- The focus of the event is a reshuffle of senior positions, not concrete policy intentions

- Key policy changes might come in the aftermath of the congress: no immediate relaxation but gradually more flexible Covid policy; real estate sector support and attempts to define new drivers of growth

- The decisions on key posts are likely to reflect the future policy focus but also the degree of political power of Xi Jinping

- U.S.-China relations are unlikely to improve in the foreseeable future and are set to remain a source of volatility

The China Communist Party Congress is held only twice every decade and there are big expectations for this year’s meeting, which begins on October 16. We focus on the direct and indirect implications for the economic outlook and investors’ interests. Domestic companies and global investors hope for a return of stability, more transparency and pragmatism on future Covid policy, as well as more support for the all-important real estate sector and measures to bolster the consumer. But President Xi, who most likely will remain for an unprecedented third term, did not reveal any concrete intentions ahead of the event. He urged Communist Party members to prepare for ‘great struggles’ ahead. Nevertheless, in the aftermath of the congress, more clarity might emerge on important topics.

1 / What is the Communist Party Congress (CPC) agenda?

1.1. About people, not policies

The top two items to watch for are leadership reshuffles and the political report delivered by CPC General Secretary Xi Jinping. A new leadership team, including the Political Bureau and its Standing Committee, will be elected immediately after the party congress at the first plenary session on October 23. There might also be clues during the congress on the makeup of the new economic team, including the candidate for Premier.

The Political Report given by Xi Jinping is expected to elaborate on recent achievements and review the current domestic and international situation. It will present a blueprint for China for the next five years and until 2035 and will give important guidelines on China’s future policy objectives, economic development plans and priorities and many other topics that are important for investors. The political part will likely focus on how China plans to build a modern socialist country by around 2050, to celebrate 100 years of the People’s Republic of China.

There are hopes that policy uncertainties may diminish after the Party Congress if the focus shifts from politics to the urgent economic challenges. While the strategic goals might remain unchanged, the focus is likely to be on policy implementation. On Covid it is expected that a more flexible and pragmatic policy stance will be adopted. Finally, there is hope that the new economic team will deal with the urgent problems in the housing sector with more measures, including direct support.

The Congress and the first plenum immediately after it will elect the new Politburo and its Standing Committee, a group of the most senior leaders in China, who will be in office for the next five years. It’s almost certain Xi Jinping will secure a third term as President at the congress. In 2018 the time limit to his term was abolished, allowing de facto unlimited political terms. Xi Jinping currently holds three titles: General Secretary of the Communist Party, Chairman of the Central Military Commission and President. He is expected to retain the first two titles at the Party Congress, and the presidency during the annual National People's Congress in March 2023.

The Standing Committee

There will be at least two vacancies on the current seven-member Standing Committee if Xi enforces the traditional 68-year-old retirement age for officials – other than himself. He needs at least three allies to secure a majority on the panel that manages the affairs of almost one-fifth of the world’s population. Two departures from the committee will have particular relevance for the economy and financial markets:

Premier Li Keqiang is due to step down and the choice of his successor is important, as Li has the trust of the economic and financial market community. There is a chance that he will pass on the baton of Premier but remain in the standing committee in another post. Investors will focus on whether the successor is open to reform and market-oriented or likely to stick to more traditional thinking and therefore policy continuity. As the role of Premier is a state role, the appointment will not be formally confirmed before the National People’s Congress in March 2023.

Vice Premier Liu He is also to step down and this may have an important impact. His replacement could influence China’s economic policy thinking and implementation significantly. Liu also heads the General Office of the Central Committee for Financial and Economic Affairs (CFEA), the highest-level working group on the economy in the CPC and chairs the Financial Stability Committee under the State Council which oversees co-ordination among regulators. Last but not least, he led China’s team during the trade disputes with the U.S..

PBoC Governor Yi Gang, and China Banking Insurance Regulatory Commission (CBIRC) chairman Guo Shuqing, might stay for another term or not. Both decisions are obviously important to investors, given the challenge of financing necessary restructuring in the real estate sector and potential uncertainty over future regulatory steps after the bold moves seen in recent years, in particular with regard to the internet and education.

1.2. The messages will become more concrete in the busy post-Congress political calendar

Immediately after the party congress little more than the political reshuffle might be known and there are important events to watch in November and December. After the congress the first new Politburo meeting will convene. Given the substantial uncertainty over the outlook for economic growth, December’s Central Economic Work Conference could provide important clues. In Q1 2023, the National People’s Congress (NPC) and CPCC (see table) meeting will give important guidelines on policy in the next five years.

