- Home »

- Insights »

- CIO View »

- Investment Traffic Lights »

- Investment Traffic Lights

- A very strong June, especially for equities, brings a good second quarter and even better first half-year to a celebratory end.

- However, the strong markets cannot really be reconciled with the political and economic news flow.

- With many of our price targets for June 2024 already reached, we do not believe the positive market momentum can continue.

1 / Market overview

An eventful first half-year turns out surprisingly well for investors

Few investors can complain about the month of June – only, perhaps, those who would like to see a stronger correlation between the markets’ trajectory and underlying fundamentals. Stocks rose significantly, bonds fell a little, commodities rose overall and, on top of all that, the market’s nervousness continued to ease. For the first time since the outbreak of Covid, both the volatility index for the S&P 500 (the Vix) and the Euro Stoxx 50 (SX5E Vol) averaged below 15 for the month. Meanwhile the nervousness indicator for U.S. Treasuries, the Move Index, fell back to its February level, i.e. before the U.S. banking turmoil began (but remains well above the levels seen from 2011 to 2021). This rounds off an already very satisfying first half of the financial year for investors, as can be seen in one figure in particular: The Nasdaq 100 gained 38.75% in the first six months, the most in its 40-year history. This was, among other things, because one of its members was the first company ever to achieve a market value of over three trillion dollars – on the last trading day of the half-year. In general, technology stocks were the big market driver in the second quarter, with artificial intelligence but so much the theme of the day that many investors may already be fed up with the entire subject. But stock markets in June were no longer driven exclusively by the big tech stocks but also by cyclical sectors such as consumer discretionary, industrials and energy.

While markets partied, the political and economic news flow was not celebratory at all. It is true that the biggest excitement of the past month, the revolt by Yevgeny Prigozhin's Wagner group, is still difficult to classify even in political-military terms, let alone in terms of an “adequate” market reaction. But there was plenty of other that would normally be considered negative for risk assets. Revised figures showed that Germany and Europe fell into a technical recession as their economic growth was negative in the fourth quarter of 2022 and first quarter of 2023. And figures from China remain meager; the post-Covid end of lockdown euphoria seems to be reaching the consumer only in dribs and drabs. In Europe and the U.S., (core) inflation figures remain high enough and labor markets sufficiently tight to keep all major central banks stressing that they will not let up in their fight against inflation. The market is now pricing in no interest rate cuts for the current year (at least, for the U.S. and the Eurozone), and the yield curve between two- and ten-year U.S. Treasuries, at minus 1.09 ppts, is as deep in negative territory as it was last in the early 1980s.

It is hard to interpret what this figure implies for the economy, but it is a reminder that the capital markets find themselves in unfamiliar territory after Covid and many years of ultra-loose monetary policy. One of the most important questions being pondered on both sides of the Atlantic, and not only by central bankers, is whether a significant deterioration in the labor market is needed to push inflation down further. Or could consumer restraint sufficiently relieve the upward pressure on prices, as U.S. Treasury Secretary Janet Yellen imagines, while the remarkable stability of the labor market acts as a fortunate economic stabilizer? We see things differently and assume that the U.S. will slide into a recession, which in turn will lift the unemployment rate.

2 / Outlook and changes

Continued mixed signals from the macroeconomic side are feeding some investors’ hopes of a soft U.S. landing. The start of a possible U.S. recession keeps receding, making investors less fearful of “higher-for-longer” Fed fund rates. But we believe that markets have been discounting the risks and seeing the positive side of economic data and that a recalibration of expectations might happen over the next couple of months.

