Special features of Liquid Real Assets

Investing in real estate or infrastructure projects usually requires large investments and a long investment horizon. With Liquid Real Assets, it is possible to implement these investment solutions as liquid, easily tradable strategies.

With Liquid Real Assets, our investors gain access to exchange-traded real estate and infrastructure securities as well as to commodities in the form of commodity stocks and direct investments in commodities via futures.

Our active fundamental and research-based approach allows us to make these strategies available for both individual and institutional investors.

DWS is one of the largest managers in Liquid Real Asset with assets under management amounting to around $ 19bn. Most of the assets are invested in infrastructure and real estate securities. In addition, in the US we offer investments in other real assets and commodities, such as gold and precious metals.

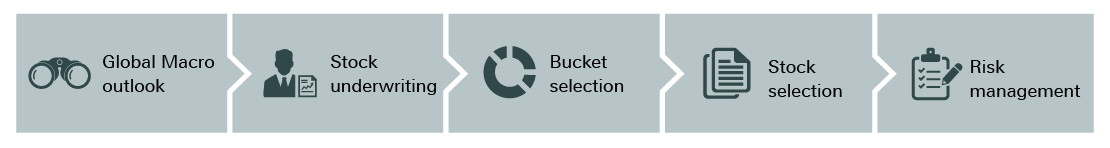

Investment process of the DWS Liquid Real Asset Strategies

Each asset class in Liquid Real Assets has a specific approach, but all have in common active stock selection that focuses on fundamental research. With the support of a large international portfolio management and analyst team, we are able to analyse the investment universe accurately.

Our teams also use the global resources of the Alternatives platform specialists who invest directly in real estate and infrastructure. The portfolio management teams also have access to the integrated research & strategy team.

Portfolio construction is based on bottom-up selection for which we use our own methodology with 28 discrete categories.