- Home »

- Insights »

- Global CIO View »

- Fixed Income »

- Bonds are back with carry

- Central banks have swung from accommodative to restrictive in a matter of months - giving bonds record losses this year.

- Now that markets have been convinced of the seriousness of the inflation fight, the surprise potential of monetary policy seems limited.

- Bond yields are once again tempting. In the face of a looming recession, they might even become more attractive. But we believe they may already be worth looking at now.

to read

Buying bonds at a time of record inflation?

Worst start to a year in decades

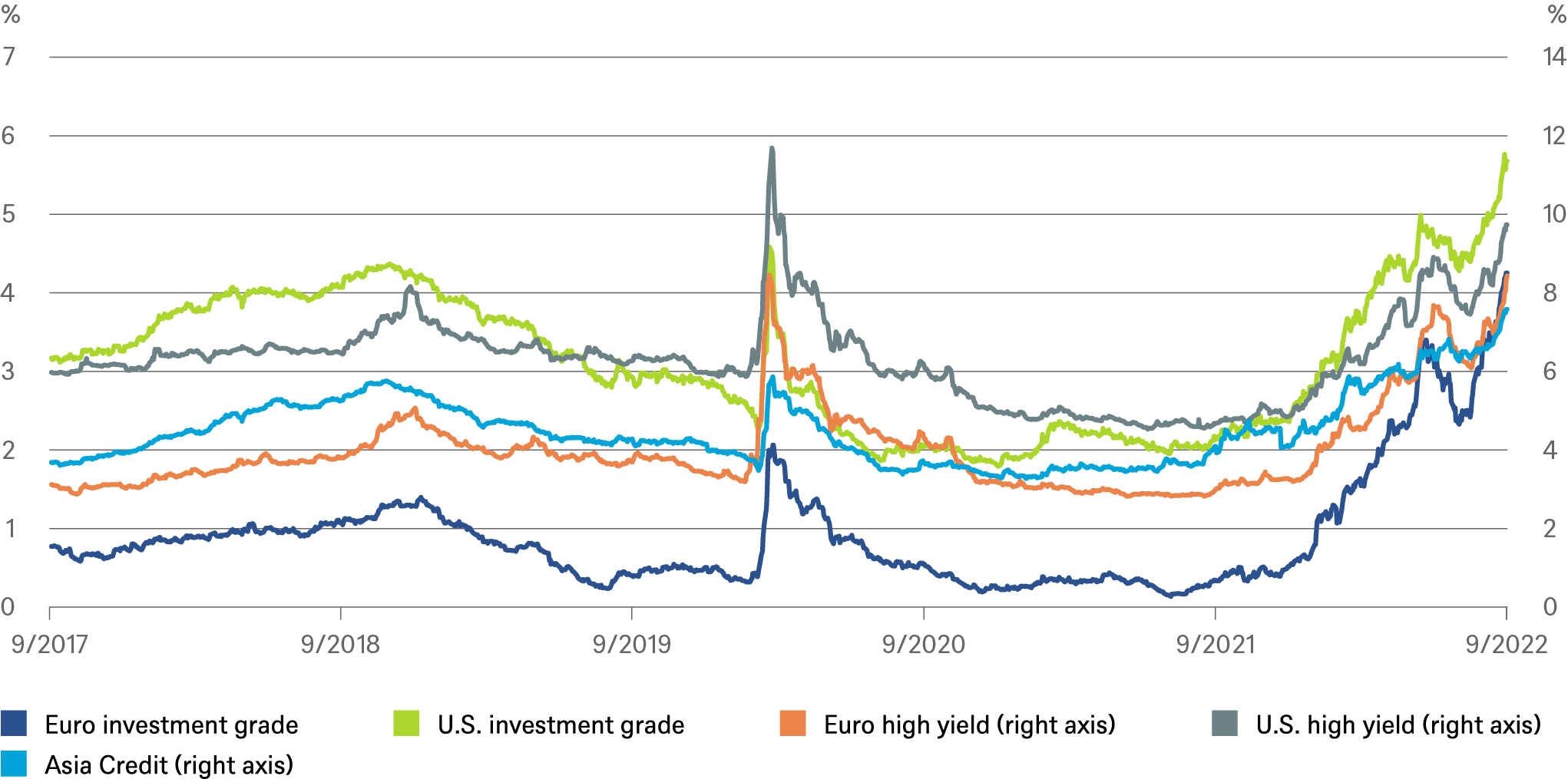

Global investment grade (IG) bonds have fallen by a full 19% [1]since the start of the year. Measured from the historical high at the beginning of 2021, the index is in a bear market – a decline of more than 20% from its peak – as the negative total return is more than minus 23%[1]. And since long-dated bonds tend to suffer most from interest rate hikes, it is no surprise that 30-year U.S. Treasuries have experienced a negative return of almost 40% since August 2020, while the value of 30-year Bunds almost halved at one point.[2] On the other hand, those who had bet on high-yield (i.e. non-investment grade, HY) bonds in these troubled times have suffered a slightly less decline, with a loss of 19% from the peak, thanks to their higher coupons and generally shorter maturities[2]. This is the view in the rear-view mirror. The road ahead hardly looks more promising. The Federal Reserve (Fed) is expected to raise its key interest rate to 4.2%[3] by the end of the year, given that U.S. inflation, even if it has peaked, is still likely to remain well above the Fed's desired 2% target for some time. The European Central Bank (ECB) is not faring much better. Inflation has yet to peak in the Eurozone. And then there is the threat of recession, particularly high given the zone’s proximity to the conflict in Ukraine.

