- Home »

- Insights »

- CIO View »

- Investment Traffic Lights »

- Investment Traffic Lights

- In a particularly strong start to the year last year’s loser were amongst the main winners this year.

- China's reopening and Europe's resilience have been the co-drivers of this rally.

- This does not necessarily make the central banks’ work any easier, especially as the risk of recession in the U.S. remains.

1 / Market overview

1.1 Strong start to the year does not make central bankers' task any easier

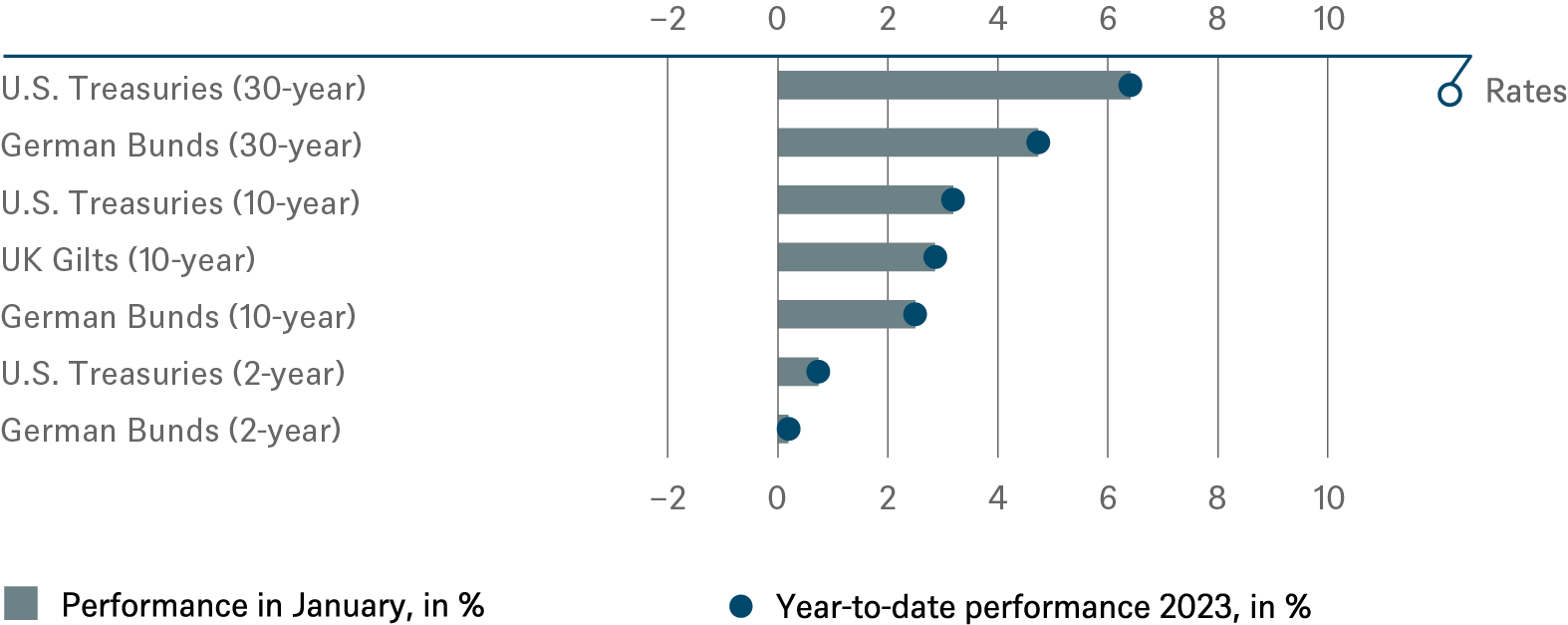

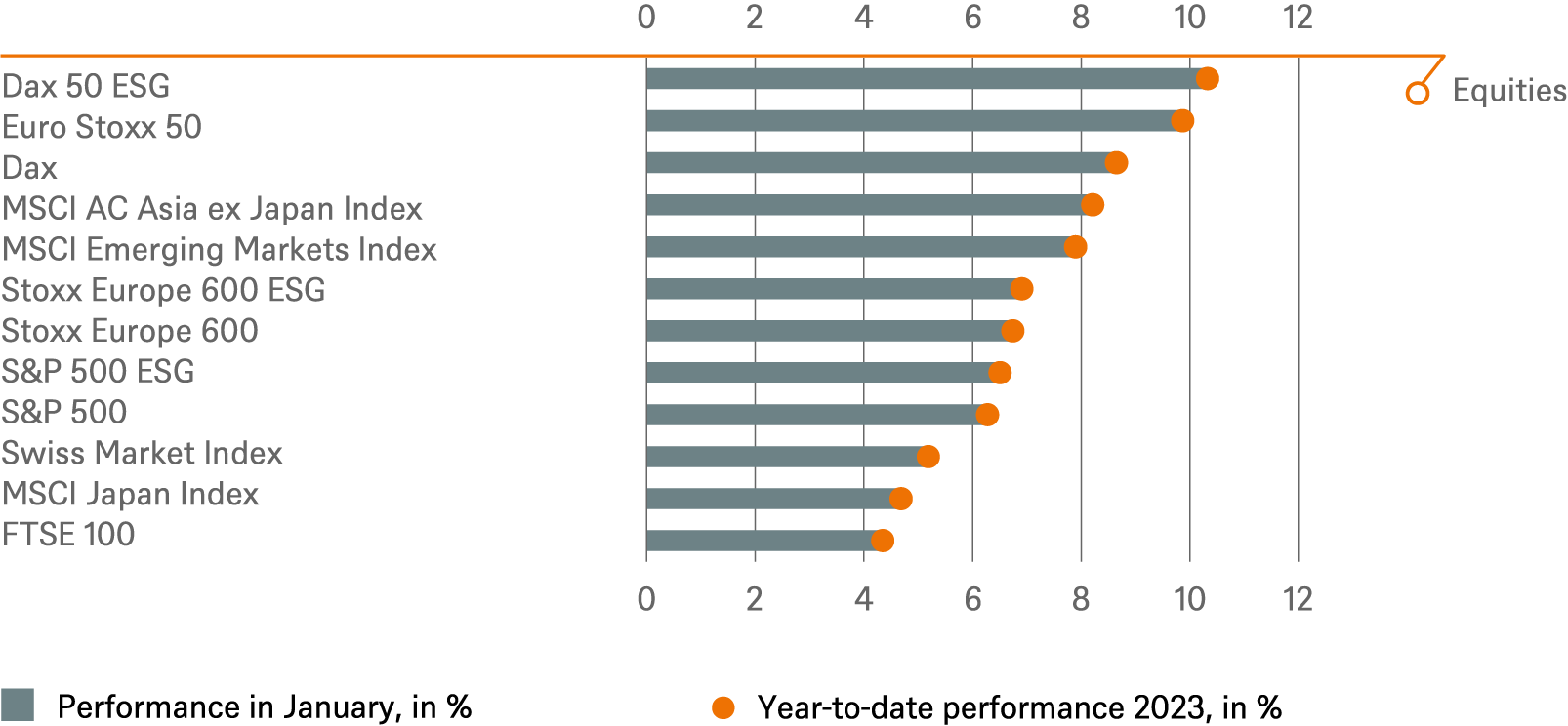

It has been the best opening month to the year for global equities[1] since 1988, with a gain of 7.1%[2]. And most other asset classes fared not much worse. With this kind of start to the year, things can't be all that bad for the global economy, can they? The answer to that can only be a resounding yes – and no. This year we have to face a number of profound contradictions that are likely to continue to give both investors and central banks a lot to think about.

