West Texas Intermediate (WTI) prices continue to oscillate close to the 40 dollars per barrel level, as the market frets over the pace of economic recovery and uncertainty over lifting or re-imposing lockdowns. The positive news flow on the development of vaccines is supportive for oil prices but the surge in new Covid-19 infections in the United States and government data showing weakening fuel demand this week have had the opposite effect. Internationally, too, the news is very mixed for oil. China and Korea reported lower new cases of Covid-19, suggesting containment of the virus in these countries, and their oil demand is above or close to last year's levels. It’s possible, however, that stockpiling of oil may be exaggerating the real level of demand in China.

In July's Joint Ministerial Monitoring Committee, OPEC reaffirmed members would meet their quota commitments, with core OPEC members and Russia slightly increasing their output while non-compliant countries are catching up on the agreed quotas. The aim of the strategy is to try to increase market share while normalizing the level of inventories. We expect OPEC+ to remain data dependent, keeping a close eye on U.S. shale production levels. We believe the huge amount of oil inventories around the world suggests at best sideways movement in oil prices in the near term. The muted sentiment in energy is likely to turn when Covid-19 case numbers show signs of containment.

Natural gas is also struggling against concerns about global demand, depressed by the Covid-19 outbreak. On the supply side, mild weather has reduced expectations for demand to fuel air conditioning. The dual pressures have caused natural-gas prices to fall and they are likely to remain weak.

Gold on the other hand brightens up the picture. Prices keep climbing, hitting an all-time high of 1,930 dollars per ounce.[1] A weaker U.S. dollar, negative real interest rates and the U.S. Federal Reserve's (Fed's) commitment to a prolonged zero-interest-rate environment keeps our gold outlook positive. At the same time palladium prices have continued to drift downward, with little news flow. The price prospects for the metal, which is used in automotive emission-control devices, hinge on whether there is a rebound in auto sales in both China and the United States as economies look to reopen.

In base metals, the market continues to focus on Chinese restocking post Covid-19. Market participants generally view the restocking effort as a prelude to infrastructure projects in the second half of the year. China already shows its commitment by increasing the local government loan limit, and governments across the United States and Europe are discussing increases in infrastructure spending as well. Meanwhile, supply disruptions persist across South America. Brazil continues to suffer outages as Covid-19 widens its reach, while Chile has recently seen large outbreaks of the virus which have also necessitated production stoppages. By restricting supply, these are positive developments for base-metal prices, but the stockpiled inventory could become an overhang on the market if the pick-up in global demand is not as robust as hoped. We expect the sector to experience varying performance in the near term, with our preference for metals with the most robust near-term fundamentals, such as nickel and copper.

On the agricultural side, talks between U.S. Secretary of State Mike Pompeo and his Chinese counterpart, Yang Jiechi, in June were constructive, with China affirming the phase-one trade agreement targets and speeding up agricultural commodity purchases. However, with Covid-19 cases on the rise once more, investors have again shifted their attention away from Chinese purchases to potential demand destruction from reduced global economic activity. Additionally, mild weather across the globe has reinforced expectations that production will be robust this year. We therefore expect prices for agricultural commodities to remain under pressure until Covid-19 concerns ease.

