- Home »

- Insights »

- Global CIO View »

- Chart of the Week »

- How and why “money” matters again

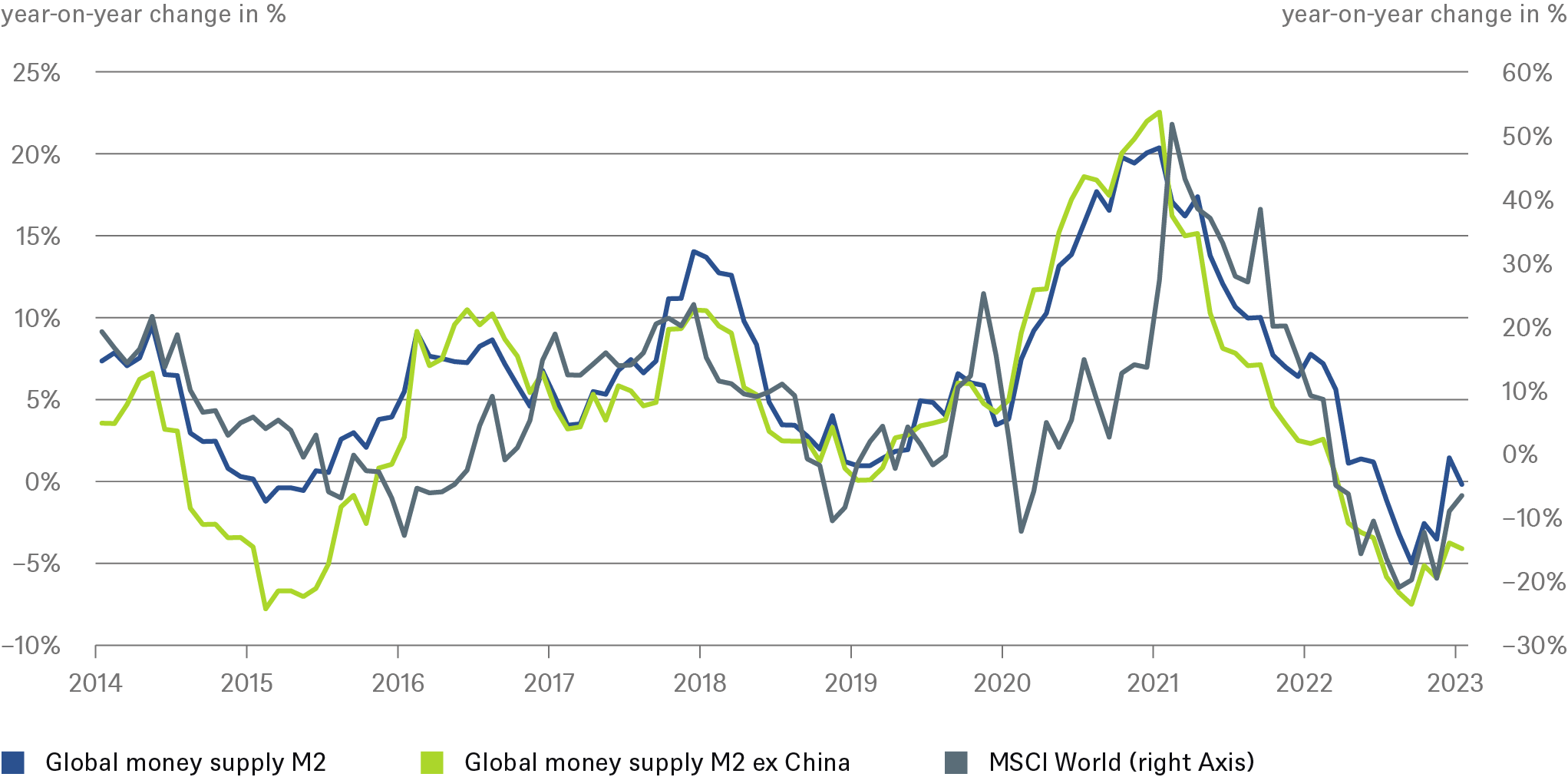

Prices on global equities seem to move in tandem with global money supply – so what?

Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 2/21/23

Finding correlations that “worked” well in the past is easy, particular with something like global money supply, where you can pick and choose which measure best fits during period considered. But relying on them is unwise, without a clear understanding of the causal mechanisms involved and assessments of how and why they might hold going forward or fail to do so.

“That said, for several major economies, we have always looked at monetary aggregates quite closely for our inflation forecasts, even when that was deeply unfashionable”, explains Johannes Müller, DWS Head of Macro Research. “Doing so provided valuable early clues that inflation might prove less transitory than widely expected.” As a recent paper by staff members of the Bank for International Settlements shows, countries with stronger money growth also saw markedly higher inflation in recent years[1].

This confirms our longstanding conviction that handled with care, including monetary aggregates in inflation forecasts can at times increase accuracy. It also underlines, though, why relying on “money” alone to correctly forecast market developments is a lot trickier than it seems. From our point of view, a lot of improvements in the fundamental data are now already priced into the global equity markets, not least, relatively rapid drops in inflation rates. But whether these declines happen quite as quickly is still very much an open question, not least when glancing at various global monetary aggregates.