- Inflation is once again playing a role in the markets. Inflation rates are likely to rise further in the current year due to special effects.

- Over the next two to three years, however, we expect inflation rates to return to below the central banks' target against the backdrop of underutilized capacities – especially in the Eurozone.

- In the long term, however, demographic and structural changes should lead to increasing inflationary pressure.

Introduction

Inflation has returned to the capital markets with a vengeance. In the U.S., inflation expectations have risen sharply since the beginning of the year, driving up bond yields. In the Eurozone, the biggest one-month increase in the inflation rate since the introduction of the single currency was recorded at the beginning of the year.

A significant and sustained rise in inflation would, sooner or later, force the central banks to act. The prospect of rising money-market rates in the long term has already been enough to cause interest rates to rise in the short term. If this trend were to continue, further losses in bond prices and rises in bond yields would be the consequence. If bond yields were to shoot up too far, so that not only nominal interest rates but also real interest rates were to rise sharply, the negative effects would not be limited to bonds. The stock market would also suffer because real interest rates play a central role in the discounting of future profits.

The factors determining the inflation trend, the level of inflation that can be expected and the likely impacts on capital markets: these are the questions we want to address in this CIO Special. To do so, we need to think in terms of different time horizons. This year numerous special factors could indeed lead to a significant rise in inflation. In the medium term, however, i.e. over the next two to three years, we do not expect inflation rates to rise too sharply because capacity underutilization and unemployment are high. This is not an environment in which wages are likely to rise nor one in which companies can raise prices significantly. In the longer term, however, i.e. over a period of four, five or more years, a significant increase in inflationary pressure is quite conceivable. We believe a demographic tidal shift, in which the working-age population in many countries will shrink and will make the supply of labor problematic, will then begin to take full effect and weak productivity growth will not be sufficient to compensate for it.

Inflation expectations have risen sharply in recent months.

The drivers of inflation worries

In January, the inflation rate in the Eurozone experienced its biggest monthly rise since the introduction of the euro: from -0.3% in December to 0.9%; an increase of 1.2 percentage points. In the U.S., the inflation rate has left its lows of last year far behind (Fig. 1).

Fig. 1: Marked rise in inflation rates

Sources: Haver Analytics Inc., DWS Investment GmbH; as of March 2021

Concern about further increases in inflation are already manifest in the markets. Inflation expectations[1] have risen sharply in recent months, from around 1.5% a year ago to just under 2.5% in the U.S. Even in the Eurozone, where the European Central Bank (ECB) is infamous for undershooting its inflation target of just under 2%, inflation expectations have risen from 0.75% a year ago to over 1.25%. However, these figures should be interpreted with caution. Often, inflation expectations measured on the basis of inflation swaps are more a reflection of current price movements than a good indicator of future inflation (Fig. 2).

Fig. 2: High correlation between inflation expectations and oil price

* Inflation expectations measured by the 5y/5y inflation swap.

Sources: Haver Analytics Inc, DWS Investment GmbH; as of March 2021.