The positive start to the year has undeniably been supported by some surprisingly positive developments. For example, falling inflation rates, especially in the U.S., the sharp drop in energy prices in Europe (natural gas[3]costs as little as it last did in September 2021), the accompanying hope that the Eurozone should escape a (technical) recession this winter, and China's abrupt reopening[4], which on the one hand has caused hardship for the population but on the other hand has laid the foundation for more positive growth this year. These may have been the main reasons for the extension of the market recovery that began last October.

Some negative factors, however, have remained or even worsened: stubbornly high core inflation, especially in Europe; the economic weakness of the UK; continued weak economic figures from China for now[5]; the Ukraine war, which still lacks any exit scenario; and, of course, recession signals in the U.S., which are not fading. Weak purchasing managers' indices, weak consumption and weak industrial production have combined to push the U.S. Conference Board's leading indicator into scary territory[6]. And the market's own frighteningly reliable recession indicator, the yield curve, continues to emit stark warnings: for seven months now, 2-year U.S. Treasuries have been yielding more than 10-year maturities and, at minus 70 basis points, the curve is as negative as it last was in the 1980s. Meanwhile, labor markets on both sides of the Atlantic remain more robust than central banks would like because the lack of labor supply is keeping wage gains high.

That brings us to the main issue for central banks and investors: will there be a soft landing – a reduction in inflation without a full-blown recession – especially in the U.S.? In January, the markets seemed to interpret worse economic prospects positively because the Federal Reserve (the Fed) might then be less hawkish. But this was against the Fed's explicit wishes. It repeatedly emphasized that it would take its time and make sure inflation was overcome before implementing interest-rate cuts this time.

1.2 In January, the market revised many 2022 trends; Europe and China ahead of U.S.

“The last will be the first” was true for many asset classes in January – which is also a reminder that the current rally is built on last year's slump. For example, the Nasdaq 100's 10.7% gain in January (its best start to a year since 2001) was preceded by a 35% drop from its 2022 peak. As a beneficiary of China's opening, the Hang Seng Index advanced almost as strongly (10.4%) – but in the past two years it had lost more than half of its peak value. European banks[7] also advanced by double digits due to the rising interest-rate environment, and so did Italian shares because the new government has so far proved far less scary than markets originally feared. All in all, this led to clear outperformance for Europe vs. the U.S.: the Euro Stoxx 50 rose by 9.9%, the S&P 500 by 6.3%, or almost two percentage points less in euro terms.

