- Home »

- Insights »

- CIO View »

- CIO View Quarterly »

- The redeeming qualities of global real estate

- Global macro storms have hurt most asset classes. Real estate has been no exception, but heading into 2023, we see reasons for cautious optimism.

- Price corrections in response to higher debt costs now provide more attractive entry points.

- A rather unusual feature of the current down-cycle is that fundamentals look quite healthy.

- However, correctly identifying structural, cyclical and micro-dynamics within segments remains critical.

1. Increasingly, various real estate segments do look like plausible beneficiaries of investing in inflationary times

From a longer-term perspective, real estate now indeed looks like a plausible beneficiary of investing in inflationary times. It is also a good example that of how asset valuations tend to be subject to a quite multifaceted interplay of different causal mechanisms. Many of these are not all that obvious ahead of time, especially to investors unable to recall previous experiences of similar shocks within their own lifetime. Recent spikes in inflation, and the striking amount of ill-advised economic commentaries in financial market commentary throughout 2022, are good examples of such a shock[1].

In general, real estate tends to provide a good hedge to inflation in terms of protecting future rental cash flows existing properties generate. In addition to lifting nominal earnings of renters, inflation tends to put upward pressure on construction costs, constraining competitive supply. Over time, moreover, real estate prices tend to track replacement costs, which are directly tied to broader inflation dynamics via material costs and wages in construction. Therefore, it comes as no surprise, that U.S. industrial and residential rents have jumped 15% over the 12 months to September 2022, as inflation has resurfaced[2]. However, the speed of adjustment differs across regions and sectors, reflecting, for example, differences in lease duration.

In U.S. residential property, lease rates can typically be adjusted annually, providing a timely hedge against rising consumer prices, especially when and where housing demand is locally strong. Within Europe, however, legal arrangements for residential rents differ country by country and often within countries too or by building type. Politicians at all levels frequently meddle with various rental protection measures, in ways that can be difficult to predict (not least as they almost as frequently trigger legal challenges).

For offices and other commercial properties, lease terms can differ as much asset by asset, as they do country by country. Some offices have automatic inflation-adjustments and offer quite good hedges as a result. Others are locked into fixed rates, or at least rates that increase at fixed increments (i.e., independently from changes in the general price level of goods and services). Parts of certain residential markets such as Germany, especially among older leases, have similar provisions. We could go on, but the simple point is that while property cash flows are generally – along with infrastructure – standouts in being well protected against inflation rising and becoming less predictable, close attention is required as to how and why such hedges might work for the specific assets in question.

For capital market participants, the bigger problem with real estate has been that during the 10 years of easy monetary policies, inflation-adjusted or "real" interest rates have tended to be low, if not negative, in most markets. That, in turn, resulted in unusually low discount rates when valuing properties, boosting asset valuations. High asset prices have been a key reason for our caution on listed real-estate for much of 2022. As we warned last year, higher inflation expectations bore the risk of volatile and rising interest rates, including real interest rates, potentially resulting a pronounced valuation-compression for real assets.