Equities no longer have "no alternative"

In this environment should one consider investing in bonds? Yes, we think. Because, to put it briefly, fixed income is finally living up to its name again and is paying out a good income component, as a logical consequence of the price losses mentioned above. However, the fact that some bond segments now look attractive again does not mean that bonds will not become even more attractive – cheaper, in other words – over the next twelve months, for two reasons.

First, from an investment cycle perspective, bonds are usually at their best when the economy is moving from downturn towards upturn. During this period "risk-free" government bonds have historically tended to do relatively well. As markets bet on Central banks to cut interest rates to get the economy moving again bond prices should rise accordingly. Once the economy has turned around and investors no longer have to fear insolvencies or widening risk premiums, corporate bonds are likely to also start to do better again. At present, however, we have not yet reached that point. The central banks are still putting the brakes on the economy.

Second, we expect volatility to continue. Even without further escalation of the war in Ukraine and worsening energy scarcity, we expect that the earnings estimates of European listed companies will still have to be revised downwards for the second half of the year. We believe talk of insolvencies will also become louder again as energy prices put pressure on margins, especially in Europe. Last but not least, the hefty price reaction of the pound and of gilts after the new government issued a “mini” budget that investors deemed too expansionary, showed how nervous investors still are in this environment. Nevertheless, we feel fixed income deserves a closer look, as perfect timing is almost impossible to achieve. Unlike just 12 months ago, yields on 10-year Bunds are no longer negative, and the real yield (which accounts for inflation) in Germany has recently touched positive terrain for the first time in years. However, this also makes holding cash less attractive as inflation eats into its real value. In the U.S., even real yields are now positive again. Over 4% is currently available for Treasuries, namely for short-dated 2-year papers with correspondingly low interest rate and volatility risk. For non-U.S. investors, however, the appeal is somewhat diminished if they want to protect themselves against currency fluctuations: hedging costs have risen to 2.4%.

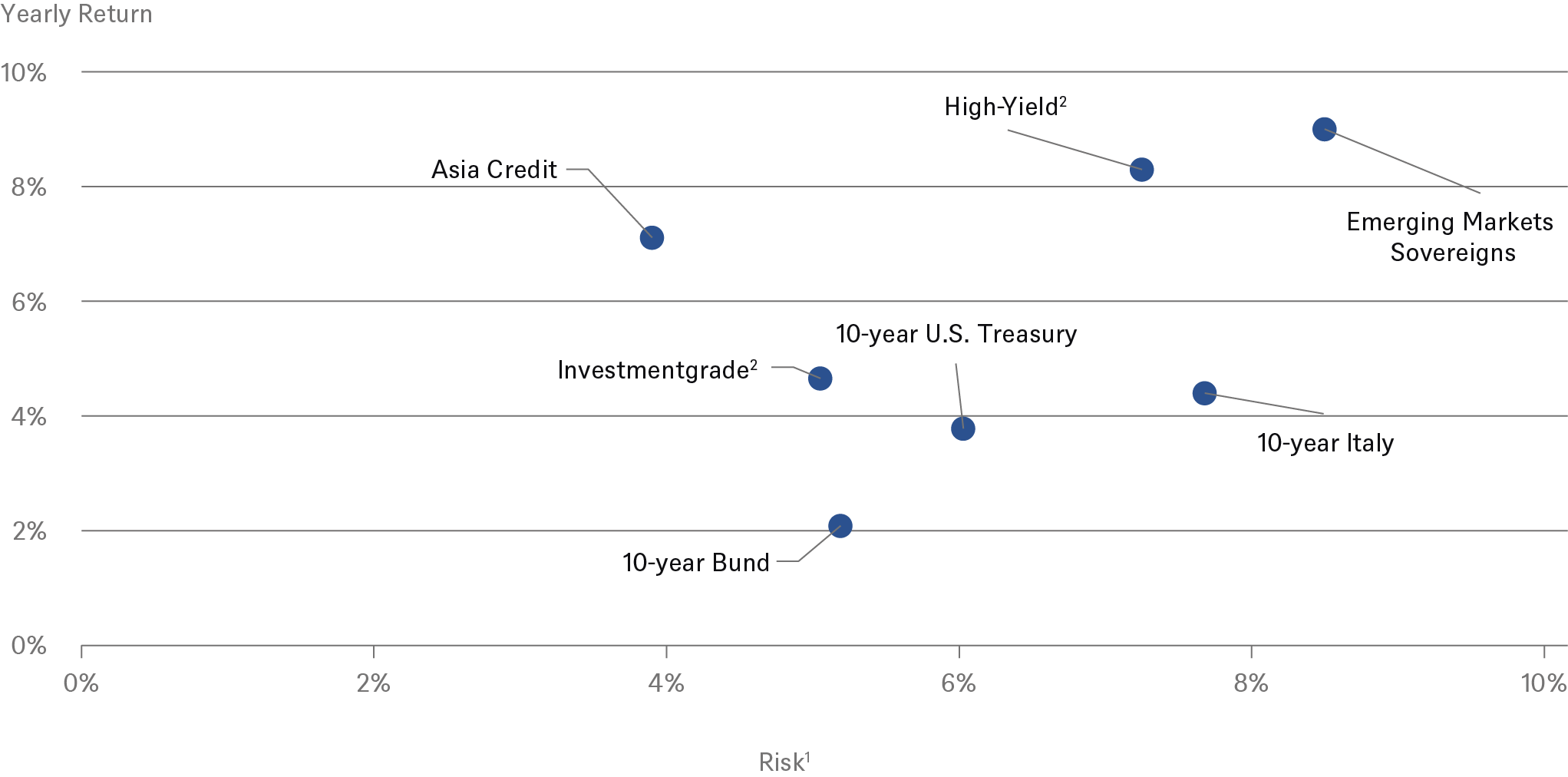

Risk and return (yield-to-maturity) for different bonds

110-year volatility

2average of EUR and U.S.

Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 9/23/22

Bonds have fallen further in response to the surprisingly high August U.S. core inflation numbers and the Fed's comments at the September meeting, and bond yields have largely moved closer to our target levels; we believe this means the risk of further big price setbacks seems lower. The following three examples[4] show how rapidly yields have moved since the beginning of the year:

- For two-year U.S. Treasuries, the effective yield was less than 0.75% at the beginning of the year but is now over 4.0%.

- At the beginning of the year, you had to pay 18 basis points per year for the privilege of owning 10-year German Bunds. Now you receive around 2% for doing so.

- And the higher risk of non-investment grade, high yield (HY) corporate bonds was compensated with a yield of just 3% at the beginning of the year in Europe and – one of more than 8% now.

We have summarized the returns for the main asset classes in the table above, which also shows the level of risk (measured by volatility over the past 10 years) for the different asset classes. Due to the very flat yield curves in the U.S. and Germany, we took 10-year sovereign bonds as a proxy for all maturities. Also, for the sake of simplification, we have combined U.S. and Euro-denominated corporate bonds, despite some yield differentials.

The trend in yields this year of course reflects important fundamental developments, the most crucial of which we believe is tighter monetary policy. For our outlook on bonds, we make the following fundamental assumptions:

- Inflation will peak this year on both sides of the Atlantic.

- In 2023 we believe inflation rates will likely come down significantly, though not to pre-crisis levels.

- The U.S. Federal Reserve (Fed) benchmark interest rate will likely peak next year. But, unlike the market, we do not expect any rate cuts as early as next year.

- The recession on both sides of the Atlantic will be short and shallow. Surely, this assumption will be tested in the coming months.

Before we take a closer look at the individual bond classes, we summarize our short- and long-term economic view.

1 / Economic Environment

A shallow recession, followed by higher inflation and weak growth

China remains wobbly

The continuing dominant influence of central banks’ policy decisions on the capital markets is undisputed. But broad economic developments are also being watched very closely by the markets. The pandemic, supply difficulties, fast-rising inflation and Russian aggression have disrupted normal supply and demand patterns so that economic forecasts are even more uncertain than usual. [5] An illustration of the dramatic level of uncertainty is that not long ago no Fed rate hike was expected until 2024.