Many policy events after the Communist Party Congress

|

Date |

Event |

Comment |

|

October 16, 2022 |

Start of the 20th Party Congress Policy report |

Lasts until October 22. Congress elects the Central Committee

President Xi will deliver a lengthy report on the Party’s achievements in the past 5 years and map out strategies for the coming years |

|

October 23, 2022 |

1st Plenum of the 20th Party Congress |

Central Committee (about 200 full members and 170 alternate members), holds the first plenum to elect the Politburo (25 members) and its Standing Committee (7-9 members) |

|

October 2022 |

Politburo meeting |

Possibly more clues on economic policy |

|

November 2022 |

Nationwide financial work conference |

|

|

Early December 2022 |

Politburo meeting |

2023 policy outlook, preparation for CEWC (see below) |

|

Mid December 2022 |

Central Economic Work Conference (CEWC) |

Held at the end of every year. The most important meeting for the Chinese economy. The Chinese Communist Party’s top leaders discuss in length the policy priorities and targets for the next year |

|

February 2023 |

2nd Plenum of the 20th Party Congress |

Discussion on reassignment of government leaders |

|

March 2023 |

National People Congress and CPPC |

The reshuffle of party and government offices will be completed after the two sessions held in March 2023. After the personnel issues are settled, the Central Committee of the Party will hold plenums over the next five years (on topics from economic policies and reforms to party leadership). |

|

Oct. / Nov. 2023 |

3rd Plenum of the 20th Party Congress |

Policy/Institutional Design/Reform document |

|

Sources: Goldman Sachs, Xinhua, DWS Investment GmbH; as of: October 2022 |

||

2 / Outlook: Unprecedented economic challenges

2.1 Short-term issues to solve: Covid policy and real estate

Covid policy is, in terms of domestic policy, a sensitive issue given the unpopularity of the strict measures, but also crucial for the economic outlook and corporate decisions. Unlike in the earlier phases of the pandemic, the main economic damage from Covid restrictions comes from the service sector and the severe reduction in consumer demand. The ongoing pressure on private consumption from the real estate crisis may make policymakers act with urgency on the zero Covid policy. Greater flexibility and pragmatism are likely to emerge, though not immediately after the congress but rather gradually, as Chinese mRNA vaccines, booster vaccinations for the elderly and new medical treatments advance.

The decisions on real estate policy are the most challenging. The sector needs to be reformed, with leverage and its dominant influence on growth reduced, in order to help prevent systemic crises and reduce the risk of major contagion effects in the real economy. The problem is not only economically urgent but also has a social impact, as the unusual strikes by mortgage payers in early summer have shown – after all, 90% of the population are homeowners.[1] The real estate sector, including services related to it, contributes up to 25-30% of GDP and makes up roughly half of the wealth of the private sector.

If the real estate sector is contained and never regains its past dominance in the Chinese economy, what will be the future growth drivers? Answering this question and effecting the necessary structural change is a major focus of long-term political planning. Not surprisingly, new sectors involving technological upgrades and, in particular, alternative energy sources have been on the priority list for years. But support is strongest for: a) the urgent new need to become less dependent on energy imports; b) achieving climate goals; and c) a political support program and related fiscal expenditures to compensate for the inevitable economic ‘damage’ from the clean-up in the real estate sector.

