- Home »

- Insights »

- CIO View »

- Investment Traffic Lights »

- Investment Traffic Lights

- Thanks to a stong year-end rally, most assets have delivered positive returns in 2023 so far, though with U.S. Big Tech dominating everything else.

- In its last trading days of the year, the market seems wedded to its belief in a soft-landing scenario.

- We have a generally positive outlook for the next twelve months, but high current valuations mean we expect only moderate returns.

1 / Market overview

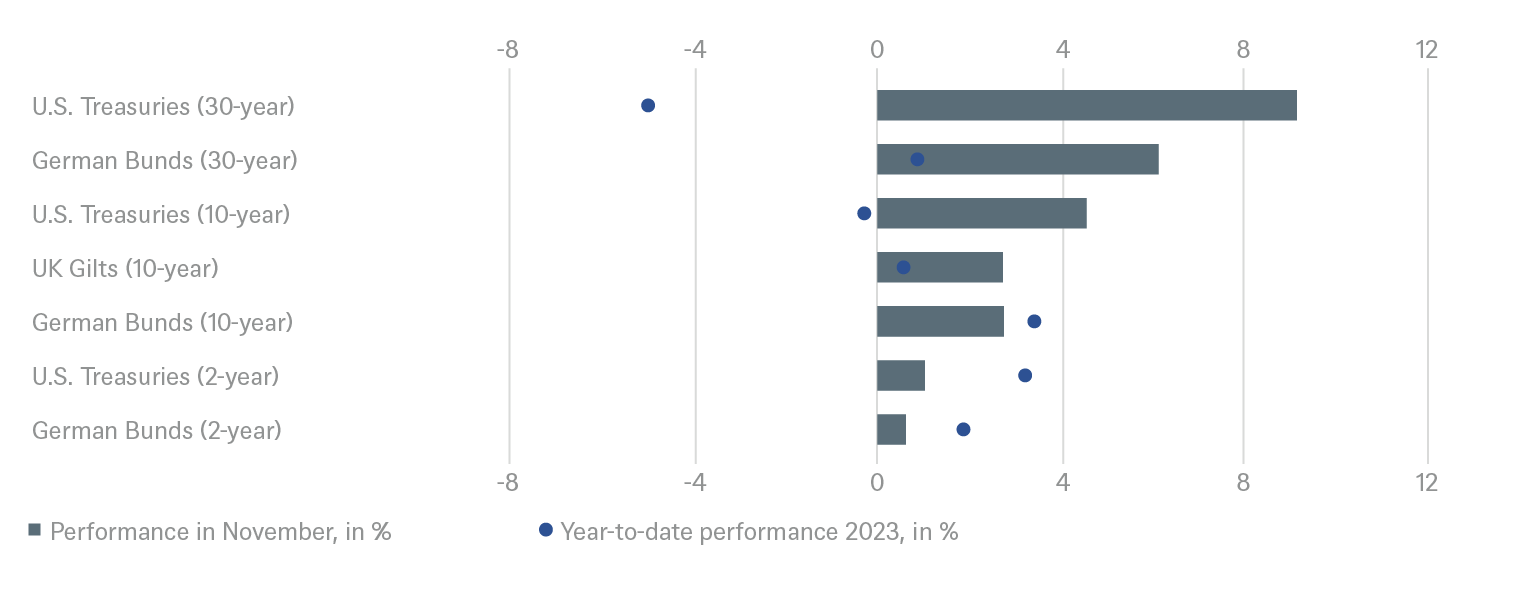

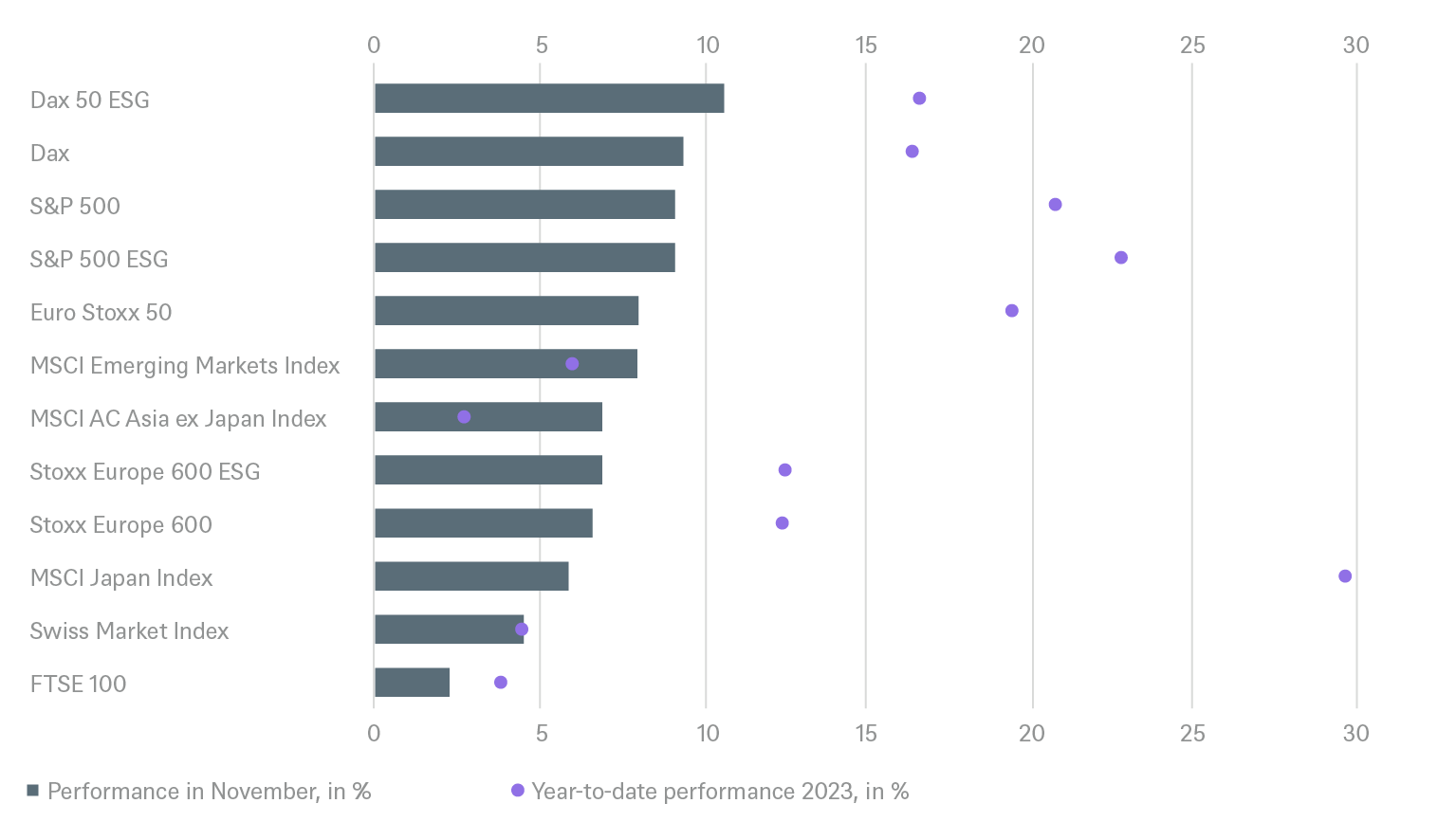

So now the market has had its year-end rally after all. In hindsight, the weakness in October turned out to be a lucrative entry opportunity for all those who stubbornly stuck to their belief that typical seasonal strength would prevail. In the final few trading days of December the markets would have to take quite a dive to reverse the November rally: the MSCI World rose by 9.2%, the most since November 2020, the month in which Covid vaccine progress provoked euphoria. U.S. bonds recorded their best month since 1985, while global bonds had their best month since 2008, with a gain of over 5%. These movements reflected the market’s hope that the battle against inflation has largely been won and that central banks might start to cut interest rates again in the first half of 2024.

The big rally has, of course, pleased investors. But it poses problems for professional market participants who, as is the common practice in the industry, prepare their forecasts for the coming year now. That is our case as we take a closer look at our expectations for 2024 in this issue of Investment Traffic Lights. For most asset classes the direction of our forecasts will not change, but the extent of the earnings potential we expect will. However, there are also examples where this potential has already been completely exhausted.