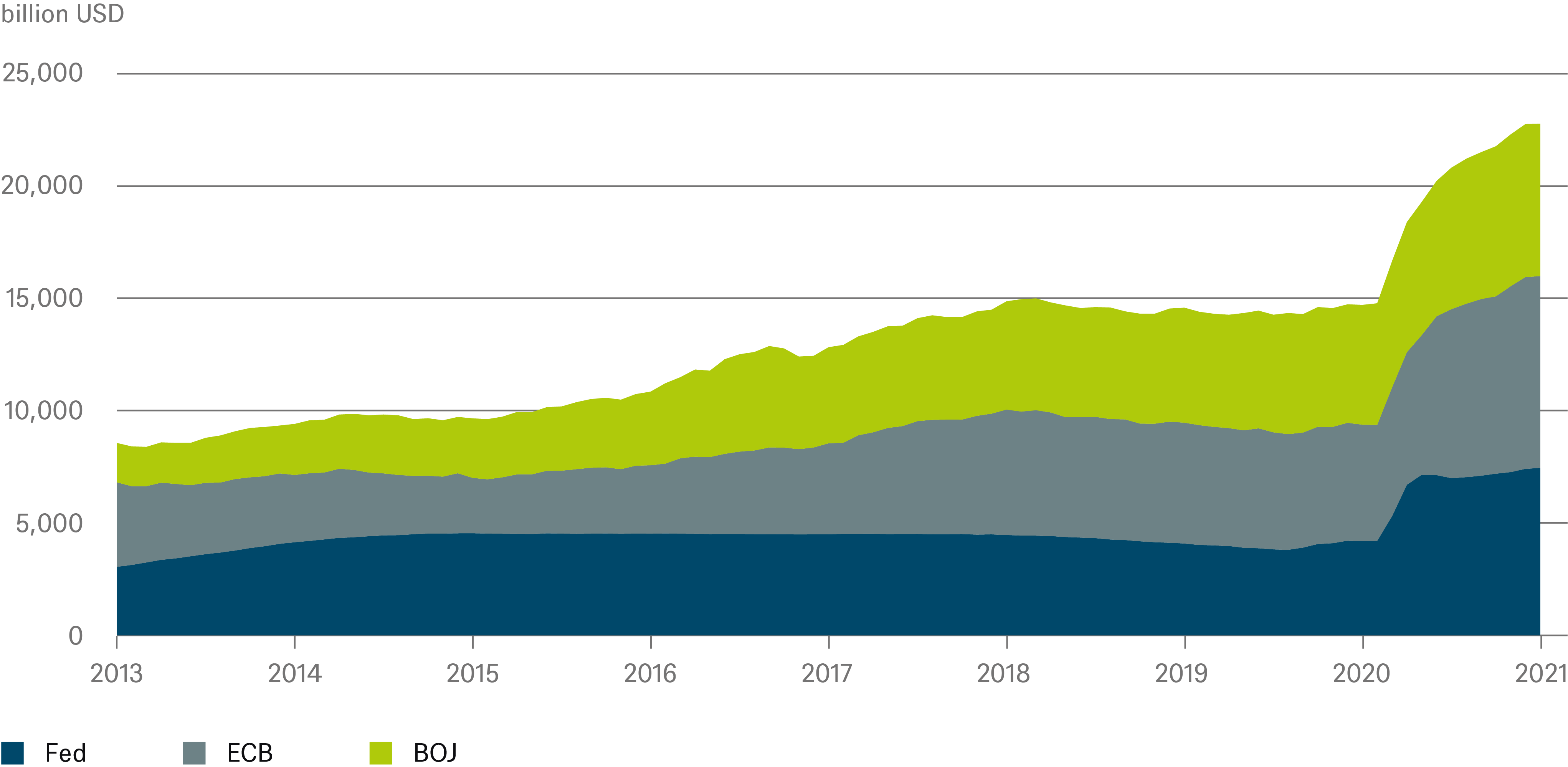

During the Covid-19 pandemic governments have propped economies up with massive fiscal packages. Last year, the U.S. government took on debt amounting to around 17% of gross domestic product (GDP); in the Eurozone, the figure was around 8.5%. To ensure that this significant government borrowing does not lead directly to an undesirable deterioration in financing conditions for companies, thereby exacerbating the crisis, the central banks have flooded the markets with money and launched extensive government-bond-buying programs. Last year, the ECB expanded its balance sheet by around 50%, partly as a result of the Pandemic Emergency Purchasing Programme (PEPP). At the Japanese central bank (the BOJ), the increase was more than 20% and at the U.S. Federal Reserve (the Fed) over 75%. The combined balance sheet total of the three major central banks increased by over 50% in the twelve months to January this year (Fig. 3).

Fig. 3: Rapid increase in central bank balance sheets

Sources: Haver Analytics Inc., DWS Investment GmbH as of March 2021

However, an increase in the central-bank balance sheet does not in itself lead to inflation. In order to have any price effect at all the money supply would have to increase first.

The money supply (as measured by M3) in the Eurozone has indeed risen sharply – most recently by around 12.5% year on year. But this is much less than the increase in the central-bank balance sheet.[2] Based on historical experience, M3 growth on this scale would suggest a core inflation rate of around 2.5%. While this would be far higher than in the recent past, it still looks quite modest compared to the aforementioned balance-sheet increase of around 50%. Moreover, econometric studies suggest that monetary stimuli are only reflected in the core inflation rate with a time lag of around one year (Fig. 4).

