- Home »

- Insights »

- Global CIO View »

- Chart of the Week »

- One January doesn’t make a December

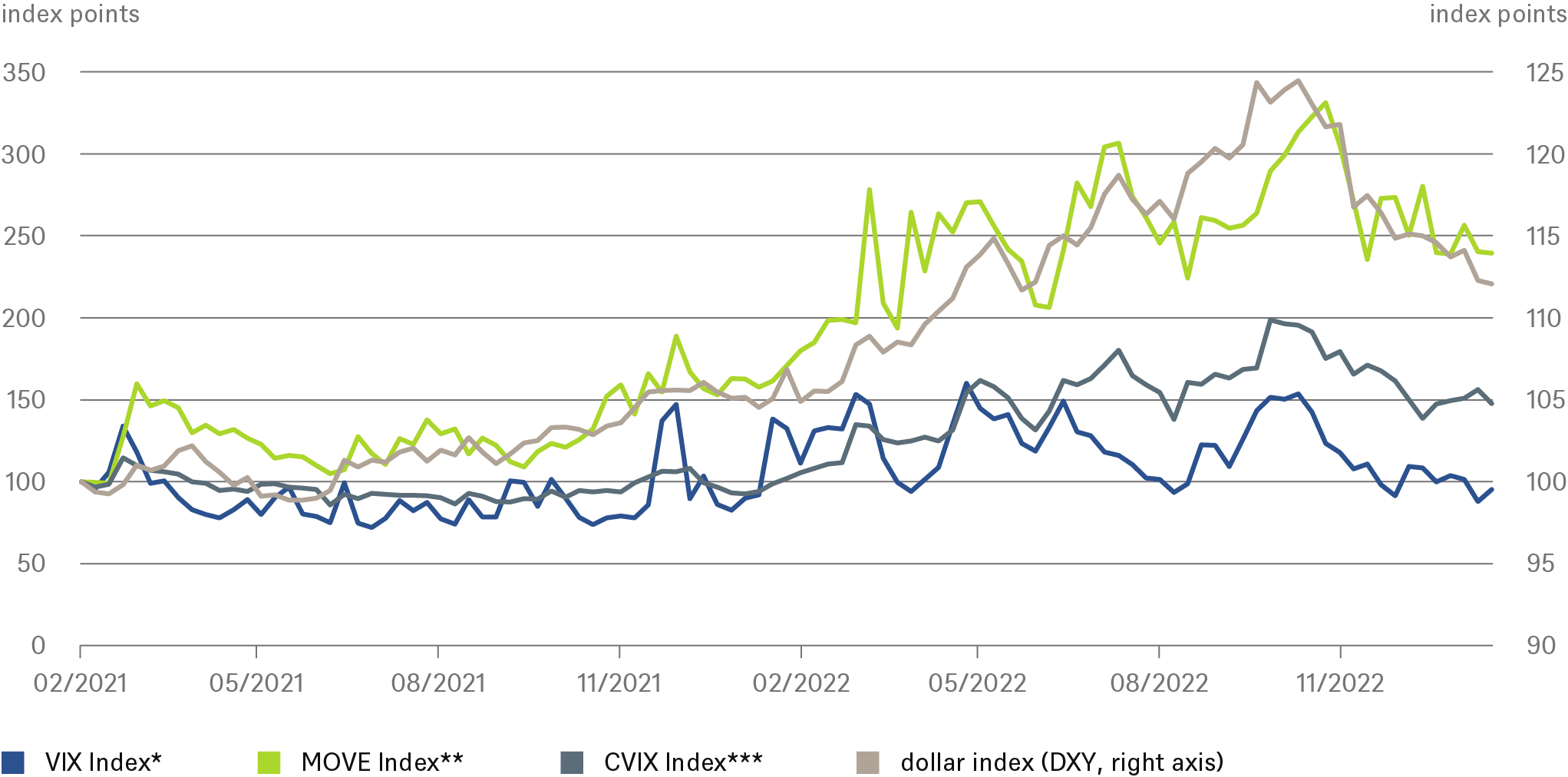

Volatility of various asset classes and dollar index peaked in autumn 2022

*The CBOE Volatility Index (Vix) is a trademarked ticker symbol for the Chicago Board Options Exchange Market Volatility Index. It is a popular measure of the volatility of the S&P 500 as implied in the short-term option prices on the index.

** The Move Index is a volatility index developed by Merrill Lynch that reflects the implied volatility for U.S. government bonds with different maturities.

*** The CVIX Index (Cvix) is the Deutsche Bank Currency Volatility Index which measures the implied volatility of the currency market.

Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 1/24/23

As inflation dynamics and central bank responses differed across countries, volatility in the currency market also rose sharply. However, the crescendo of nervousness about inflation and geopolitics is most clearly visible in the dollar exchange rate. As the chart shows, the greenback lived up to its reputation as a safe haven and rose continuously in value.

There were, of course, good reasons why it then fell away again at the beginning of autumn as market volatility declined and share prices rose in response to the mild winter; the securing of energy supplies in Europe; easing inflation; and China’s reversal of its Covid lockdowns.

Where do we go from here? Volatilities are not a good leading indicator for the markets. Rather, like purchasing managers' indices, they tend to move in parallel to the market[1]. That was also evident in figures published on Tuesday which showed Europe back on a growth path while the U.S. remains in contraction – as the stock market also reflects.

Therefore, the outlook for markets is not as bad as feared in mid-2022 but not good yet either. We think it would be premature to revise up our year-end forecast for the S&P 500 (4,100 points) on the basis of the promising opening to the year. However, we may do so in Europe and Asia, where the macroeconomic environment has surprised much more positively.

In Europe and Asia too, however, the trees do not grow to the sky. There are plenty of factors that could unleash renewed volatility: the troubling strength in core inflation, the margin pressure on companies, low consumer confidence and lackluster growth, for example.

And finally, there is still the huge shadow of the Ukraine war, whose future course remains completely uncertain. That’s why we continue to expect volatility to reignite this year and price setbacks to occur. We therefore recommend a patient approach.