2.2. Structural domestic policy changes and geopolitics

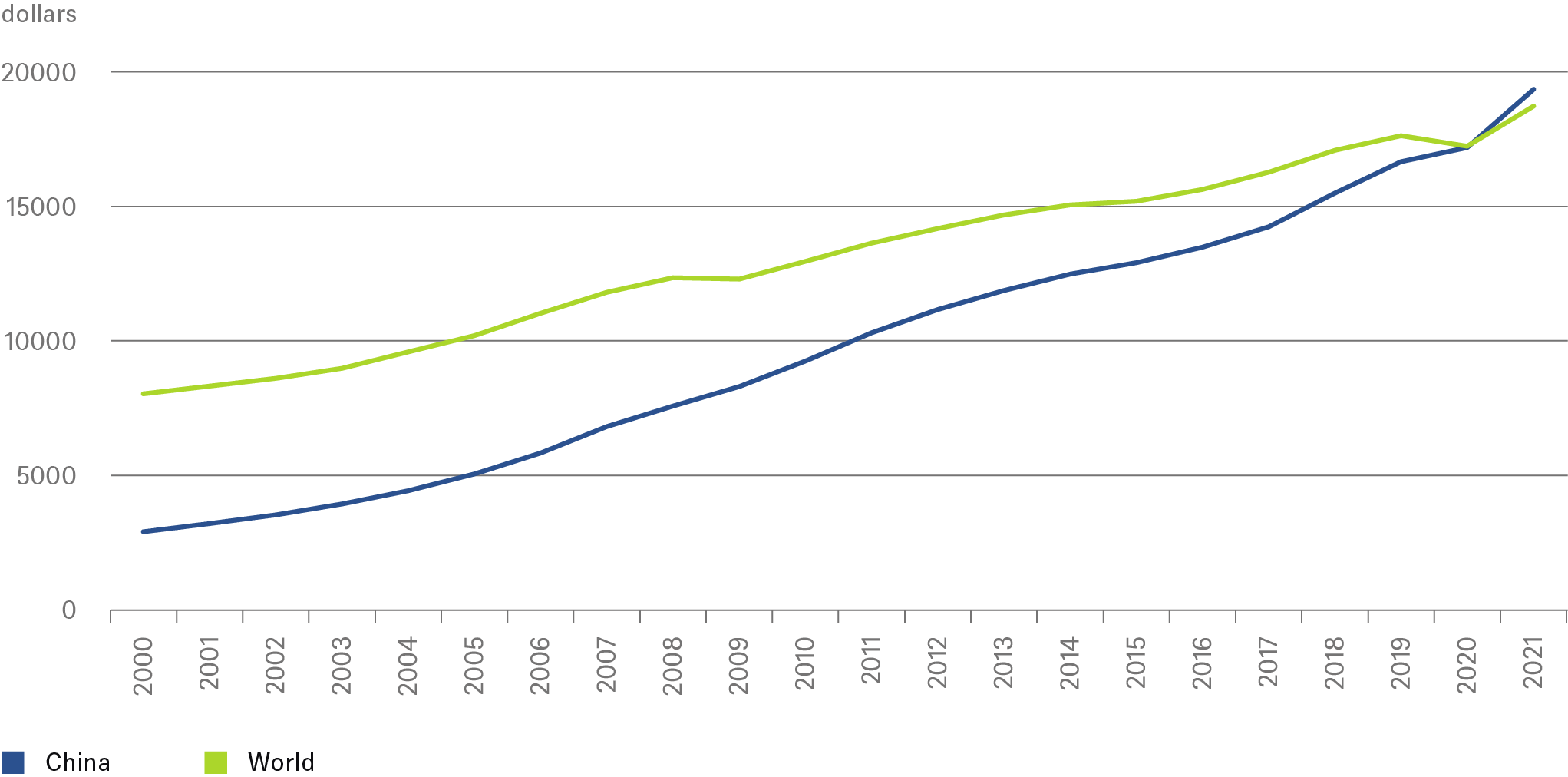

The policy report by President Xi will likely stress major achievements, such as the fact that China’s economy is on course to surpass the U.S. as the world’s biggest in roughly a decade. Domestically, he has already declared victory over extreme poverty, defined as those who earn less than 11 Yuan (about US$ 1.50) per day. Progress in welfare can also be shown by the fact that Chinese GDP per capita overtook the global average level in 2021.

Chinese GDP per capita surpassed global average in 2021

Sources: Refinitiv Datastream, Word Bank, DWS Investment GmbH as of 10/22

While increasing income was the main policy target until recently, as long as two years ago the focus shifted towards ‘common prosperity’: better distribution of wealth and correcting imbalances in the social system. Common prosperity is likely to be kept as a major long-term goal. The details released in the aftermath of the congress will be closely watched because this goal has been the trigger for a wide range of important regulatory measures, from reducing the influence and misuse of power by internet companies, to improving data security and labor conditions, and making education more affordable, among other things. While the current messaging is hinting that the boldest steps have already been taken, there could be more developments in the next round of measures.

