How times change. When, a few years ago, the European Central Bank (ECB) called on member states to fulfill their responsibilities, it mainly meant implementing austere fiscal policies geared toward reducing public debt. To put it mildly, the EU governments have been rather hesitant to do so. In Italy, France and Spain, debt has increased or at best stabilized since the financial crisis. In the Eurozone as a whole, public debt has fallen, but this is mainly due to the consolidation of a few countries, such as Germany or the Netherlands.

Nowadays, when the ECB admonishes countries with regard to fiscal policy – as Mario Draghi recently did at the press conference after the September meeting of the Governing Council of the ECB – it is to ask them to loosen the purse strings in order to support their weakening economies. This pressure is likely to increase significantly in the coming months. Monetary policy – especially that of the ECB – is reaching its limits: it cannot cut interest rates much further and a (significant) expansion of the quantitative-easing (QE) program is hardly feasible politically. In addition, capital-market interest rates have already reached historic lows.

In our view, the new President of the ECB, Christine Lagarde, will certainly increase the pressure on the member states to do more – within the scope of her possibilities and her mandate. Given her experience and reputation, she will probably be able to achieve significant concessions. And strategists and portfolio managers alike believe that these concessions – first and foremost a German fiscal package – could help markets the most.[1]

Germany is not loosening the (debt) brake

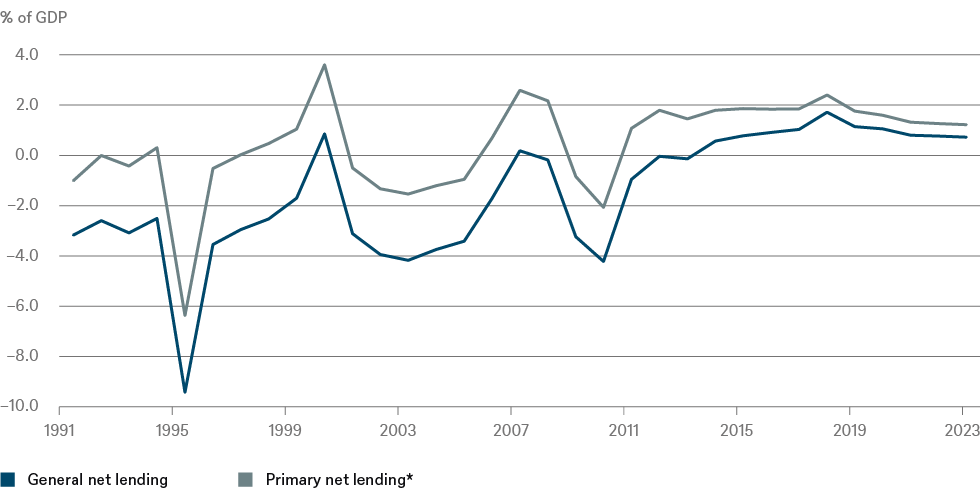

Mario Draghi obviously had Germany in mind, too, when he addressed the member states with room for expansionary fiscal policy at the press conference. But one should not get one's hopes up too high in the short to medium term: as far as its fiscal policy is concerned, Germany is still geared toward consolidation rather than expansion. Germany has been generating surpluses for years (see Fig. 1). Usually, the government should now be investing heavily. New German Bunds are not only interest-free, investors are even willing to accept negative interest rates and effectively pay on top. Moreover, both by historical and international standards the government's investment ratio is low (see Fig. 2). Meanwhile, complaints about Germany's inadequate infrastructure (rail and broadband cable) are significant. Nevertheless, we assume that the German government's restrictive stance will not change much in 2020 mostly due to self-imposed political restrictions.