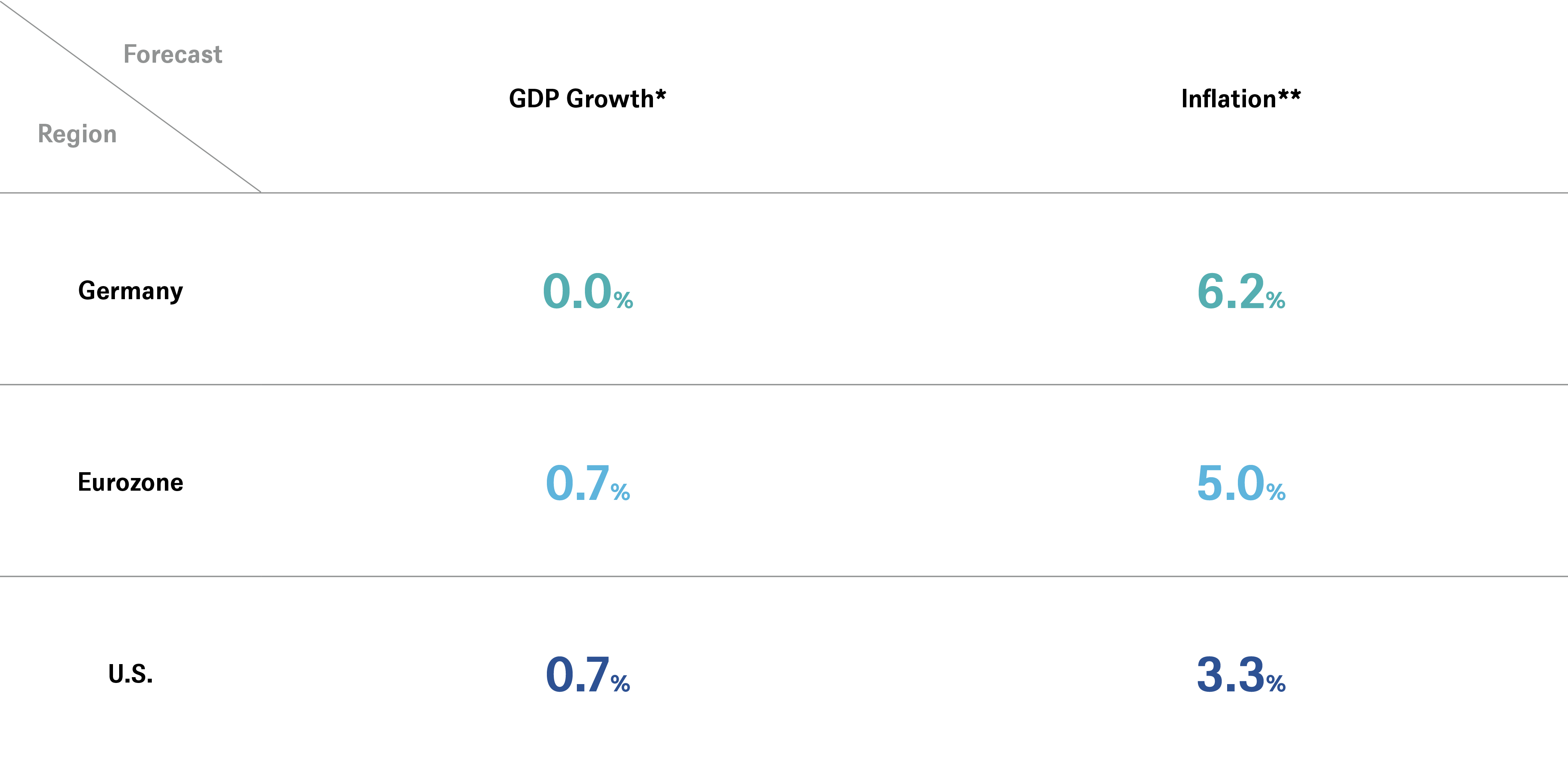

GDP growth and inflation U.S. and Eurozone for 2023

Sources: Investment GmbH as of 8/18/22

Forecasts are based on assumptions, estimates, opinions and hypothetical models that may prove to be incorrect.

There is no denying that inflation forecasts are currently the biggest challenge for market participants and central banks alike. We expect high inflation and rate hikes to push the major economies into a shallow recession over the next six months. In Europe, in particular, we see downside risks in Germany and Italy, two large economies that are particularly dependent on Russian gas. However, we also cannot rule out the "risk" that things may go better than expected. So far, nominal consumer spending has proven to be quite resilient, but spending in real, inflation-adjusted terms, has already stalled. In the U.K., plagued by particularly high inflation, the new prime minister, Liz Truss, has already announced a far-reaching cap on energy bills for private households. We are convinced that central banks will focus on fighting inflation, even if this exacerbates an economic downturn. In Europe, there remains a risk that energy supplies will deteriorate further, and so the inflation peak may still be ahead, while in the U.S. annual inflation seems already to have peaked. But inflation, coming not only from energy and food prices but also stickier long-term price drivers such as wages and rents, is likely to keep us busy for some time. As a result, we expect the Fed to keep on raising rates into 2023. We think it will stick with its final rate level for the full year, unless labor markets show clear signs of weakening (which is not our baseline scenario). Inflationary pressures and the risk of de-anchoring inflation expectations have also forced the ECB to raise rates more aggressively than the markets had expected until recently. Even after the 75-basis point hike in September, unprecedented in ECB history, further rate hikes of this magnitude, or at least of 50 basis points this year, can no longer be ruled out. We expect a deposit rate of 2% this year with significant upside potential still in 2023.

At the same time, however, a number of factors suggest the central banks may have a better hand than generally assumed. First, both the Fed and the ECB will have raised their key interest rates by next year at the latest to a level that could be described as restrictive, assuming the neutral interest rate is around the level the central banks assume (less than 3% in the U.S., 2% in the Euro area). Second, the main drivers of inflation are shifting away from the supply side to the demand side, which central banks are much better able to control. And finally, monetary policy usually takes 12 to 18 months to feed through to the economy. And so, the medicine may already be beginning to work (as seen, for example, in the real estate markets) without showing up yet in the labor market or inflation figures.

Unlike the Fed and the ECB, the Bank of Japan (BoJ) is sticking to its loose monetary policy. But we believe the pressure on the BoJ to act is likely to increase, not least because of the weak yen. In trade-weighted terms, it is trading at its lowest level against a basket of currencies since 2007, and it was last this weak against the dollar in 1990. [6]Whether imported inflationary pressure will force the BoJ to make a sudden U-turn remains to be seen. We do not expect it to. In China stringent zero-covid policy measures continue to pose a risk to economic growth and supply chains. In addition, the government seems to be struggling to get a grip on the nervous real estate market. We believe a further escalation of the Taiwan dispute, while unlikely at present, poses an incalculable risk to our growth forecasts.

Some evidence points to structurally higher inflation and lower growth rates

Even in 2024 we believe that inflation rates in the U.S. and Europe are unlikely to reach the 2% level desired by central banks, despite the probable inflation-reducing base effects in commodities and a gradual easing in supply chain problems. A number of factors argue for a tendency toward higher price pressures: a) continuing labor shortages; b) receding globalization as a result of geopolitical tensions, particularly between China and the U.S., but also between Russia and much of the world, generating a desire to repatriate/reshore production for security of supply reasons; and c) the end of deflationary exports from China. In addition, we believe the increasing aging of societies in industrialized countries and elsewhere is also likely to create inflationary pressures.

Forecast - Productivity gains and population growth in decline in the U.S. – and major parts of the developed world

Sources: Haver Analytics, DWS Investment GmbH as of 9/19/22

Forecasts are based on assumptions, estimates, opinions and hypothetical models that may prove to be incorrect.