This is true for our home market, Germany. The DAX has climbed to a new record high just as the international media were again questioning whether Germany is once again the sick man of Europe. A resounding slap in the face from the Constitutional Court on the 2023 budget seemed to confirm the media’s skepticism. The current euphoria in the markets therefore increases the potential for disappointment and corrections in German stocks early in 2024. If, for example, inflation rates do not slide downwards as consistently from now on, or the economic sneezes turn into a serious cold, the German market looks vulnerable.

Before turning to our detailed forecasts, however, we take a brief look back at the year 2023 from its final days.

1.2 The rally that began in 2022 has continued, with setbacks

Equities saw the positives in almost everything, and yet only a few stocks led the way

In retrospect the performance of the equity markets in 2023 was much more straightforward than that of bonds: they benefited from both good news and bad, so long as long as the bad news was about inflation and economic growth as this raises hopes of interest rates to decline. High interest rates have ultimately been the biggest enemy of equities since the beginning of 2022. The recovery in the equity markets that began in early October 2022 – fueled by hopes of overcoming the Covid crisis for good and getting on top of inflation – continued in 2023. The crisis at regional U.S. banks in the spring only put a short-term damper on the recovery. The immediate provision of fresh liquidity and guarantees by the Fed and other institutions quickly revived investors' spirits. So did the newly sparked hype about artificial intelligence.

The Artificial Intelligence hype also ensured that U.S. technology stocks far outperformed the rest of the stock market universe. More than three quarters of the increase in the market capitalization of the S&P 500 can be attributed to just seven stocks. Or, put differently, while the Dow Industrial and the Russell 2000 only gained single-digit percentages in the first eleven months of 2023, the Nasdaq 100 shot up by almost 50% – despite the simultaneous surge in interest rates, which which itself only peaked at the end of October.

Different economic developments

What bolstered equities, and this was the other key theme of 2023, is that the U.S. economy held up much better than feared. The situation was quite different in China where the economy did not get back on to its feet as quickly as expected, even though the official growth figures for 2023 will probably show a 5 before the decimal point. But the mood in the country and its markets is not so positive, with the crisis in real estate also a factor. The Hang Seng index has lost almost a sixth of its value this year. And it has lost a quarter of its value since 2010, while the MSCI World stock index has gained 160 %.

Geographically close but in a different league in terms of performance was the Japanese market, which has risen by almost a quarter so far this year. That inflation has, after many years plagued by deflation, finally emerged, and that wages are rising, too, is helping companies, which are also making progress in their reforms. Meanwhile an extremely weak yen has helped propel the export sector. Many Japanese government bonds have also returned to positive territory in terms of total returns in the last few yards of this year thanks to the fall in bond yields (corporate bonds were already clearly in positive territory).

