- Home »

- Insights »

- CIO View »

- Investment Traffic Lights »

- Investment Traffic Lights

- From an investor’s perspective, January was somewhat mixed; however, the positive sentiment from the end of 2023 continued, particularly for equities.

- Good U.S. data further boosted investor expectations of a soft landing, which is reflected in demanding valuations.

- While many bond segments continue to entice investors with high initial yields, many equity indices have already surpassed their year-end rally.

1 / Market overview

1.1 Markets just keep on partying

Anyone who thought at the end of 2023 that investors would pay for their year-end rally euphoria with a major hangover at the start of 2024 has quickly been proved wrong. Once again, the U.S. came up with better-than-expected figures: Annualized economic growth in the fourth quarter rose to 3.3%, the unemployment rate remained at 3.7%, and inflation remained largely in check. The latest purchasing managers' indices and consumer confidence (which climbed to a two-and-a-half-year high in January) further boosted hopes of a so-called soft landing: in other words, a further fall in inflation without bringing the economy to its knees. The central banks were also kind enough not to disrupt the party, at least to the extent that their various representatives gave different views on inflation and rates over the course of the month so that investors were able to pick out the comments that suited their views best. Things then became somewhat clearer after the European Central Bank (ECB) and the U.S. Federal Reserve (the Fed) meetings. Although Christine Lagarde was not euphoric about Europe's economic trends, she pointed out the positives: Economic growth in the Eurozone narrowly avoided slipping into contraction in the fourth quarter of 2023 and inflation eased. However, in view of the many wage rounds still to come, she considered discussions on interest rate cuts to be premature. A week later, on the final day of January, the Fed was more optimistic about interest rate cuts in the medium term, but upset some investors, at least for a while, by ruling out the early rate cut they had been praying for in March.

But the markets are still optimistic on rate cuts. They expect almost six, of 25 basis points each,[1] this year in the U.S. and the Eurozone, while we expect three, but would also not rule out four cuts anymore. Although there was initially a counter-reaction in bond yields after their drastic fall in the last two months of 2023 — 10-year U.S. Treasuries rose from 3.8% to almost 4.2% at their peak - they dipped well below the 4% mark again at the end of January, despite the Fed "disappointment". Equities, meanwhile, have just continued to rise. In the U.S. this was initially driven once again by the major technology stocks, while the small caps (Russell 2000) fell. Towards the end of the month, however, even good quarterly figures from technology stocks were not quite enough to meet the high expectations, with the result that the S&P 500 and the Nasdaq lost some of their gains and ended January with a rise of less than 2%. However, even a repeat of that advance will be anything but easy in the coming months, and we expect nervous sideways trading. The markets could also be increasingly influenced by the U.S. election campaign, even if we believe it is too early to make any reliable forecasts. In any case, only a clear victory for one of the two parties (i.e. control of the White House and Congress) is likely to lead to market-relevant political changes.

