- The major central banks are all currently emphasizing that they are wary and investors are too.

- If you're unsure about where the economy and inflation are headed, attractive dividend stocks could help to navigate various scenarios.

- What constitutes an attractive dividend stock cannot be determined on the basis of a few key figures; it also depends on qualitative criteria.

The saddest stock rally as a basis for dividend stocks

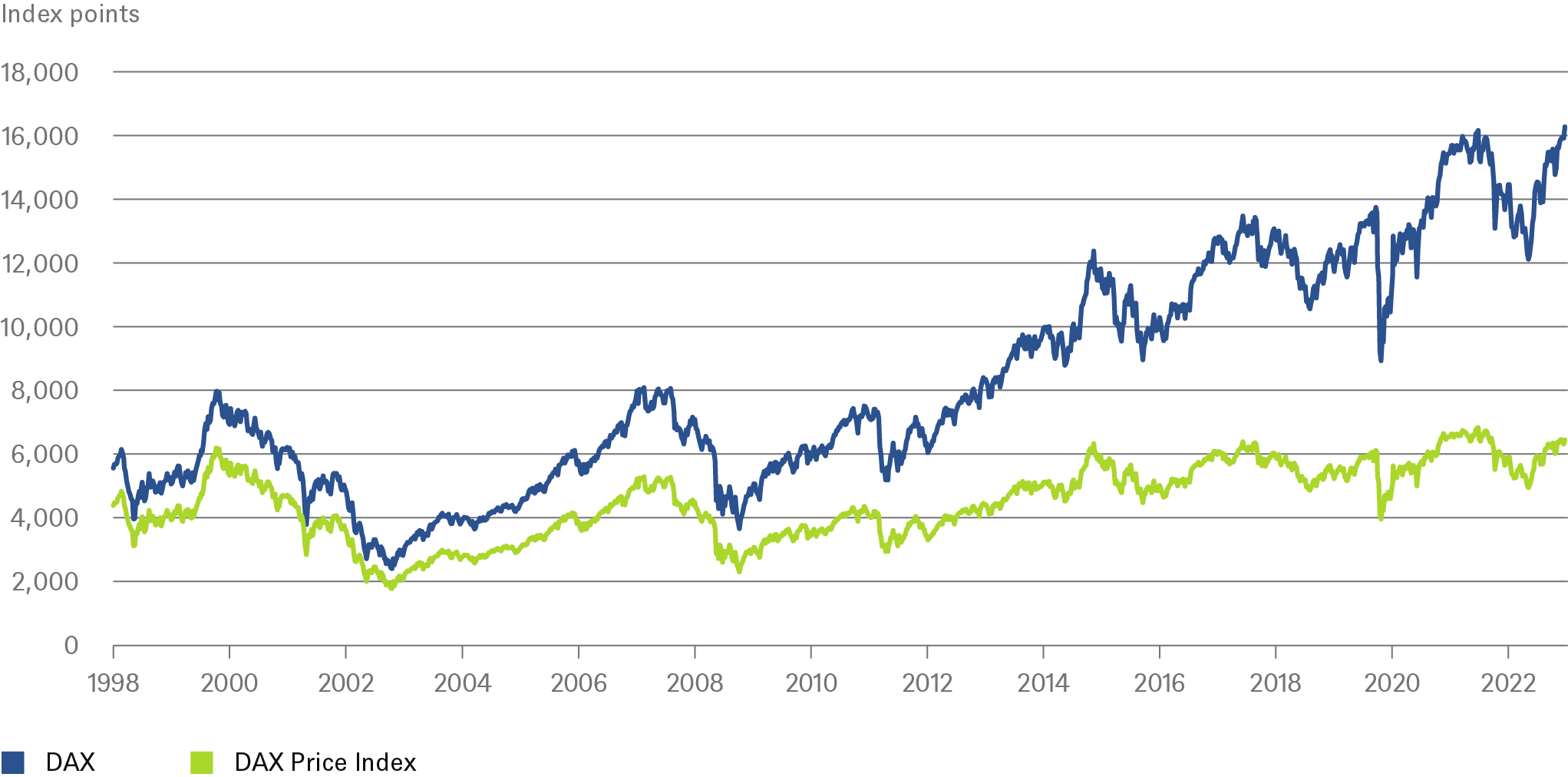

On May 19 the Dax hit a new record high of 16,275 points – a gain of 92%, almost a doubling, since the low in March 2020. That sounds impressive, even more so when you remember the mood in Germany shortly after the Russian invasion began in February 2022. The Euro Stoxx 600 has yet to reach a new record high, gaining "only" 67% since the 2020 low. But there is a special distinguishing feature in the Dax’s outperformance in this comparison: the Dax index includes reinvested dividends, unlike the Stoxx 600. What the big margin shows is just how much dividends can add for investors.

