- Home »

- Insights »

- CIO View »

- Chart of the Week »

- Danger of rising yields if Trump is re-elected?

Buyers of U.S. government Treasury bonds are no doubt starting to consider the potential impacts of the November presidential election on their investments. The result is still in question. But we consider the likelihood that Donald Trump's election victory could lead to comparable (yield) distortions as in 2016 after the votes have been counted to be low - which is not to say that yields are not likely to rise in general. We expect that the surprise effect would be much less pronounced, the markets would probably price in the scenario earlier and, last but not least, we are in a different economic and interest rate cycle. But one thing at a time.

Even though the election is still nine months away and Trump's candidacy for the Republican nomination is not yet quite a done deal, the possibility that Trump will return to power seems to worry the markets.

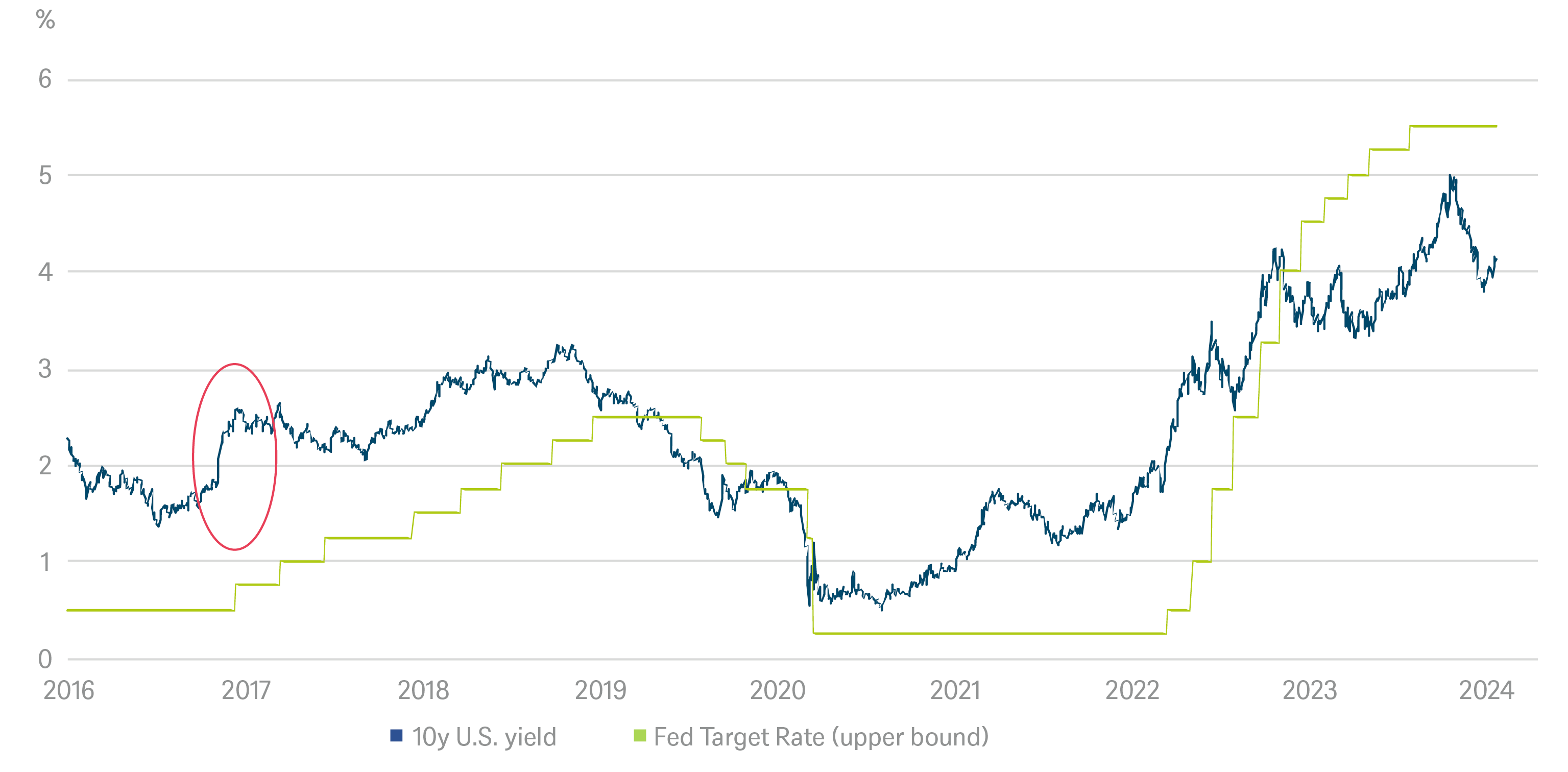

In November 2016 yields skyrocketed in the weeks following his victory. Starting at levels of around 1.80% shortly before the election, the yield on ten-year government bonds reached just under 2.65% by mid-December, which was then the sharpest rise in seven years. At the time the Federal Reserve (Fed) was at the beginning of an interest rate hike cycle and had only carried out one increase by the time of the election.

How will U.S. government bond yields react to a Trump election victory?

Sources: Bloomberg Finance LP, DWS Investment GmbH as of 1/23/24

The drivers that caused the yield on ten-year U.S. Treasuries to rise sharply for much of last year might be reinvigorated by Trump’s potential return. And so could the so-called term premium: an expression of the expected uncertainties and risks over the remaining term of the bonds. The bigger the question marks, typically the higher the term premium. At the moment, Donald Trump has made few concrete announcements. He has said he will raise the tariff on all imports to 10%,[1] which is likely to be inflationary, and announced that he will retain the 2017 tax cuts,[2] which are also fueling growth and prices. This, together with the experiences from Trump's first term in office, in our opinion provide sufficient arguments for higher yields in the event of his election.

The Treasury market is already in difficult waters. Investors are increasingly asking themselves who will buy the high volume of new bonds that will have to be issued to finance the spending planned by the current government. Against the backdrop of the current geopolitical tensions, there is a real risk that important international buyer groups could disappear. In addition, the Treasury market is facing extremely high maturities this year and next, making high levels of refinancing another factor.

The question of whether the first Republican primary results have already triggered market reactions may not be clear given the backdrop of a series of other market-moving events. However, the more the market expects Trump to win the election and translates this into higher yields and a stronger dollar, we then expect a smaller reaction following a Trump victory. Nevertheless, Trump is likely to be associated with higher risk for most market participants in the run up to the election and after – and rightly so, in our view.