- Home »

- Insights »

- CIO View »

- Investment Traffic Lights »

- Investment Traffic Lights

- Even without Putin's war financial markets would have had much to digest this year. The risk scenario now features the threat of recession and corporate profit declines.

- The war leaves many possible scenarios open. We assume that NATO will not become directly involved and that Russian gas will continue to flow to Europe.

- In our core scenario we expect further rising interest rates on a 12-month horizon, leaving some potential for gains in equities and select corporate bonds.

to read

1 / Market overview

Will central banks achieve a soft landing, confront stubbornly high inflation too late, or strangle the economy? Until mid-February these were the big questions investors were asking. Above-average growth this year in industrialized countries was expected, and an almost double digit rise in corporate profits. But with Vladimir Putin sending troops into Ukraine what investors had been worrying about suddenly looked trivial. And it is indeed trivial compared to the immeasurable suffering Putin is inflicting on the Ukrainian population, as well as on his own conscripts. Putin’s aggression has immersed everyone in profound concern and pervasive uncertainty.

Putin’s goal remains unclear. He spoke of the necessary demilitarization and denazification of Ukraine, claims which sounded absurd, not least given the Jewish background of Volodymyr Zelensky, Ukraine’s head of state. But it sounds as if he was not only concerned about Crimea and the Donbass, but the entire country. Although Ukraine's interest in joining NATO and the EU may have been Putin's greatest annoyance, earlier texts and his "invasion" speech[1], in which he denied Ukraine its right to be a country, suggest that he seems to be more concerned with something like a historical mission[2]: the restoration of large parts of the Soviet Union and the reunification of the Russian Orthodox Church[3].

The possibility that Putin may be aiming at the assimilation of Ukraine makes it difficult to define a worst-case scenario for the markets. In the past three weeks many certainties have been overturned. Disruption to Europe's energy supply from Russia is suddenly no longer a tail risk. Add Putin's on-the-record geopolitical ideas, his brutal actions in Grozny and Aleppo, and the fact that he governs in a bubble with similarly minded military and intelligence officials, and the picture does not look promising. It is also difficult to imagine how Putin can make a U-turn and save face. A large part of the sanctions and the withdrawal of many Western companies would probably continue for the time being even in the event of a cease-fire, while the Russian leader would remain persona non grata in the West. Perhaps only his entourage, even if they are hand-picked followers, can persuade him to compromise. Their optimism is likely to have been dented by the modest military success[4] achieved to date and by the imposing weight of Western sanctions. If at some point the Chinese leadership concludes that closing ranks with Moscow would entail too high of an opportunity cost, a palace revolt in the Kremlin might not be far away. Alternatively, Putin might be trusted by his close circle and allowed to do almost anything, with dire consequences also for capital markets. But razing Kiev, the "cradle of Russia," including the imposing Orthodox church buildings, would be difficult to reconcile with Putin’s narrative as the protector of Greater Russia. One could also speculate about a partition of Ukraine or the installation of a puppet government but, in the final analysis, such speculation would merely show how difficult it is at present to develop a realistic scenario for an end to the war.