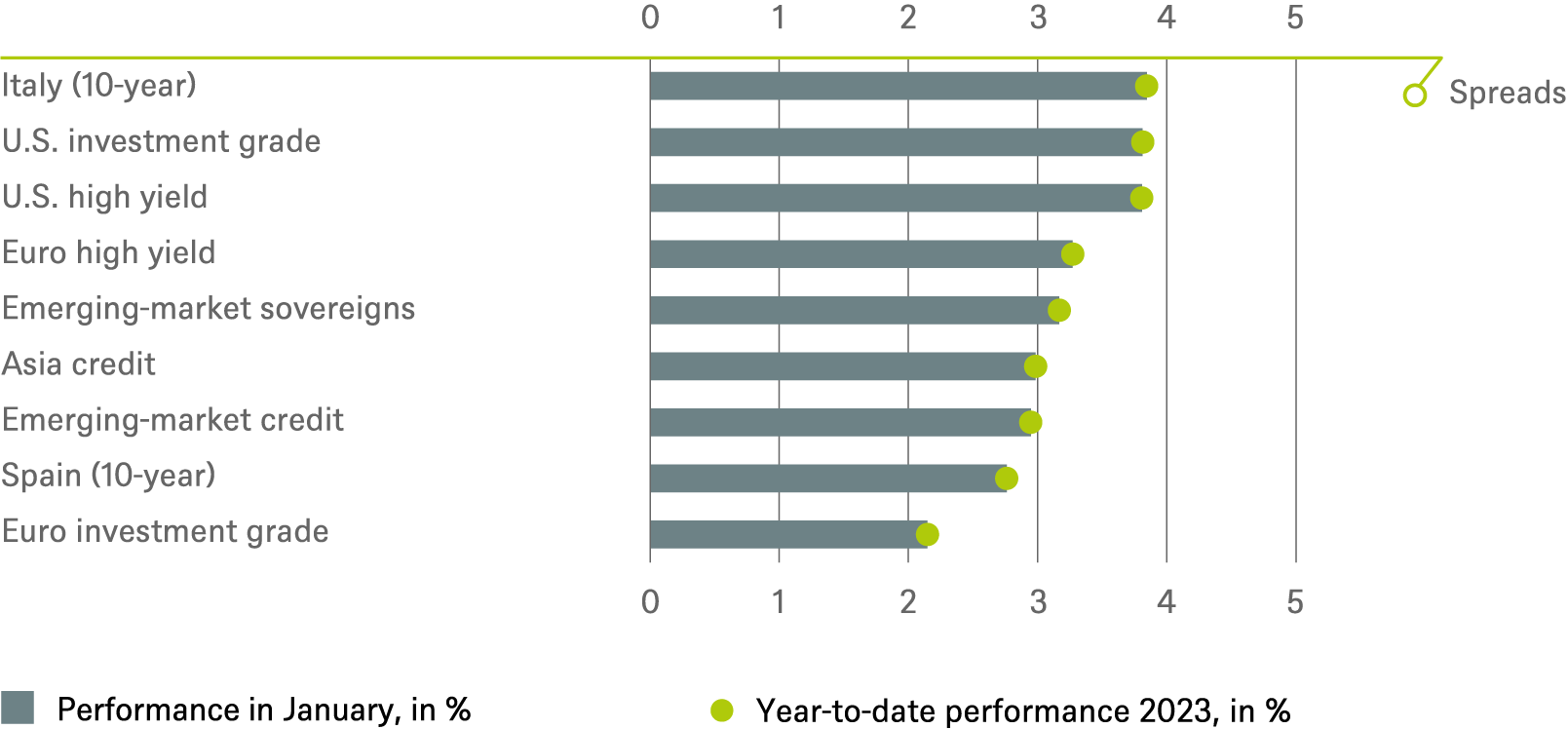

On the bond markets, longer-dated securities naturally benefited most from the slight drop in yields, and here, too, Italy did particularly well – 10-year yields fell by 55 basis points[8].

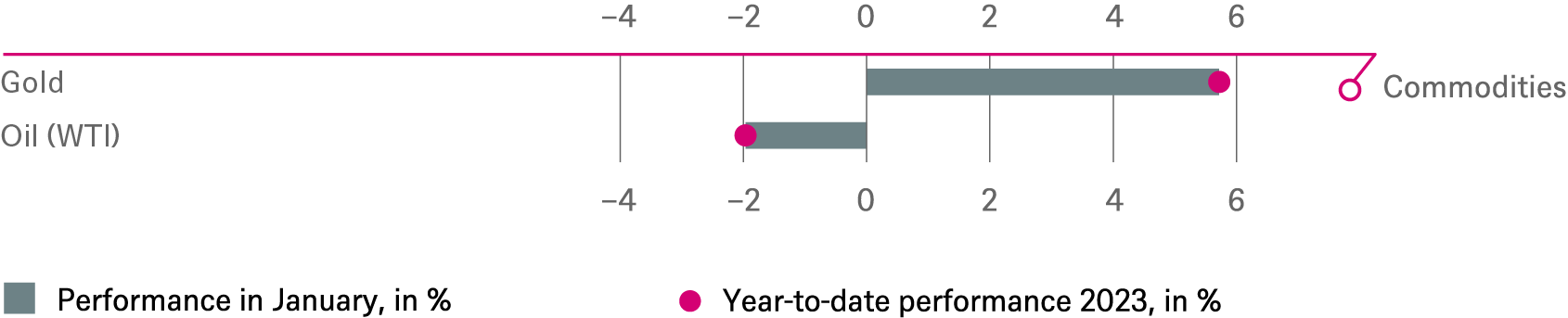

In commodity markets it was declining energy prices that boosted the mood of the rest of the market. Industrial metals rose, in some cases by double digits, probably because of China's reopening. In precious metals, silver slipped, while gold, probably due to strong central-bank purchases, was able to make significant gains, even in the risk-on environment. But gold did far less well than the other supposed money alternative, cryptocurrencies, whose most important representatives were able to gain 40% – from the lows to which they were beaten down last year.