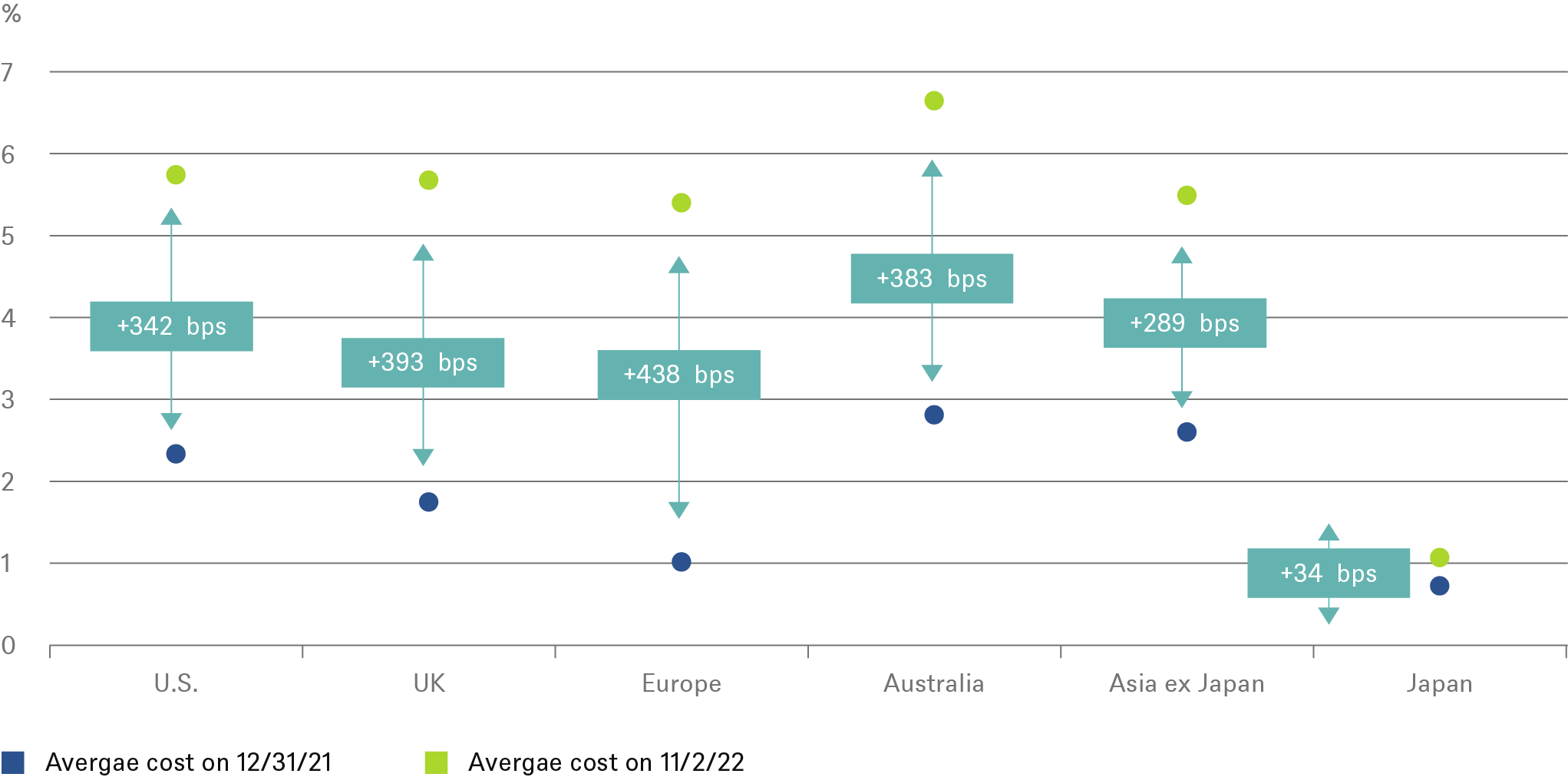

In much of the world, this process has been in full swing, throughout the year to date. To illustrate some of the mechanics, consider debt financing cost for typical real estate companies in various regions. In most markets, both base interest rates (i.e. nominal yields on low risk government bonds of similar duration) and spreads have gone up sharply. The Euro area has seen the biggest widening in spread. At the other extreme, financing costs in Japan barely budged.

Costs of debt financing have risen globally, with Japan the clear exception.

Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 11/2/22

This increase in financing costs has had a sizeable impact on global real estate valuations, with price corrections in almost every market outside of Japan, in response to higher debt costs and reduced investment activity. For non-listed real estate assets, these pressures have intensified in recent quarters in most markets and segments. As is typical for down-cycles, the ride has been even rougher for listed real estate companies. More subtly bank lending has been slowing and underwriting standards have increased, making it more challenging to put together complex transactions and squeezing deal volumes. This has caused knock-on effects, at least within certain segments. Globally, balance sheets of listed real-estate company generally remain solid but for some European ones, they look stretched. We expect equity raises in Europe where debt levels are unsustainable at current levels of interest costs, diluting the stake of existing shareholders – and potentially putting further pressure on share prices.