In the U.S., the increase in M2 money-supply growth has exceeded 25%. However, as in the Eurozone, this increase was essentially due to a one-off strong expansion of the money supply at the beginning of the pandemic. Since then, the money supply has been growing at reasonably "normal" rates of about one percent per month in the U.S. and about half as much in the Eurozone. And in the U.S., the correlation between money supply growth and the inflation rate is empirically far weaker than in the Eurozone.

Fig. 4: Eurozone: Weak correlation between money supply and core inflation

Econometric studies suggest that monetary stimuli are only reflected in the core inflation rate with a time lag of around one year.

Read more on next page...

Inflation outlook

But all these effects are temporary in our view. By their very nature, base and one-off effects drop out of the year-on-year comparison after twelve months at the latest. For example, the VAT effect in Germany will only be seen in the inflation rates in July to December of this year; by the beginning of next year, raw material prices will no longer compare with the ultra-lows of 2020, but with those currently prevailing in the market. And many special effects will most probably not remain permanently but should decrease over time. The current restrictions in hospitality, entertainment and numerous other service sectors should be relaxed, not tightened. Viewed in this light, they represent a one-time price shock that will even have a disinflationary impact in the period thereafter. Again, temporary price changes do not constitute lasting inflation, which is a process of longer-term price increases.

The same applies to the massive government support in the U.S. from the recently passed 1.9 trillion U.S. dollar fiscal package. The largest share of this will be paid out to consumers this year and it can be assumed that increased demand coupled with still weak production may well drive prices up in the short term. The same holds if the currently discussed 3 trillion dollar infrastructure package is put into law. But for that to incite an inflationary process it would be necessary to pass bigger and bigger packages on a regular basis. That is highly unlikely. At the same time, production is more likely to expand than contract. So there should be no follow-up impetus for inflation from this either.