1.2 Asia’s markets are diverging; High Yield performs strongly

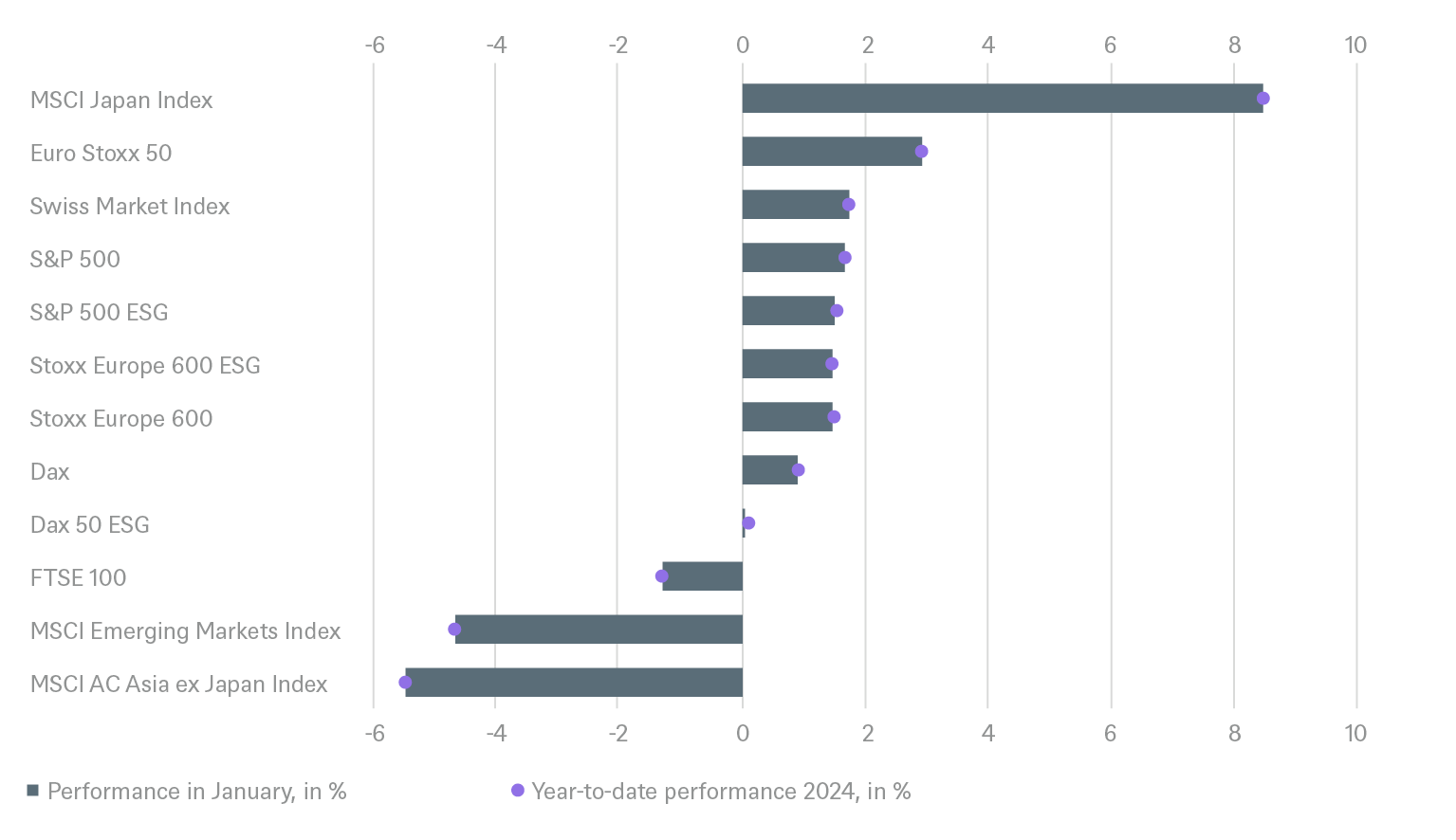

Even though it was the U.S. that came up with the better figures, Europe's stock markets won the January race with a gain of 3% compared to 1.7% for the S&P 500 (with all these numbers on a total return basis). In Asia the discrepancies were far more extreme: the MSCI Japan soared by a full 8.5%, while the MSCI China continued its three-year slump with a drop of around 10%. Further negative news, not only from the real estate sector, depressed sentiment, and Beijing's actionism (such as a ban on short selling; making it more difficult to acquire foreign funds; instructions to large state-owned companies to buy their own shares) gave the impression that a government is panic-stricken.