2 / Outlook and changes

Incoming economic data in Europe and recent feedback from European companies is very consistent with our house view of a shallow recession. In the U.S., the bears are focusing on the persistent inversion of the yield curve – often seen as a sign of imminent recession – and poor retail sales numbers. But, more importantly in our view, U.S. inflation is clearly coming down and we expect the federal funds rate to peak in March/April at around 5%. This prospect has allowed investors to focus on the light at the end of the tunnel and to start the year in a positive mood. In addition, the rapid economic reopening in China has raised Asia’s growth prospects.

2.1 Monthly Pick: Emerging Markets upgrade

Emerging Markets (EM) equities bottomed out in early October. Since then, we have seen: 1) a dramatic U-turn in China’s Covid strategy; 2) better liquidity support for the Chinese property sector, 3) a modest improvement in geopolitical relations, with in-person talks between Biden and Xi; 4) favorable news on Chinese American Depository Receipts (ADR) listing rules; and 5) the Chinese government’s regulatory relief for the local technology sector, reasserting the importance of the private sector in China, following the government’s previous clampdowns. In addition, EM globally should benefit from an end to Fed monetary tightening and the U.S. dollar’s appreciation. We expect a rapid recovery in Chinese gross domestic product (GDP) in 2023, driven by consumption and services. Unlike in developed markets (DM), earnings in EM are expected to rise during 2023 (around 15% earnings-per-share (EPS) growth versus flat growth for the rest of the world) while the 33% price-to-earnings (PE) discount to the S&P 500 remains larger than the average for the past 20 years, of 25%.8 Therefore, we believe it is not yet too late to shift further funds into EM. We are upgrading EM and Asia ex Japan to “outperform,” relative to the MSCI AC World Index.

2.2 Fixed Income

Government bonds

Markets doubt the Fed’s determination to stick to higher rates for longer as inflation and economic data in the past couple of weeks seem to support a more dovish view. The peak interest rate itself might be the less critical issue – the market puts the peak slightly below 5% while most Fed members hint at more than 5%. The bigger potential for disappointment probably lies in the pace of rate cuts. Markets expect two rate cuts this year – we don’t.

The easy gains in the fight against inflation have been realized now, but progress might stall if oil and other commodities rebound, for example. We expect the Fed to pause at 5% (or slightly more). The recent market rally has already eased financial conditions slightly. But the Fed's credibility depends on remaining hawkish and not being forced into a premature pivot. We therefore believe 10-year Treasuries could rise further.

In German government bonds we have downgraded both 2-year and 10-year Bunds to -1 as we expect range trading with a slight upwards bias for the coming months during which the ECB will hike rates further.

For Italian 10-year bond spreads, we are now neutral (from -1), as markets seem to be in risk-on mode, with carry being preferred again. Surprisingly, there haven’t been political clashes between the EU and the new Italian government so far and the markets do not seem to be concerned about the big upcoming economic challenges and high yield levels.

The Bank of Japan (BoJ) decided to “enhance the sustainability of monetary easing” by doubling the yield cap on 10-year yields but maintaining the yield target at 0% and the main policy rate at -0.1%. They also want to improve the “functionality” of the market with this new policy twist. But the increasing interventions needed to keep the 10-year yield below the new ceiling of 0.5% are not making the market more liquid.

Investment-grade (IG) credit

U.S. downgrade to -1: The Fed is closer to the end of its hiking cycle, inflation is falling, and the increased concerns about earnings may begin to dampen the actual impact when expectations are missed.