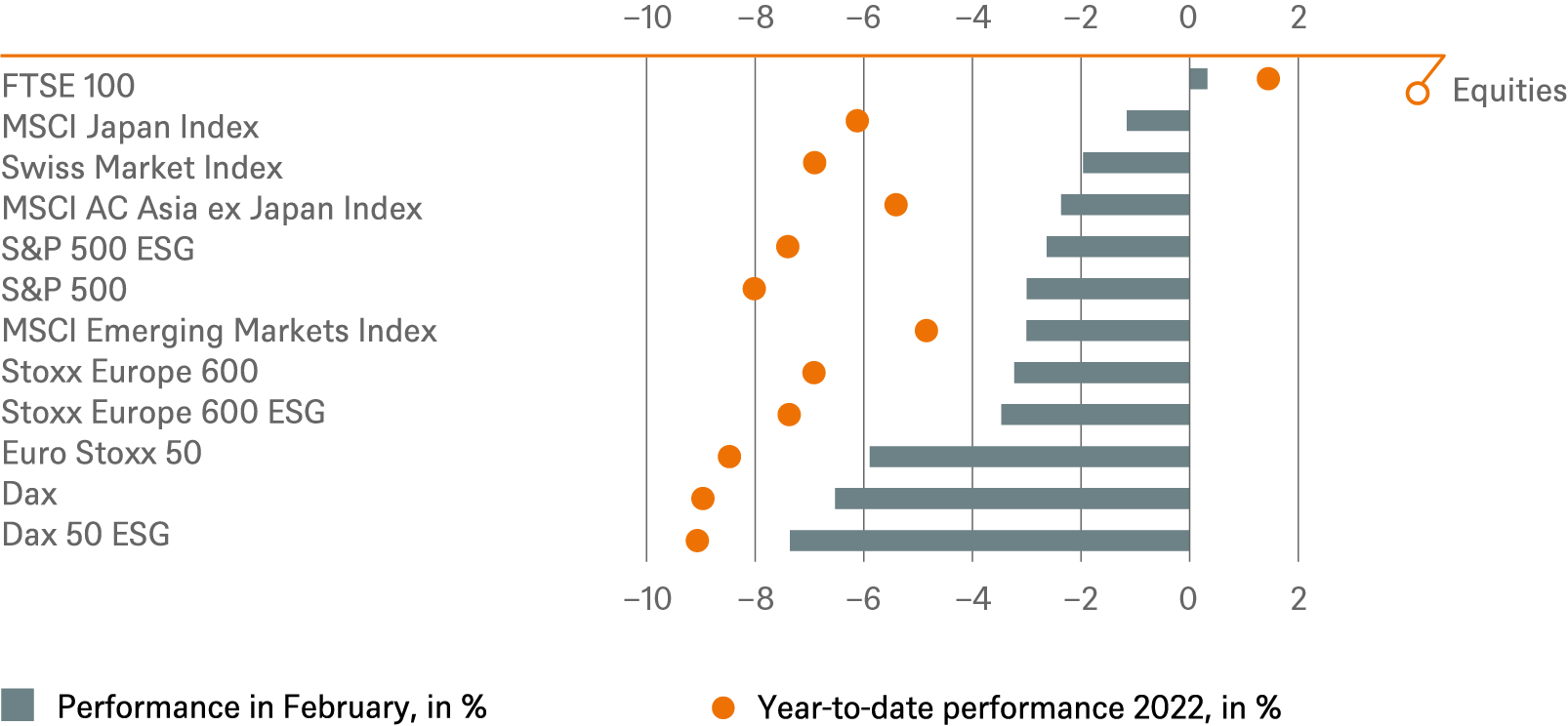

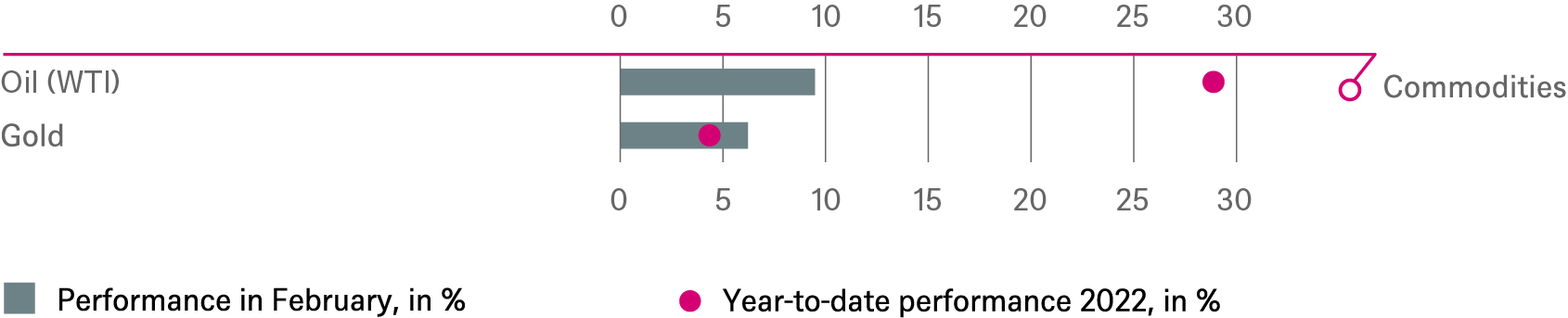

The huge uncertainty has been reflected in high volatility on the capital markets since the war began. There have been some extreme daily price fluctuations, particularly in commodities whose supply has been cast into doubt. In addition to concerns about supply bottlenecks, Western sanctions on Russia[5] in particular have already had a strong impact. The ruble is now hardly traded and has lost at least 50% of its value and the Russian stock market is still closed; Russian bonds have collapsed. In the roughly three weeks since Putin's televised speech[6], the Dax, Euro Stoxx 50 and emerging markets (MSCI EM) have lost between 8 and 10% of their value, and the S&P500 2%. Among sectors, energy and healthcare have risen slightly, and so have utilities (though with strong regional divergences). Consumer and financial stocks have done badly, losing almost 10%. Gold lived up to its reputation as a crisis currency with a gain of 10%, while cryptocurrencies lost ground. Coal and nickel more than doubled in price, crude oil rose by 40% and European natural gas by 70%. Wheat, too, has increased in price by over 50% in these almost three weeks.[7]

Inflation has therefore been given fresh impetus by the crisis – and this additional inflationary pressure comes when the U.S. already recorded a 40-year high inflation rate of 7.9% in February. Higher inflation expectations are also evident in the bond markets and the further flattening of the U.S. yield curve (between the 2- and 10-year yield spreads) provides further grounds to be wary for skepticism, as inversion of this curve has been anticipated with every U.S. recession in the past 70 years. In this time of massive uncertainty, however, one thing is certainly clear: the capital markets’ reassessment of the state of the world is far from complete, because the conflict and political situation remains so unclear.

