What happened?

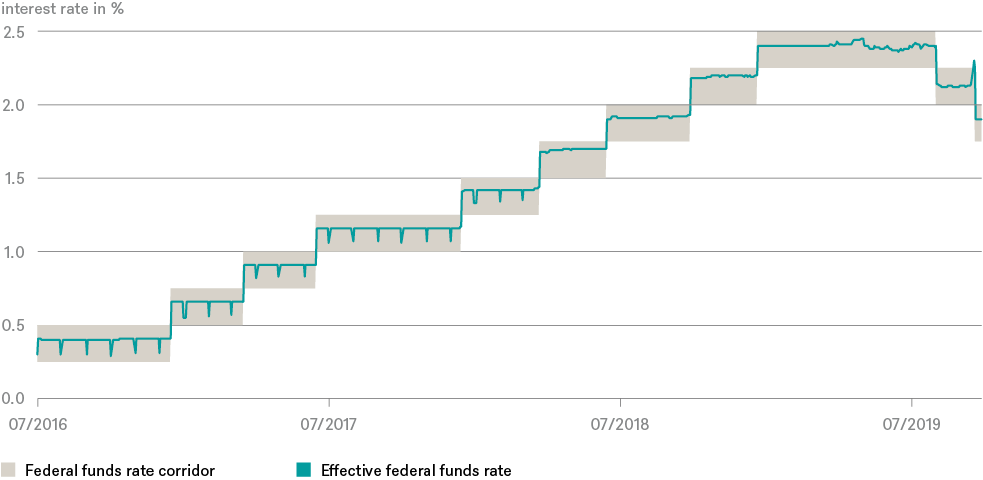

On Monday, September 16, and Tuesday, September 17, Overnight Treasury general collateral (GC) repurchase-agreement (repo) rates surprisingly surged to almost 10%. Theory suggests that they should trade closer to 1.8%, the interest rate the U.S. Federal Reserve (the Fed) pays commercial banks on their excess reserves. Because of the glitch in the repo market, the effective federal funds rate (EFFR) left the band set out by the Fed (then: 2.00%-2.25%, now 1.75%-2.00%). The Fed hurried to intervene and started offering repo facilities starting on Tuesday, September 17. Within a couple of days, through overnight and 2-week repos, the Fed pumped close to 200 billion dollars into the system. Why did this happen? Was it just a technical glitch? We doubt it.

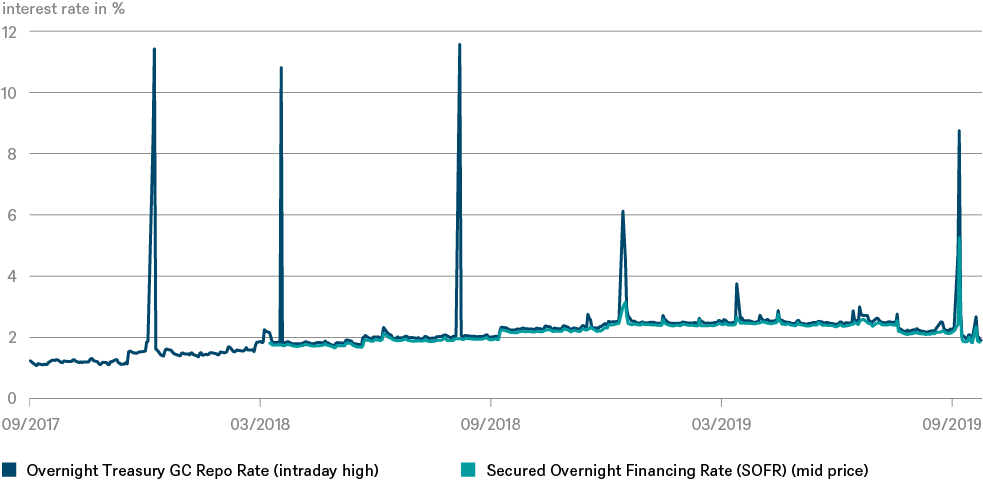

For one thing, there have already been a couple of similar events in recent years (see chart). The main difference back then was that those elevated intraday highs were insignificant in size relative to the total of repo transactions. This time around, however, the Secured Overnight Financing Rate (SOFR), which measures the average cost of repo transactions on any given day, also increased significantly, leading the Fed to intervene directly in the repo market.