The aging and even shrinking of the population in some economies is also a key reason why we expect real economic growth to slow further in structural terms. The chart above shows this using the U.S. as an example; in Europe, Japan and China, lower migration figures exacerbate the problem.

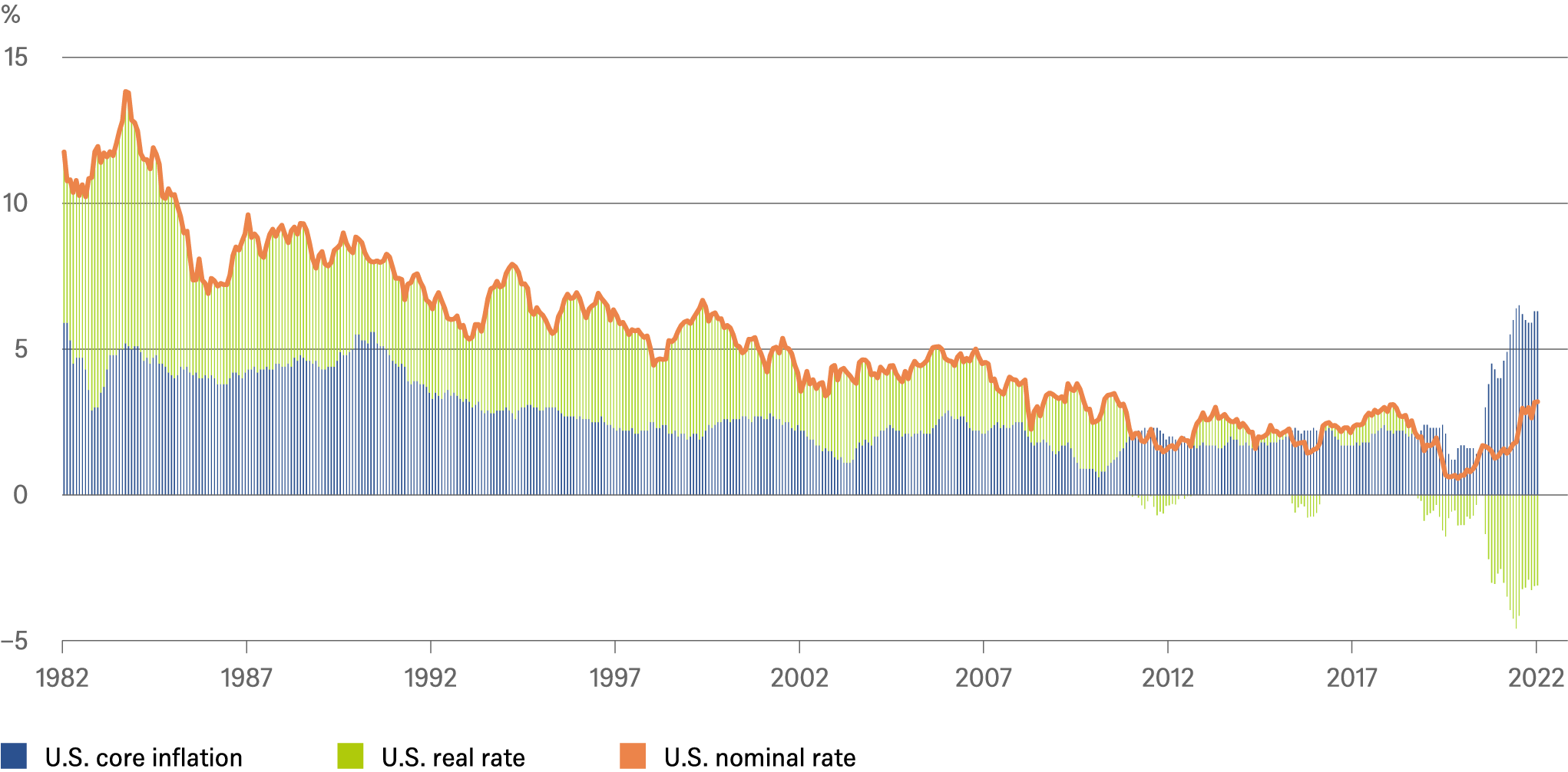

However, declining growth and inflation rates have been a concern for the industrialized countries for some time. The lower chart shows how nominal 10-year interest rates have developed, broken down into real interest rates and core inflation.

U.S. 10-year Treasury yield decomposition

Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 9/19/22

2 / Bond segments

Decades of low inflation and generous central banks have made investors sluggish

More than thirty years since the so-called “Greenspan Put” became associated with Fed monetary policy, one cannot blame investors for not wanting to believe that central banks would jump to their side if equities were to plunge into a bear market or it became apparent that the economy was sliding into recession. Although it had been obvious for several quarters that inflation would be much less "transitory" than initially assumed and the Fed had already announced a more restrictive interest rate stance by the end of 2021, it took Jerome Powell's speech in Jackson Hole at the end of August to finally convince the markets that the Fed was serious this time. The U.S. core inflation rate in August completed the job. The market now expects a fed funds rate of around 4.2% by the end of this year and a peak of over 4.3% in spring 2023. The market had also expected two rate cuts before 2023; this has now shrunk to a 25 basis-point move after the Fed's September meeting. We still do not expect an interest rate cut.