We have upgraded Euro IG to +1. New issuance has slowed dramatically since the beginning of the year, while investors are cash rich leading to spread tightening.

High-yield credit

Despite the fact that the European Central Bank (ECB) has maintained its relatively hawkish narrative, the euro high-yield (HY) market has performed quite strongly this year so far. The higher-beta segments, especially, have been able to outperform while higher-quality credits have slightly underperformed the overall market. The primary market has reopened after the seasonal break in December. We still think that investors need to be prepared for high volatility and market swings. We expect macro factors to continue to remain dominant in the short run and therefore our tactical preference for the moment is to remain on the sidelines. The same is true for U.S. HY bonds.

Emerging markets

Asian credit has continued to rally, with investor sentiment positive as China continues to reopen and introduces supportive measures for the real-estate sector. Investors put cash to work in the run up to the Chinese New Year and HY outperformed IG. The primary market continued to be active, with new issuances achieving decent new-issue premiums. We also saw the first China HY property deal in over a year and expect more given the recent swing in sentiment. We maintain our tactical view at +1.

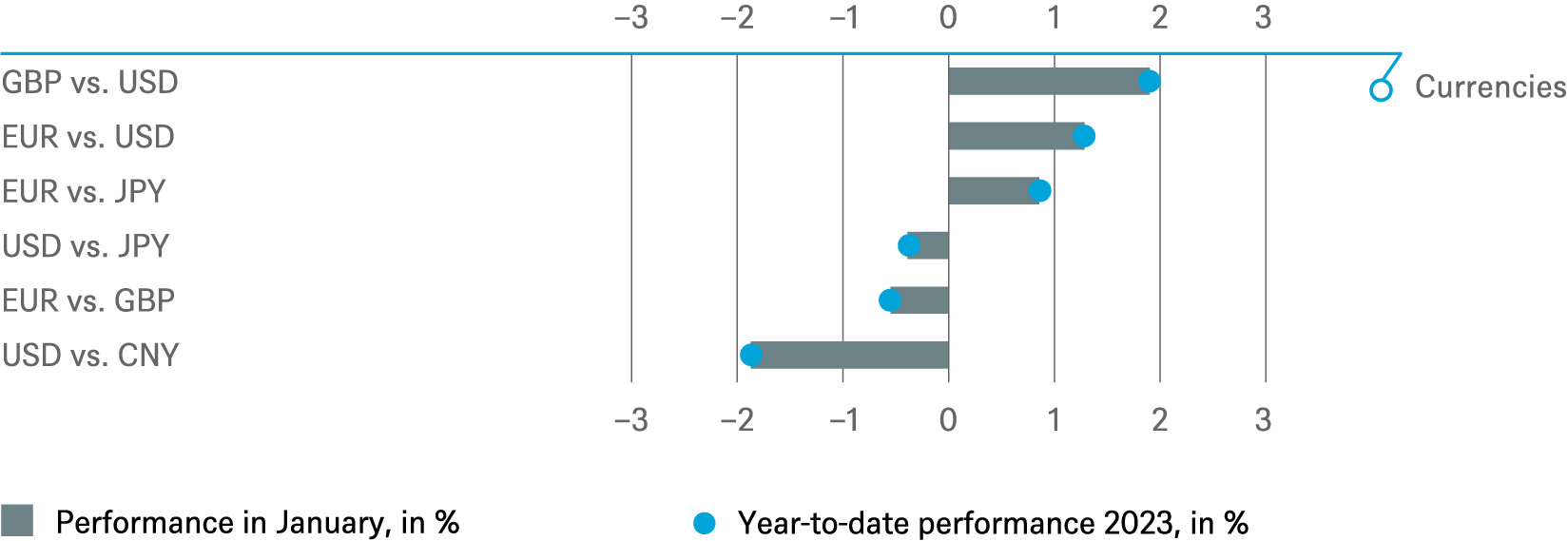

Euro vs. dollar

The ECB remains hawkish, sticking to the path for rate policy set out in December, which is supportive for the euro. Meanwhile, U.S. economists are revising up their economic outlook and yet the Dollar Index [9]is still trending lower. The market is still long euro and the net position in the international money market has changed little. At this juncture we are still biased towards being long euro but remain cautious.