Intraday Repo Rate vs. SOFR

Sources: Bloomberg Finance, DWS Investment GmbH as of 9/26/19

The episode certainly brought back some bad memories. Ruptures in certain parts of the money market preceded the great financial crisis (GFC) at its outset in 2007. This time around, market participants were left wondering why banks with ample reserves would be unwilling to lend money to each other for an interest rate of up to 10%, when they would only receive 1.8% from the Fed. However, we do not believe this incident has to do with a lack of trust between the banks. For one thing, overnight repos have U.S. Treasuries as collateral. So, they are as safe a loan you can make – counterparty risk looks very small therefore.

Why did rates spike now?

Several short-term causes appear more likely to have been the immediate triggers. A corporate-tax pay day and a large Treasury settlement from prior auctions (of 3-, 10- and 30-year Treasuries)[1] both drained some 100-150 billion dollars from the market.[2] While neither should have come as a surprise, other factors perhaps did. Few doubt that this event could not have been dealt with and in hindsight it might be easy to claim that the Fed should have been better prepared. There have been changes at the helm of the New York Fed this summer that some interpret as having dented the bank's market/trading expertise in general.[3] And when the Fed conducted its first repo operation since the GFC on Wednesday morning, the exercise was delayed by 25 minutes due to technical difficulties. Before the GFC, repo interventions had been common practice for the Fed.

The mechanics of the repo market

At this point, it may be worth exploring some of the basics of the repo market. For banks seeking funding it offers liquidity, thanks to various non-bank entities, such as money-market funds. Other traditional sources of bank funding are unsecured loans. Banks can also borrow from the Federal Reserve's discount window.[4] That interest rate, known as the Federal Reserve discount rate, is usually 0.5% higher than the EFFR. As a result, it mainly tends to be used by banks struggling to find other funding sources.

Only 24 primary dealers are trading counterparties to the Fed. They have to make bids in Treasury auctions and are able to receive interest on their (reserve) holdings at the Fed. The repo market, however, is open to many more institutions. Banks and investors use the repo market to exchange top-rated assets for short-term cash funding. Borrowers then repurchase the assets for a slightly higher price at an agreed date, usually the next day. The U.S. repo market has an average daily notional amount of 2.2 trillion dollars outstanding.[5]

Some long-term considerations

In our view, some longer-term shifts may have contributed to recent troubles. One obvious set of suspects are some of the side-effects of more than a decade of unconventional monetary policies. These led to the Fed's balance sheet to first grow and then shrink again, as the Fed started its balance-sheet normalization program in October 2017. The Fed grew and shrank its balance sheet to a large part by buying and selling Treasury, agency and mortgage-backed securities. When buying/selling these securities from/to a dealer (i.e. a commercial bank), the bank's reserves at the Fed increase/decrease. The Fed's balance-sheet normalization program therefore resulted in decreased bank reserves.

It is normal for a central bank's balance sheet to grow more or less in line with the economic growth of the country. And it has also been normal for the demand for U.S. currency to grow even faster, due to foreign demand. On average, over time, the overall level of U.S. currency outstanding has been growing at a 5% to 7% annual rate, and is now $1.7 trillion, well over double the level before the financial crisis. Reserves, in the meantime, fell from their peak of $2.8 trillion in 2014 to about $1.5 trillion before the repo-market turmoil. Just to meet the currency expansion without draining on reserves, the Fed would have needed to expand its balance sheet by roughly 10 billion dollars per month.

In light of the Fed's balance-sheet normalization, it instead shrank its balance sheet and in particular the reserves (a central bank's liabilities consist of currency in circulation and reserves). That decrease in reserves may partly explain why during the repo rate spike in September, the Fed's liquidity injections didn't immediately find their way to the institutions needing short-term funding.

While in absolute terms excess reserves are still high in historic comparison, they have been falling since 2014 and are concentrated at a couple of banks. Concentration in the banking sector has increased as various statistics show: 70% of all deposits are held by 10 banks. It is even worse when it comes to reserves. As Lorie Logan, senior executive at the NY Fed, admits, the concentration of reserves is an issue they are looking into:[6] According to Bloomberg Intelligence, three banks hold half of all reserves held at the Fed. And looking only at excess reserves, the concentration intensifies significantly. Four banks have much of the excess dollar bank reserves.[7]

Moreover, since 2008, the Fed is paying interest on excess reserves, limiting the incentive of commercial banks to lend money. Before that, the Fed could rely much more on banks being incentivized to hold as little reserves as necessary. Other regulatory changes probably also contributed. Various parts of the Dodd-Frank rules[8] enacted in the U.S. have led banks to hold more reserves, leverage less and limit proprietary trading. Basel III[9] is only adding to this, especially in terms of capital requirements. As JP Morgan's CEO Jamie Dimon put it: "banks have a tremendous amount of liquidity, but also have a tremendous amount of restraints on how they use that liquidity."[10]

Other more recent changes also come to mind. This includes tax cuts and spending increases under the current U.S. administration, which have led to a surge of financing needs from the U.S. Treasury. The Treasury's net issuance has thus increased from less than 0.7 trillion dollars in 2017 to 1.3 trillion dollars in 2018 and an estimated 1.2 trillion dollars this year.[11] The earlier-than-expected resolution of the debt ceiling makes it likely that the Treasury will issue 800 billion dollars in net new debt by the end of this year.