2.1 Fixed Income

Government Bonds

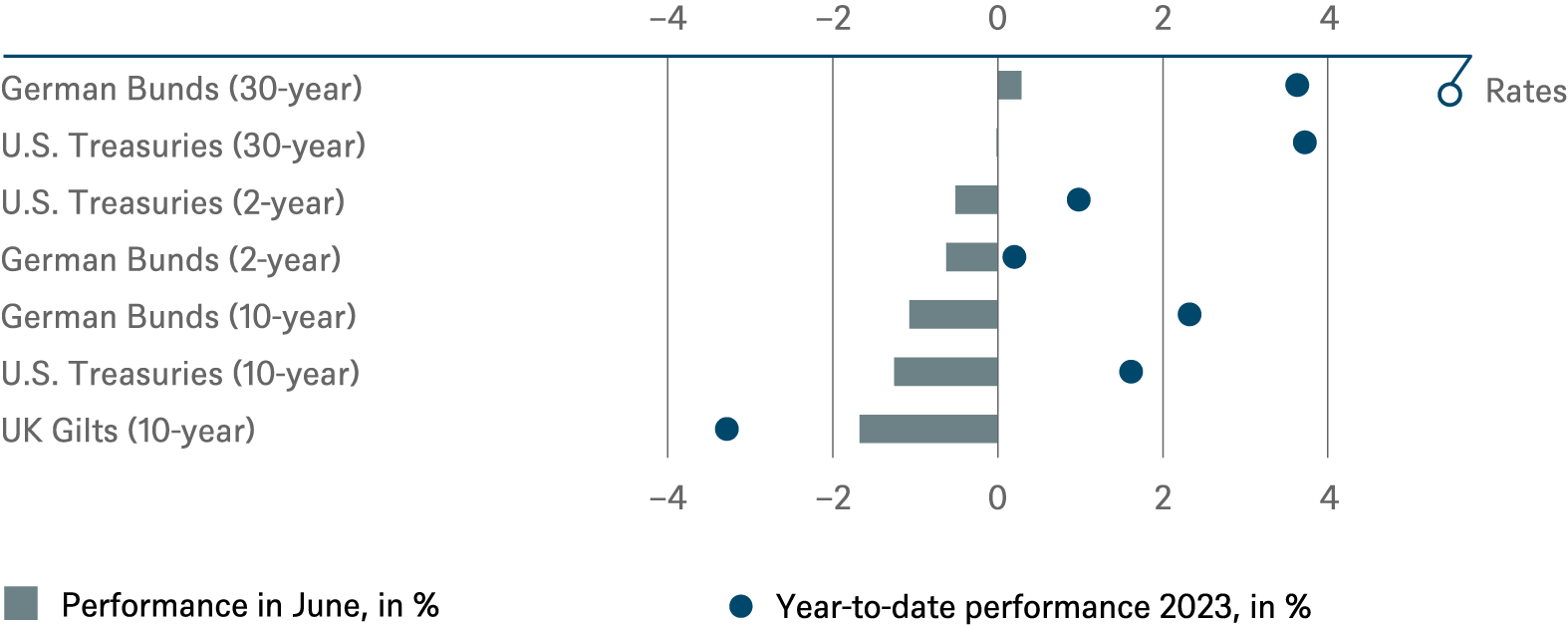

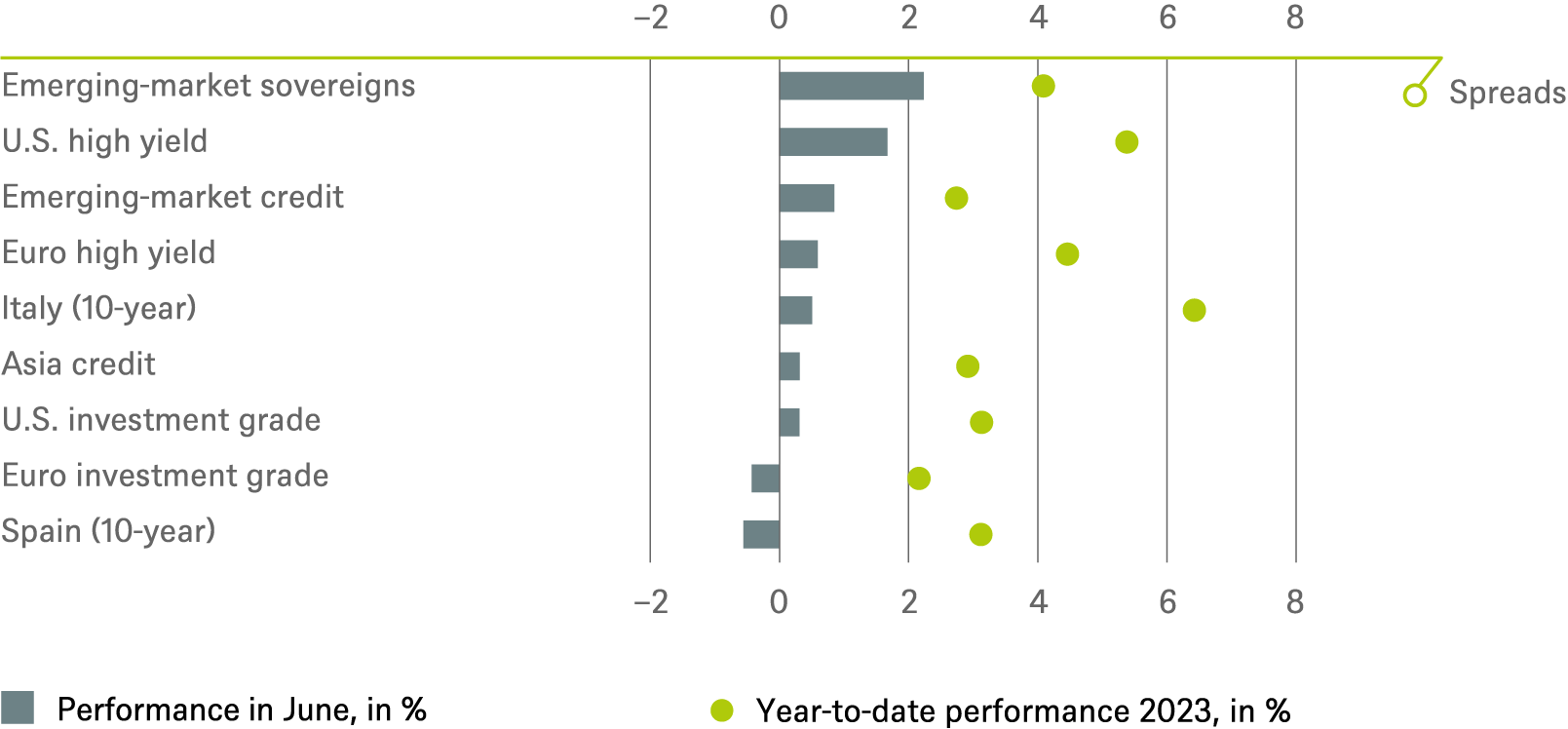

Inflation is gradually moving in the right direction but our short-term outlook on rates is more bearish. There is not much fresh major data in coming weeks, but another interest rate hike is feasible in July given the very hawkish tone of the Fed’s June meeting. We therefore expect markets to continue to price in a more hawkish Fed. Consequently, our short-term position on the 2-year part of the US-Treasuries curve moves to underperform while we keep a neutral stance elsewhere. In Europe the ECB raised all key interest rates by 25 bps in June as expected and will continue to pursue a restrictive monetary policy. Another rate hike is expected in July. The more hawkish language from both the Fed and the ECB has led to a rise in 2-year Bund yields above 3%. We maintain a neutral stance for the time being on 2-year, 10-year, and 30-year Bunds. Our outlook on the 10-year Italian BTP-Bund spread remains at outperform, just as the spread on Spain’s 10-year bonds, – as recent market activity seems to favor spread products. Support from the European Union, Eurozone and ECB has strengthened the resilience of government bond spreads in general.

Investment Grade Credit

