- Home »

- Insights »

- CIO View »

- Chart of the Week »

- Financing solutions to drive Europe’s transformation

It is an increasingly familiar dilemma. Europe’s transformation towards a cleaner future requires significant capital deployment, but with debt levels limiting what governments can do and banks hampered by tighter financial conditions. Fortunately, sustainability-linked bonds could be just what the doctor ordered to help address Europe’s key challenges such as adverse demographics, industrial competitiveness and the climate transition.

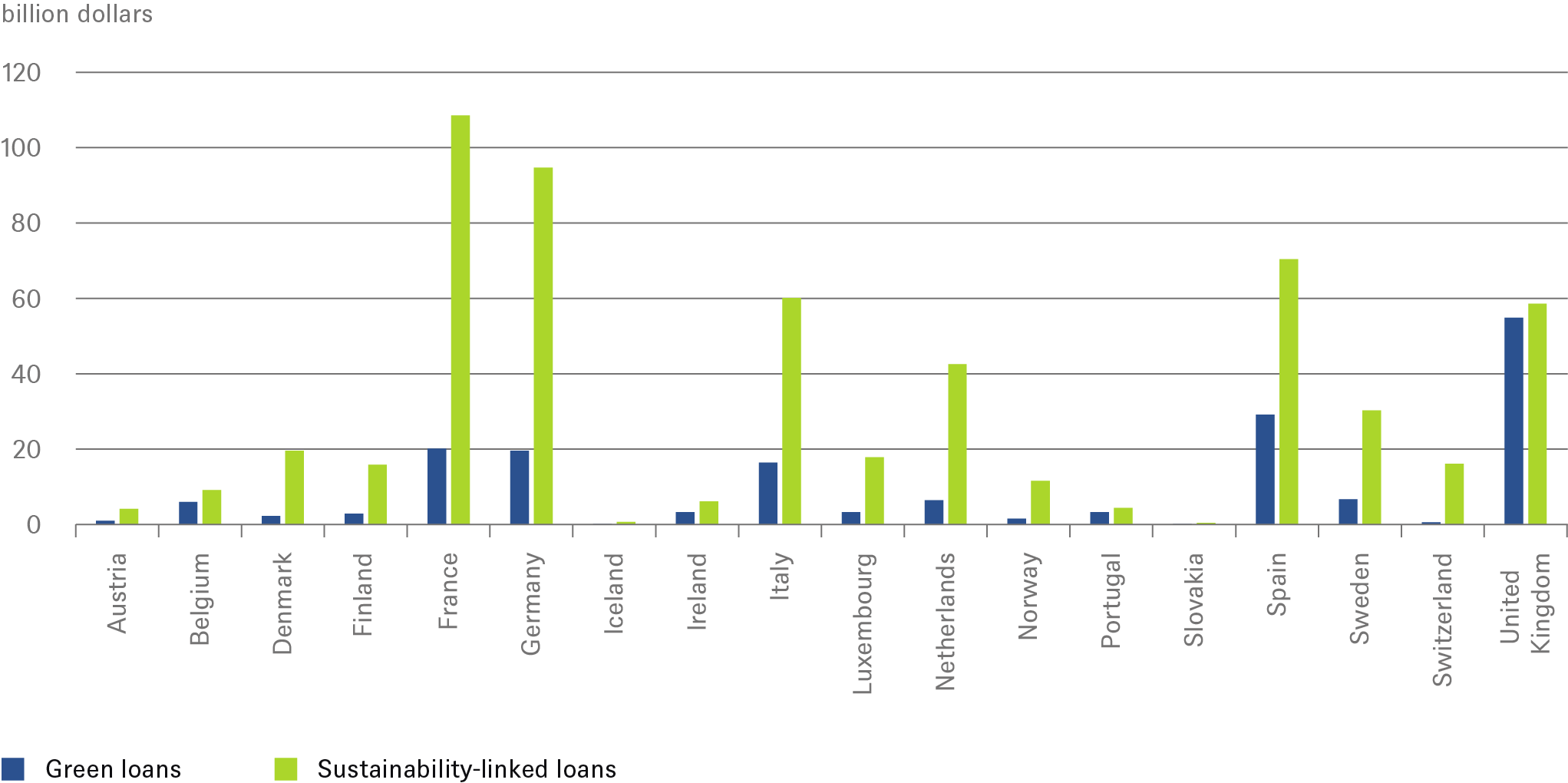

Our Chart of the Week shows the size of both green and sustainability-linked lending markets across Europe. The later refers to bonds and loans where a portion of the interest rate is linked to the borrower achieving specific environmental, social, or governance (ESG) targets set out in the loan agreement[1]. We see a bright future ahead as small and medium-sized enterprises (SMEs) turn their financing sources away from traditional bank lenders and find liquidity from private capital via the direct lending market and sustainability-linked bonds. Financing SMEs is essential since they form the backbone of Europe’s economy accounting for more than half of Europe’s GDP and employing around 100 million people[2].

Outstanding green and sustainability-linked loans in European countries (US$ bn)

Sources: The Institute of International Finance (IIF) (January 2023), DWS Investment GmbH as of 4/19/23

Such lending can then help accelerate growth and transformation processes across the manufacturing, transportation, healthcare and education sectors as well as improve the competitiveness of SMEs of all sizes and across all sectors and geographies. Take European healthcare systems, which increasingly need to deliver more and better care with fewer resources. Healthcare and life sciences have been one of the dominant users of private debt in Europe, accounting for 18% of total deals in 2022[3]. These sectors are also starting to show how being at the vanguard of sustainability-linked financing could help provide the investments and system adjustments needed to cope with aging populations, the rise in chronic diseases, the shortage of healthcare workers as well as the constraints on public finance.

SMEs are vital in this regard since they constitute 95% of Europe’s 34,000 med tech companies[4] and have developed nearly 20% of all human medicines recommended for authorization in 2020, half of which target a rare disease[5]. Unlocking the channels of sustainable finance for this sector will become increasingly valuable not just to address Europe’s demographic challenge but also to bolster the health and productivity of Europe’s citizens. This Earth Day seems like a good reminder that solutions developed to protect the environment can have plenty of other benefits too.