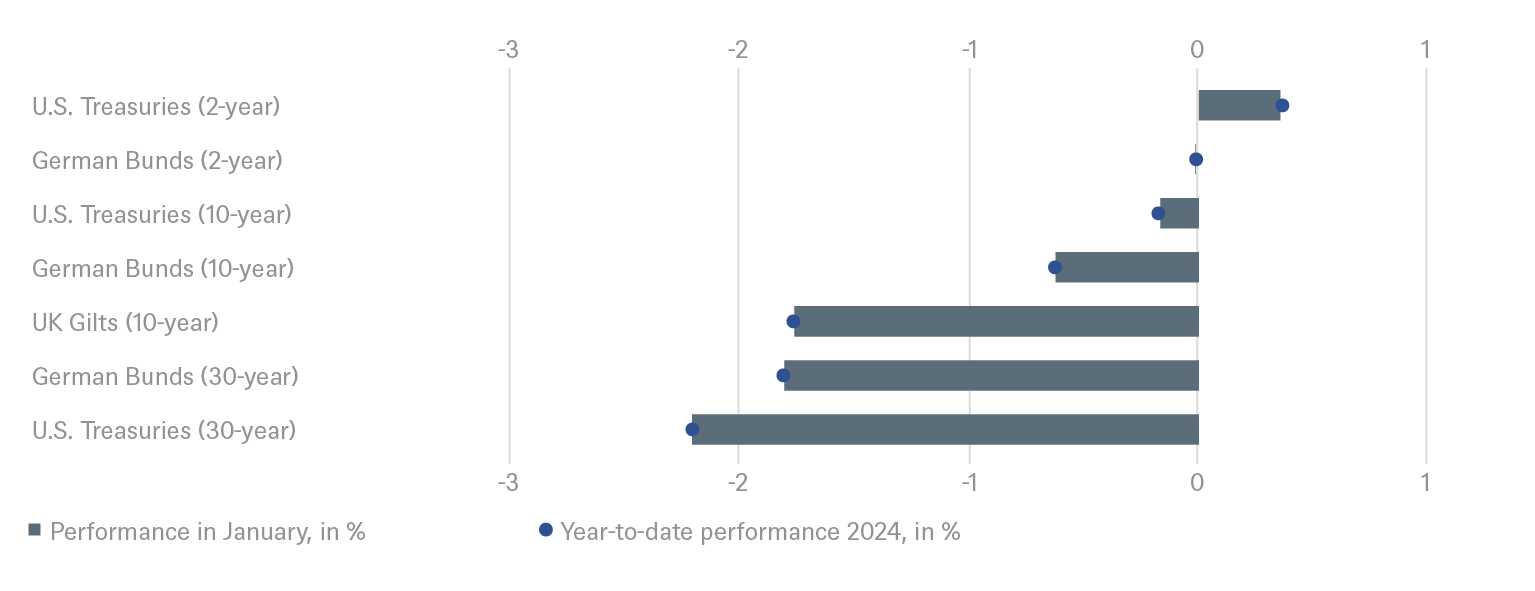

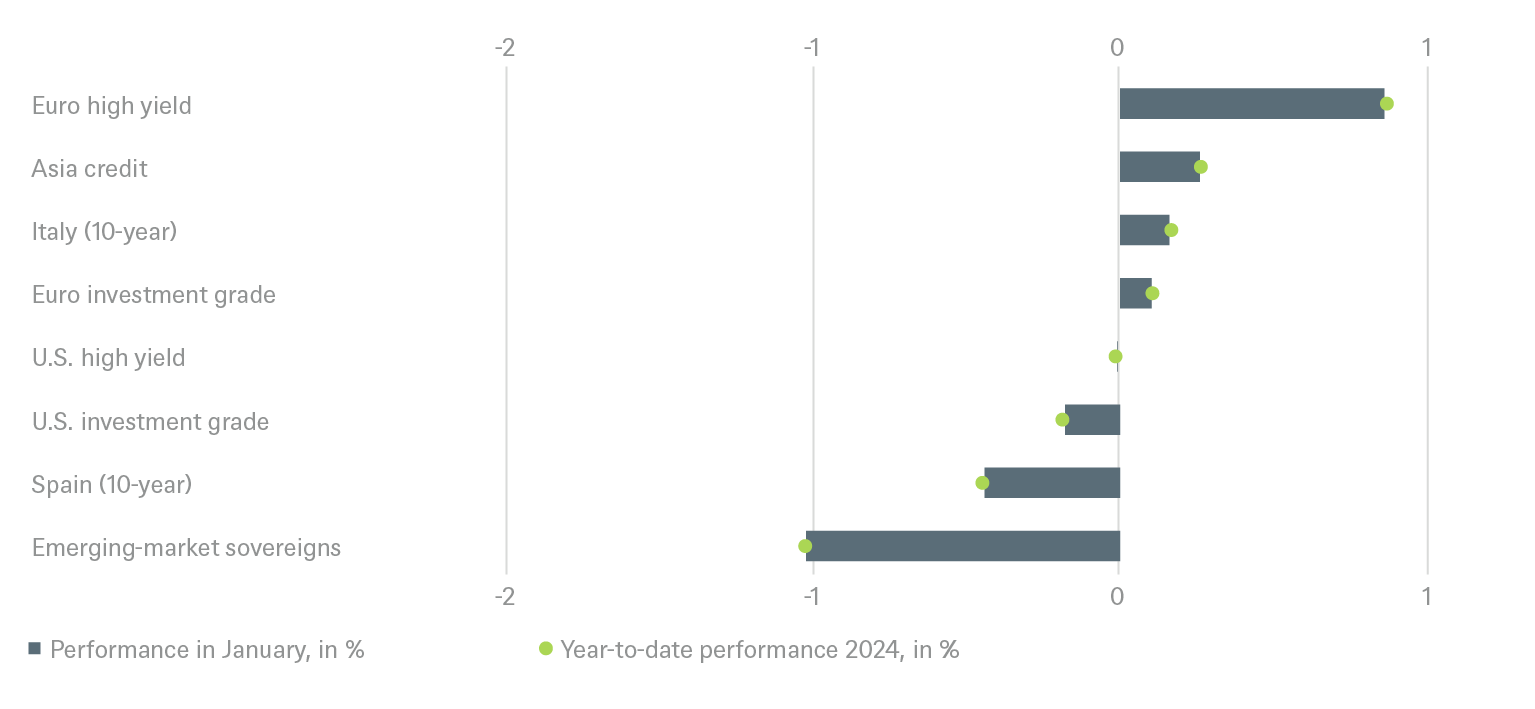

January was a mixed month for bond investors. Ten-year German government bonds lost 0.6% and British ten-year bonds 1.9%, while European high-yield bonds gained 0.5%, showing that investors' appetite for risk in this segment has hardly suffered. In the investment grade segment in both the U.S. and Europe, even returns of close to 0% spoke for confident investors, as both regions had to digest a record amount of bond issuance.