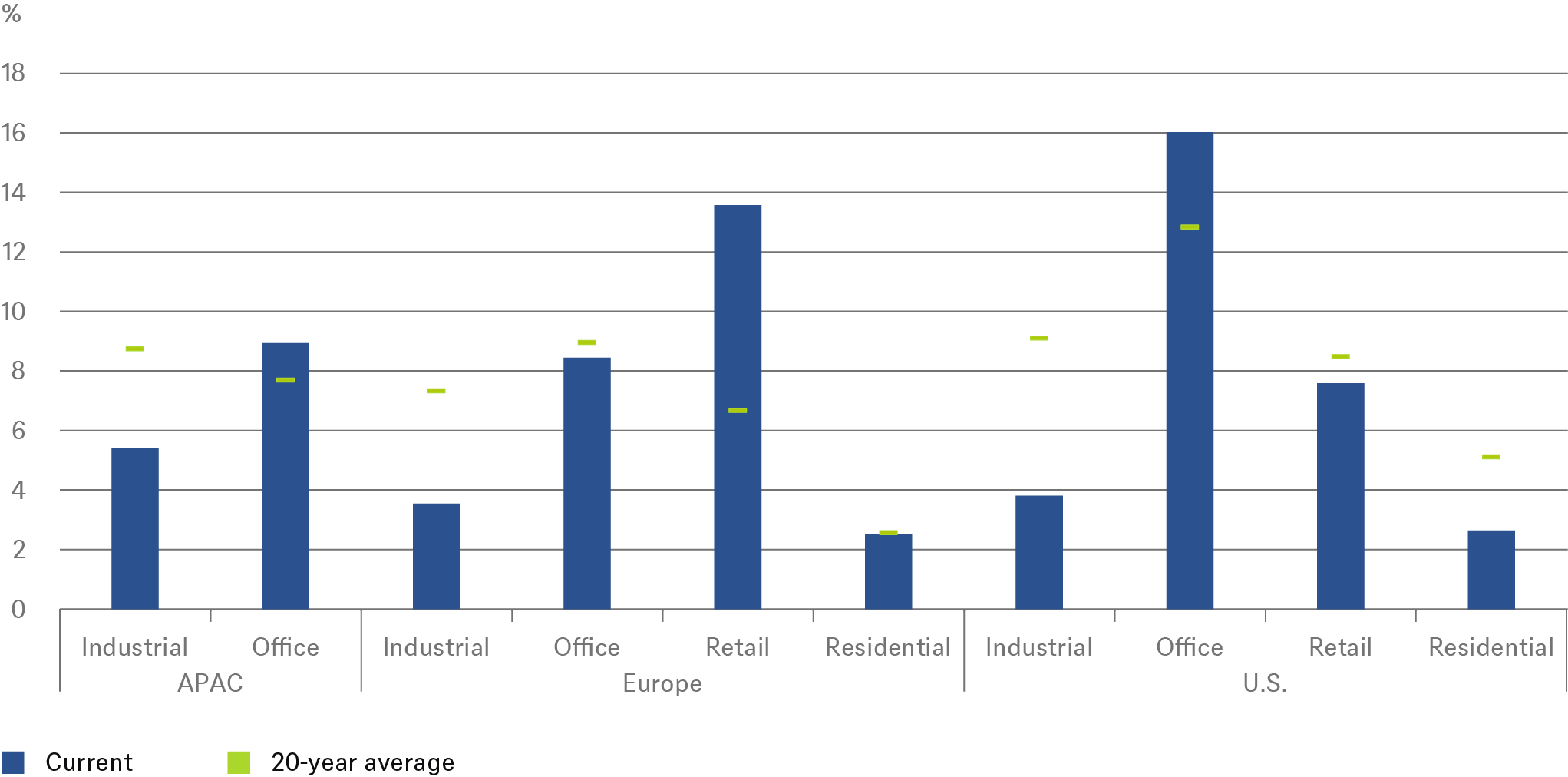

At the same time, however, a rather unusual feature of the current real estate down-cycle is that fundamentals and longer-term value drivers remain quite healthy. In particular, North American real estate approaches this looming downturn with supply well under control, as labor shortages and soaring materials costs (up 45% since pre-COVID) have curbed the development[3]. Inflation-adjusted spending on real estate construction has fallen by 18% since the beginning of 2020 to its lowest level since 2015, and the rising cost and tighter availability of financing, as well as mounting economic jitters, seem likely to squeeze activity further[4]. Completions lag behind construction spending by about a year, but we believe that supply is cresting and will drop sharply toward the end of 2023. In most other regions and sectors too, vacancies are below historical averages, and in some segments, notably industrial real estate in much of the developed world, as well as the U.S. residential sector, well below those averages.