We are upgrading our rating for U.S. Investment Grade (U.S. IG) bonds to outperform. With the debt ceiling concerns and the June Fed meeting behind us, we anticipate a gradual upward trajectory in the market over the next few weeks. We continue to see positive inflows into this asset class, and primary issuance is expected to slow down, not least because the blackout season is starting with quarterly results coming out. Overall yield levels seem attractive when viewed on a year-to-date and one-year basis. Spread levels appear less attractive but investors seem hesitant to sell given the overall yield levels, which should provide support.

We maintain a positive outlook on Euro Investment Grade (EUR IG) bonds and remain overweight. The credit markets have performed encouragingly in recent weeks, with spreads tightening at a decent pace. Although new issuance has been more mixed than in recent weeks, we have seen strong inflows from both institutional and retail investors. Corporate Hybrid bonds continue to offer investors attractive opportunities.

High Yield Credit

We maintain a neutral stance on U.S. High Yield (U.S. HY) bonds. Spreads tightened both before and after the Federal Open Market Committee (FOMC) decision. We currently hold a neutral stance on Euro High Yield bonds (EUR HY). Market sentiment remains constructive overall, and the favorable fundamentals of the high yield market have contributed to the tighter spreads. But we maintain a neutral position as the supporting factors that have driven the market may be losing steam due to increased primary issuance. With spreads tightening there is an increased risk of a correction in the near term.