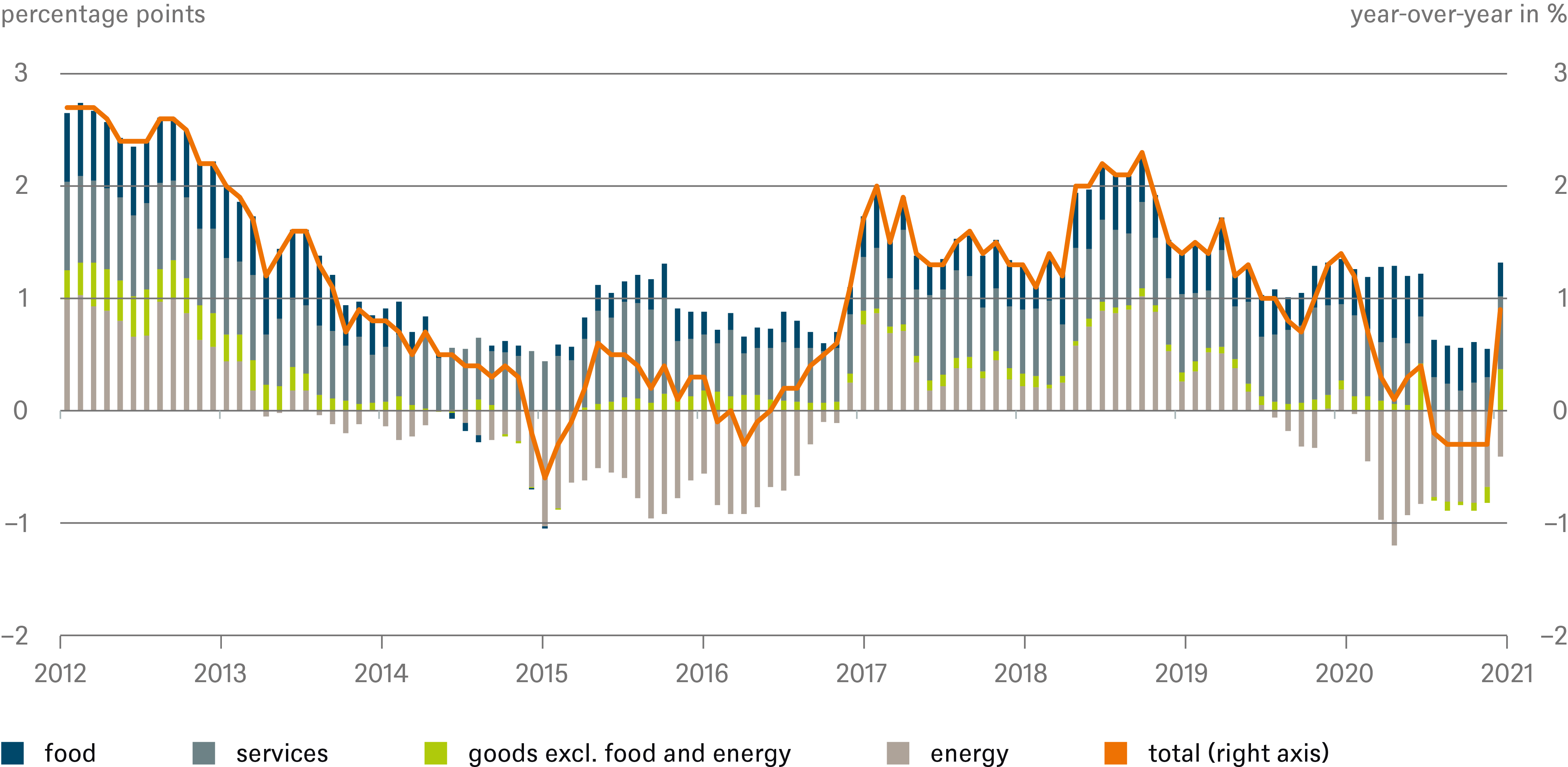

Medium term: little room for higher prices

In a narrow sense, all these temporary effects do not even constitute inflation. After all, economists understand inflation as a process of continuously rising prices, such as in a wage-price spiral. Fed Chairman Jerome Powell recently pointed this out at a hearing in the U.S. Congress. A jump in prices caused, for example, by the end to a VAT reduction does not come every year. To understand where permanent inflation can come from, one has to look at the individual components of the inflation rate (Fig. 6). Changes in the prices of tradable goods have not played a role for years. Globalization and productivity advances through automation and digitization have either significantly reduced production costs or significantly curtailed the pricing power of producers and retailers.

