ||

| German Bunds (30-year) | ||

| UK Gilts (10-year) | ||

| Japanese government bonds (2-year) | ||

| Japanese government bonds (10-year) |

Spreads |

1 to 3 months |

until Dec 2023 |

|---|---|---|

| Spain (10-year)[4] | ||

| Italy (10-year)[4] | ||

| U.S. investment grade | ||

| U.S. high yield | ||

| Euro investment grade[4] | ||

| Euro high yield[4] | ||

| Asia credit | ||

| Emerging-market credit | ||

| Emerging-market sovereigns |

Securitized / specialties |

1 to 3 months |

until Dec 2023 |

|---|---|---|

| Covered bonds[4] | ||

| U.S. municipal bonds | ||

| U.S. mortgage-backed securities |

Currencies |

1 to 3 months |

until Dec 2023 |

|---|---|---|

| EUR vs. USD | ||

| USD vs. JPY | ||

| EUR vs. JPY | ||

| EUR vs. GBP | ||

| GBP vs. USD | ||

| USD vs. CNY |

4.2 Equity

Regions |

1 to 3 months[5] |

until Dec 2023 |

|---|---|---|

| United States[6] | ||

| Europe[7] | ||

| Eurozone[8] | ||

| Germany[9] | ||

| Switzerland[10] | ||

| United Kingdom (UK)[11] | ||

| Emerging markets[12] | ||

| Asia ex Japan[13] | ||

| Japan[14] |

Style |

1 to 3 months |

|

|---|---|---|

| U.S. small caps[25] | ||

| European small caps[26] |

4.4 Legend

Tactical view (1 to 3 months)

The focus of our tactical view for fixed income is on trends in bond prices.Positive view

Neutral view

Negative view

Strategic view until December 2023

- The focus of our strategic view for sovereign bonds is on bond prices.

- For corporates, securitized/specialties and emerging-market bonds in U.S. dollars, the signals depict the option-adjusted spread over U.S. Treasuries. For bonds denominated in euros, the illustration depicts the spread in comparison with German Bunds. Both spread and sovereign-bond-yield trends influence the bond value. For investors seeking to profit only from spread trends, a hedge against changing interest rates may be a consideration.

- The colors illustrate the return opportunities for long-only investors.

Limited return opportunity as well as downside risk

Negative return potential for long-only investors