2.3 Equities

As set out in more detail above, the markets had reasons to start the year on a positive note. For now, we are comfortable with our (strategic) S&P 500 December 2023 target of 4,100, which leaves only little upside from current levels. However, our European (tactical view: outperform) and emerging markets (tactical view: outperform) targets might have room for upward revision, as we think their excessive discount to the U.S. market has room to shrink further. However, despite some macroeconomic relief, we do not want to become too bullish. Corporate margins reached historical records in 2022, helped by companies’ ability to raise prices. As pricing power and inflation are fading, we expect corporate margins to decline in Europe and the U.S. and therefore forecast flat earnings for the MSCI World Index in 2023. The lack of EPS momentum might persist for quite some time. We are concerned that global equity markets may have entered an extended period in which their annual return potential is limited to just 0% to 5% while bonds, whose outlook in our view is better than equities’, offer an appealing alternative.

A cyclical case can not only be made for Asia but probably for European small- and mid-caps, too. Following a period of clear underperformance vs. their large-cap peers we have reviewed and reconfirmed our “outperform” call on the MSCI Europe SMid Cap Index vs. the Stoxx 600. These smaller stocks should be driven by less defensive sector weighting, better-than-average EPS growth and a probable recovery in valuations. In addition, mergers & acquisitions (M&A) activity, which paused last year but historically has added 2% to small&mid cap outperformance, should begin again, as large companies use their cash-flows to grow their overall revenues.

With regard to sectors, we have made three changes. Most defensive stocks have become too expensive in our view as investors shifted to (perceived) safe havens when economies slowed. We cannot see sector-specific catalysts that could extend the 20% to 30% PE premium even further and are therefore downgrading consumer staples to underweight and health care to neutral.

We are shifting money into the communication services sector (upgraded to outperform). As a reminder, the sector was “created” 4 years ago by merging the “defensive” telecommunications sector and “growth-oriented” (social) media industry. In telecoms we expect improving cash-flows due to the fading 5G and fiber capex cycle. In addition, we see initial signs that telco pricing power in Europe is improving. During the past 12 months (social) media stocks have seen a significant re-set of their earnings expectations and valuation levels. We believe that this process is already more advanced than in the IT sector, justifying an upgrade.

U.S. Market

A shallow recession and soft landing for the U.S. labor market should limit the negative impact on consumer spending. Rising real interest rates will, however, put pressure on valuation multiples, especially for long-duration companies. Consensus EPS and margin assumptions are too optimistic.

European Market

In Europe, the excessive valuation discount to the U.S. should shrink as the economy is developing relatively better. The positive relative view also applies elsewhere: wage increases are lower than in the U.S.; institutional investors’ poor sentiment on pan-European equities has not yet subsided completely; EPS revisions are more resilient than in the U.S. Our preferred sector is pan-European banks.

Emerging Markets

EM are upgraded to outperform. Their current valuation levels are too low and they are beneficiaries of the rapid Chinese reopening, the expected end of the Fed’s hiking cycle in mid-2023 and the U.S. dollar weakening should benefit this asset class. International investors have not yet returned.

2.4 Alternatives

Real Estate

U.S. real-estate investment performance has stumbled in response to rising interest rates. But property fundamentals are robust. While a mild recession might soften leasing momentum, we believe that markets will remain tight as construction slides. In our view, high interest rates will put further downward pressure on real-estate values in 2023. This repricing, amid healthy underlying fundamentals, should create attractive investment opportunities.