But the biggest contributor may well have been the Fed's tapering. Since the start of tapering in January 2014, the Fed has been decreasing the amount of its bond purchases and between October 2017 and July 2019, its balance sheet has been shrinking. Credit Suisse' Zoltan Poszar points out that the Fed's tapering has sucked some 400 billion dollars out of the system so far (at increasing speed), but that other forms of tapering have to be added to this sum.[12] This includes tapering as a result of the inversion in the yield curve. The yield-curve inversion disincentivizes carry traders trying to earn a margin from borrowing short term to buy Treasuries (i.e lending longer term). For foreign investors, the point at which this trade becomes unprofitable has been reached way before the yield curve inverted, as they had to pay for hedging costs (in yen or euro). Altogether, Credit Suisse estimated that the various tapers took 800 billion dollars off demand.[12]

All of these longer-term shifts led to a rare loss of control by the Fed. As a consequence of the dislocations in the repo market, the effective federal funds rate left the Fed's corridor.

The effective federal funds rate left the Fed's corridor

Source: Bloomberg Finance as of 10/4/19

Conclusion

While the September incident was after all swiftly fixed, it is clear to us that something has to be done. After all, this happened in quiet market times – while these periodic glitches (quarter end) could happen in stressed markets as well. For the Fed and market participants alike, the episode should serve as a reminder that both the Fed and markets are still learning how to cope with unfamiliar challenges, in the aftermath of a decade of unconventional monetary policies.

Many market participants believe that the best way out is for the Fed to increase its balance sheet (and thereby increase market liquidity) faster than planned through increased Treasury purchases. Estimates range from 500 billion dollars to more than 2 trillion dollars to fix the repo market. Fed officials were talking about 250 billion dollars.[13] Perhaps, that might work. However, any such aggressive measures are likely to have more unanticipated, unintended and potentially negative side-effects. Market participants hoping for more monetary-policy innovations should be careful what they wish for. They might just get it – potentially throwing up yet more and unfamiliar challenges further down the line.

1. As primary dealers have to bid on all Treasury auctions, the large Treasury settlement meant that dealers had more Treasuries than usual on their balance sheet, which they needed to finance

2. Average of various brokers' estimates.

3. See: https://blogs.uoregon.edu/timduyfedwatch/2019/09/20/what-the-fed-did-right-and-what-the-fed-did-wrong/

4. A discount window is a monetary-policy instrument provided by the central bank allowing eligible banks to borrow money on a short-term basis in order to meet temporary liquidity shortages

5. Source: Securities Industry and Financial Markets Association (SIFMA) as of 09/2019

6. https://www.ft.com/content/83a5bb70-dbca-11e9-8f9b-77216ebe1f17

7. https://www.ft.com/content/1735cc1e-e057-11e9-b112-9624ec9edc59

8. Effective in July 21, 2010, the Dodd-Frank act introduced a transformation of the U.S. financial regulatory system, affecting most parts of the U.S. financial services industry and all federal financial regulatory agencies. It included rules restricting banks from making certain speculative investments, corporate-governance provisions and increased consumer protection.

9. Developed in light of the deficiencies in the financial-market regulatory environment laid open by the Global Financial Crisis, Basel III is a global, voluntary regulatory framework setting standards for bank capital requirements, stress tests and market liquidity risk that was agreed on in November 2010.

10. https://www.bloomberg.com/news/articles/2019-09-22/repo-market-s-liquidity-crisis-has-been-a-decade-in-the-making

11. As primary dealers have to bid in Treasury auctions, the excess Treasury supply from an increase in net issuance ends up on their balance sheets in the short term. The dealers' resulting higher financing demand tends to increase overnight repo rates for a few days.

12. Credit Suisse as of 8/12/19: "Global Money Notes #23 – The Revenge of the Plumbing"

13. Bloomberg Finance L.P., as 9/26/19: "Repo-Market Cure May Take $500 Billion of Fed Treasuries Buying"