The Dax at a record high - but only with reinvested dividends

Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 5/25/23

The Dax is a performance index, and so it is calculated as if all dividend payments were reinvested. The Stoxx 600, on the other hand, like most stock indices in general, is a price index and accordingly dividend payouts count as outflows. Calculated as a price index, the Dax, the German benchmark index, has not yet reached a new high and is, in fact, only just above its high in March 2000, the dotcom peak. Dividends shape the total return of stock indices and their impact differs widely, depending on the index.

The table below shows how various stock indices have performed over the last 25 years with and without dividends. In this selection, it is striking that in the case of the Dax, Stoxx 600 and global value stocks[1] (MSCI Value), dividends have contributed an average of three quarters to the total return over the past 25 years, while in the case of the S&P 500 and global growth stocks it was less than half, and in the case of the technology index only one sixth. Now, generally, there is nothing “good” or “bad” about a certain level of dividend payouts. Ceteris paribus, the total return of an index should not depend on the distribution level[2] – unless one assumes different returns for distributed and retained earnings. However, we believe there are some qualitative and quantitative differences between indices with high and low payout ratios, which we will discuss in more detail.

Dividends Yields and volatiles of various stock indices

Cars, share buybacks, bond yields and sustained price rises

In addition to reaching its record high – thanks to dividends – the Dax is currently showing another peculiarity that is not insignificant when considering dividend strategies: for the 2022 fiscal year, 30% of the total dividends paid out came from the automotive sector, although it accounts for only 11% of the market capitalization of the index. Such observations are just as interesting for the topic of dividend sustainability, which we will discuss in more detail later, as the following development: global share buybacks, virtually the stepsister of the dividend, reached a new record high in 2022. The 1,200 largest listed companies worldwide bought back shares worth USD 1.3 trillion – which is also roughly equivalent to the amount paid in dividends. Over the past ten years, the amount of share buybacks has tripled, while the amount of dividends paid out has "only" increased by a factor of one and a half.

However, the main reason for the renewed interest in dividend strategies has to do with the current situation in the markets. More handsome bond yields, stable equity markets and relatively robust profit margins are being met by stubbornly high inflation rates, central banks shambling nervously from data point to data point, and uncertainty about whether some regions will slide into recession this year. The Ukraine war, geopolitical tensions relating to China, and discussion of the solvency of the U.S. government add to the uncertainty. It is an uncertain overall mix that could well be described as fertile for dividend strategies.

1 / Markets in a state of limbo

1.1 No peace for investors: geopolitics, Covid, interest rates, war, 2022 crash

To get a sense of what will be in focus for investors in 2023, it is important to consider the disruptions they have had to deal with in recent years: Brexit, Trump, Covid and the Ukraine war. There have been multiple share price collapses, with relatively quick recoveries. Some business models exploded overnight, others imploded. For a long time, the major U.S. technology stocks seemed unbreakable. Then they too collapsed, but their correction phase was short-lived. And probably most importantly from a capital market perspective, years of low or even negative interest rates have suddenly been followed by high inflation and an abrupt turnaround in interest rates. This culminated in a 2022 that was one of the worst years ever for the capital markets, with stocks and bonds diving deep into negative territory at the same time. It is not hard to imagine that some investors have had their fingers burned in these rollercoaster markets, and now want to act more cautiously.

1.2 Central banks with no wriggle room

The high inflation rates from 2021 onwards were new to all of us, and now we have to tread carefully, as we cannot say with certainty what may happen next with inflation and economic growth. But the central banks have reinforced one impression, especially after the crisis in U.S. regional banks: even if the cycle of fast interest rate hikes leads to casualties and accidents in the capital markets or in the real economy, they will not rush to the markets' aid with monetary medicine. No central bank wants to declare victory in the fight against inflation prematurely. And in both Europe and the U.S. the latest inflation figures, producer prices, price components of the purchasing managers' indices and statements of ECB and Fed members do not suggest that the first interest rate cuts will come as early as this year, as the markets are currently pricing in.