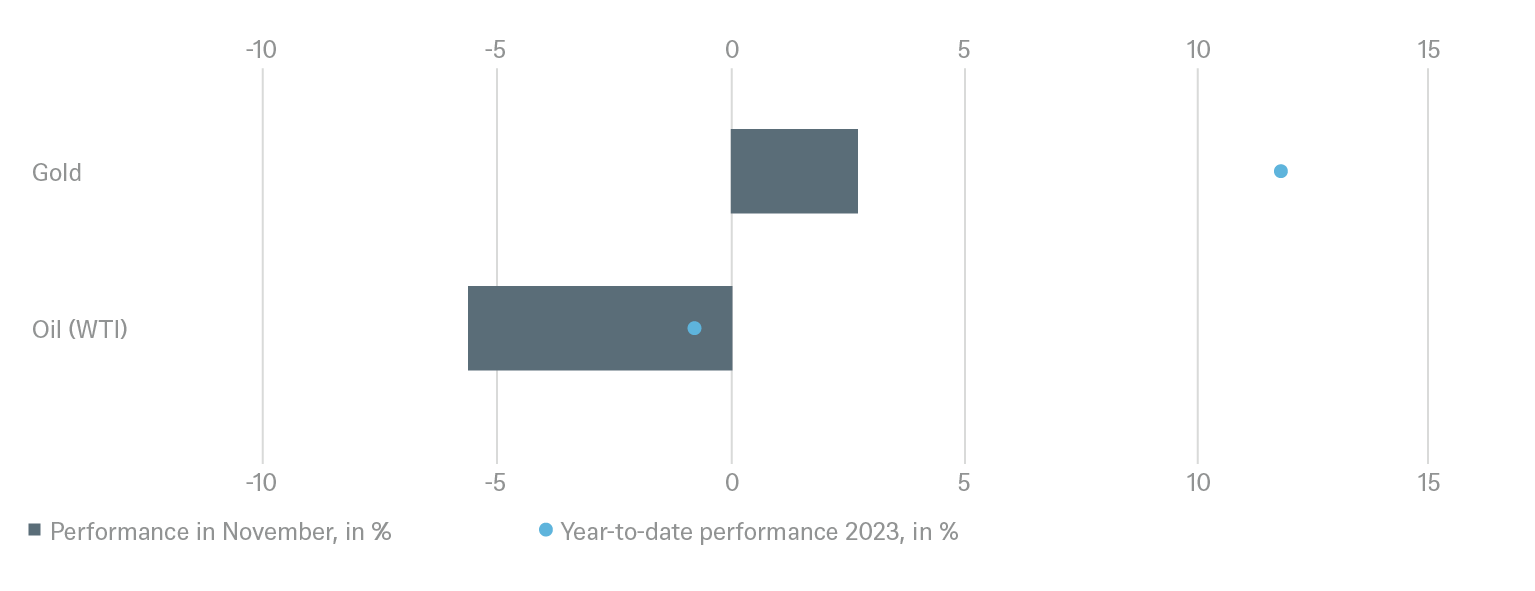

Only one asset class did not fare too well: commodities were the big losers of 2023, with the Bloomberg Commodity Index down by around 10%. This might have been because of the exaggerated increases that occurred following the start of the war in Ukraine, economic weakness in China or headwinds from interest rates. Gold was the exception, up by around 10%. Geopolitical crises, most recently in the Middle East, high inflation, the prospect of falling real yields, and strong purchases by central banks proved to be a helpful mix for the yellow metal.

Finally, the trends in market volatility are worth mentioning. For equities the risk index (as measured by the VIX based on the S&P500) was as low at the end of the year as before the Covid crisis. For bonds, on the other hand, it is still as high as it was during the Great Financial Crisis of 2008/09.

2 / Outlook and changes

2.1 Fixed Income

We see a generally benign environment, as we forecast rate cuts by the U.S. Federal Reserve (the Fed) and the European Central Bank (ECB) from the second quarter onwards. Mixed data in the U.S. leaves hope for a soft-landing intact. Coming months are likely to be characterized by the process of the Fed nearing the end of hiking cycle, but with higher rate regime, with significant fluctuations in terms of what regime markets price in.

Government Bonds

We anticipate gradual normalization of rates and steepening of curve (more pronounced in the front end), especially in the U.S. In the Eurozone, we expect less central bank-buying, but do not expect any major selloffs in the government debt of either Italy or Spain.

Seems like government bond yields have topped out

Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 12/6/23

Investment Grade Credit

Low growth and receding inflation are a good environment for corporate credit. Given that corporate fundamentals stay sound, we see room for moderate spread tightening. We would consider any temporary spread widening as buying opportunities. Especially in the U.S., all in yields continue to be seen as attractive when viewed on a multi-year basis, even though spreads to Treasury yields are less attractive.

High Yield Credit

New issue volume has modestly recovered for both U.S. and EUR high yield (HY) as more HY issuers seek to address 2024 and 2025 maturities, despite higher coupons. For U.S. HY, credit fundamentals for most issuers have remained mostly favorable in 2023, but we expect them to become more mixed, as refinancing near-term maturities has become more expensive. We expect default rates to increase from now 2.3% to 3.25% in 2024 and are Neutral this segment. For EUR HY we are more positive as they trade on higher spreads than their U.S. peers. We expect volatility to remain high, however, as the default rate could rise to 2.75% and regional geopolitical risks may produce new headwinds.