Vacancies are below historical averages in most regions and sectors

Sources: NBER, DWS Investment GmbH as of 11/1/22

2. Still, correctly identifying structural, cyclical and micro-dynamics at particular locations and segments remains critical.

Of course, none of this should lead to complacency. One of the challenges since the outbreak of Covid-19 has been correctly identifying longer-term structural forces (including e-commerce and demographics), fading pandemic effects, notably in terms of supply chain disruptions, and cyclical dynamics, including inflation and recession risks. One common source of error has been to extrapolate the vagaries of the past two years to a longer-term investment horizon.

Take U.S. residential real estate. What matters most in determining rents are the local dynamics in terms of residential vacancies, household disposable income, household formation and net migration. In the short-term, we may nevertheless see some broader trends, pointing towards higher rents. After all, higher interest rates on mortgages may deter would be home buyers, at least as long as house prices remain so high that they make the monthly payments increasingly unaffordable for many households. At the same time, families still have to live somewhere, which is likely to skew residential demand towards rental housing. As a necessity, spending on rents tends to be cyclically defensive, and as already mentioned, U.S. residential rents tend to be quite inflation-sensitive, thanks to the prevalence of short leases.

Historically, U.S. residential rents tend to track inflationary pressures reasonably well, even during economic down-turns as was well illustrated during the 1970s. Along with our macro-economic colleagues, we expect only modest recessions in the U.S. and most other developed markets, with declines in aggregate economic output likely to be relatively short and shallow, while labor markets and household income look set to hold up reasonably well.

U.S. residential rents typically respond to inflationary pressures, particularly when fundamentals are strong

Sources: NBER, DWS Investment GmbH as of 11/1/22

More than the national picture, though, what really matters for investors in U.S. housing is where and why fundamentals are most likely to remain especially strong or especially weak. In turn, that partly depends on the legacy the pandemic and its aftermath are likely to leave, notably in terms of more flexible and increasingly remote or hybrid work-from-home arrangements.

Covid-19 temporarily accelerated, and then softened, apartment demand in lower-cost cities of states in the Sun Belt and Mountain West. Household formation soared from 700,000 in 2020 to 2.3 million in 2021 (having averaged 1.1 million over the past 20 years); muted apartment absorption implies that it has collapsed in 2022[5]. Subdued apartment leasing in several Sun Belt markets, such as Phoenix, Texas, and Florida, over the past three quarters also suggests that a decade-long migration away from gateways cities like New York and Chicago, which accelerated dramatically during the pandemic, has essentially stalled, perhaps because an exodus of provisionally remote employees has subsided[2].

Even if remote working recedes from pandemic levels, however, it is unlikely to completely reverse in our view. Greater corporate acceptance of distributed working will, after a transitory pause, continue to facilitate the migration of young Millennial families (joining Baby Boomers and others) to these growing U.S. cities, a trend that was in place well before COVID.

If this analysis on the long-term pandemic effects on U.S. population dynamics is correct, that also suggests that remote working will continue to weigh on the offices in traditional headquarter locations, which is likely to compound the damage from a recession, even a mild one. But before looking at such risks, consider what the above discussion of U.S. dynamics says about other regions. In such analyses, the U.S. often plays an outsized role, partly because of the timely availability of data to illustrate causal mechanisms identified. In assessing the global implications, though, keeping regional differences in mind is often critical.