European property prices have undergone a significant correction over the past six months. However, we believe that most of the expected decline has now happened, and we anticipate that the full extent of the price correction should be over by the middle of this year, with a recovery beginning soon after. Occupant fundamentals remain in good shape, and any downturn is expected to be mild. Interest rates continue to rise as inflation remains elevated in early 2023 but falling commodity prices provide some upside to the near-term outlook. In our view, the repricing of the market creates an opportunity for newly allocated capital to engage in real-estate investment strategies. We continue to favor the residential sector, including operational residential such as student housing and senior living. we see the significant revaluation of the logistics sector as now providing an attractive (re-)entry point, while price dislocation between prime and secondary office assets should also provide strong opportunities for the refurbishment of aging assets as part of a value-add or impact strategy.

In Asia, high inflation, rising interest rates and weak economic growth are likely to pose near-term headwinds to real-estate investments as investors and occupants recalibrate their strategies. The repricing of commercial real estate due to rising yields will likely continue this year, creating better investment opportunities in core Asia-Pacific markets such as Australia and South Korea, compared to high-priced Japan. Investors should focus on quality- and ESG-oriented assets in sectors with positive demand-supply fundamentals, such as emerging office locations, active logistics and the developing living sector.

Infrastructure

Significant economic turmoil – including recession - will continue to put pressure on markets, making the defensive characteristics of infrastructure more important than ever. The infrastructure market has not been immune to wider market caution but data continues to support robust returns and a solid outlook for fundraising and transactions. We believe there will likely be a continued focus on infrastructure characteristics as investors look to tap into the growing opportunity offered by the energy transition. We expect that Europe will transform not only its energy sector but also its wider economy through infrastructure investment.

Gold

Real (U.S.) interest rates have edged lower so far this year as assets have rallied broadly and financial conditions have eased. In our view, incoming inflation data, labor-market data, and Fed-speak would all need to remain benign to provide further near-term upside in precious metals. We are skeptical that this will happen.

Oil

We have upgraded oil on the basis of positive short-term and long-term expectations. We expect OPEC+ to keep global inventories steady to maintain the current price range. We still expect Brent crude to rise to a price of $100 by year-end.

Past performance is not indicative of future returns.

Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 1/31/22

4 / Tactical and strategic signals

The following exhibit depicts our short-term and long-term positioning.

4.1 Fixed Income

Rates |

1 to 3 months |

until Dec 2023 |

|---|---|---|

| U.S. Treasuries (2-year) | ||

| U.S. Treasuries (10-year) | ||

| U.S. Treasuries (30-year) | ||

| German Bunds (2-year) | ||

| German Bunds (10-year) | ||

| German Bunds (30-year) | ||

| UK Gilts (10-year) | ||

| Japanese government bonds (2-year) | ||

| Japanese government bonds (10-year) |

Spreads |

1 to 3 months |

until Dec 2023 |

|---|---|---|

| Spain (10-year)[10] | ||

| Italy (10-year)[10] | ||

| U.S. investment grade | ||

| U.S. high yield | ||

| Euro investment grade[10] | ||

| Euro high yield[10] | ||

| Asia credit | ||

| Emerging-market credit | ||

| Emerging-market sovereigns |

Securitized / specialties |

1 to 3 months |

until Dec 2023 |

|---|---|---|

| Covered bonds[10] | ||

| U.S. municipal bonds | ||

| U.S. mortgage-backed securities |

Currencies |

1 to 3 months |

until Dec 2023 |

|---|---|---|

| EUR vs. USD | ||

| USD vs. JPY | ||

| EUR vs. JPY | ||

| EUR vs. GBP | ||

| GBP vs. USD | ||

| USD vs. CNY |

4.2 Equity

Regions |

1 to 3 months[11] |

until Dec 2023 |

|---|---|---|

| United States[12] | ||

| Europe[13] | ||

| Eurozone[14] | ||

| Germany[15] | ||

| Switzerland[16] | ||

| United Kingdom (UK)[17] | ||

| Emerging markets[18] | ||

| Asia ex Japan[19] | ||

| Japan[20] |

Style |

1 to 3 months |

|

|---|---|---|

| U.S. small caps[31] | ||

| European small caps[32] |