- Home »

- Insights »

- Global CIO View »

- Chart of the Week »

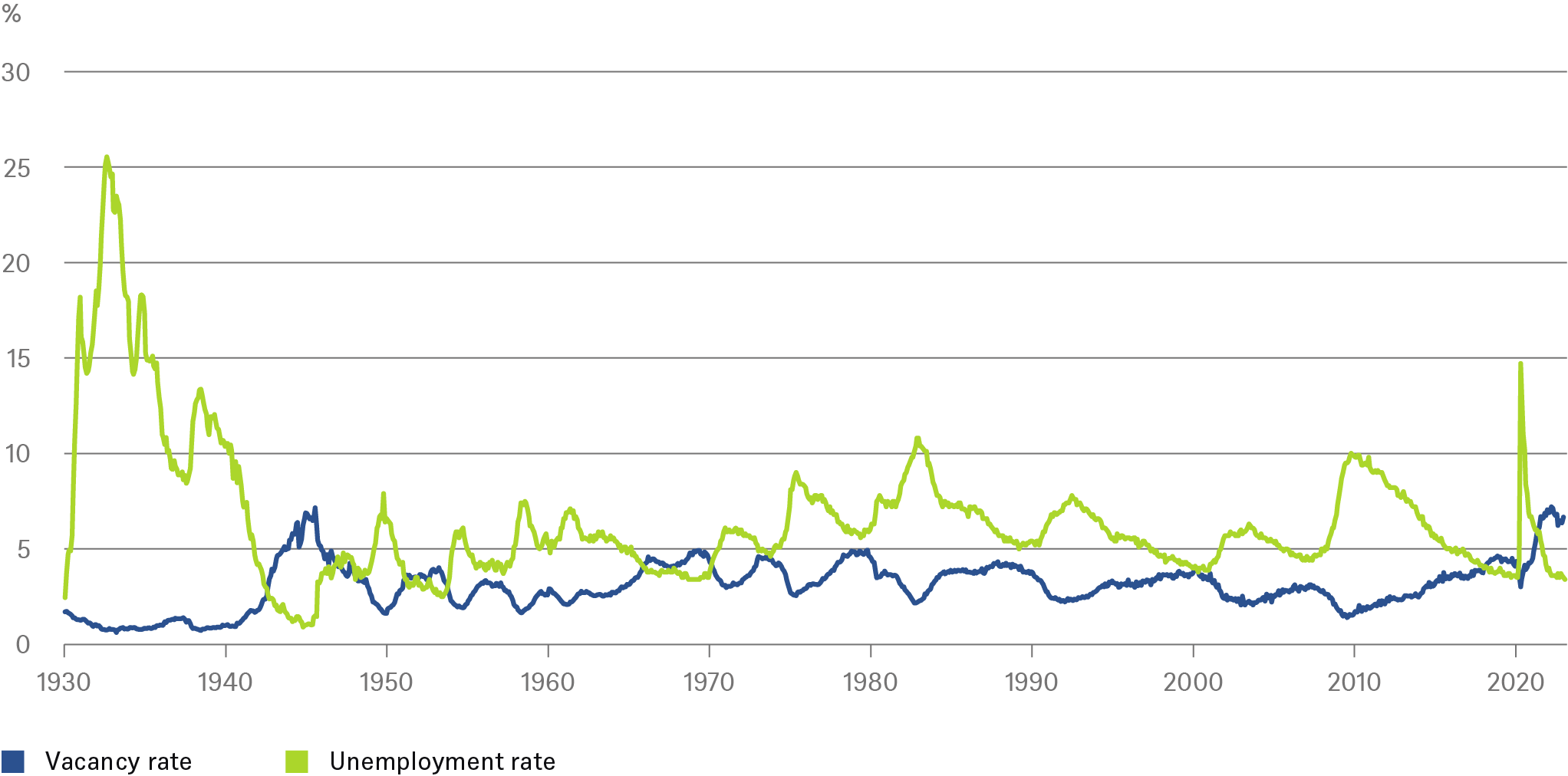

- Plenty of U.S. jobs, still too few takers

Job openings and job seekers

Sources: Reproduction of Michaillat, Pascal, and Emmanuel Saez. 2022 (https://doi.org/10.48550/arXiv.2206.13012) by the use of data from Barnichon (2010), Petrosky-Nadeau & Zhang (2020) and Bureau of Labor Statistics (2022), DWS Investment GmbH as of 3/1/23

There are many explanations for today's oversupply of jobs. To start on the (labor) demand side, companies are probably delaying layoffs because they are afraid they will not find enough workers when they need them again. Moreover, there are probably some mismatches, not least in geographical and skills terms, between job seekers and jobs being created, for example in the course of the reshoring initiatives. On the (labor) supply side, there are additional possible reasons that could explain the shortage: workers have become more choosy, as the lavish financial aid during the Covid crisis allowed them to build up a cushion that gives them corresponding leeway; the improved possibilities of working from home allow for more part-time work; in the course of the Covid crisis, an above-average number of people retired.

It will probably be a few more quarters before the reasons for the distortions in the labor market start to be fully understood. But central bankers and investors have to worry about unemployment rates, wage trends and inflation in the here and now. No wonder, then, that bankers and investors are so data dependent and that interest rate and inflation expectations remain so volatile in financial markets. "If it were solely for the labor market, which shows no signs of weakening, the Fed would have to raise interest rates to 5 or 6%", Christian Scherrmann, USA economist at DWS, sums up the current situation.