2 / Outlook and changes

Having to integrate an uncertain future into one's investment decisions is part of the daily routine for capital investors – and it makes no sense to moan. But the level of uncertainty now is quite exceptional. Record high inflation on both sides of the Atlantic, the beginning of rate hike cycles in the U.S. and Europe (the ECB’s first hike since the end of 2005[8]) and numerous supply chain bottlenecks are now being exacerbated by a war that has the potential to spill over into EU member states and whose further course depends largely on one unpredictable individual, Vladimir Putin. A surprise ceasefire is also a possibility and perhaps just as likely as a grueling war of attrition or further escalation. Investors therefore also face the risk of missing a recovery rally. But a further correction in the markets is very possible, especially if the economic environment deteriorates so quickly that declining corporate profits are to be expected. Regardless of the further course of the conflict, rising costs are likely to weigh on profit margins in many companies this year.

Against this background, we are aware that our current 12-month forecasts will be subject to a higher-than-normal risk of needing to be revised in the coming weeks. In addition to Putin's aggression, the central banks' dilemma, faced with soaring inflation and great risks to economic growth, will also be a key factor this year. In our core scenario, we assume that the conflict will not spread to NATO and that Europe's oil and gas supplies will not be adversely affected in the long term.

2.1 Fixed income

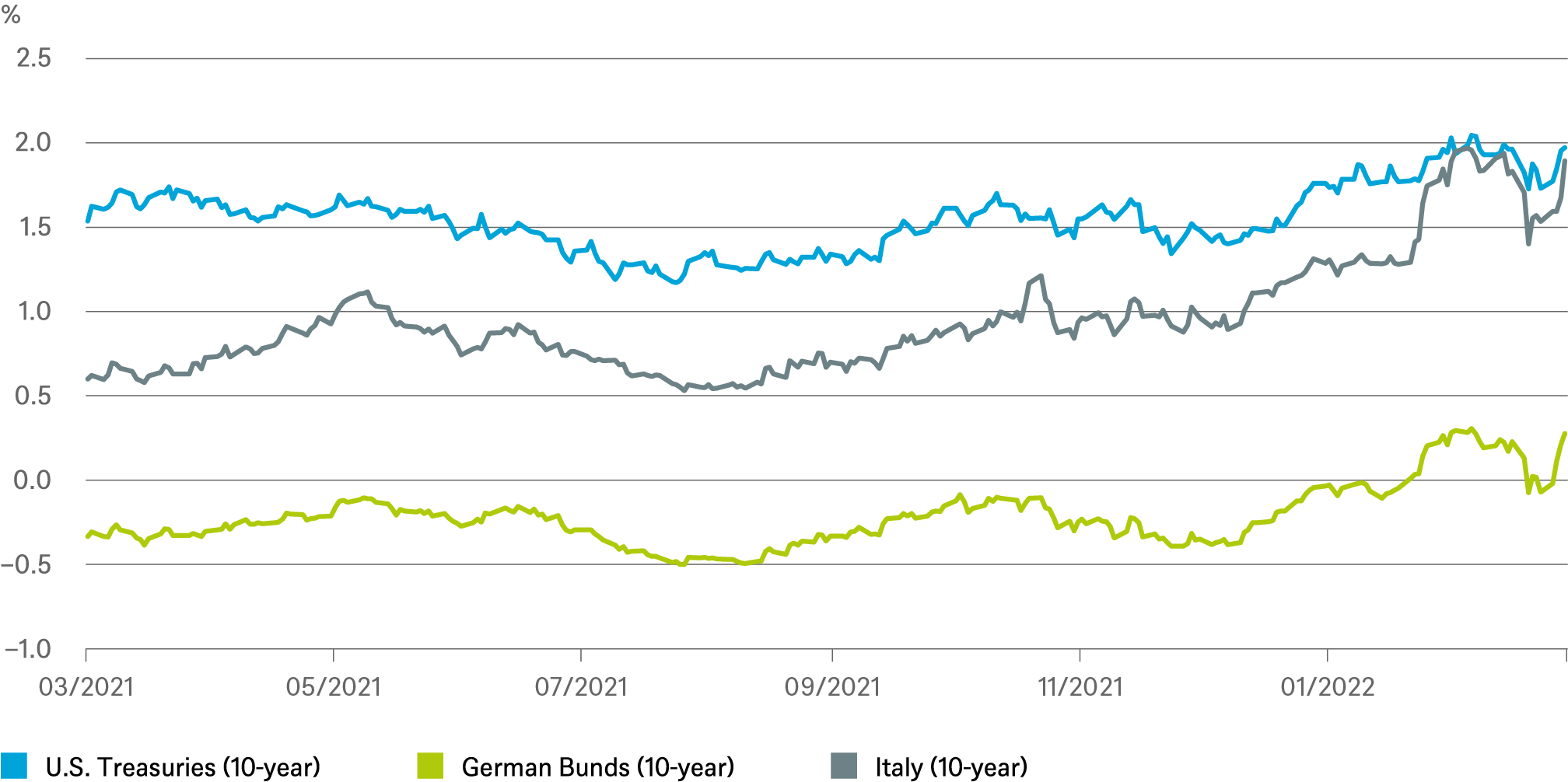