Emerging Markets

EM Sovereigns: Within the index some sovereign bonds are trading at relatively tight spreads. But we see some potential for further spread tightening in some HY names.

Asian credit spreads have tightened since China cut both its one-year medium-term lending facility loans and seven-day reverse repo rate by 10bps. Investors are eagerly waiting to see if further easing or policy support will follow. The primary market has been relatively slow as investors seek more guidance from the FOMC. High quality IGs and HYs in Asia continue to experience decent demand. We maintain our overweight position for Asia Credit, as well as for the broader EM Credit asset class. The rationale behind our stance is that EM credit spreads have started to break out of the trading range observed in the past two months. Spreads for HY issuers have compressed against those of their IG counterparts. This can be attributed to the agreed-upon U.S. debt ceiling extension, ongoing disinflationary trends, expectations that major central banks are getting closer to peak interest rates and optimism about policy reforms in some key EM countries.

Euro vs. Dollar

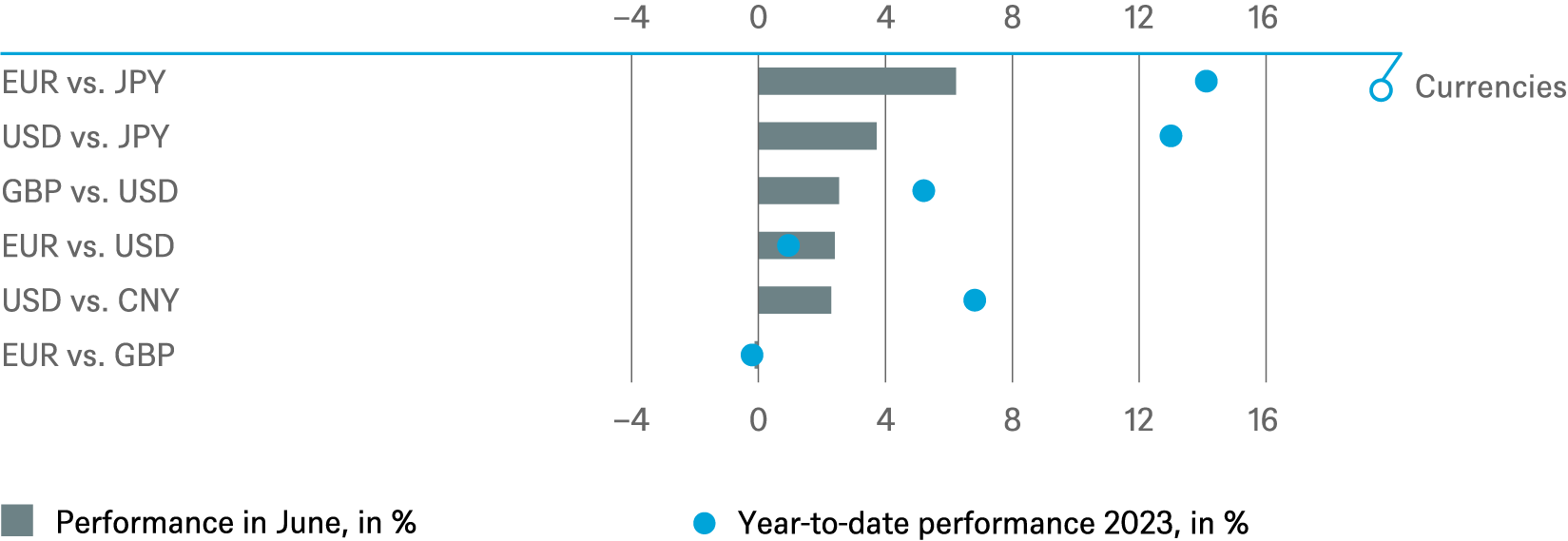

We move back to neutral on the Euro vs. the Dollar (EUR/USD). The ECB delivered hawkish comments at the late June meeting in Sintra as expected, which should help the Euro. Economic performance is better in the U.S. than in the Eurozone, but the market put more weight on the Fed’s June pause in rate hikes. On the British pound vs. the dollar (GBP/USD) we remain GBP long (+1), given the better than expected incoming data on growth and the still hawkish BoE.