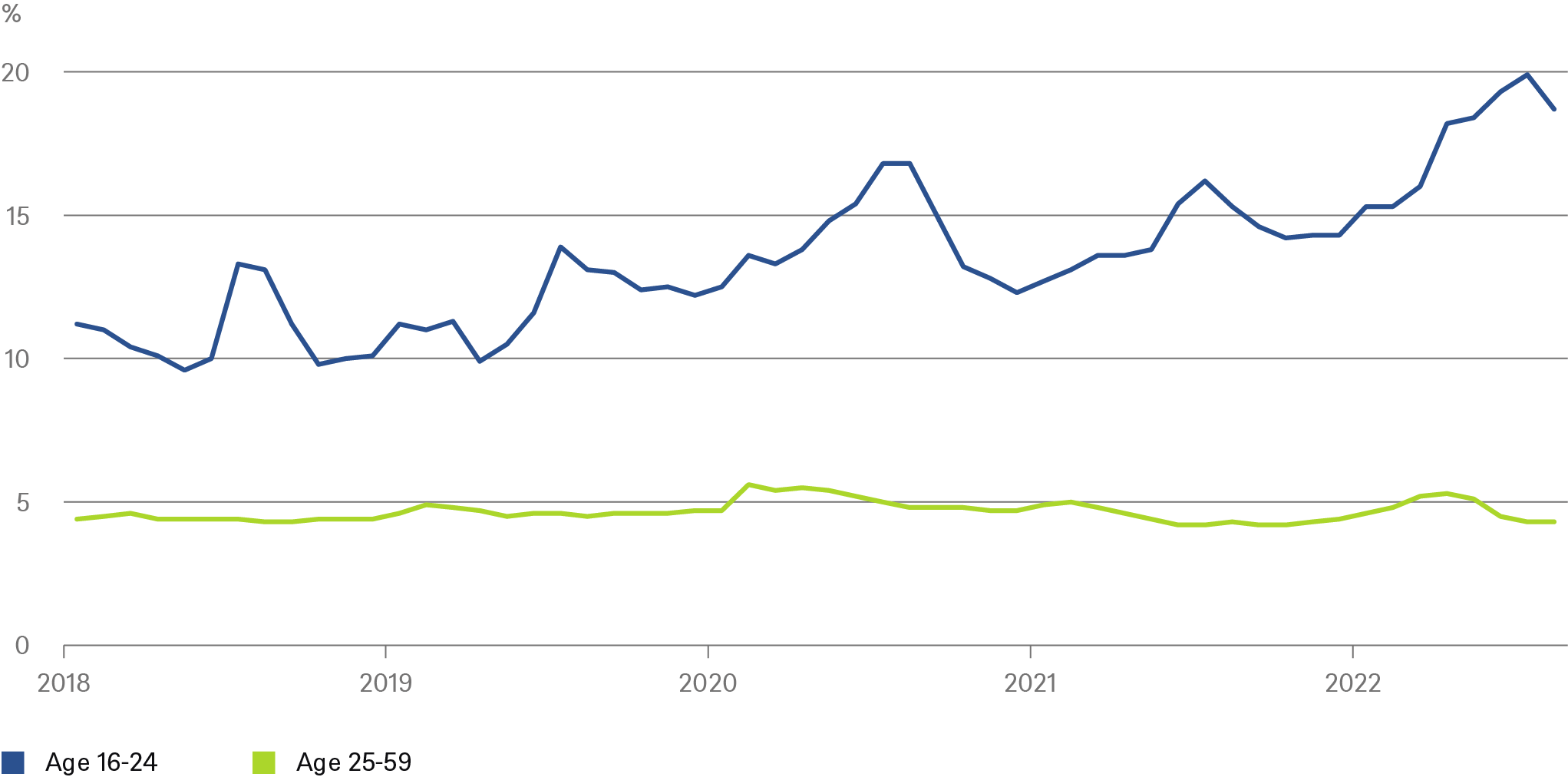

Meanwhile the challenges to the Chinese economy have become unprecedented and are broad-based. Regaining stable GDP growth is a major task. The deliberate decision to ‘downsize’ what was the (overblown) biggest sector, real estate, makes it necessary to find and push ahead with other sources of growth. Private consumption is currently hampered by Covid restrictions on service sector activities; however, high and sticky unemployment is adding to the problem. Youth unemployment tends to rise in summer when millions of students graduate, but currently the level is worrisome. There is a structural element to this unemployment as the large tech companies plan job cuts, because they have new business models or for other structural reasons.

Unemployment of urban work force in the corresponding age segment

Sources: China National Bureau of Statistics, Haver Analytics, DWS Investment GmbH as of 10/22

Finally, geopolitical issues are a major challenge for China and any clues on further developments and policy intentions in upcoming communications is of high interest. U.S.-China relations have deteriorated significantly in recent years, and the relationship is likely to become still more complicated. The stepping up this month of U.S. measures to restrict exports of computer chips and components to China in order to hamper China’s chip industry does not bode well for near-term improvement. Tensions between them might well deteriorate further, fueling the military build-up on both sides. Yet, at the same time, China remains an extremely important trade partner for most Emerging Market and many developed countries. Hopes that, after the major political questions in China are settled, there will be room for improving foreign relations, are likely to prove overly optimistic.