Despite all the warnings that it could be a disaster, Japan's consumption tax is going to be raised from 8% to 10% on October 1, 2019. Katrin Löhken, economist at DWS covering Japan, had a deeper look into the subject and concluded that history is unlikely to repeat itself. A first attempt to raise the tax was made as long ago as the autumn of 2015. It did not do too well, taking the blame for an abrupt collapse in economic growth – though a previous, April 2014 tax increase was also part of the problem. Since then an increase has been taken into consideration for several times before being put back in its "dangerous – do not touch" box. And yet, the temptation to open the box keeps coming back because the fiscal position is weak and the social-security burden growing. What is going to happen this time?

The environment might be seen as the key to answering that question – not the climate but the national and global political and economic one. The reason why the tax increase is seen as so important, is the fact that the nation's debt position is bad and its fiscal position chronically poor. Japan is the most heavily indebted industrial country with a national-debt burden of 237% of gross domestic product (GDP). The fiscal deficit is likely to be around 3% again in 2019 and, according to Internal-Monetary-Fund (IMF) forecasts, a balanced budget is not in sight in the foreseeable future. Consumer-spending accounts for 56% of Japan's GDP. If the tax increase were to provoke another consumer strike – as with the previous increases in 1997 and 2014 – the revenues the tax intends to raise would immediately be blown out of the water. Instead, depressed consumers and corporations would drag the economy down again, into recessionary depths that would worsen the fiscal and debt position further. In 2014, private consumption dropped by a calamitous 4.8% compared to the previous quarter, causing GDP to shrink by 1.9%. Consumption also remained weak in subsequent quarters. In fact, the nominal level of consumer spending at the peak before the VAT hike in 2014 was not reached again until the end of 2018 – and in real terms consumer spending remains lower than it was five years ago.

It is plain then that the tax increase in October is hazardous. It is also not coming at the easiest of times internationally. The global economy is unstable. The U.S.-China trade war, geopolitical tensions in the Gulf and the big Brexit question mark threaten to make consumers and companies more nervous. And Japan, an export-led nation, is particularly vulnerable to trade hostilities. China is Japan's largest trading partner, the United States its second largest. A recent decline in Japanese consumer confidence might have been triggered more by the uncertain external environment than by the government's plan to raise the consumption tax. Corporate sentiment is still holding up quite well despite manufacturing's trade war-related woes. The Purchasing Managers' Index (PMI) for the service sector, which is most finely attuned to disruption from the rise in the tax, rose to 53.3 points in August 2019.

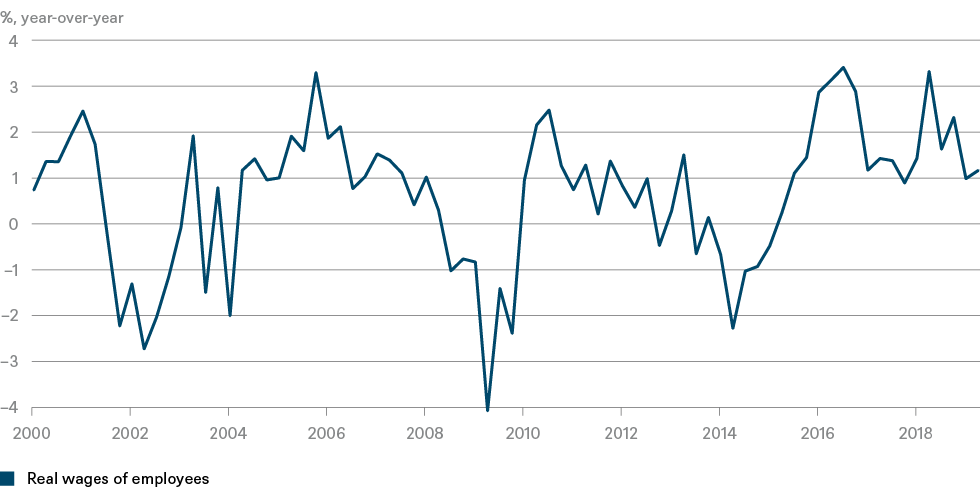

Overall, however, the timing looks better. The economy grew more than expected in the first half of the year, and with a positive output gap, suggesting growth was higher than trend and therefore potentially inflationary – and Japan would welcome a little more inflation. Companies are still ready to invest and anecdotal evidence suggests that they are relaxed about the tax hike this time. Most are likely to pass it on instead of eating into their own margins. Equally important, private demand is supported by a very strong labor market, with a historically low unemployment rate of 2.2%. Firms are having difficulty finding staff for some jobs. An economic slowdown should therefore not provoke sweeping redundancies. Above all, however, the recovery in real wages means that disposable income will finally rise noticeably again: while real wages grew by an average of only 0.5% per year between 2009 and 2017, the average has risen significantly to 1.8% per year since the beginning of 2018 (see chart 1). That should keep consumer spending up.