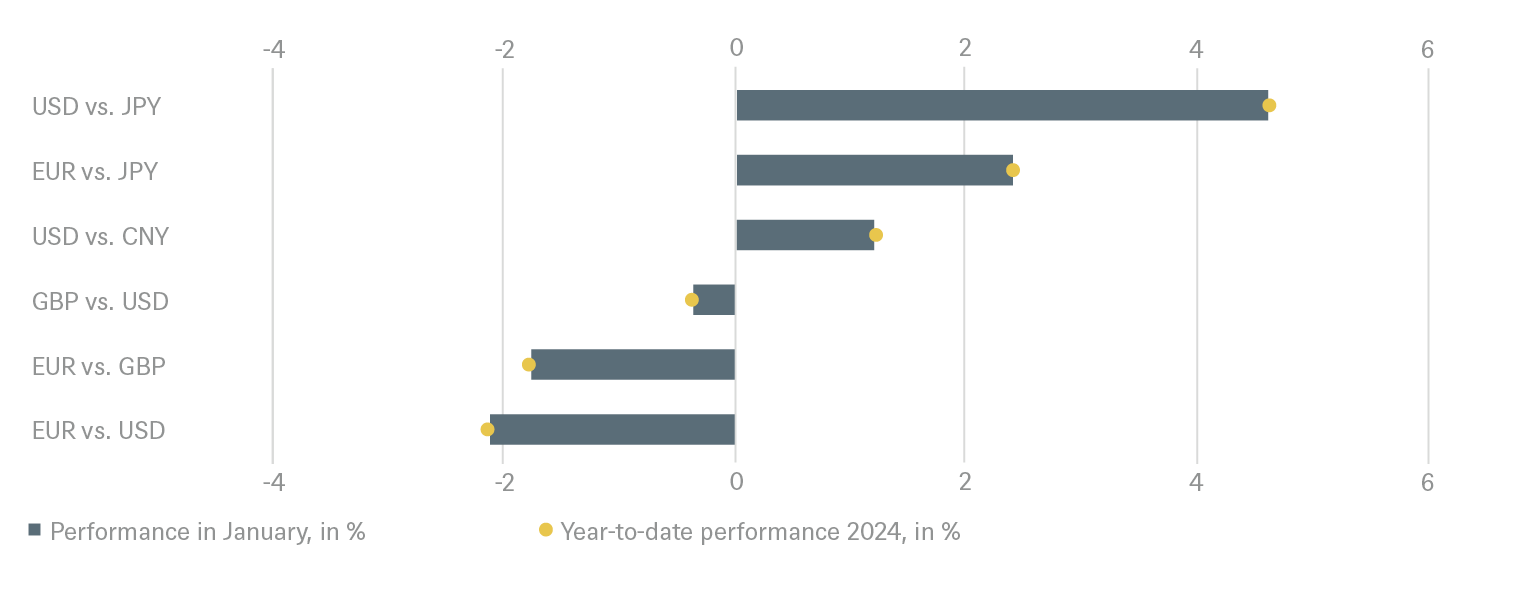

In currencies what stood out was a strong dollar and a weak yen: in combination this meant the yen depreciated against the dollar by almost 4%.