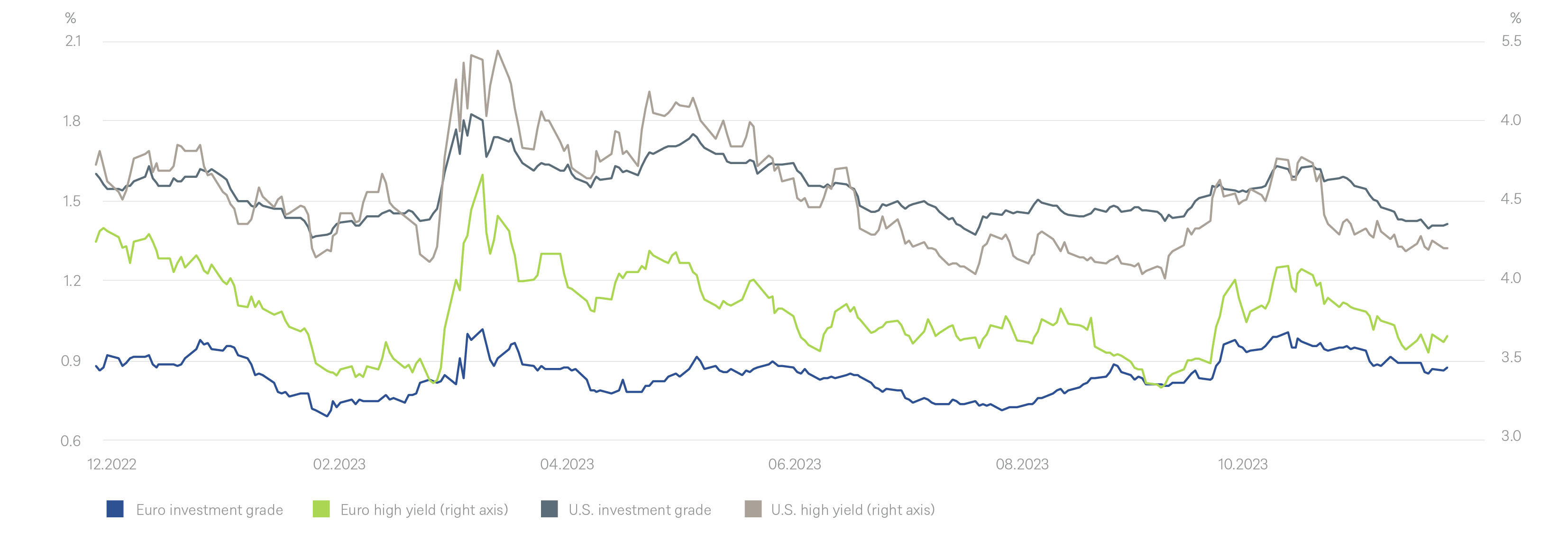

Credit spreads hardly indicate fear of a real recession

Emerging Markets (EM)

We expect EM sovereign spreads to move sideways (in the base case), as several risks have been priced in. We like solid “IG” issuers with attractive valuations. For EM corporates, we note that credit fundamentals by leverage and liquidity improved significantly post Covid and are the strongest in 10 years, putting them well ahead of global peers.