In our view the Japanese economy will therefore get off more lightly this time, especially as the loss of purchasing power will be smaller than in 2014 for a number of reasons.

- The tax hike will only be two percentage points – in 2014, it was three percentage points. The government estimates that tax revenues will rise by 5.6 trillion yen, considerably less than the 8.2 trillion yen in 2014, implying less money is being taken from consumers.

- Some important consumer goods – such as food, beverages and newspapers – will be exempt from the tax increase this time. This exemption helps to explain why there has been nothing like the pre-hike rush to spend that occurred in 2014 (see chart 2).

- The government has learned from the past and has adopted other mitigating measures, worth about half the expected increase in tax revenues:

- for families, vouchers for free day-care centers for children, abolition of school fees for pre-school children, and secondary-education subsidies for low-income households;

- additional benefits for low-income pensioner households;

- temporary-tax rebates for the purchase of environmentally friendly cars and extended depreciation options for house purchases;

- and a government-rebate system for credit-card payments, amounting to 5% of the purchase sum, from October 2019 to June 2020. This is also intended to provide an incentive to cashless payment, which is unpopular in Japan.

Two special factors should also help to stimulate spending. Japan will host the Olympic Games in the summer of 2020. In other countries hosting the event has spurred a retail boom. In addition, the government's discount scheme for cashless payments runs only until June 2020, and that might encourage consumers to spend before the discount ends.

All in all, we therefore expect private consumption to decline by 1.8% year-over-year in the fourth quarter of 2019 and also to contract slightly in the first quarter of 2020. But we do not believe a decline of this magnitude would be enough to drag GDP growth into the negative at the end of 2019. And we would expect a return to moderately positive growth rates thereafter, with the Olympic Games and expiry of the rebate system spurring consumers on. Meanwhile the shaky external environment will be felt above all in the export sector. We are forecasting overall economic growth of 0.6% this year, softening to 0.2% in 2010. However, we believe a recession should be avoided given these measures.

Of course, another slump in consumption cannot be ruled out. If it were to happen, fiscal policy would be called on. Prime Minister Abe is stressing that he will not hesitate to provide fiscal support in the event of an unexpected slump, thereby easing the pressure on the central bank to become even more expansive. The Bank of Japan's toolbox looks empty and there is growing discussion of the negative side effects of extremely expansionary monetary policy on the financial system. The Bank of Japan is therefore likely to keep its now modest supply of ammunition for a potentially greater emergency. It may also hope that the rise in prices caused by the consumption-tax rise will generate a bit more inflation.

Impact on the yen and Japanese equities

We expect the yen to continue gradually appreciating. We take this view not on macroeconomic grounds but because the yen is perceived as a safe haven and the global economic environment remains highly uncertain.

We do not believe that a stronger yen (12-months forecast: 105 yen per dollar) will place an excessive burden on Japanese companies, which are generally well positioned within their sectors relative to their global peers. The majority of the companies we have talked to are also budgeting for an exchange rate of 105 yen per dollar. At this level, we do not expect any intervention from the Bank of Japan. We have also received confident affirmations from companies regarding the consumer-tax hike. Most of them do not fear a slump in demand as the tax increase is small and accompanied by many supportive fiscal measures. Japanese companies, on the other hand, are worried about the global trade dispute. While it looks as if we are on the way to an agreement with the United States, the conflict with South Korea is not facing any visible easing.

Aside from this, many factors favor the Japanese industry. First and foremost, they have made rapid progress in implementing shareholder-friendly measures. Corporate unbundling, the spinning off of unprofitable subsidiaries, improvements in corporate governance and the steady increase in dividend pay outs from companies' full coffers – all of these factors are currently in shareholders' best interests. In addition, analysts' previously negative earnings revisions for 2019 and 2020 are now slowly stabilizing. We believe Japanese industry is well prepared for the expected surge in investment in production facilities for organic light-emitting diode (OLED)[1] and 5G technology. All this is complemented by a valuation that looks very appealing both on historical terms where Japanese stock markets are concerned and relative to other regions. However, Lilian Haag, Portfolio Manager at DWS, points out: "In our opinion, the Japanese market is valued very favorably. But this valuation is unlikely to be sufficient for a stock-market rally. We would have to see a broad cyclical recovery for this. We are neutral on the region, but with a positive bias."

Wage growth in Japan is pretty decent by Japanese standards

Sources: Refinitiv, DWS Investment GmbH as of 9/20/19

History is unlikely to repeat itself: consumption plunged in 2015

*t = quarters; t = 0 corresponds to the VAT-hike date

Forecasts are not a reliable indicator of future returns. Forecasts are based on assumptions, estimates, views and hypothetical models or analyses, which might prove inaccurate or incorrect.

Sources: Refinitiv, DWS Investment GmbH as of 9/20/19