For example, we would expect that in many Asia office markets, a cultural affinity for office-based interaction may blunt incursions from remote or even hybrid working. And generally, but especially in Western Europe, such office markets like central London may see a bifurcation. State-of-the-art, environmentally friendly “Next Generation” office buildings look well placed to continue benefitting from a flight to quality, as companies strive to bolster their environmental, social and governance (ESG) credentials and entice talented employees. Finally, and even leaving the U.K. and Brexit aside, labor markets within the European Union (EU) are not quite as flexible as in the United States when it comes to remote working. In particular, a salaried New York employee can work from Florida, Phoenix or Montana with far less paperwork required by his or her employer, than, say, for a Frankfurt based employee to work from Tuscany, the Algarve or the Tyrolean Alps.

Other U.S. inspired investment ideas travel rather better. In particular, the underlying forces that underpinned demand in logistics and certain industrial segments are not only intact in most markets; in our view, they have likely strengthened. U.S. e-commerce jumped from 14% of retail sales (including restaurants but excluding autos and gas) in 2019 to 21% in April 2020; it has since drifted back to 18% as stores have reopened[6]. Abstracting from the recent volatility and short-term cyclical risks, we believe that U.S. e-commerce penetration will rise to at least 25% by the end of the decade; meanwhile, efforts to secure supply chains in the wake of pandemic disruptions and geopolitical tensions will add further support to industrial demand. There are good reasons to expect similar patterns in other regions.

By contrast, offices, along with traditional retail, is likely to remain one of the more challenging segments in many real-estate markets, where selection and a strong understanding of micro-drivers remains key. For example, high vacancies in U.S. offices and European retail are likely to exert downward pressure on nominal rent growth, making it all the more important to identify business likely to emerge as winners, at least in relative terms. In retail, the combination of an inflationary squeeze on disposable incomes, recessionary job losses, and a post-pandemic pivot from goods to services spending may add further headwinds to rents, but there are likely to be plenty of exceptions. In U.S. retail, where brick-and-motor stores have long been among the most exposed to the rise of e-commerce, neighborhood and community centers appear to have turned the corner. Their vacancy rates have dropped to their lowest levels in 17 years and their necessity (e.g., grocery) and service-oriented (e.g., health care) tenants increasingly appear resistant to recession and e-commerce[2].

To be sure, one problem of any such data point is that Covid-19, its aftershocks and geopolitical tensions have commercial and demographic trends over the past two years. It is precisely in the presence of such uncertainties, however, that having strong views on what drives divergence in performance by asset, segment or region can be most beneficial, especially during a period of slowing growth and mounting recession risks. In private real estate, further repricing could create significant tactical opportunities to gain access to strategically attractive stock at a reduced price.

To sum up, we expect the combination of low initial vacancy rates and constrained supply to sustain healthy U.S. real estate fundamentals, albeit not in all sectors and markets. From a global perspective too, performance is likely to diverge over coming quarters, with residential and logistics looking well positioned. For listed real estate, we see the potential for bottoming in relative performance in early 2023 as the prospects of an end of global central bank tightening cycles nears. In Europe, recent price corrections, especially where paired with strong fundamentals and reduced development, suggest scope for value gains in the longer-term. Receding risks of a cutoff in Russian gas supplies resulting in energy rationing this winter should also boost sentiment and underlying economic prospects.

For the Asia Pacific region, we see solid longer-term potential, but would caution that in terms of the near-term outlook, each country and indeed location and segment needs to be analyzed separately, and thoroughly. Even purely from a macro perspective, rising interest rates have already taken a toll on real estate in Australia and South Korea, although this is now laying the groundwork for recovery. Japan is expected to be among the top-performing markets in the world in 2022, thanks to low and stable interest rates, though of course, if this ever were to change, we could see similar dynamics there to the ones already seen in much of the rest of the world.

Globally, the bottom line is that fundamentals are reasonably healthy, even as some of the hottest markets, for example in North American residential, have seen significant deceleration compared to the strong trends witnessed in 2021. Overall, we believe that underlying real estate prices will largely stagnate over the next two years, resulting in low-single-digit, rental income driven returns and that outcomes will vary widely across sectors and markets, not least in terms of landlord’s

ability to pass on inflation. Correctly identifying structural, cyclical and micro-dynamics at particular locations and segments will be critical. With inflation likely to remain sticky and unpredictable, however, that seems like quite a reasonable alternative to other asset classes.