"Prompting” is swiftly becoming a key skill. Before very long, knowing how to engage with artificial intelligence (AI) and providing it with context and nuance will be essential for any student or white-collar worker. Generative AI promises big boosts in productivity. Its varied uses are already becoming clear in areas such as programming or summarizing existing human knowledge of potential relevance for a specific client question in, say, business consulting.[1] Large language models (LLM) can also offer a much more natural user interface with specialized applications suited to the task in question. The trick is to assess their replies with specific goals in mind.

Take the question of how (not) to identify the long-term beneficiaries of AI in the stock market. This is a good example of what AI can do, but also where there are likely to be limitations – at least for the foreseeable future. “It only knows what it has seen and seen enough times to make sense of,” as an excellent primer for newcomers on the topic has it.[2] As we previously described, recent advances in AI can – if used properly – be extremely useful for augmenting, rather than replacing human expertise. Pattern recognition tends to be of limited use, if encountering rare or unusual problems.[3] Perhaps more importantly, it will take time for AI users, both individuals and companies, to reorganize how they work around the new possibilities AI is opening up.[4] For example, a good prompt asking for stock-market beneficiaries might helpfully include a reference to Clayton Christensen's thinking on different types of innovations[5] (see our article “Electrification: The Innovator’s Dilemma”[6]) or ideas of picking high-quality stocks generally (see our article ”Quality: A guide for stock pickers”[7]). Do not simply expect it to automatically “understand” the relevant context, though.

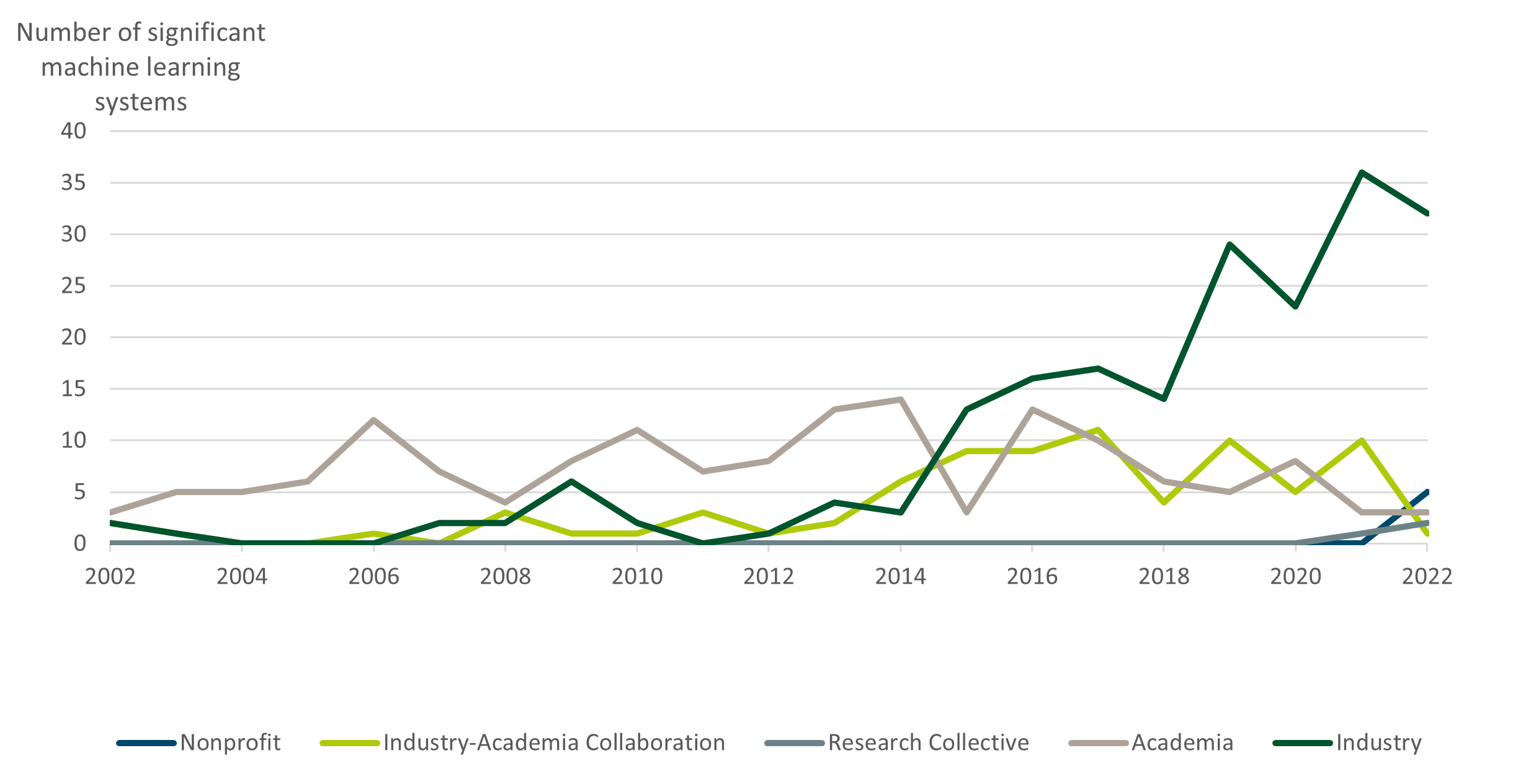

Industry rather than academia takes the lead

Source: “The AI Index 2023 Annual Report,” AI Index Steering Committee, Institute for Human-Centered AI, Stanford University, Stanford, CA, April 2023

In terms of identifying long-term beneficiaries of AI, two bits of context any experienced human investor knows are that (a) forecasts are extremely tricky for disruptive technologies[8]and (b) AI has been a hot topic in recent months, driving up relative valuations. Markets are adaptive. Companies have incentives to tell their investors what those investors want to hear. Knowing this, one might, for example, use AI to look for companies which have been investigating – and bragging – about their transformative AI potential for years, rather than focusing on recent converts or comments during the latest earnings calls. It also helps to keep an eye on developments beyond the U.S., especially in Asia.[9]

Recent progress has been years in the making. Consider how far AI has come, for example, in playing chess. In 2017, it was announced that Deep Mind’s AlphaZero could trounce “the strongest superhuman chess engine,” entirely by teaching itself, “without learning established human wisdom on chess strategy.”[10]Of course, self-taught AI programs would work nowhere near as well if the rules kept changing. Still, in many areas, AI is already accelerating scientific discovery and innovation. This includes an increasing share of applied research by industry, rather than academia (see chart), promising readily applicable breakthroughs. “We believe that AI beneficiaries have powerful levers to drive future revenue and profit growth. In our analysis we put particular emphasis on the moat – that is, the durable competitive advantage – around a company's AI product as well as its related growth potential,” explains Tobias Rommel, Senior Portfolio Manager at DWS.