2.2 Equities

The bull market thesis for equities is supported by a rise in equity markets of almost 15% year-to-date. Equities offer investors the chance to participate in innovation and potentially benefit from better inflation compensation than many other asset classes. Higher prices are mostly a result of increased price-to-earnings (PE) ratios. Market participants seem more at ease, worrying less about inflation, recession and the Russian war. Instead, they are focusing more on Artificial Intelligence (AI), and we share the market’s euphoria about the significant efficiency gains AI will eventually bring. AI looks poised to become the next growth driver for the technology sector. However, in the second half of the year we expect some angst to return to the equity markets, making the current complacent valuations unsustainable. Core inflation remains sticky, the U.S. and EU economy are entering a soft patch, China’s post-pandemic recovery is taking time, and the market’s perception of AI winners and losers is likely to shift over time. It is still early days for AI.

U.S. Market

Driven by seven mega-large-cap growth stocks, the S&P 500 has already surged beyond our previous June 2024 target of 4,200. But we remain confident about our twelve months target and, given our cautious near-term market outlook, we are therefore lowering U.S. equities to underperform, relative to global equities. The current PE-ratio of above 20 times does not align with our base case scenario of mid-single digit EPS growth in 2024, especially given the expected increase in U.S. 10-year yields to beyond 4%.

European Market

While Europe retains its status as our preferred region, it has yet to prove its ability to outperform the U.S. during periods of market weakness. Europe sceptics would need to argue against Europe’s superior earnings momentum. In addition, the gap between growth and value stocks has almost reached the peak levels last seen in 2021, despite the adverse effects of rising interest rates, as AI has favored growth stocks, which are more prominent in U.S. markets. Normalization in that extreme valuation differential could prove beneficial for European equities.

Emerging Markets

Taking account of macroeconomic, microeconomic and geopolitical factors, we are now adjusting our rating for Emerging Markets and Asia ex Japan equities to neutral. The long slow Chinese post-pandemic recovery has contributed to this shift. Beyond this, earnings revisions have been more negative in EM than in other regions. Despite some high-level diplomatic initiatives, the near-term outlook for US-Chinese relations show only modest signs of improvement. Consequently, investors are redirecting their focus away from Chinese equities towards Japan’s Nikkei as an alternative way to obtain exposure to the region’s enduring Asian growth narrative.

2.3 Alternatives

Gold

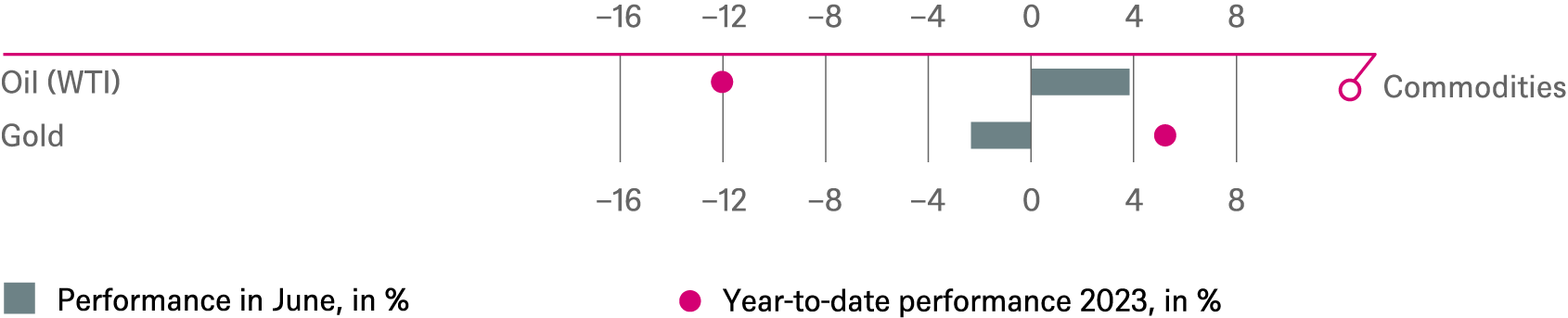

Gold’s lackluster performance, despite a weaker dollar and stagnant or declining real rates, is an indication that a further downturn may be looming in the near term. However, our outlook remains optimistic regarding the medium-term fundamentals.