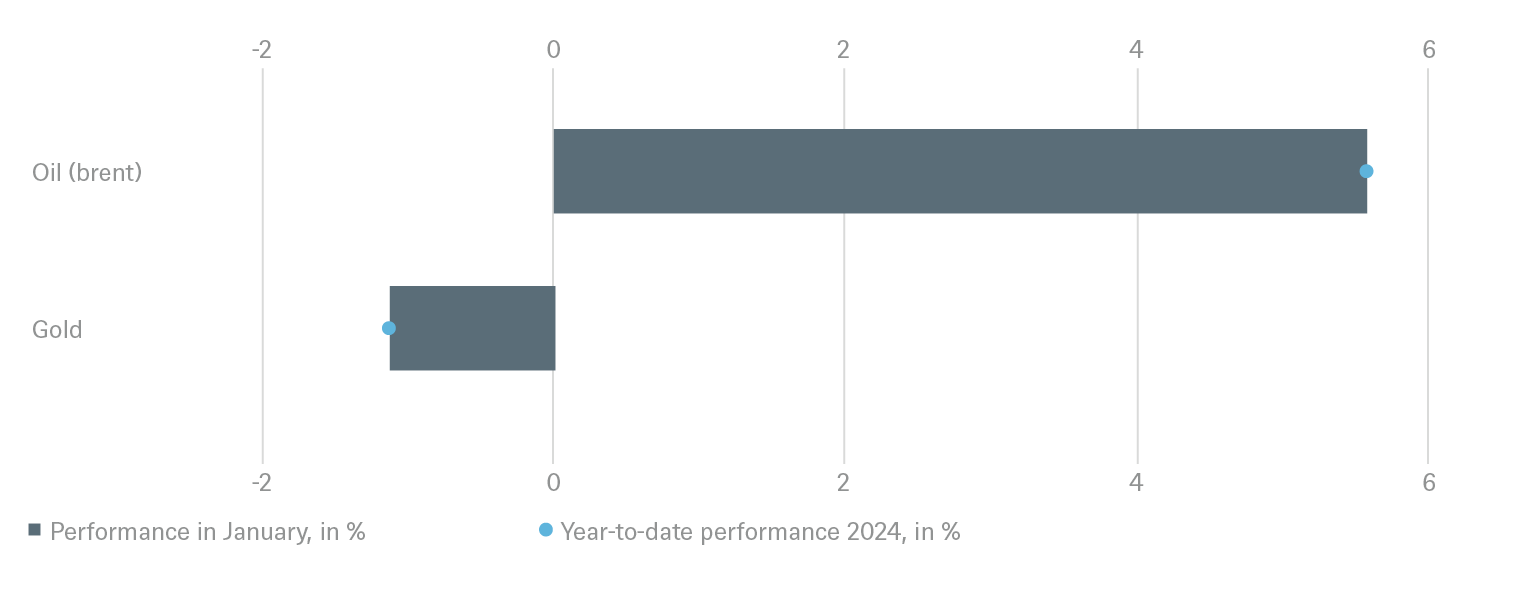

Another pair of assets were also interesting: gold and oil. The former was unable to hold its ground despite further major geopolitical tensions and lost around 1% in value, in line with slightly higher bond yields, while Brent crude rose by 6% in January. One likely reason is the tension in the Middle East, where attacks by Houthi rebels in the Red Sea caused further unrest. Freight rates for containers almost tripled between the beginning of December and January 25. Some economists already fear that this will have an impact on inflation, but we feel inflation will continue to ease slowly.

2 / Outlook and changes

It is hard not to be amazed by the sheer optimism with which markets are driving up asset prices. It is, however, easy to understand what this optimism is based on: the apparent resilience of the U.S. economy, once again. Like an unruly pupil who has now calmed down, inflation now seems to be behaving itself, so that the Fed can start thinking about easing its strict monetary policy. And the damage done by that policy to growth is apparently small: the worst the U.S. economy seems to face is a soft patch in the second quarter, not a deeper fall. Therefore, there is little threat to the expected profit growth of listed companies or the riskier part of the corporate bond market. And even those still fearing a weak 2024 might be tempted to look through this period and invest based on the expected 2025 earnings growth.

We, however, retain a dose of skepticism. Achieving a soft landing while avoiding a renewed flare up in inflation might be possible but it is from the only likely scenario. Given the various risks, not least the geopolitical ones, we prefer now not to increase our target levels for equities and interest yields, meaning that our expected return potential has dropped to the low single digit percentage points.

2.1 Fixed Income

Government bond yields dropped rapidly in the final two months of 2023 but have rallied somewhat in January, just to drop again by the end of the month as a reaction of the post-meeting comments from Lagarde and Powell. We do not believe that one rate cut more or less, one month earlier or later, will make a big difference to the U.S.’s economic trajectory, but for markets these are strong short-term drivers. And short-term drivers are likely to be the main theme of 2024 as the central banks are not bluffing when they say they are data dependent.

Government Bonds

U.S. Treasuries: Despite opposing views within the FOMC and markets that are constantly repricing their 1H24 rate cut expectations, the widespread expectation is that Fed hikes are done and front-end yields are heading lower. We are still positive on 2-year Treasuries and neutral on 10-year & 30-year Treasuries.

German Bunds: There are conflicting views within the ECB board as well, but we still do not expect rate cuts before June 2024, not least because we expect the ECB will want more visibility on wage developments in the Eurozone, with many sectors currently negotiating new wage settlements. We are back to neutral on 2-year & 10-year Bunds and remain neutral on 30-year Bunds.

Corporate bonds

Europe: We remain positive on Investment Grade (IG), where even record issuance is not deterring investors. We particularly like corporate hybrids. We have downgraded High Yield (HY) to negative, as the strong rally has made valuations much less attractive. Many BB and high single B rated credits are trading very tight despite the fact that they face cyclical risks. The current valuation offers in our opinion an unfavorable risk/return profile after the latest repricing. Moreover, we expect further headwinds for corporate fundamentals especially in the first half of the year as an important part of the recent deflationary pressure is weak demand and therefore low corporate pricing power.