Fig. 6: Eurozone: Service inflation is main contributor to inflation

Sources: Haver Analytics Inc., DWS Investment GmbH as of March 2021

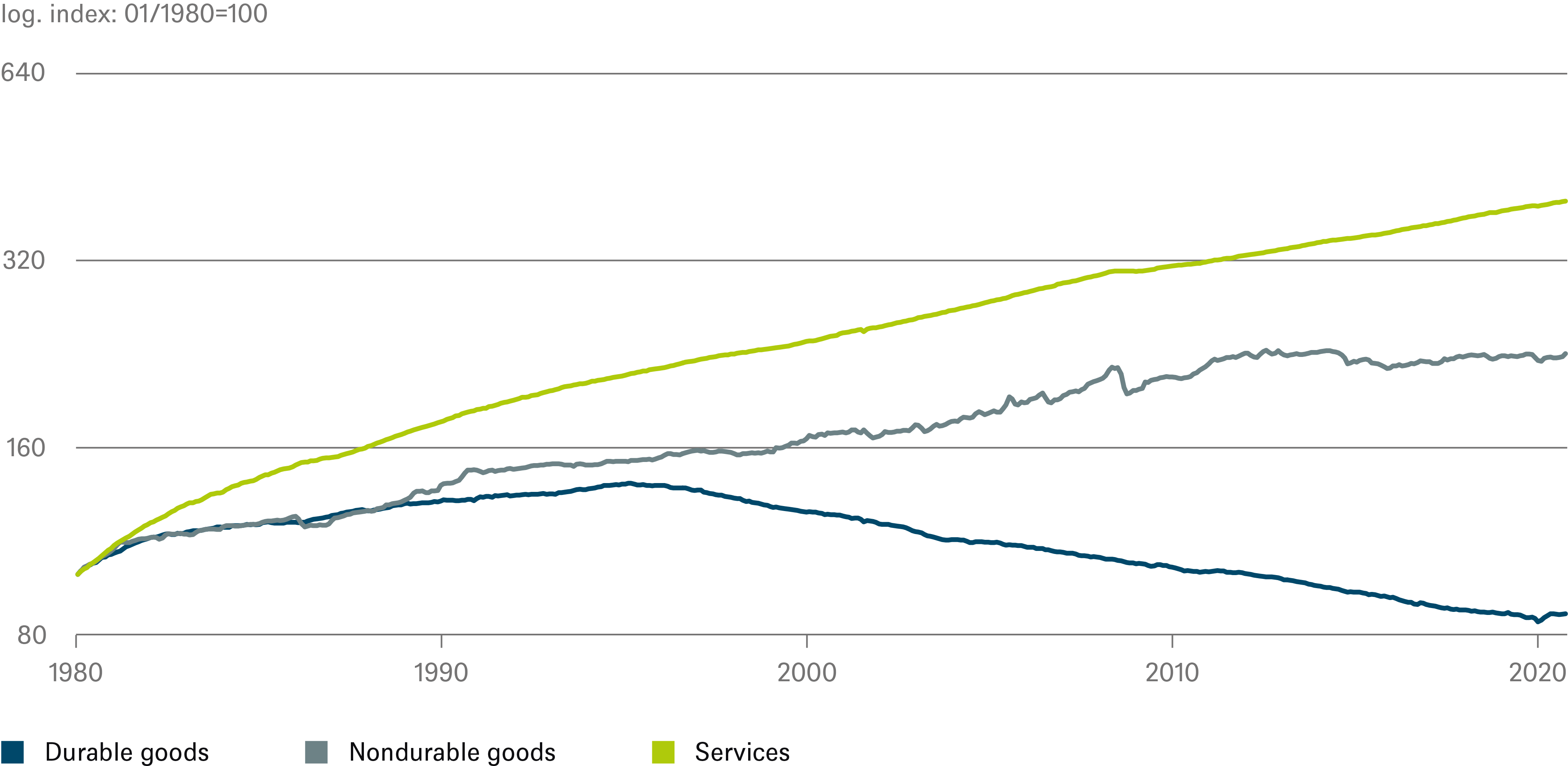

In the U.S. the effect is so pronounced that consumer durables prices have reduced inflation rates since the mid-1990s (Fig. 7)

Fig. 7: U.S. PCE* price index: prices of tradable goods have been falling for years

* Chain-type price indexes of personal consumption expenditures (PCE)

Sources: Haver Analytics Inc., DWS Investment GmbH as of March 2021

Prices for food and energy fluctuate over time, sometimes adding to inflation – when crops suffer or oil prices spike – and sometimes subtracting from it. The only stable driver of prices in recent years is the services sector. One explanation for this is so-called "cost disease:" In the service sector, investments and intermediate products generally do not play a large role. With a few exceptions, the sector is very personnel-intensive. Wages in the manufacturing sector can rise in step with productivity without having an inflationary effect. However, in order to be able to retain workers in the service sector, wages and salaries have to increase in the same way, even if productivity is not or only barely increasing. These cost increases have to be passed to consumers. Physiotherapists, for example, have been treating the same number of patients per hour for decades. Their productivity is therefore more or less constant. Nevertheless, their salaries are rising, otherwise no one would train to become a physiotherapist. The key factor in service inflation is therefore the overall development of wages and salaries. And we are skeptical that there will be strong wage increases in the near future.[3]

We expect high (open or hidden) unemployment to persist for the next one or two years. This is not an environment in which marked price or wage increases are likely to occur.