Inflation scare bigger than war scare for sovereign yields

Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 3/10/22

In the short term, we believe government bond yields are likely to remain caught between economic risks, rising inflationary pressure, a massive increase in government debt and monetary policy that remains expansive overall, even as the tightening cycle is about to begin. On a twelve-month horizon, we continue to expect a moderate increase in nominal yields on top of what has already been quite an impressive move: since the end of December the stock of negative-yielding bonds worldwide has shrunk from USD 14 trillion to USD 4 trillion.[9] For our forecasts the outlook for real yields has darkened somewhat since the beginning of the year, while the inflation component of yields has risen. Contributing factors in Europe, especially Germany, include the prospect of new fiscal packages. Our forecasts for corporate bond spreads have been revised upward in light of recent developments, but we see potential for spreads to tighten again over the next 12 months. In our opinion, yields on investment-grade European corporate bonds, for example, are already pricing in a recession. From a risk-return perspective, we see Asian corporate bonds as the most attractive, preferably outside China, which could be drawn into the Russian war even more than it would like. We see the U.S. dollar settling at around 1.15 per euro within twelve months. The Japanese yen, in turn, could live up to its reputation as a safe haven in these uncertain times.

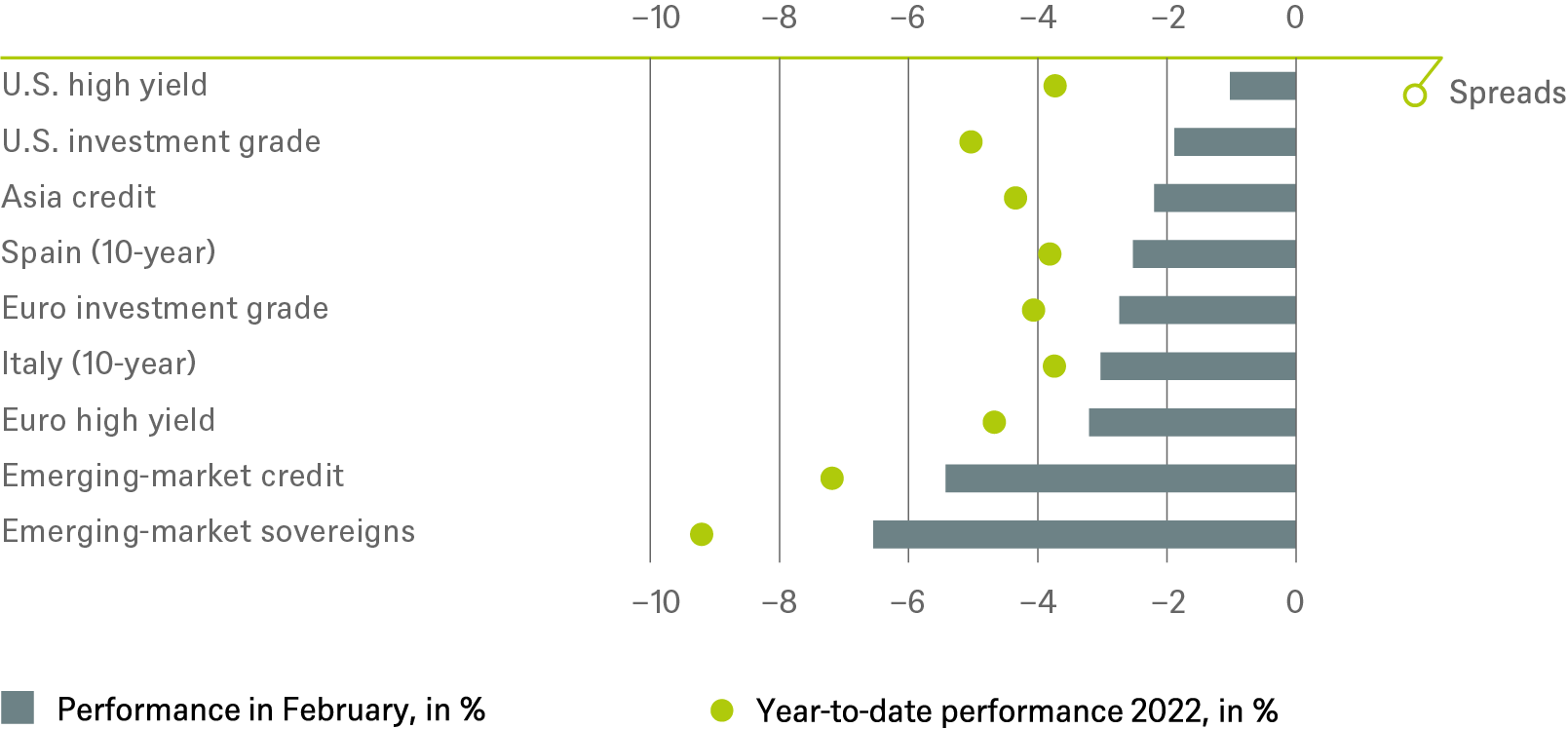

Euro HY takes the biggest hit from Putin. US corporates more worried about rate hikes

Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 3/10/22

2.2 Equities

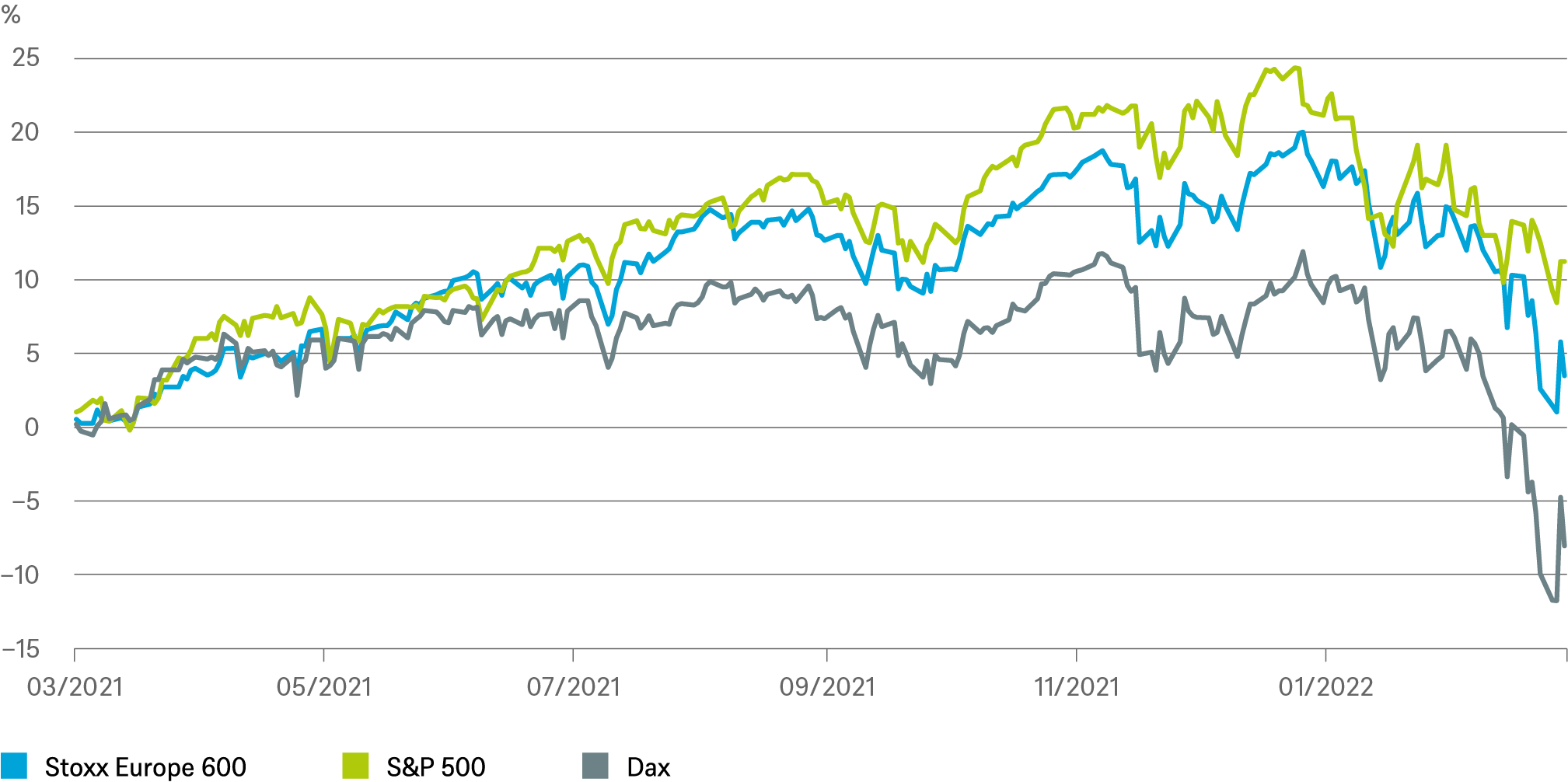

In the short term we continue to see good reasons for caution in equities. But we believe the markets should find a bottom in the next few months and then rise again, supported by persistently negative real yields and economic recovery. Dividends, which tend to offer comparatively inflation-proof current income, could also prove attractive in an environment of higher inflation, especially given the medium-term inflation uncertainty and the lack of viable alternatives. However, we expect volatility to remain high in the coming months. The volatility of the Dax and the Euro Stoxx 50 rose in March to the highest level since March 2020.

We have no regional preferences for the coming twelve months. It is true that U.S. equities face being weighed down more heavily by rising interest rates and have record valuation premiums compared with the other regions. But the other regions also face challenges. For example, we expect emerging markets to regain ground but when any recovery might gain momentum depends heavily on China, where we do not yet see the bottom as having been reached. We believe European equities, on the other hand, are likely to suffer from a risk discount due to the Ukraine crisis for a while longer. We are maintaining our mix of growth and value stocks, not least to guard against a deeper than expected slowdown in economic growth. However, even the major technology stocks are not likely to remain unassailable. On the one hand, they are being hit by rising interest rates in the U.S., which could push real yields closer to the zero line. On the other hand, the renewed disruption to supply chains caused by the war could, in our opinion, lead companies in the short to medium term to give higher priority to safeguarding their operations than to digitization. We continue to favor the healthcare sector as we believe it combines affordable growth opportunities with good defensive qualities. We also like companies in the “agribusiness value-chain” as they might help provide portfolios with potential inflation protection, as sellers of scarce fertilizers and grains should benefit from renewed pricing power. In other sectors too we prefer companies with high pricing power.