U.S.: We downgraded IG to negative as we expected that heavy issuance in January would weigh on markets after the strong year-end rally in 2023. But in fact, almost USD 200bn in issuance has been easily digested by the market. Asset class inflows, attractive yields and the growing conviction that the Fed is done hiking has supported the asset class and fundamentals continue to be in good shape. On HY we stay neutral. Spreads have tightened on mixed inflation news and the lower probability of near-term rate cuts. Fund flows have been neutral year-to-date with flow activity reflecting changing sentiment. New deals have been generally well received with tight pricing and slim allocations.

Emerging Markets (EM)

EM Credit: Asian credit started the year rather unremarkably with credit spreads moving within a very tight range after the strong rally we saw at the end of last year. Investors expected the primary market to be busy, with yields lower, therefore secondary market activity was rather muted. We expect new issuance to remain active until the Chinese New Year in February, with the majority of it Investment Grade. We remain positive on Asia Credit.

Currencies

U.S. economic data has turned to the upside after around three months of relative disappointment. Market positioning is slightly short the U.S. dollar (USD), but the technical picture favors the greenback. We have gone short EUR vs USD tactically.

2.2 Equities

Despite their recent rally we remain overweight on Japanese equities. Japan has been the only region globally that has seen positive earnings per share (EPS) revisions during the past six months. Higher estimates have been supported by a stable economy, low interest rates and a weakening Yen. Furthermore, the Nikkei remains a haven for investors that have given up on Chinese equities. We expect this trend to continue, with the Bank of Japan expected to lift their interest rates only marginally into positive territory by April, but not beyond.

Meanwhile we are not yet warming to Chinese equities where unpredictable government interventions keep pushing valuations down towards single digit price to earnings (PE) valuation levels. At the same time investors remain unconvinced about the impact of government stimulus on the Chinese economy. Elsewhere in Emerging Markets we see robust micro and macro fundamentals. But to us they seem already reflected in valuations and we remain neutral on EM.

After the strong rally in the S&P 500 (almost 20% since late October), we see downside risk again based on: 1) our valuation models; 2) negative 2024 EPS revisions; 3) misplaced market bets on early Fed cuts; 4) residual inflation, elevated deficits and thus lingering higher Treasury yield risk; and 5) U.S. election uncertainty.

We stick to our overweight call on consumer discretionary shares. Our positive view assumes that economic growth will be at its weakest in the second quarter, labor markets will remain robust and retail stores, both physical and online, will keep reporting solid numbers. We notice, though, that automotive, luxury goods and apparel trends are weak and need to be monitored closely.

Healthcare has been the best performing sector so far this year, with a strong recovery in the biotechnology sector, driven by innovation, Merger and acquisition (M&A) and the peak in interest rates. Based on past experience a case could be made for underweighting the sector as we enter the U.S. presidential election debates. However, so far, healthcare reform does not seem to be high on the agenda of either the Republicans or the Democrats and we stick to our neutral recommendation on the sector and see likely earnings growth of more than 10% this year.

Finally, we are sticking to our neutral in energy. The global transition out of fossil fuels has not yet gained momentum and demand for oil and gas from Emerging Markets remains strong. However, supply growth has been even stronger, especially with ever growing U.S. shale oil production, which has come as a surprise to many. This has added to the downward pressure on energy prices (which has partly been offset by renewed concerns caused by the attacks in the Red Sea of the Houthis).

2.3 Alternatives

Gold

Like U.S. Treasuries, the gold price is constantly subject to the changing signals coming from the Fed and the U.S. economy. Navigating the precious metals landscape in 2024 will require careful attention to the Fed’s balancing act. On the one hand, falling rates and easing monetary policy bode well for silver and gold. But, on the other hand, lingering inflation, the strong jobs market, and the threat of a hard landing could throw a wrench into the works. Each scenario offers a compelling argument for or against precious metals; the reality is that it’s likely that 2024 will be a year of twists and turns for the Fed and for the markets it most influences.