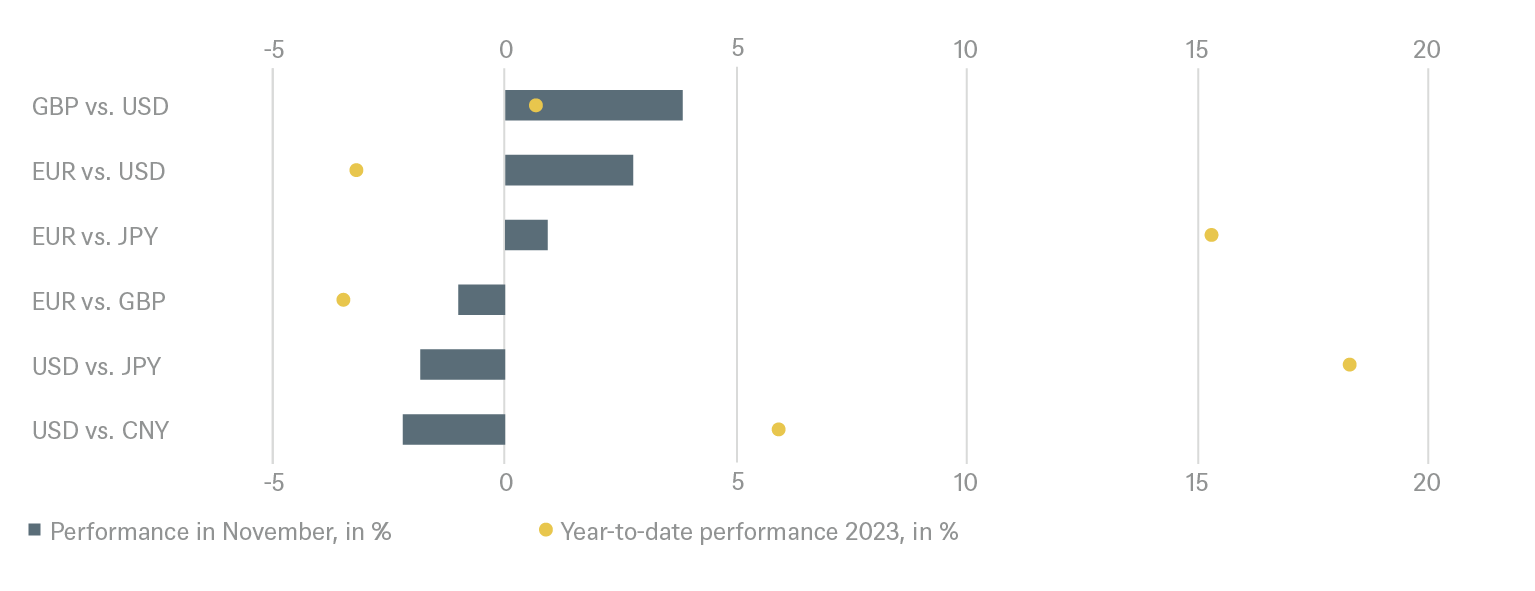

Euro vs. dollar

We expect foreign exchange markets to remain strongly focused on key economic data releases on both sides of the Atlantic, as these are key drivers are economic data, as expectations for bond yield differentials remain critical determinants to the near-term outlook of the euro versus the dollar. The refinancing needs in the US could keep the dollar strong.

2.2 Equities

The base case is a soft-landing. Our economists forecast that the Fed and ECB are done with hiking. We believe inflation should approach targets levels by the end of 2025. This will allow central banks to enter the loosening cycle in June 2024. The drags of high central bank rates on inventory levels and the real estate market have become visible during recent months. However, some of the effects on the real economy are yet to arrive. Activity is expected to slow during the coming two quarters, however, without causing a severe recession, as labor markets remain tight and therefore consumer spending should stay robust. We stress the fine difference in our assumption that central banks start cutting because they “can cut” (clear progress on fighting inflation) and not because they “have to cut” (to prevent a looming recession). The latter motivation to cut would clearly be bad for equity markets. Equity investors have started to focus at the “light at the end of the tunnel” in recent weeks, as the prospects of falling central bank rates could start a moderate GDP re-acceleration from H2 2024 in the US and Europe.

We believe that the above macro scenario warrants a constructive equity outlook, while acknowledging recent market strength limits further return potential for global equities. We currently have little conviction to call out a strong regional return-differentiation. The diminishing equity risk premium (ERP) has been a key driver for equity markets in 2023, reflecting dis-inflation, fading recession-fears and AI-euphoria.

Without valuation support, most of the expected return will therefore have to come from dividends and earnings growth. The good news is that - following 3 years of flat EPS of the MSCI AC World - we expect an earnings re-acceleration towards 8% in 2024 and beyond. Cloud computing, progress in AI and a recovery in the semi-conductor cycle could support at least mid-teens EPS growth for IT (neutral, expensive), communication services; health care (neutral, pending US-election) could benefit from the launch of anti-obesity drugs. Elsewhere, EPS growth in-line with nominal GDP (less price increases than 2023, but better volumes) are our key assumptions. Our estimates are approx. 3% below consensus, as the latter might still have to reflect the drag from high central bank interest rates.

“When and how to position portfolios towards the entry in the monetary loosening cycle?” should become the key tactical decision of fund managers in 2024. Re-positioning is likely to start ahead of the expected first rate cut in June 2024. Stock performance patterns following the release of low US CPI numbers for October could be indicative of the playbook. As such, listed real estate, small caps, “Value”, Europe, unprofitable biotechnology and other disregarded market segments could make it back to the PM buy-list.