German stocks get double whammy: cyclicality and proximity to war

Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 3/10/22

2.3 Alternatives

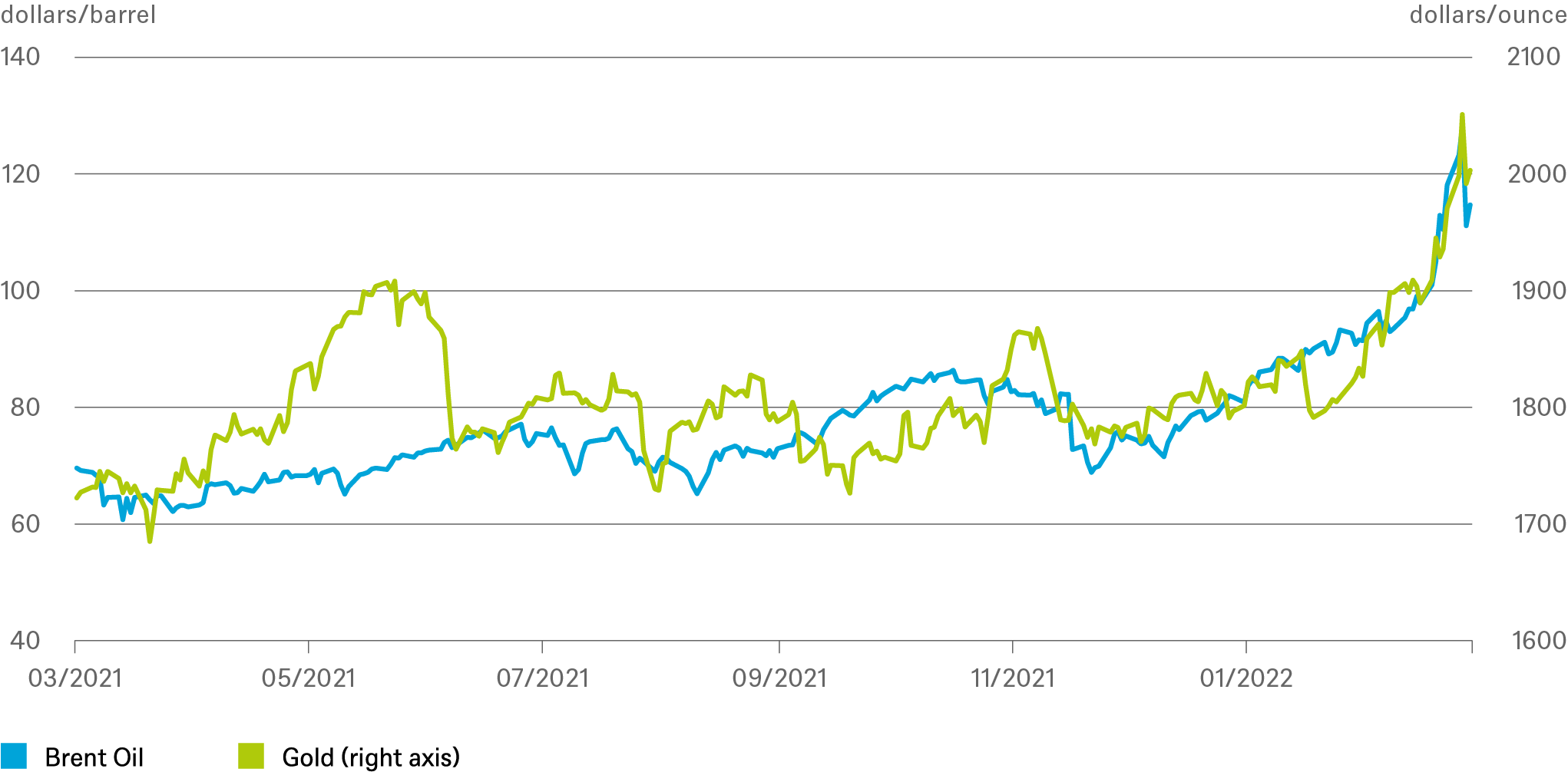

For energy, commodities and gold prices, we believe the elevated risk premiums that have followed Russia's invasion are likely to persist, at least in part, for the forecast period. Some of the extreme price spikes immediately after the start of the war, or after the beginning of Western sanctions, have receded, as they partly reflected short-term logistical difficulties, especially in oil, or uncertainty about the export of Russian commodities, such as gas, in general. Nevertheless, most commodities are trading well above their levels at the beginning of the year. Agricultural commodities as well as metals and oil have increased in price by around two-thirds[10] compared to the average in the three years prior to the pandemic.