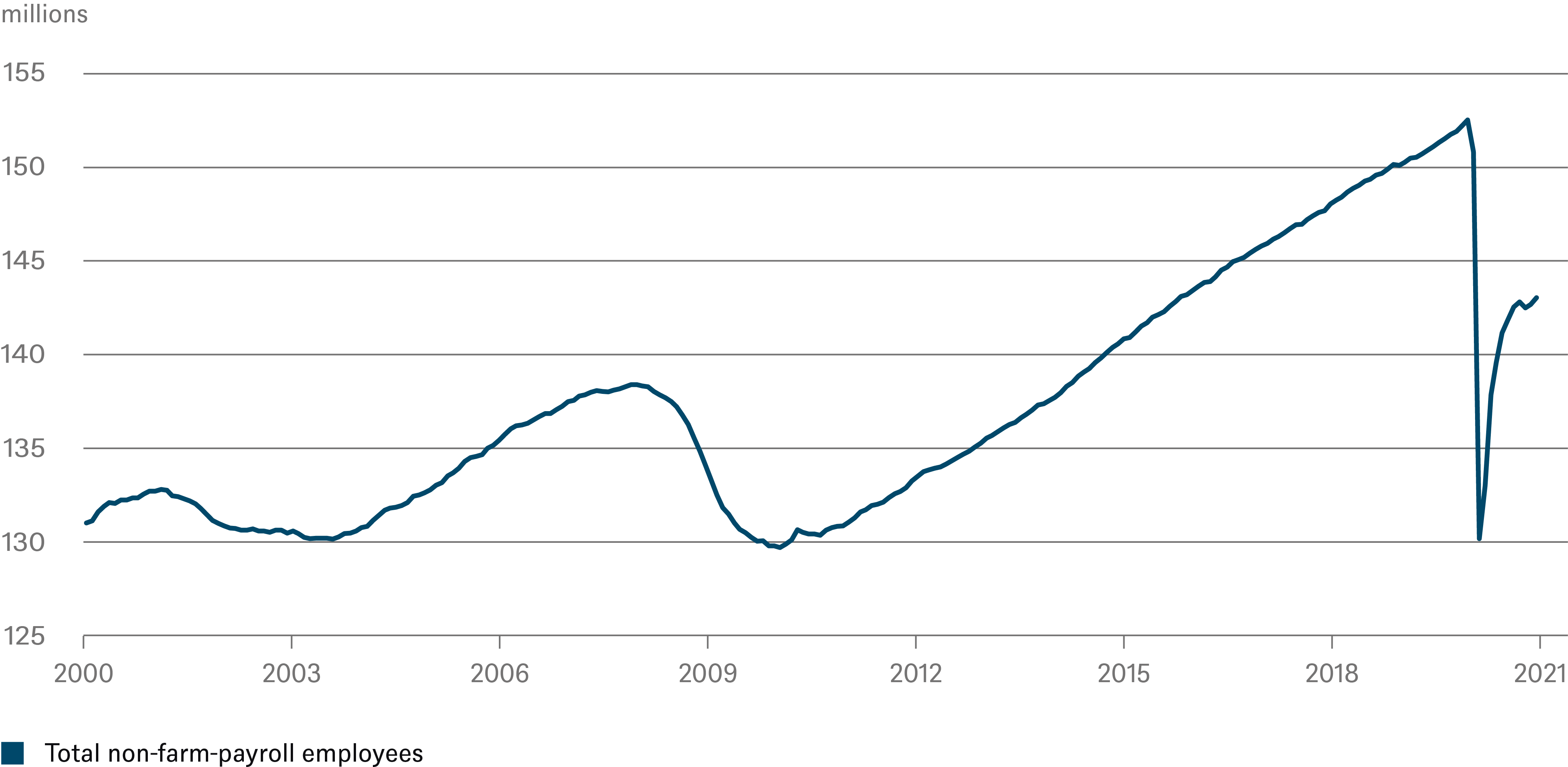

This is primarily because we have been experiencing the worst recession in post-war history. According to OECD calculations, capacity underutilization in the U.S. is around six percent, and as high as eight percent in the Eurozone. In the U.S., around 22.5 million jobs have been lost during the crisis. Although 13 million new jobs have already been created since the crisis bottomed out, the momentum has slowed (Fig. 8). Thanks to the global vaccination campaign and massive government support, this crisis should be overcome much faster than the great financial crisis, meaning that the output gaps should close more quickly and it should take less time to return to full employment. Nevertheless, we expect high (open or hidden) unemployment to persist for the next one or two years. This is not an environment in which marked price or wage increases are likely to occur.