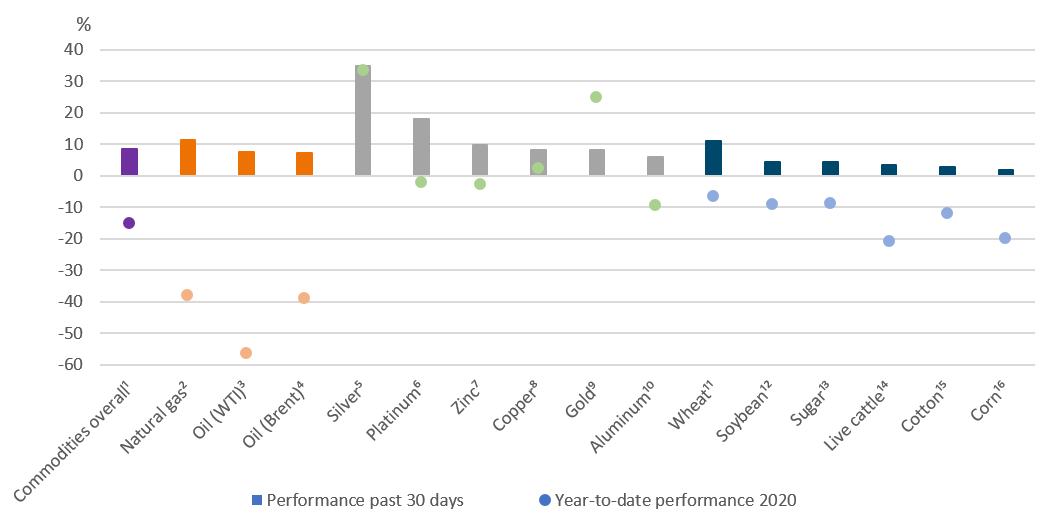

Past 30-day and year-to-date performance of major commodity classes

Past performance is not indicative of future returns.

Sources: Bloomberg Finance L.P., DWS Investment Management Americas Inc. as of 7/27/20.

1Bloomberg Commodity Index, 2Bloomberg Natural Gas Subindex, 3Bloomberg WTI Crude Oil Subindex, 4Bloomberg Brent Crude Subindex, 5Bloomberg Silver Subindex, 6Bloomberg Platinum Subindex, 7Bloomberg Zinc Subindex, 8Bloomberg Copper Subindex, 9Bloomberg Gold Subindex, 10Bloomberg Aluminum Subindex, 11Bloomberg Wheat Subindex, 12Bloomberg Soybeans Subindex, 13Bloomberg Sugar Subindex, 14Bloomberg Live Cattle Subindex, 15Bloomberg Cotton Subindex, 16Bloomberg Corn Subindex

Appendix: Performance over the past 5 years (12-month periods)

|

|

06/15 - 06/16 |

06/16 - 06/17 |

06/17 - 06/18 |

06/18 - 06/19 |

06/19 - 06/20 |

|

Bloomberg Commodity Index |

-13.5% |

-7.0% |

5.8% |

-8.9% |

-18.4% |

|

Bloomberg WTI Crude Oil Subindex |

-41.7% |

-17.4% |

56.7% |

-20.2% |

-56.6% |

|

Bloomberg Brent Crude Subindex |

-35.5% |

-13.3% |

67.2% |

-16.1% |

-38.1% |

|

Bloomberg Natural Gas Subindex |

-32.2% |

-19.5% |

-19.0% |

-22.4% |

-50.0% |

|

Bloomberg Gold Subindex |

12.0% |

-7.5% |

-1.2% |

9.5% |

24.1% |

|

Bloomberg Silver Subindex |

17.9% |

-12.9% |

-5.0% |

-8.3% |

16.6% |

|

Bloomberg Platinum Subindex |

-5.5% |

-10.8% |

-9.2% |

-4.3% |

-1.1% |

|

Bloomberg Copper Subindex |

-17.3% |

20.4% |

6.0% |

-10.2% |

-1.5% |

|

Bloomberg Aluminum Subindex |

-6.5% |

13.4% |

10.2% |

-18.4% |

-14.6% |

|

Bloomberg Zinc Subindex |

2.6% |

28.5% |

4.6% |

-6.4% |

-17.8% |

|

Bloomberg Corn Subindex |

-20.3% |

-7.2% |

-18.1% |

3.7% |

-26.4% |

|

Bloomberg Wheat Subindex |

-32.0% |

-1.5% |

-21.2% |

-2.8% |

-9.2% |

|

Bloomberg Soybeans Subindex |

10.6% |

-21.0% |

-13.6% |

-4.2% |

-10.6% |

|

Bloomberg Sugar Subindex |

48.8% |

-35.0% |

-16.5% |

-5.6% |

-12.7% |

|

Bloomberg Cotton Subindex |

-6.2% |

6.4% |

23.4% |

-24.2% |

-10.9% |

|

Bloomberg Live Cattle Subindex |

-18.4% |

13.3% |

-10.0% |

-2.4% |

-17.6% |

Past performance is not indicative of future returns.

Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 7/27/20.