Strategic Asset Allocation (SAA)

The strategic asset allocation (SAA) serves as the foundation of the investment strategy. The SAA process aims to monitor that the portfolio meets the long-term return and risk targets. Emphasis is put on the long-term strategic perspective, the alignment with the specific investment needs and the minimization of unrewarded and concentrated risks. As a result, we combine our long-term market expectations (DWS Long View) and our proprietary optimization process - Group Risk in Portfolios (GRIP).

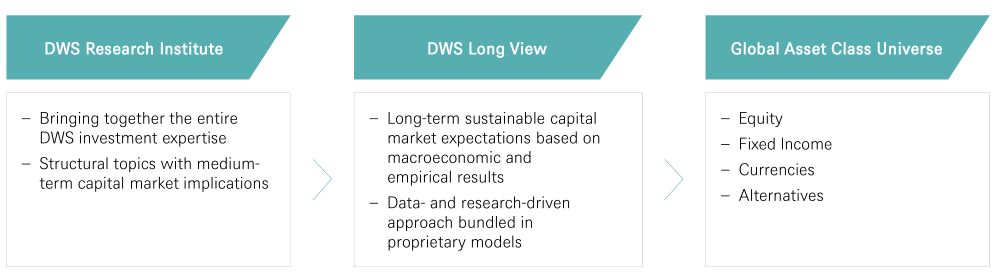

DWS Long View

The DWS Long View is our fundamental framework to calculate forward-looking long-term capital markets assumptions based on macro and empirical research in a data-driven multi-pillar approach for a wide range of asset classes, both liquid and illiquid as well as selected ESG strategies.

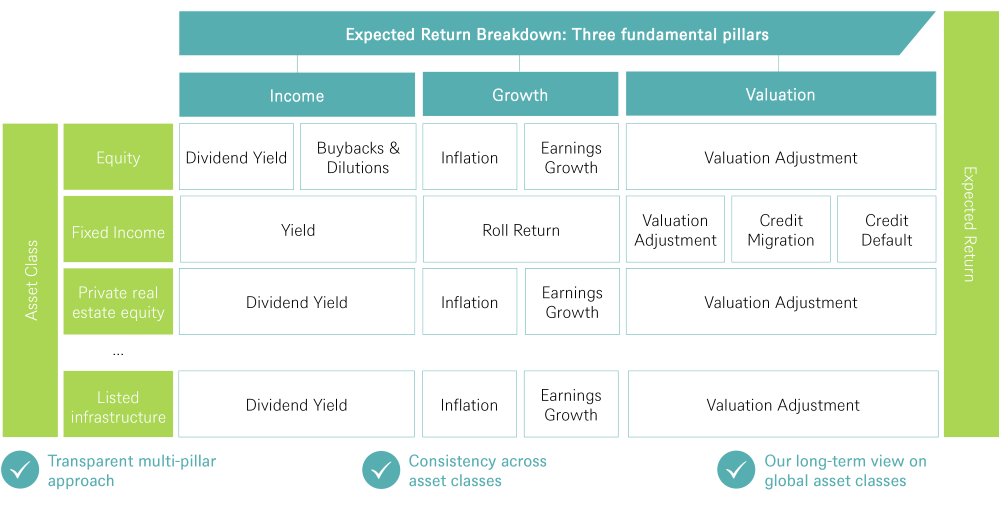

DWS Long View: A multi-pillar approach to model expected returns across asset classes

For illustrative purposes only. Source: DWS Group GmbH & Co. KGaA

GRIP-Methodology

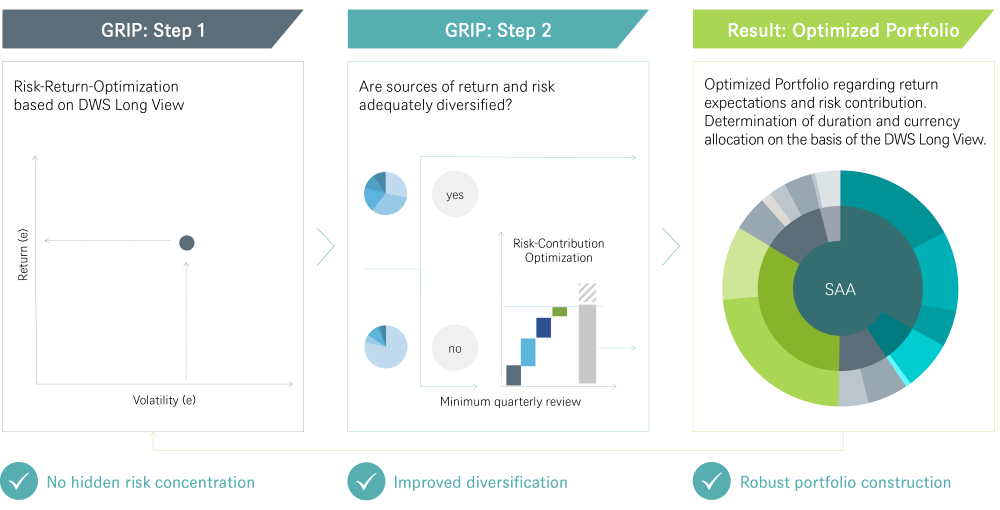

By using the expected long-term returns (DWS Long View) and risk parameters as inputs for the optimization process, we construct an optimized strategic asset allocation using our proprietary GRIP approach.

Our GRIP methodology is a robust, risk-based optimization approach designed to create allocations that are truly diversified, with less extreme asset and risk allocations, as well as a higher number of uncorrelated exposures.

GRIP-Methodology

Portfolio optimization based on fundamental assessments Note: (e) = expected. For illustrative purposes only. Source: DWS Group GmbH & Co. KGaA

Note: (e) = expected. For illustrative purposes only. Source: DWS Group GmbH & Co. KGaA

SAA Solutions

Using the SAA framework, we aim to design, build and analyze possible solutions that try to match client specific investment needs and the desired risk profile.

The integration of alternatives or the incorporation of an ESG perspective next to profound risk analytics are essential elements of our holistic SAA approach.

In order to reflect changes in our strategic market assessment, the strategic asset allocation (SAA) is regularly reviewed to harmonize the alignment with the long-term investment objectives.