- Home »

- Insights »

- CIO View »

- Chart of the Week »

- Still waiting for U.S. labor market to turn

One of the quirks of economic forecasting is that things rarely look quite as clear cut in real time, as they do with the benefit of hindsight. Take signs of economic weakening, and not the rather obvious ones seen in Europe, but the more subtle ones across the pond. For quite a while, we and other observers have basically just been waiting for the U.S. labor market to finally turn, in line with a whole host of other indicators.

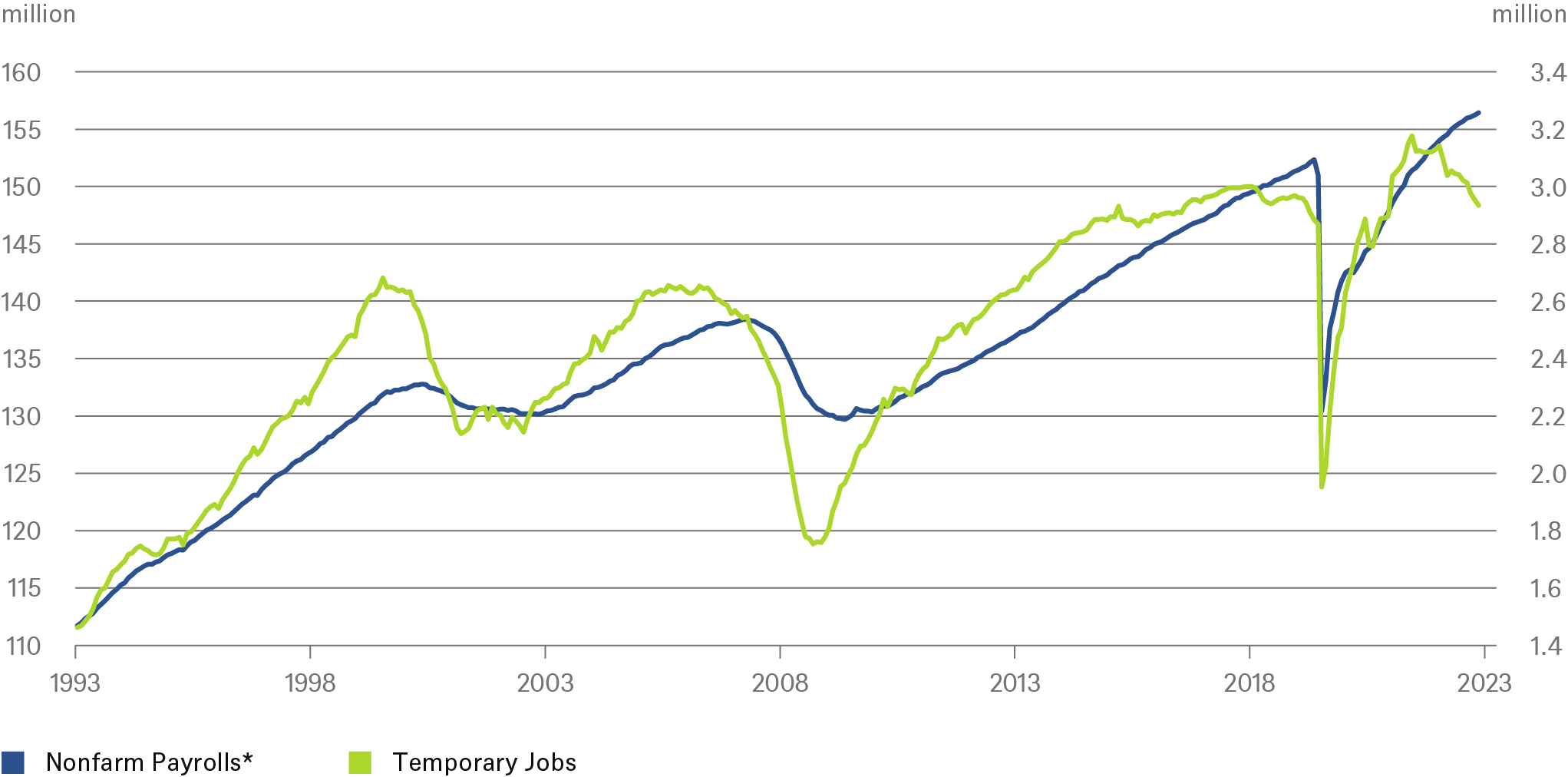

No wonder then, that every bit of new data is coming under intense scrutiny. Take last week's figures for the American job market covering non-farm payrolls. These were not a disaster, but clearly point to a slowdown.[1] At 3.8%, the unemployment rate has reached its highest level since February 2022. Wage growth is moderating. Temporary help services jobs are usually quite a good bellwhether, as our Chart of the Week shows. In seasonally adjusted terms, they have fallen by 3.6% over the past six months. When did we last see such a loss of temp jobs? Back in 2020, starting in March in the runup to the pandemic induced recession. Before that, in April 2008, in February 2001, and in March 1991. Rings a bell, doesn’t it?

At least when it comes to temporary help services, U.S. labor markets are already weakening.

*seasonally adjusted

Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 9/06/23

Before jumping to conclusions, though, it is worth keeping in mind that monthly U.S. jobs data can be fickle, seasonal adjustments are tricky and even aggregate data is prone to numerous revisions, often quite extensive ones. For example, August hiring was robust with 187,000 jobs created, but a downward revision of 110,000 jobs over the past two months suggests a bit less momentum than initially thought. Meanwhile, labor supply unexpectedly increased in August as suggested by the labor force participation rate which rose from 62.6% to 62.8%. However, not all people who entered (or returned to) the labor force found their way into employment: the unemployment rate rose from 3.5% to 3.8%, a clear "dovish" signal for central bankers. As a result, more supply is being met with somewhat less demand, which may explain lower wage growth: average hourly earnings rose "only" 0.2% month on month (m/m), down from 0.4% m/m in June and July.

For investors, the key point may prove to be that the latest jobs and inflation data takes some pressure off the Fed, as it supports a data-dependent "on hold" at the upcoming September FOMC meeting. Potentially, this could even pave the way towards the Fed further increasing rates no further this year, making the next major discussions all about how much rates will be cut in 2024 – once inflation is sufficiently close to 2%. After all, consumers have become increasingly reliant on income rather than excess savings to finance consumption. Further headwinds are on the horizon. Increased use of credit at higher interest rates, upcoming student loan repayments, combined with a further decline in wage growth and a further softening of labor market conditions could prompt consumers to moderate their spending plans by more than recent strong numbers on personal consumption suggest.