In the case of oil we believe that the current prices should slowly lead to initial reactions on the demand side. A little more clarity could be provided by the start of U.S. travel at Spring Break. On the supply side we do expect OPEC production to expand; in particular, a U.S. agreement with Iran should bring additional volumes back to the global market. Otherwise, we believe the price of oil in twelve months' time is likely to depend on the further course of the war and to a great degree on how much of the oil that Europe and the U.S. won’t take anymore can be diverted to China and other countries not involved in the sanctions. After all, Russia contributed around 7.8 million barrels per day in 2020, around one-eighth of global production. For the time being we expect the price to settle below $100 per barrel on a 12-month horizon. Increased geopolitical risk premiums should also continue to provide a tailwind for gold, as should rising inflation expectations.[1]

So far the best hedge in the correction: Gold and Oil

Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 3/10/22

Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 3/10/22

2.4 ESG developments

The crisis should serve as an additional wake-up call for investors on ESG risks. Russian assets have long traded at discounts, reflecting both environmental and governance concerns. However, their collapse in recent weeks highlights how severe the impact of such risks can be when they are indeed fully priced in.

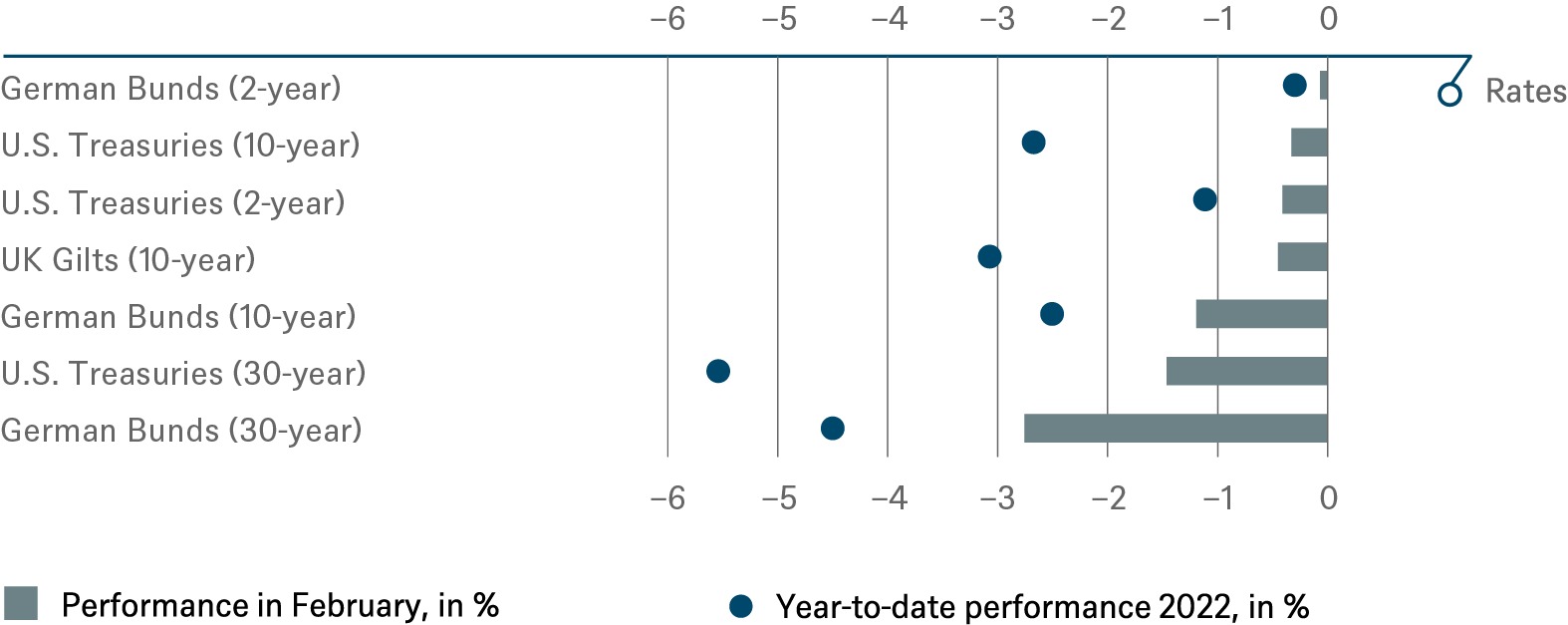

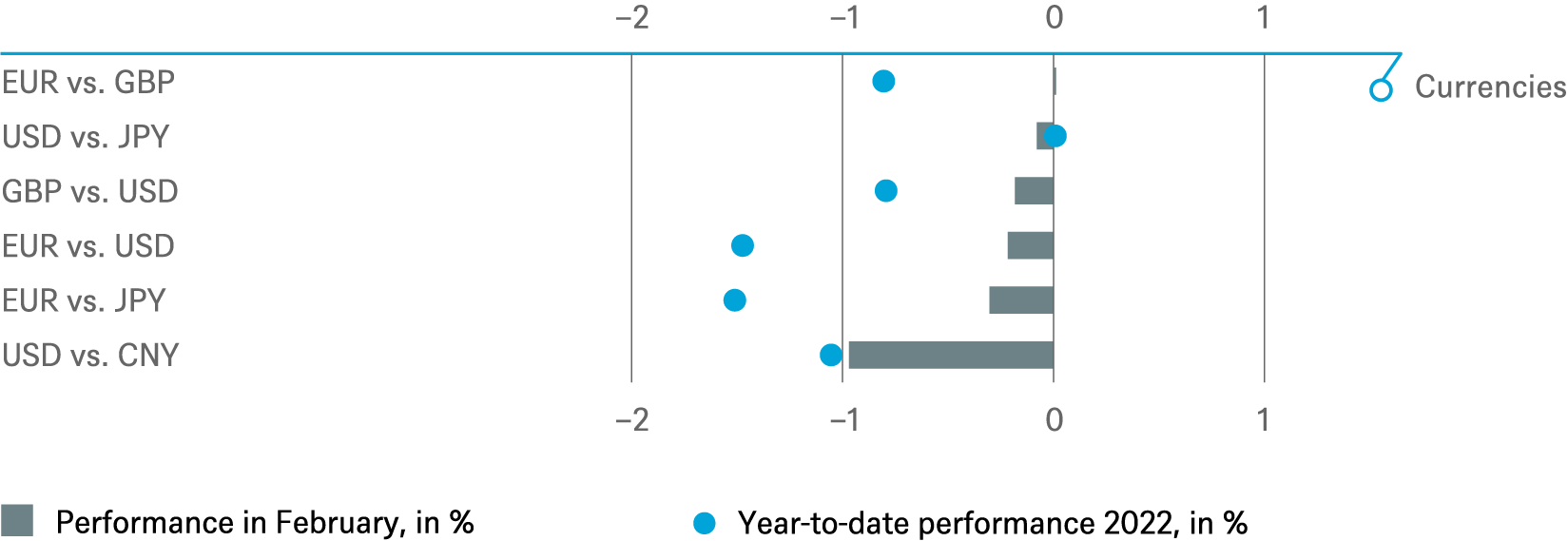

3 / Past performance of major financial assets

Total return of major financial assets year-to-date and past month

Past performance is not indicative of future returns.

Sources: Bloomberg Finance L.P. and DWS Investment GmbH as of 2/28/22

4 / Tactical and strategic signals

The following exhibit depicts our short-term and long-term positioning.

4.1 Fixed Income |

||

|---|---|---|

Rates |

1 to 3 months |

until Mar 2023 |

| U.S. Treasuries (2-year) | ||

| U.S. Treasuries (10-year) | ||

| U.S. Treasuries (30-year) | ||