Financial markets‘ inflation expectations seem to have stabilized

* Inflation expectations for the 5 years following the next 5 years

** Inflation for next 10y as derived from 10y inflation protected sovereign bonds

Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 9/21/22

We think that where their main dilemma is concerned - fighting inflation versus supporting the economy – central banks are more likely to remain restrictive longer than absolutely necessary this time, having stuck to their loose monetary policy longer than necessary in recent years. The structural deflationary forces of the past two decades made loose policy possible. Central banks can at least draw some relief from the fact that inflation expectations have not yet soared, as can be seen, for example, from the 5y5y forwards in the U.S. which, at around 2.6%, are only slightly above the pre-pandemic 5-year average of 2.2%. Inflation expectations have not gone through the roof either in 10-year inflation-indexed government bonds, although, as the chart shows, a certain upper bound seems to have already formed, especially in the U.S..

But the extent of bond market uncertainty is, however, reflected in the MOVE Index, which tracks volatility in the U.S. Treasury market. Aside from a short period of turbulence in March 2020, it is now the highest it has been since the 2007/8 financial crisis. [7]

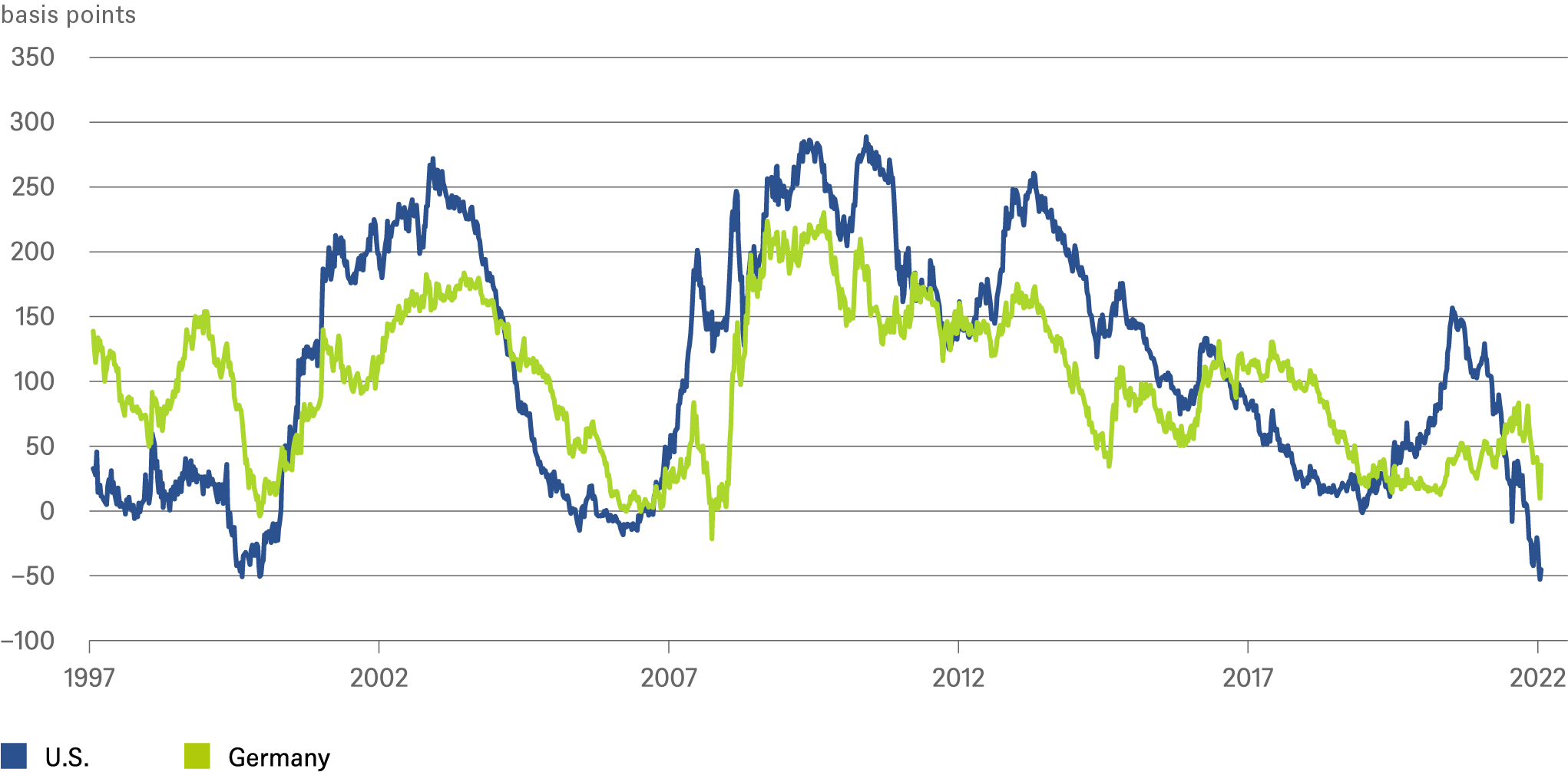

Sovereign bonds

U.S. – decent yield and positive real yields

Since the beginning of the year Treasury yields have vaulted many bars that were previously thought to represent an upper limit. The 10-year went from 1.5% to over 3.5%; the 2-year from just over 0.5% to over 4%, and the yield curve inverted (see chart). At minus 0.55%, the spread between 2-year and 10-year bonds was as low as it had last been in April 2000 – and that had been the only occasion on which the spread had been this negative. In the U.S., the past 10 recessions were all preceded by an inverted yield curve, with a lag of 18 months on average. A similar time lapse now would take us to the second half of 2023 (as the curve inverted in July 2021), but the predictive power of such averages should not be overestimated.