For the year as a whole, however, we remain positive on gold. Possible Fed rate cuts, a wave of de-dollarization, and strong central bank gold buying are its main supports, along with geopolitical tensions. Also, a weaker dollar, often a consequence of easing monetary policy, has acted historically as a tailwind for Gold, boosting its haven appeal and attracting capital away from the greenback. Dollar depreciation, coupled with likely Fed cuts in the second half of the year, could propel gold towards USD 2,300. Our short-term target remains USD 2100/oz.

Oil

January’s temporary increase in oil prices as a result of attacks on an oil freighter in the Red Sea and an attack on a U.S. military base at the border between Syria and Jordan has reminded investors how quickly an escalation in Middle East tensions can push up the risk premium for oil. With, unfortunately, no geopolitical de-escalation in sight, there is no reason to believe that oil will lose its risk premium this year. Independent of any serious disturbance of oil supply in the Strait of Hormuz we believe the global supply-demand picture for oil might move out of balance as the global economy seems to improve faster than expected. We therefore believe oil prices could increase near-term, despite strong non-OPEC supply.

3 / Past performance of major financial assets

Total return of major financial assets year-to-date and past month

Past performance is not indicative of future returns.

Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 01/31/24

4 / Tactical and strategic signals

The following exhibit depicts our short-term and long-term positioning.

4.1 Fixed Income

Rates |

1 to 3 months |

through Dec 2024 |

|---|---|---|

| U.S. Treasuries (2-year) | ||

| U.S. Treasuries (10-year) | ||

| U.S. Treasuries (30-year) | ||

| German Bunds (2-year) | ||

| German Bunds (10-year) | ||

| German Bunds (30-year) | ||

| UK Gilts (10-year) | ||

| Japanese government bonds (2-year) | ||

| Japanese government bonds (10-year) |

Spreads |

1 to 3 months |

through Dec 2024 |

|---|---|---|

| Spain (10-year)[2] | ||

| Italy (10-year)[2] | ||

| U.S. investment grade | ||

| U.S. high yield | ||

| Euro investment grade[2] | ||

| Euro high yield[2] | ||

| Asia credit | ||

| Emerging-market sovereigns |

Securitized / specialties |

1 to 3 months |

through Dec 2024 |

|---|---|---|

| Covered bonds[2] | ||

| U.S. municipal bonds | ||

| U.S. mortgage-backed securities |

Currencies |

1 to 3 months |

through Dec 2024 |

|---|---|---|

| EUR vs. USD | ||

| USD vs. JPY | ||

| EUR vs. JPY | ||

| EUR vs. GBP | ||

| GBP vs. USD | ||

| USD vs. CNY |

4.2 Equity

Regions |

1 to 3 months[3] |

through Dec 2024 |

|---|---|---|

| United States[4] | ||

| Europe[5] | ||

| Eurozone[6] | ||

| Germany[7] | ||

| Switzerland[8] | ||

| United Kingdom (UK)[9] | ||

| Emerging markets[10] | ||

| Asia ex Japan[11] | ||

| Japan[12] |

Style |

1 to 3 months |

|

|---|---|---|

| U.S. small caps[23] | ||

| European small caps[24] |

4.4 Legend

Tactical view (1 to 3 months)

The focus of our tactical view for fixed income is on trends in bond prices.Positive view

Neutral view

Negative view

Strategic view through December 2024

- The focus of our strategic view for sovereign bonds is on bond prices.

- For corporates, securitized/specialties and emerging-market bonds in U.S. dollars, the signals depict the option-adjusted spread over U.S. Treasuries. For bonds denominated in euros, the illustration depicts the spread in comparison with German Bunds. Both spread and sovereign-bond-yield trends influence the bond value. For investors seeking to profit only from spread trends, a hedge against changing interest rates may be a consideration.

- The colors illustrate the return opportunities for long-only investors.

Limited return opportunity as well as downside risk

Negative return potential for long-only investors