Track record

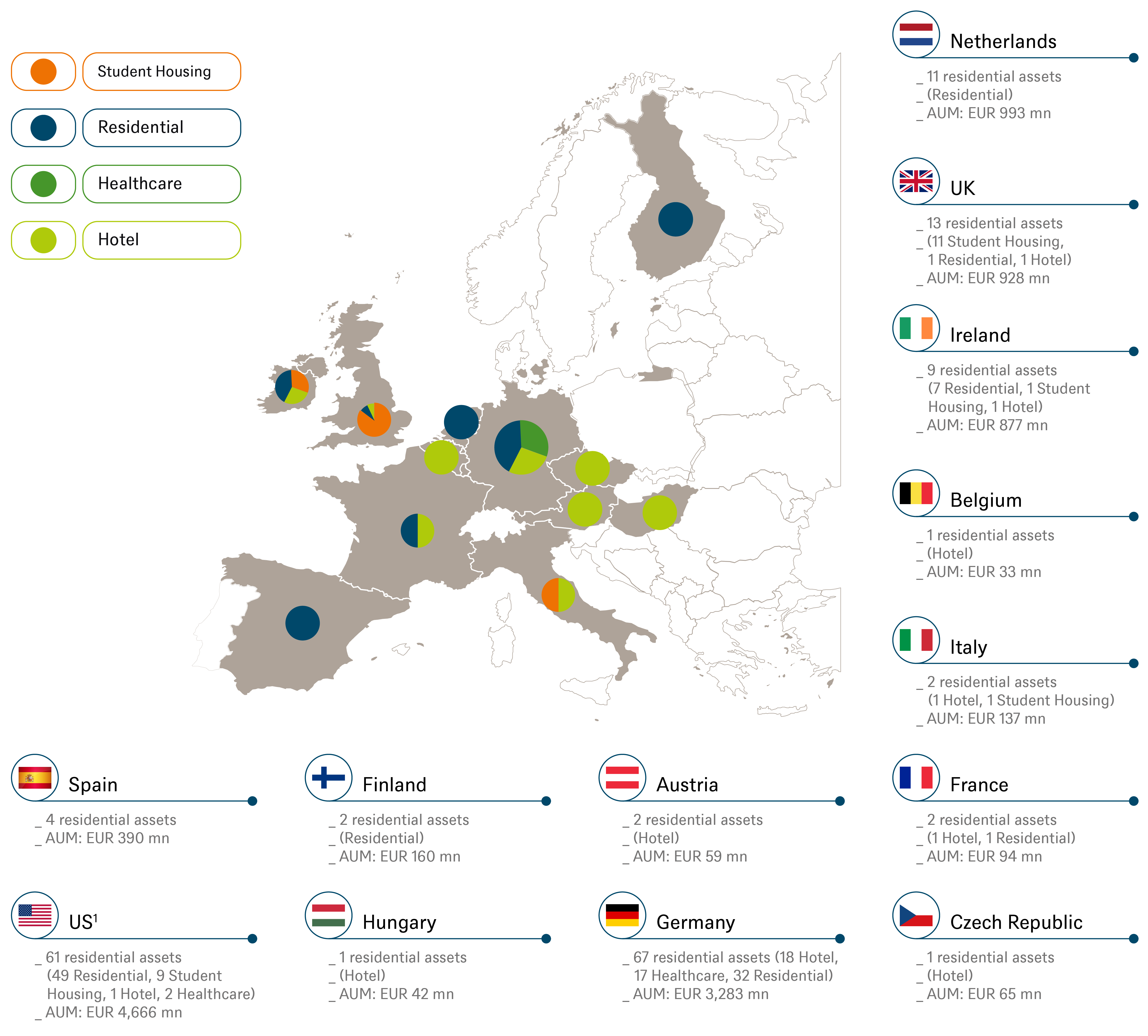

'Living’ portfolio

-

European AUM: €7.1bn[1]

-

Global AUM: €11.7bn

Expertise

Expertise

-

15 years investing in the 'Living' sector

-

50 years investing in real estate globally

Robust local network

6 European office locations

ESG Integration

€16.6bngreen label assets globally[2]

Stability, access and outperformance - why European residential is rising up the agenda

With strong fundamentals and a record of stable returns throughout the cycle, European residential has become increasingly popular. For a number of years, the residential rented sector has been rising up the agenda of many institutional investors. Not only has the sector recorded some of the highest returns in Europe over recent years, the perception of residential as a safe-haven investment was once again reinforced throughout the 2020 pandemic. Furthermore, with new residential markets opening up to institutional investment, the ability to access the market is also increasing, and with this we strongly believe the sector is well set to become a major part of the real estate universe.

DWS: A leading institutional investor in the living sector

As institutionalisation in the European residential market continues, investors can leverage DWS's extensive track record built over 15 years of investing in this sector for our clients. With an established local presence in key European markets, we have built a substantial portfolio across the full spectrum of Residential, Student, Healthcare and Hotel sectors for investors.

DWS has an experienced team and extensive network of market contacts, professional advisers and specialist operational partners. An investor can leverage this expertise to build out their European exposure to the 'Living' sector.

KEY TRENDS IN THE RESIDENTIAL MARKET[3]

Specific investment themes

Research - read our latest house views on the European 'Living' sector

Picture for illustrative purposes only.

Experience investing across the residential spectrum

Over EUR 11.7 billion globally of assets in the 'Living' sector*

1 US data as at March 2021

* Living includes Residential, Student Living, Healthcare and Hotels.

Source: DWS as at August 2021. USD: EUR 0.8178

Experience in action – read our recent 'residential' announcements

We are committed to integrating ESG throughout the investment process

DWS has deep experience across multiple operational structures in the 'Living' sector

Source: DWS, March 2021. Pictures for illustrative purposes only.

Read more about our real estate capabilities covering equity and debt strategies.

2. Green label assets include those with 3rd party designation, such as LEED or BREEAM, data as of December 2020.

3.

Sources: DWS, MSCI, Eurostat, OECD, Oxford Economics, 2021. As of December 2020.

The comments, opinions and estimates contained herein are based on or derived from publicly available information from sources that we believe to be reliable. We do not guarantee their accuracy. This material is for informational purposes only and sets forth our views as of this date. Past performance or any prediction or forecast is not indicative of future results. Investments are subject to risks, including possible loss of principal amount invested.