What if we are wrong and experience a hard landing? Obviously, earnings projections would fall, and the ERP would rise dragging down equity indices. Fortunately, bond yields have normalized since their lows in 2020. As a result, they have regained some of their traditional ability to “buffer” equity losses in a diversified portfolio, limiting the need to reduce equity investment for pessimistic investors. While bonds might offer a better risk-return in 2024 than equities, investors will remember that in 2023 stocks have proven again to offer superior inflation protection, strong participation in innovation and offer exposure to economic growth. As such, long-term investors will stick to equities in 2024 as a core position in their portfolios even if they are not yet willing to bet on the light at the end of the tunnel.

Equity markets enjoyed a decent year-end rally

Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 12/6/23

U.S. Market

We look negative on the U.S. market. Our December 2024 index target for the S&P 500 is 4.700. With respect to valuation, we expect US bond yields (DWS forecast US10y 4.2%) to cap the trailing-PE just below 20x for the S&P. For 2024 we see no further valuation support from additional shrinking of the US equity risk premium, as it already reflects “soft-landing euphoria” and indicates limited risk awareness of investors.

European Market

For Europe we remain positive. The Stoxx profits from the yearend rally. We are especially positive on European SMID caps, companies which are delivering solid EPS growth. However, there is a better global GDP required as trigger for further gains.

German Market

We remain neutral on German equities. Overweight profitable growth stocks with attractive earnings growth and recovery potential and solid balance sheets. We focus on companies with greater pricing power and defensive characteristics and remain underexposed to sectors with structural problems and companies with weak balance sheets.

Japan

Japan remains attractively priced. We have no recession fears and are positive on the inflation outlook. The cheap Yen is sort of a foreign exchange tailwind, which benefits earnings. Furthermore, Japanese equity is an alternative to Chinese equities for Asian investors.

Emerging Markets

We are positive on emerging markets. Our focus is on selected Asian consumer and technology stocks. The rebounding semiconductor cycle is expected to be the main driver of EM earnings per share growth in 2024, and we like Asian semi-stocks. Within Indian equities, we highlight banking stocks as an opportunity to participate in the growth of the world's most populous country.

2.3 Alternatives

Real Estate

Relative to listed markets, it typically takes 6 to 12 months longer for price trends to be fully reflected into real estate transaction valuations. At this stage, it is unclear when exactly “higher for longer” nominal interest rates might be fully reflected in real estate valuations. Despite some moderation in demand, fundamentals remain solid, with low vacancy rates and heathy rent growth across most sectors and regions. Recession might dampen leasing, but construction has also been falling amid repricing prices and tighter financing. "Flight-to-quality" of tenants toward energy- and water efficient buildings with good air quality supports office refurbishment, especially in Europe.

EU carbon allowances

We see the price of EU carbon allowances at EUR 95/tonne in 12 months' time. Falling natural gas prices are enabling European utilities to shift more power generation away from coal, reducing demand for EU allowances. However, policymakers continue to tighten the rules governing the emissions trading market, which will support increases in the EU carbon price in the short to medium term. In addition, we continue to expect the prices may consolidate towards the end of the year partly due to milder than usual weather lowering demand.

Gold

Gold rallied after the Fed signaled that rate hikes could end soon and has performed well throughout 2023. We expect a further rally if the Fed signals possible cuts, so we remain unchanged at $2,300/oz for 4Q23 and our 12-month forecast is $2,250/oz. The geopolitical risk premium has offset the headwinds from tighter financial conditions. However, we expect both to reverse over time and it appears that elevated central bank buying will continue, supporting gold through 2024. For deferred gold, we believe the fair value is around USD 2,000/oz and we prefer gold exposure for December 2024.

Oil

Our 12-month forecast for Brent is $88 per barrel. We increased our forecast to account for updated fundamental drivers. Our forecast reflects ample supply near term and undersupply towards the end of 2024. Our base case assumes Saudi Arabia and Russia will remove the additional, voluntary cuts in supply in 2024. We also incorporate moderate growth in crude demand, consistent with the global GDP path envisioned by our macroeconomists. Recent inventory draw-down has helped support Brent price recovery, and the Israel – Hamas conflict has added to significant uncertainty to near term supply. We have not priced in significant changes to supply from Iran as of now. Furthermore, the energy market continues to price out immediate risk of the Israel-Hamas conflict expanding into wider regional hostilities. The ongoing demand weakness may require Saudi Arabia to maintain the current production level well into 1Q24. Despite negative headwind across the crude complex, we favor WTI over gasoline and diesel.