Fig. 8: U.S. employment: still a long way to go

Sources: Haver Analytics Inc, DWS Investment GmbH as of March 2021

We expect the momentum to be greater in the U.S. than in Europe. The deflationary impact of the crisis should be mitigated in the U.S. by the much larger rescue packages. We therefore expect inflation to peak at around 2.5% this year – also due to the above-mentioned special and one-off effects. Thereafter the inflation rate should fall back to below 2% and then slowly approach values of just over two percent in the course of the coming year.

In the Eurozone, too, we expect inflation to rise in the short term in the current year, not as markedly as in Germany, but in the fall the inflation rate is likely to reach the 2% mark. Taking inflation over the year as a whole, however, we expect significantly lower average rates of around 1.5% this year and next.

Demographic wind is, in our view, likely to change, shifting from being a tailwind that has boosted growth and thus has held inflation back to a headwind that is likely to lower the growth prospects and add to inflationary pressures.

Long term: demographics can drive inflation up

However, in our opinion, it would be a mistake to join the chorus of those who, in recent decades, have proclaimed the permanent death of inflation.

A major factor influencing the low inflation rates of the past decade has been the global financial crisis of 2008/09. After the crisis, the private sector, both households and companies, had to reduce debt levels which had climbed unsustainably high. This resulted in years of restraint in consumer spending and investment, which was also reflected in the very slow reduction of output gaps in the U.S. and Europe. This "demand shortfall" has also kept prices in check to some extent. But every crisis is different. Due to massive government support of the economy, the increase in private-sector debt has been limited during the Covid pandemic. The economy is therefore likely to rebound much faster after this crisis is over than it did after the financial crisis. The need for deflationary debt reduction (deleveraging) is therefore much smaller this time.

Demographics are one reason for the low inflation that has prevailed for decades. Due to declining birth rates, the working-age population has grown faster than the total population almost everywhere in the world. This means that the supply of labor needed to produce goods grew even faster than the demand for these goods. This has had an almost deflationary effect, especially in the area of tradable goods (commodities). And the effect was intensified by the fall of the Iron Curtain and China's integration into Western value chains. However, these two momentous developments have long since come to an end and are unlikely to be repeated.[4]

In fact, the demographic wind is, in our view, likely to change, shifting from being a tailwind that has boosted growth and thus has held inflation back to a headwind that is likely to lower the growth prospects and add to inflationary pressures. According to the United Nations, the growth of the working-age population in the major economies will stagnate or even contract substantially (Fig. 9). This means that a shortage of workers is likely to drive wages up.

Fig. 9: Working age* population is declining

* Population aged 15-65

Sources: United Nations, Haver Analytics Inc., DWS Investment GmbH as of March 2021

Nor should one have high hopes that productivity growth can offset this changed demographic impact. For one thing, productivity growth in the U.S. and Europe has been weak for decades (Fig. 10). The reasons for this are numerous, but a not insignificant one is that the service sector's share of total value added has risen significantly – as already mentioned, most of the productivity growth has been in industry. Another major reason is demographics again – aging societies generally exhibit weaker productivity growth because older workers adapt less readily to innovations than younger ones.[5]

Fig. 10: Productivity growth* is disappointingly weak

* Moving 10-year average

Sources: OECD, Haver Analytics Inc., DWS Investment GmbH as of March 2021

As retirees continue to consume but no longer produce, shrinking supply meets stagnating or even rising demand: these are definitely the ingredients for rising inflationary pressure. But whether this inflationary pressure actually translates into inflation depends not least on the central banks. They have already signaled that they will tolerate a moderate overshoot in inflation for a certain period of time. Therefore inflation rates that are stable at over 2% in a few years' time are a quite realistic expectation. We expect inflation rates to pick up earlier, more strongly and more sustainably in the U.S. than in Europe because the U.S. economy continues to look far more dynamic than the Eurozone’s.

But central banks most probably will not tolerate any level of overshooting. As a rule, an aging society does not "want" inflation, not least because the proportion of pensioners is growing. Since they often receive fixed nominal pensions, higher inflation means lower real incomes for them. And the older portion of the population, who are still working, unfortunately also suffer from higher inflation rates because they have often invested a higher proportion of their assets in fixed-income securities.

Read more on next page...