What makes the current situation different from the beginning of the year is the fact that yields are already very close to the levels that the market might consider to be the peak of the interest rate cycle, i.e. around 4% for 10-year bonds. However, if a 5% rate were to appear in 2023 we believe the surprise would be no greater than those seen so far this year.

Like the Fed, we believe that inflation in the U.S. is likely to remain well above the 2% target in 2023 and 2024. Together with the expected impact of quantitative tightening – reduction in the Fed's bond holdings – we expect moderate upward pressure on government bonds with longer maturities, although they already trade well above the inflation-neutral rate[8] now. The rise in 2-year U.S. Treasury yields on a 12-month horizon is likely to be limited by market expectations of easing from late 2023. However, the asset class has become less attractive for foreign investors as currency hedging costs have risen significantly.

Yield curves (2 years / 10 years) in Germany and the U.S.

Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 9/19/22

Europe – a more mixed picture

In Europe we remain cautious on Bunds and expect yields to rise further, despite the sharp increase so far, following the ECB's recent significant stepping up of its interest rate rhetoric. The ECB's tighter stance in tandem with the moderate growth outlook has now led to the yield curve flattening that we have been expecting for some time. We expect the ECB to raise the key interest rate to 2% before the end of this year.

For the EU periphery the new transmission protection instrument (TPI) should help contain risk premiums on Italian and Spanish government bonds. However, a post-Mario Draghi government in Italy and a weaker growth outlook are negatives, and so we do not expect any narrowing of Italian risk premiums, at least. The current risk premium is already enough for Italy's 10-year inflation-indexed government bonds to trade at more than 2% (thus “real” rates), while the real interest rate in Germany still remains in negative territory [9] although coming from minus 2% at the beginning of the year.

Sovereign bond yields in the U.S., Germany and Italy

Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 9/13/22

Emerging markets – a highly complex picture

Reconciling the emerging market picture is more difficult than ever. The economic slowdown in the EU, U.S. and China is affecting emerging economies in varying degrees. EM countries are also on different sides of commodity market dislocations – some are net exporters, some net importers. China meanwhile is pursuing a counterproductive Covid strategy and geopolitical flashpoints, such as the war in Ukraine, which has an impact far beyond the immediate region – through food exports from Ukraine, for example. Other factors too are weighing on all emerging markets, such as rising U.S. interest rates, a stronger dollar and faltering global trade. All these risks are leading investors to demand higher risk discounts for emerging markets – or even withdraw their funds altogether. All these factors should be kept in mind before being blinded by the higher yields.

However, this does not necessarily mean that there are no interesting bonds in the sector, depending on country selection. We are taking a closer look at current account balances and debt levels again, now that countries have had to put together aid programs in response to Covid and commodity and food price explosions. Among investment grade sovereign bonds, we are looking in particular at Chile, Uruguay, Romania and Indonesia.

Corporate bonds

U.S. – decent carry, but some obstacles

We expect the U.S. investment grade (IG) market to be increasingly affected by structural issues during the remainder of the year, including persistent inflation, geopolitical tensions, and more aggressive central bank policy, via the rising fed funds rate and the Fed’s balance sheet contraction. Credit fundamentals are relatively strong on a historical basis, especially as companies have had ample time to prepare for an impending storm. As a result, we expect only a moderate default rate of 3.5% in the high-yield (HY) segment this cycle. Markets might think otherwise, as this segment offers a yield-to-maturity of almost 10%[10]currently. Maybe, as the threat of recession continues to intensify, we may see some credit tightening in lower quality cyclical companies. We expect risk premiums to rise slightly on a 12-month horizon for both IG and high-yield bonds. But the asset class has become less interesting for foreign investors as currency hedging costs have risen significantly.

Interest yields do not seem to have peaked yet for Euro-, U.S.- and Asian Credit

Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 9/13/22

Europe – decent carry, decent challenges

The combination of the Ukraine war, upcoming interest rate hikes and the ECB's phasing out of purchases hit European corporate bonds hard in the first half of the year. The big sell-off, which has driven yields to highs last seen at the beginning of the Covid crisis, has made this bond class attractive again in our eyes, especially as we believe it already prices in a recession sufficiently. Moreover, we believe even the more cyclical sectors are quite well funded, so they should be able to weather sales and margin declines. In the high-yield segment investors now receive a yield of 8.5%, despite balance sheet numbers that are good for this part of the cycle, and we expect defaults to rise to a still historically moderate rate of 3.0%. However, there could be fresh nervousness in the market in the fall and winter, arising from the energy crisis and higher insolvencies. But from a 12-month perspective we are reasonably positive on both IG and HY. The risk premiums on both asset classes are likely to narrow if it becomes apparent next year that the inflation picture is improving and the ECB is going to become more predictable again in its interest rate steps.

Emerging Markets – mixed basket

The global environment for emerging market bonds is highly uncertain, as described above. But many commodity exporters have proven resilient. We believe strong credit fundamentals in the corporate sector, with robust liquidity and low leverage, offer a cushion against a potential slowdown. We favor HY over IG as the much higher interest income should more than offset the expected credit losses. In the short term, however, we have become a bit more cautious overall following these sector’s outperformance of the global index in recent months. We believe tightening Fed policy, along with rising concerns about a U.S. recession, is likely to make investors more cautious again about EM corporate bonds. Issuers must be scrutinized closely. We prefer companies with pricing power, high cash holdings and good access to capital markets or bank loans.