Base and Precious Metals

Regarding base metals, the landscape is a blend of positive and negative signals. Recent developments have revealed more signs of physical tightness in copper and aluminum, while zinc and nickel rallies remain fleeting due to supply concerns and apprehensions surrounding the sluggish recovery of the Chinese property market. As for precious metals, they are managing to hold their ground. However, the presence of stronger growth and labor market data, coupled with forward rates pricing below the Fed’s median target, continue to pose risks to the downside.

Oil

The global crude oil market is currently grappling with conflicting signals influencing its fundamentals. As a result, we believe that crude prices will continue range-bound trading for the time being. Nonetheless, towards the second half of the summer, we anticipate a potential improvement in prices, as the expected declines in releases from the U.S. Strategic Petroleum Reserve (SPR) releases and the implementation of OPEC’s cut agreements.

2.4 DWS High Conviction

A unique feature amid the current macro weakness is the resilient labor market. We therefore believe that consumer spending will remain robust over coming months and upgrade consumer discretionary to outperform. High-end and middle-class consumers still want to spend on luxury goods, sports fashion, new cars, and convenient online shopping. The valuation premium of the consumer staples sector has retreated by 20% points year-to-date, sufficient to close our previous underweight and move to neutral.

Other than that, we remain bullish on European equities, as already mentioned above, as well as on the Global Communication sector which combines defensive qualities with pricing power as a result of years of consolidation and gives exposure to the tech/AI sector at reasonable prices.

Past performance is not indicative of future returns.

Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 6/30/23

4 / Tactical and strategic signals

The following exhibit depicts our short-term and long-term positioning.

4.1 Fixed Income

Rates |

1 to 3 months |

until June 2024 |

|---|---|---|

| U.S. Treasuries (2-year) | ||

| U.S. Treasuries (10-year) | ||

| U.S. Treasuries (30-year) | ||

| German Bunds (2-year) | ||

| German Bunds (10-year) | ||

| German Bunds (30-year) | ||

| UK Gilts (10-year) | ||

| Japanese government bonds (2-year) | ||

| Japanese government bonds (10-year) |

Spreads |

1 to 3 months |

until June 2024 |

|---|---|---|

| Spain (10-year)[1] | ||

| Italy (10-year)[1] | ||

| U.S. investment grade | ||

| U.S. high yield | ||

| Euro investment grade[1] | ||

| Euro high yield[1] | ||

| Asia credit | ||

| Emerging-market credit | ||

| Emerging-market sovereigns |

Securitized / specialties |

1 to 3 months |

until June 2024 |

|---|---|---|

| Covered bonds[1] | ||

| U.S. municipal bonds | ||

| U.S. mortgage-backed securities |

Currencies |

1 to 3 months |

until June 2024 |

|---|---|---|

| EUR vs. USD | ||

| USD vs. JPY | ||

| EUR vs. JPY | ||

| EUR vs. GBP | ||

| GBP vs. USD | ||

| USD vs. CNY |

4.2 Equity

Regions |

1 to 3 months[2] |

until June 2024 |

|---|---|---|

| United States[3] | ||

| Europe[4] | ||

| Eurozone[5] | ||

| Germany[6] | ||

| Switzerland[7] | ||

| United Kingdom (UK)[8] | ||

| Emerging markets[9] | ||

| Asia ex Japan[10] | ||

| Japan[11] |

Style |

1 to 3 months |

|

|---|---|---|

| U.S. small caps[22] | ||

| European small caps[23] |

4.4 Legend

Tactical view (1 to 3 months)

The focus of our tactical view for fixed income is on trends in bond prices.Positive view

Neutral view

Negative view

Strategic view until June 2024

- The focus of our strategic view for sovereign bonds is on bond prices.

- For corporates, securitized/specialties and emerging-market bonds in U.S. dollars, the signals depict the option-adjusted spread over U.S. Treasuries. For bonds denominated in euros, the illustration depicts the spread in comparison with German Bunds. Both spread and sovereign-bond-yield trends influence the bond value. For investors seeking to profit only from spread trends, a hedge against changing interest rates may be a consideration.

- The colors illustrate the return opportunities for long-only investors.

Limited return opportunity as well as downside risk

Negative return potential for long-only investors