Implications for capital markets

What does our inflation picture mean for the capital markets?

Stock markets

To analyze the impact of inflation on stock markets, one has to look at the impact on earnings and valuation separately. First, let's look at earnings: In principle, we assume that most companies listed in the global equity indices will be able to compensate for the pressure on margins caused by rising commodity prices and other input costs by raising prices and increasing efficiency. Profits are therefore unlikely to suffer in companies with strong market positions. Particularly in sectors with a high proportion of raw-material costs, such as the chemical industry, it can even be the case that these time-delayed cost pass-throughs are contractually agreed. Other sectors, such as the software industry, have had to cope with high wage increases for IT experts for years but their profit growth remains impressive and can still regularly exceed analysts' estimates.

It is more difficult to assess the impact of rising inflation expectations on the second (and more important) factor – stock valuation. Especially for short-term stock-price movements, valuation changes are the main drivers. Typically, rising inflation expectations correlate with improved economic growth and an increase in nominal interest rates. Therefore, investors shift toward companies that particularly stand to benefit from recovery in the economy and in interest rates. The sectors that benefit most tend to include capital goods, transportation, chemicals, energy and banking. Conversely, cyclically stable sectors such as utilities, consumer staples or healthcare are less favored, and stocks with a high proportion of earnings in the distant future, so-called growth stocks, are also penalized.

However, as long as this nominal interest-rate increase does not go unchecked and real interest rates do not become significantly positive, we do not expect the rotation within the equity market to significantly affect the overall MSCI World Index level in the current market phase. Specifically, U.S. 10-year Treasury bond yields of 2% are consistent with our current index target for the S&P 500 of 4,100 for March 2022. However, if nominal rates move closer to 3% and allow for clearly positive real rates, then fixed income would once again be a real investment alternative for some investors and would push equity valuations down. But we are not there yet. With moderate inflation and interest-rate increases, equities remain attractive. And the significant earnings growth after the Covid lockdown could attract new investors.

Typically, rising inflation expectations correlate with improved economic growth and an increase in nominal interest rates. Therefore, investors shift toward companies that particularly stand to benefit from recovery.

Property rents tend to track inflation over the long term, and should real interest rates remain exceptionally low, this in turn is seen as positive for relative pricing.

Real-estate markets

The current inflation outlook is largely positive for the real-estate sector. The underlying drivers shaping the near-term inflation outlook are likely to have little impact on real-estate rents. As many leases, particularly in Europe, are indexed to inflation, short-term price increases should support net operating incomes. Moreover, as real-estate yields continue to command a historically high premium over long-dated government bonds, the sector should be well positioned to withstand further bond-market volatility.

Looking ahead to 2022, the inflation outlook is less positive for the sector overall. A large output gap points to continued spare capacity in parts of the real-estate market, in particular in the retail sector. We do not expect rental growth to resume globally until 2022. In the next couple of years, real-estate performance is likely to be driven primarily by yield compression, i.e. higher valuations, rather than rental growth as long-term investors continue to drive up prices in sectors such as logistics and residential.

In the long run, a smaller working-age population and a gradual increase in inflation should prove positive for some parts of the sector. Property rents tend to track inflation over the long term, and should real interest rates remain exceptionally low, this in turn is seen as positive for relative pricing. Overall, a shrinking labor force could lead to demand for office space coming under pressure, but this should also have a positive impact on residential rents, especially if a smaller labor force enjoys higher wages across the income spectrum.

Read more on next page...

Summary

We expect that inflation could intensify in the short term. But its rise is likely to be temporary and essentially due to base, special and one-off effects – and is likely to be ignored by monetary policymakers. Like us, central banks assume that, in the medium term, capacity underutilization and high unemployment will keep inflation rates in check for some time to come. This holds particularly for the Eurozone.

In our view, the need for monetary tightening will come when the pandemic and its aftermath are history and full capacity utilization prevails. By then demographic change is likely to lead to increasing inflationary pressure.

All in all, the inflation trend we have outlined will oblige the central banks to communicate their policy course to market participants extremely carefully. But we do not expect inflation rates to reach unmanageable levels. None of these are reasons for panic, but they are good reasons to be vigilant.