Asian Credit

Strong fundamentals in many parts of Asia with the exception of some sectors in China

Asian bonds currently offer a 7.1% yield, despite solid corporate balance sheets on average and better credit quality compared to developed markets. This is especially true for Asian investment grade (IG) bonds, which have been quite stable despite high global market volatility. We remain cautious on Chinese bonds, not only because of the zero-Covid policy, which should, however, be largely priced in. High-yield (HY) bonds from the real estate market sector are particularly weak, as there are few signs that pressure on the sector is easing. As long as the real estate market is not more strongly supported by the government, valuations look only superficially attractive. Outside Chinese credit, we believe structural growth and positive commodity dynamics offer better opportunities, for example in India and Indonesia.

Currencies

Unstoppable dollar – for now

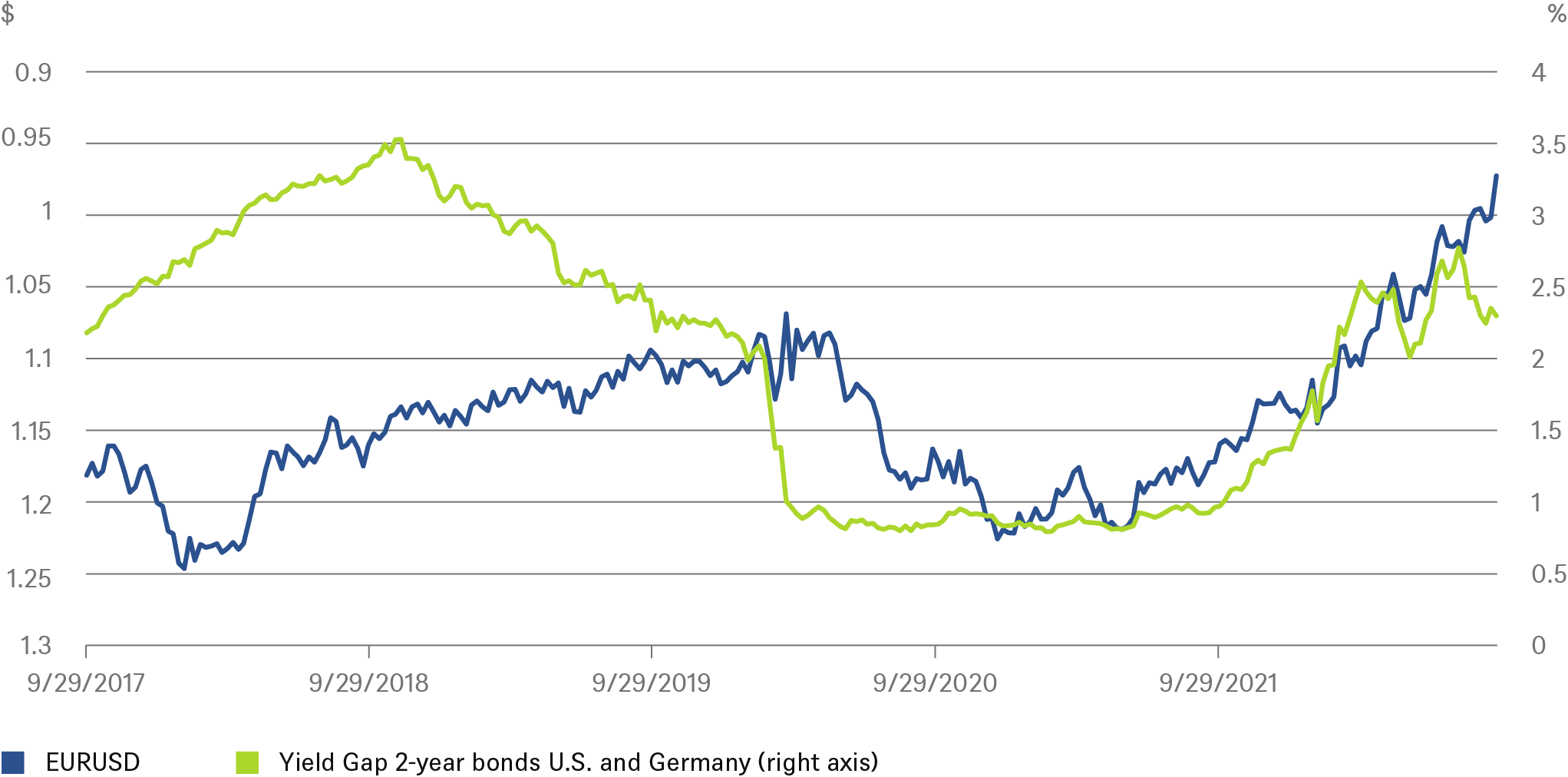

We believe the global economic slowdown and energy crisis will keep the Euro under pressure. Furthermore, the current risk-off modus of markets supports the dollar which is seen by investors as safe-haven. At the same time, the nominal yield differential against the dollar looks likely to play a more important role again in thea future. As we believe the yield differential may have peaked, the euro may find some support going forward.

EUR/USD vs yield gap of 2y sovereign bonds U.S./ Germany

Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 9/23/22