| German Bunds (2-year) | ||

| German Bunds (10-year) | ||

| German Bunds (30-year) | ||

| UK Gilts (10-year) | ||

| Japan (2-year) | ||

| Japan (10-year) |

Spreads |

1 to 3 months |

until Mar 2023 |

|---|---|---|

| Spain (10-year)[11] | ||

| Italy (10-year)[11] | ||

| U.S. investment grade | ||

| U.S. high yield | ||

| Euro investment grade[11] | ||

| Euro high yield[11] | ||

| Asia credit | ||

| Emerging-market credit | ||

| Emerging-market sovereigns |

Securitized / specialties |

1 to 3 months |

until Mar 2023 |

|---|---|---|

| Covered bonds[11] | ||

| U.S. municipal bonds | ||

| U.S. mortgage-backed securities |

Currencies |

||

|---|---|---|

| EUR vs. USD | ||

| USD vs. JPY | ||

| EUR vs. JPY | ||

| EUR vs. GBP | ||

| GBP vs. USD | ||

| USD vs. CNY |

4.2 Equities |

||

|---|---|---|

Regions |

1 to 3 months[12] |

until Mar 2023 |

| United States[13] | ||

| Europe[14] | ||

| Eurozone[15] | ||

| Germany[16] | ||

| Switzerland[17] | ||

| United Kingdom (UK)[18] | ||

| Emerging markets[19] | ||

| Asia ex Japan[20] | ||

| Japan[21] |

Style |

||

|---|---|---|

| U.S. small caps[33] | ||

| European small caps[34] |

4.4 Legend

Tactical view (1 to 3 months)

- The focus of our tactical view for fixed income is on trends in bond prices.

- Positive view

- Neutral view

- Negative view

Strategic view until March 2023

- The focus of our strategic view for sovereign bonds is on bond prices.

- For corporates, securitized/specialties and emerging-market bonds in U.S. dollars, the signals depict the option-adjusted spread over U.S. Treasuries. For bonds denominated in euros, the illustration depicts the spread in comparison with German Bunds. Both spread and sovereign-bond-yield trends influence the bond value. For investors seeking to profit only from spread trends, a hedge against changing interest rates may be a consideration.

- The colors illustrate the return opportunities for long-only investors.

- Positive return potential for long-only investors

- Limited return opportunity as well as downside risk

- Negative return potential for long-only investors