Figure 1: German government finances – general net lending vs. primary net lending

*net lending excluding interest payments

Sources: IMF, Haver Analytics Inc. as of 10/2019

Figure 2: Public investment expenditure in Germany

Source: Haver Analytics Inc. as of 10/2019

The "Debt Brake"

Germany's balanced-budget amendment – the so-called "Debt Brake" – has been a part of the German constitution since 2009. Roughly speaking, it states that under normal economic conditions the federal government must not issue more than 0.35% of gross domestic product (GDP) as new debt each year. The federal states are required to draw up balanced budgets, too. As the social-security systems in Germany cannot incur any significant debt either, the result is that the cyclically adjusted deficit in Germany is limited to around 0.35% of GDP – far below the Maastricht criterion of three percent. In case of a downturn, higher deficits (the so-called automatic stabilizers), resulting from higher social spending and lower tax revenues, are permitted. In addition, higher debt issuance is possible in the event of "natural disasters and exceptional emergencies." Even though the law only came into force after the financial crisis, it is clear that it would have qualified as an emergency. However, it is unclear how serious a downturn it would have to be in order to classify as such an exceptional situation. The extent to which German fiscal policy is actually restricted by the debt brake will only become apparent in the next downturn. Currently, the 0.35% rule amounts to a permissible net new debt limit of just under 12 billion euros.

The "Black Zero"

One is inclined to ask: What would it take for Germany to loosen the purse-strings? Apart from Trump, Brexit and a large-scale climate program of the German government? And the explicit wishes of the other EU member states (and the ECB)? When will Germany finally make use of its existing scope for fiscal policy? If the German government really wanted to act without restriction, it would have to remove the Debt Brake from the constitution (at least as far as federal spending is concerned). After all, the self-restraint has largely achieved its goal: Germany is fulfilling the Maastricht criterion of national debt below 60% of GDP for the first time in 15 years. A constitutional amendment would require a two-thirds majority in both the Bundestag and Bundesrat and thus a broad political consensus. In a federal system like that of Germany this requires not only time but above all a great deal of political will. The latter seems distant when it comes to the Debt Brake, at least for the time being, as can be seen in the debates on the "Black Zero."[2]

German policy-makers remain reluctant to carry out overdue investments, despite a weakening economy. This does not mean, however, that Germany will fall into complete fiscal immobility. There will most probably be limited solutions for individual problems. The Ministry of Labor is preparing a reform of subsidies for reductions in working time. Such measures were regarded as a great success story during the financial crisis. In addition, there will probably be similar targeted measures if the United States actually imposes punitive tariffs on car imports. These would naturally be a big blow for Germany's automotive industry (and especially its suppliers). In addition to supporting short-time work, mitigating measures could include special depreciation allowances, perhaps by tying them to the switch to electric vehicles. Given the good budgetary situation, such measures would be easily feasible. If they had to, German politicians would probably find ways and means to interpret the self-imposed restrictions creatively enough trying to avoid Germany sliding into a recession. Since we don't see a serious recession approaching, all of the measures are likely to fall well short of what capital markets are hoping for.

