- Home »

- Insights »

- Global CIO View »

- Chart of the Week »

- Europe’s inflation divergence

One of the downsides of having a common currency is that it makes dealing with asymmetric shocks difficult. Member countries lose their ability to use monetary policy to react when some surprising event hits economies of a common currency area in different ways, or when the magnitude and duration of a shock varies. The Eurozone has just experienced three such shocks: Covid-19, the resulting global supply chain disruptions and the energy shocks following Russia’s 2022 full scale war on Ukraine.[1]

Considering the scale of these challenges – not to mention numerous related distorations in measuring economic data[2]- the European Central Bank (ECB) seems to be coping reasonably well, at least for now. While it was arguably late in spotting inflationary warning signs, it seems to have done better recently. After such a diverse range of shocks hitting a still very heterogenous bunch of still largely national economies, finding common policy responses that appear to be getting the euro area back on track should already count as an achievement.

Inflation range in the Eurozone

*as measured by the Harmonized Index of Consumer Prices (HICP)

Sources: Haver Analytics Inc. as of 1/5/24

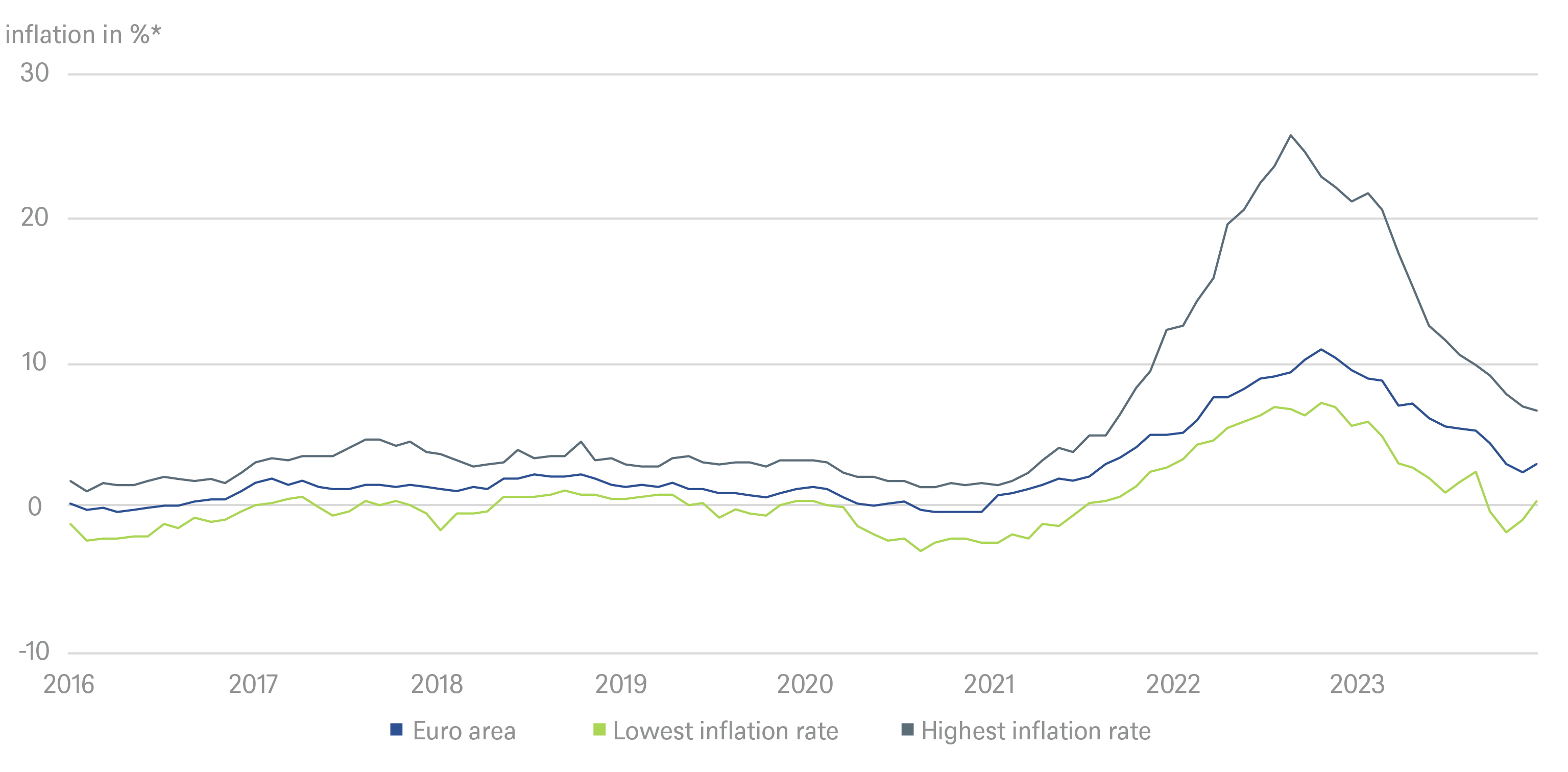

Our Chart of the Week shows inflation rates for the euro area as a whole since 2016, as measured by the Harmonized Index of Consumer Prices (HICP), as well as the range between the country with the lowest inflation rate and the highest at each point in time. As of December 2023, inflation rates ranged from 0.5% in Italy and Belgium to 6.6% in Slovakia. The chart also shows how and when inflation increased. Equally striking is the growing range between the inflation rates of different Eurozone members since the start of the Covid pandemic in 2020.

The reasons are easy to pinpoint. Pandemic related lockdowns and government support programs varied greatly across member countries, as did exposures to global supply chain hickups and dependencies on Russian energy imports. Within the euro area, there is plenty of diversity not just in terms of economic development, the energy mix differs across countries, the share of such unusually pandemic sensitive sectors as tourism or how heavily food and energy weighs in national HICP baskets. More subtly, when it comes to second round effects, countries differ a lot in terms of how quickly labor markets adjust, as well as how rents, social benefits, regulated prices and taxes respond to inflation.

“This does not make the ECB's job easy, especially as politicians are always trying to exert influence,” argues Ulrike Kastens, Senior Economist Europe at DWS. "But the risk of inflation is far from over, especially due to rising wages in economic heavyweights such as Germany."