Geopolitical risks seem reflected in the gold price but not in the oil price

Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 12/6/23

2.4 DWS High Conviction

We remain positive on investment grade credit and high-quality Covered Bonds. In emerging market sovereign, we focus on a basket of Europe investment grade names. In high-yield, we selectively favour rising stars and event-driven names. Overall, yields remain attractive on a multi-year basis. While spreads are less compelling, investors seem reluctant to sell given the yield levels. On the equity side, our main growth calls are global communication services and global consumer discretionary. The communications sector has real AI exposure, a reasonable valuation, and solid EPS growth. The consumer discretionary sector, on the other hand, is supported by robust labor markets. In real estate, we like logistics. As e-commerce drives demand, markets for distribution capacity are tightening around the world. Residential real estate is benefiting from housing shortages in most major markets. Higher interest rates are also shifting demand to rental. In infrastructure, in EMEA, greenfield project to boost the energy transition and refinancings of transportation assets look attractive, while in the US, more traditional assets and infrastructure sub-sectors such as power, renewables, digital, rail and waste are interesting. Direct lending could take the lead in 2024, focusing on recession-resistant sectors with stable recurring cash flows, high profitability and the ability to pass on costs to customers, such as healthcare, IT, software and business-to-business services.

3 / Past performance of major financial assets

Total return of major financial assets year-to-date and past month

Past performance is not indicative of future returns.

Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 11/30/23

4 / Tactical and strategic signals

The following exhibit depicts our short-term and long-term positioning.

4.1 Fixed Income

Rates |

1 to 3 months |

until Dec 2024 |

|---|---|---|

| U.S. Treasuries (2-year) | ||

| U.S. Treasuries (10-year) | ||

| U.S. Treasuries (30-year) | ||

| German Bunds (2-year) | ||

| German Bunds (10-year) | ||

| German Bunds (30-year) | ||

| UK Gilts (10-year) | ||

| Japanese government bonds (2-year) | ||

| Japanese government bonds (10-year) |

Spreads |

1 to 3 months |

until Dec 2024 |

|---|---|---|

| Spain (10-year)[1] | ||

| Italy (10-year)[1] | ||

| U.S. investment grade | ||

| U.S. high yield | ||

| Euro investment grade[1] | ||

| Euro high yield[1] | ||

| Asia credit | ||

| Emerging-market credit | ||

| Emerging-market sovereigns |

Securitized / specialties |

1 to 3 months |

until Dec 2024 |

|---|---|---|

| Covered bonds[1] | ||

| U.S. municipal bonds | ||

| U.S. mortgage-backed securities |

Currencies |

1 to 3 months |

until Dec 2024 |

|---|---|---|

| EUR vs. USD | ||

| USD vs. JPY | ||

| EUR vs. JPY | ||

| EUR vs. GBP | ||

| GBP vs. USD | ||

| USD vs. CNY |

4.2 Equity

Regions |

1 to 3 months[2] |

until Dec 2024 |

|---|---|---|

| United States[3] | ||

| Europe[4] | ||

| Eurozone[5] | ||

| Germany[6] | ||

| Switzerland[7] | ||

| United Kingdom (UK)[8] | ||

| Emerging markets[9] | ||

| Asia ex Japan[10] | ||

| Japan[11] |

Style |

1 to 3 months |

|

|---|---|---|

| U.S. small caps[22] | ||

| European small caps[23] |

4.4 Legend

Tactical view (1 to 3 months)

The focus of our tactical view for fixed income is on trends in bond prices.Positive view

Neutral view

Negative view

Strategic view until Dece 2024

- The focus of our strategic view for sovereign bonds is on bond prices.

- For corporates, securitized/specialties and emerging-market bonds in U.S. dollars, the signals depict the option-adjusted spread over U.S. Treasuries. For bonds denominated in euros, the illustration depicts the spread in comparison with German Bunds. Both spread and sovereign-bond-yield trends influence the bond value. For investors seeking to profit only from spread trends, a hedge against changing interest rates may be a consideration.

- The colors illustrate the return opportunities for long-only investors.

Limited return opportunity as well as downside risk

Negative return potential for long-only investors