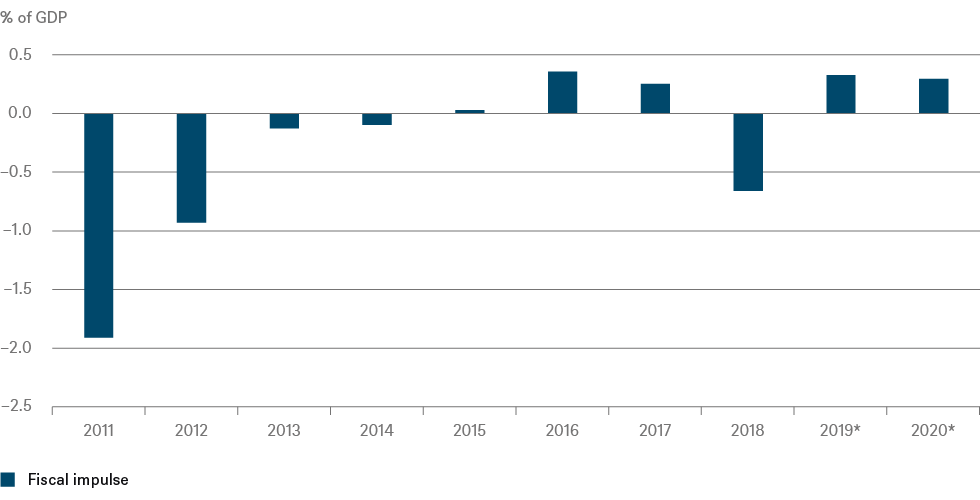

Already expansive and already planned

Those who place their economic hopes on the German state should also be aware that it is already acting quite loosely – at least by German standards. Economists estimate the effects of the budget on the basis of the economic impulse. It equals the annual change in the primary balance adjusted for cyclical influences (total government balance before interest payments). If, for example, the government increases the deficit from two to three percent of GDP (or equivalently reduces its surplus), economists talk about a positive fiscal impulse of one percent of GDP. This can currently be observed in Germany: while last year the government consolidated by about half a percent of GDP, this year it is sending a positive fiscal stimulus of roughly the same magnitude (see Fig. 3). This looser fiscal policy essentially arose from increased welfare-state benefits (increases in child benefit, basic tax allowance, etc.).

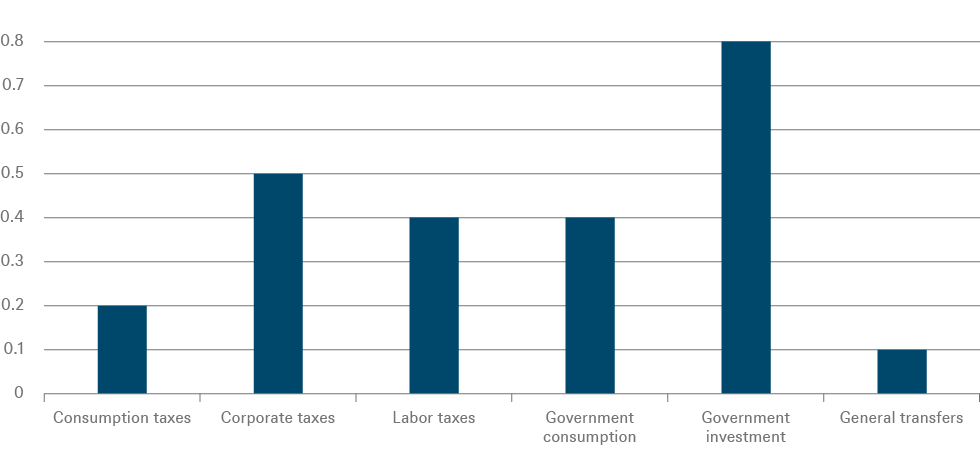

Hence, this year the government is supporting macroeconomic demand by one percent more than last year. However, since these expenditures mainly address consumer spending, the growth effect appears to be limited in both the short and long term. According to calculations by the International Monetary Fund, general transfers are government expenditures that – at least in Europe – have the smallest multiplier effect, i.e. the smallest impact (see Fig. 4). This is underscored as Germans are saving more again: apparently some of the stimulus has been put aside rather than consumed.

In addition, the government has already budgeted large parts of the surpluses for the coming years. According to estimates by Germany's leading economic research institutes[3], the surplus is likely to shrink from 63 billion euros last year to around 4 billion euros in 2021 – about 0.1% of GDP. Once again, the current fiscal stimulus is largely attributable to higher social benefits (i.e. increase in maternal pension etc.). The abolition of the solidarity surcharge[4] – at least for large parts of the population – does exhibit a higher multiplier, but its corresponding volume (10 billion euros) is not likely to give the economy a significant boost.

Figure 3: Fiscal impulse in Germany

*forecast EU commission

Sources: EU commission, Haver Analytics Inc. as of October 2019

Figure 4: Fiscal multiplier estimates for the EU

Source: IMF as of April 2014

...and the others?