One can find good reasons to suggest that inflation rates should move back toward the central banks' 2% targets on a 2-3 year horizon but, at the same time, no one will doubt that the clash of restrictive monetary policy, high inflation rates, record high government debt levels and, simultaneously, high demand for fiscal spending (on defense, infrastructure, the energy transition, to name the most urgent) increase the degree of uncertainty.

USD is not an individual case: in industrialized countries, higher interest rates clash with high debt levels

Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 5/25/23

Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 5/25/23

Markets expect decreasing interest rates and stable stock markets yet still remain skeptical

A look at the markets' implicit interest rate expectations shows that they do not expect a prolonged period of inflation and do expect bond yields to fall – either because of weaker economic growth or because they believe more economic accidents will force the Fed to change course. Stock markets, some at record levels, are expecting zero earnings growth this year – a real decline given inflation – but expect the S&P 500, for example, to return to earnings growth of 4.6% in 2024. But fund managers repeatedly express their skepticism about the stock markets. And this skepticism is apparent when taking a second look at the S&P 500: its high level (a gain of more than 7% this year) is largely due to the rapid price gains of a dozen large technology stocks.

2 / The charm of dividend payers

The Nasdaq's stellar performance over recent decades is proof that solid dividend payers are not always the best choice for investors. But we think that a focus on stocks that pay out regularly has the potential to work well in the current market environment. Before we go into more detail, a word about the benchmark indices we use. Since we don't think there are any good global indices for good dividend payers, we regularly take the MSCI World Value Index as a proxy index and contrast it with the MSCI World Growth. Alternative (opposing) pairs would be the Nasdaq vs. the Dow Industrial or the MSCI Information Technology (IT) vs. the MSCI World ex IT.

2.1 What currently speaks for dividend strategies

It may seem strange at first to call for dividend-oriented equities in a year in which (especially corporate) bonds are once again yielding handsome returns. Rather like proclaiming this the year of value stocks[1] when, after just twelve months of correction (both in absolute terms and relative to value stocks), growth stocks are already back to their old strength. This year, for example, the Nasdaq is already ahead by around 25%, [3] while the more value-biased Dow Industrial is treading water. However, our aim here is not to place dividend stocks above all other forms of investment, but to explain why we believe their all-round Qualities may be particularly suited to the current market environment. This is indeed where their strength lies: being relatively well prepared for different market scenarios. To a degree, therefore, they offer a safety net. What this might also imply, conversely, is that if you have a clear, confident picture of the coming 12-24 months, you may feel you could achieve a higher return in other asset classes. But in our view the following currently speaks in favor of dividend stocks:

- According to surveys of fund managers, [4] major U.S. IT stocks are once again among the favorites of professional investors. They are therefore what the market often refers to as the “most crowded trade”. Accordingly, the drop-off point is high if the sector does not deliver. We too, admittedly, continue to see good opportunities in some tech segments, not least due to the ubiquitous rise of artificial intelligence. And in recent quarters many tech top dogs have shown that they are able to control costs when the environment demands. At the same time, however, this sector remains vulnerable to economic slowdown, especially in those companies that rely heavily on the (cyclical) advertising market. In addition, the valuation of growth stocks is disproportionately affected when interest rates rise, or when central bank rate cuts that are priced in by the market do not materialize, because profits accruing (again disproportionately) in the future must then be discounted at a higher interest rate. The chart below shows that 15 years of exceptional outperformance by growth stocks were preceded by several decades in which value stocks outperformed.

Performance of value stocks versus growth stocks; with and without dividend payments

* Full data for total performance only available from 1995 onwards // Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 5/25/23

* Full data for total performance only available from 1995 onwards // Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 5/25/23

- There is no longer no alternative to equities, especially now that corporate bonds are once again yielding good returns. And, unlike equities, it is well known that with bonds, at least those with an investment grade rating, you can be reasonably sure of getting your original investment back at maturity. However, dividend stocks have two advantages over bonds: 1. they have the potential to be better protected against inflation, assuming that companies can pass on price increases to customers, which should have a correspondingly positive effect on the stock price and dividends. 2. If stock markets perform better than expected, dividend-bearing securities still have further upside potential.

Dividends and bond yields

* Investment grade bonds, yield-to-maturity //Sources: Refinitiv, DWS Investment GmbH as of 5/25/23

- Stock markets, especially in the U.S., have been driven by two factors in recent years: the widening of profit margins and of valuation multiples. For example, after falling from about 6% to 4% from 1970 to 1990, the net profit margin of the S&P 500 has since risen to 12.5% at its peak in 2021 before falling back to about 10.5% now. The development of the price-earnings ratio (P/E ratio) shows less continuity. Again, it has deviated from the extremely high levels of two years ago but is still above the long-term average. There are good reasons why we believe neither margins nor P/E ratios should necessarily revert to old lows. That they can maintain the current level is much more optimistic, and the most optimistic assumption would of course be that both could rise again. However, sideways movement in the stock markets, in which few price gains are expected, would mean sustainable dividend payers are likely to be in demand.