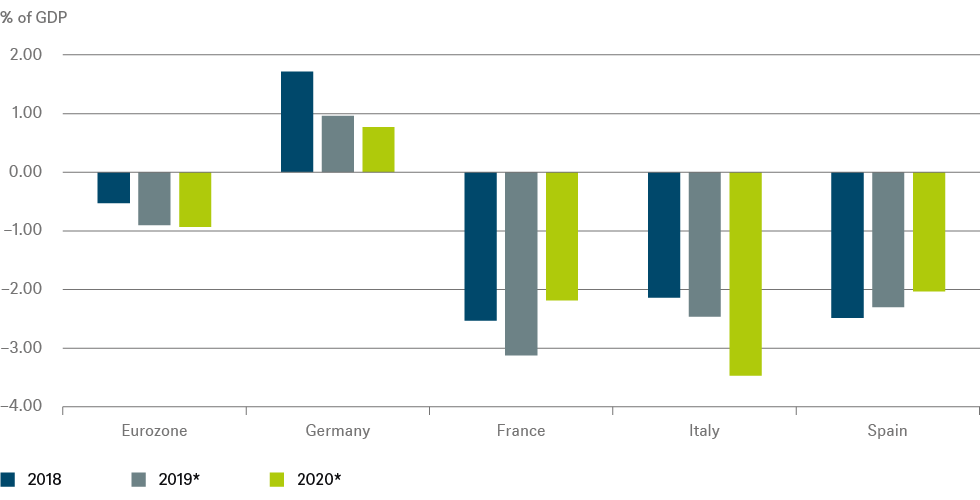

One should not expect much deviating actions from the other large EU states in the coming months either. This is, however, for opposing reasons: they would like to pursue a much more expansionary fiscal policy, but their public finances are strained, at least according to the Maastricht criteria of the Eurozone (see Fig. 5). Italy, for example, has barely avoided an EU deficit procedure twice already. We assume that the (new) EU Commission will be somewhat more accommodating with the (new) Italian government, after more conciliatory tones have also been heard from Rome. The current Italian budget draft states a deficit of 2.2% of GDP. This is still higher than what has been agreed with the EU Commission at the beginning of the year. But in assessing the economic impact, we believe one should focus less on the absolute level and more on the change compared to the previous year. For 2019, the Italian government expects a deficit of just under 2.1%. Thus it can no longer claim to be pursuing an imposed austerity course. Nonetheless, a somewhat looser budgetary policy is unlikely to give the Italian economy the desired stimulus. This would require a truly concerted action combining fiscal-policy demand impulses with structural reforms on the supply side. Unfortunately, this is not to be expected from the new Italian government either.

For comparison, the 2018 tax reform in the United States accounted for more than 0.7% of GDP. The corporate tax cuts were aimed at least in part at supporting longer-term investments and at triggering a sense of optimism in the economy. Nevertheless it is questionable if a budget deficit of around 5% can be justified in view of a national debt of more than 100% of GDP. Especially since the tax reform occurred during an economic boom and its effects may have fizzled out already. In any case, there are currently no signs of a similar volume in the Eurozone that could cause any real change in sentiment.

Figure 5: Government net lending in the Eurozone

*forecast EU commission

Sources: EU commission, Haver Analytics Inc. as of October 2019

Conclusion

Even if the ECB's pressure on the Eurozone member states should increase, one should not be too optimistic. Of course, Christine Lagarde, the new head of the ECB, will probably be looking for a more expansionary fiscal policy. Unless a serious recession in Europe were to occur, we should not expect a lot of fiscal policy measures, however. Germany (and other EU countries as well) will likely become more expansive, but not to the extent necessary to have a substantial impact. In addition, the measures hardly address the areas in which an expansionary fiscal policy would have the greatest (multiplier) effects.

So anyone who hopes for the government to boost the economy again is likely to be disappointed. In the longer term, however, this could also apply to supporters of the Debt Brake in Germany. If the Federal Government really continues to insist on the "Black Zero" instead of interpreting the Debt Brake more flexibly, many will sooner or later ask themselves whether this self-imposed constraint is really as wise as it seemed at the time. At the least, a broader debate is likely to arise when the next recession is in the books.

1. Source: Bank of Americas Merrill Lynch Fund Manager Survey as of September 2019

2. Refers to Germany's balanced budget

3. Source: Gemeinschaftsdiagnose 2-2019, Projektgruppe Gemeinschaftsdiagnose as of September 2019 http://gemeinschaftsdiagnose.de/wp-content/uploads/2019/10/GD_H19_Langfassung_online.pdf

4. The solidarity surcharge is a tax imposed on all income in Germany. Proceeds are intended to be used to finance the additional costs of the German reunification, such as upgrading the formerly Eastern German states' infrastructure or paying for their pension obligations.