Net profit margins and price/earnings ratios: where else are we headed?

* based on next 12 months earnings estimates// Sources: Refinitiv, Bloomberg Finance L.P., DWS Investment GmbH as of 5/25/23

Therefore, anyone currently not very convinced about where growth, inflation and stock market valuations are headed might favor dividend stocks.

2.2 What are the fundamental arguments in favor of dividend stocks?

Regardless of the current market and economic environment, we believe good dividend payers offer further advantages. Paying dividends is not in itself a quality criterion for companies. How they handle their disposable funds depends on many factors, and first and foremost on the maturity of the company. Young companies are virtually required to invest their profits in their own growth. In addition, there may also be tax and other reasons why companies either retain their profits or prefer to pass them on to their shareholders via share buybacks (which can also be structured more flexibly) instead of dividends. But apart from that, from an investor's point of view, there are some implicit and explicit reasons to invest in solid dividend payers:

- A (constant) dividend sends a strong signal. It suggests the company expects to continue to generate sufficient profits to pay dividends in the future. As a rule, dividends should be at least on a par with the previous year. That is because reducing the level of the dividend is already considered a loss of face, at least for the less cyclical sectors, while suspending the dividend payment is virtually an affront. Thus, dividend payments per se carry the signet of financial sustainability.

- Of course, this is especially true for some of the most reliable dividend payers: mature companies from cyclically resistant sectors. And since dividend payouts generally fluctuate less than profits, and a portion of the investment flows back into the hands of the investor with each payout, you acquire a defensive quality from your investment at the same time.

- Regular distributions also discipline management. When free funds become a scarce commodity after dividend payments, people think harder about their further use. If companies accumulate too much cash, a worry for investors is that the cash might be used for unprofitable acquisitions. The track record for takeovers of American companies by German ones, for example, will have left many investors wishing that the money had been directed towards the company's own shareholders, not those of other companies.

- Not only do dividend stocks provide investors with a regular income (making them the only possible equity investment for many pension funds and foundations), but dividends can be expected to grow with profits, profits with sales, and sales with inflation. Thus, the investor gains an income component that’s protected against inflation.

- In the market vernacular, "cash is king". A broader expression that might also apply to dividend stocks is that "a bird in the hand is worth two in the bush".

2.3 Not all dividends are equal – the strategy stands and falls with stock selection

Private investors who want to pursue a dividend strategy, however, face a fundamental problem: it is not possible to determine which company is a sustainably good dividend payer on the basis of just a few key figures. Rather, you must take a good look at each individual company and make a qualitative assessment of whether the company can continue to meet its payment promises to shareholders in future. This also explains, as mentioned above, why it is so hard to find a good dividend index.

Entire sectors can also fall out of favor. Among the best dividend payers historically, for example, are those sectors that are currently the focus of much ESG discussion. The energy sector is particularly eye-catching – once again shining with an above-average dividend yield. But even if no one doubts the solvency of the oil companies over the next few years, there is a great deal of uncertainty about the degree to which the sector will become more difficult in the medium term because of regulatory intervention.

In general, the dividend yield (i.e. dividend divided by the share price) is anything but a clear indicator of the quality of a dividend stock. This is because a fairly high dividend yield can regularly be a sign of skepticism about the company's ability to continue paying dividends (as this skepticism might have pushed the share price down). Of course, this is even more true if the payout ratio is equally high. In the worst case, it is over 100% of profits (more precisely, one would have to speak of free cash flow), which would mean that the company in question would have to dig into its very substance to be able to pay out the dividend.

If looking for sustainability and low fluctuation in payouts, a focus on two parameters: dividend yields of 1% to 6% and payout ratios averaging 30% to 80% (depending on the maturity of the company) have worked quite well in the past. Above all, as the chart shows, with lower dividend yields we have not been disappointed by exaggerated dividend promises. But, to emphasize once again: these figures can only provide a rough orientation. There is no getting around precise analysis of the individual stocks.

Estimated versus realized return sorted by dividend yield amount

Sources: IBES consensus FTSE World since 1995, DWS Investment GmbH as of 12/1/23