- Home »

- Insights »

- Global CIO View »

- Chart of the Week »

- Too few companies use internal water pricing

Still too few companies are using internal ‘shadow’ water pricing

* MSCI All Country World Gross TR Index, Market cap as of 2/28/23

Sources: CDP database, DWS analysis 2023, DWS Investment GmbH as of 3/15/23

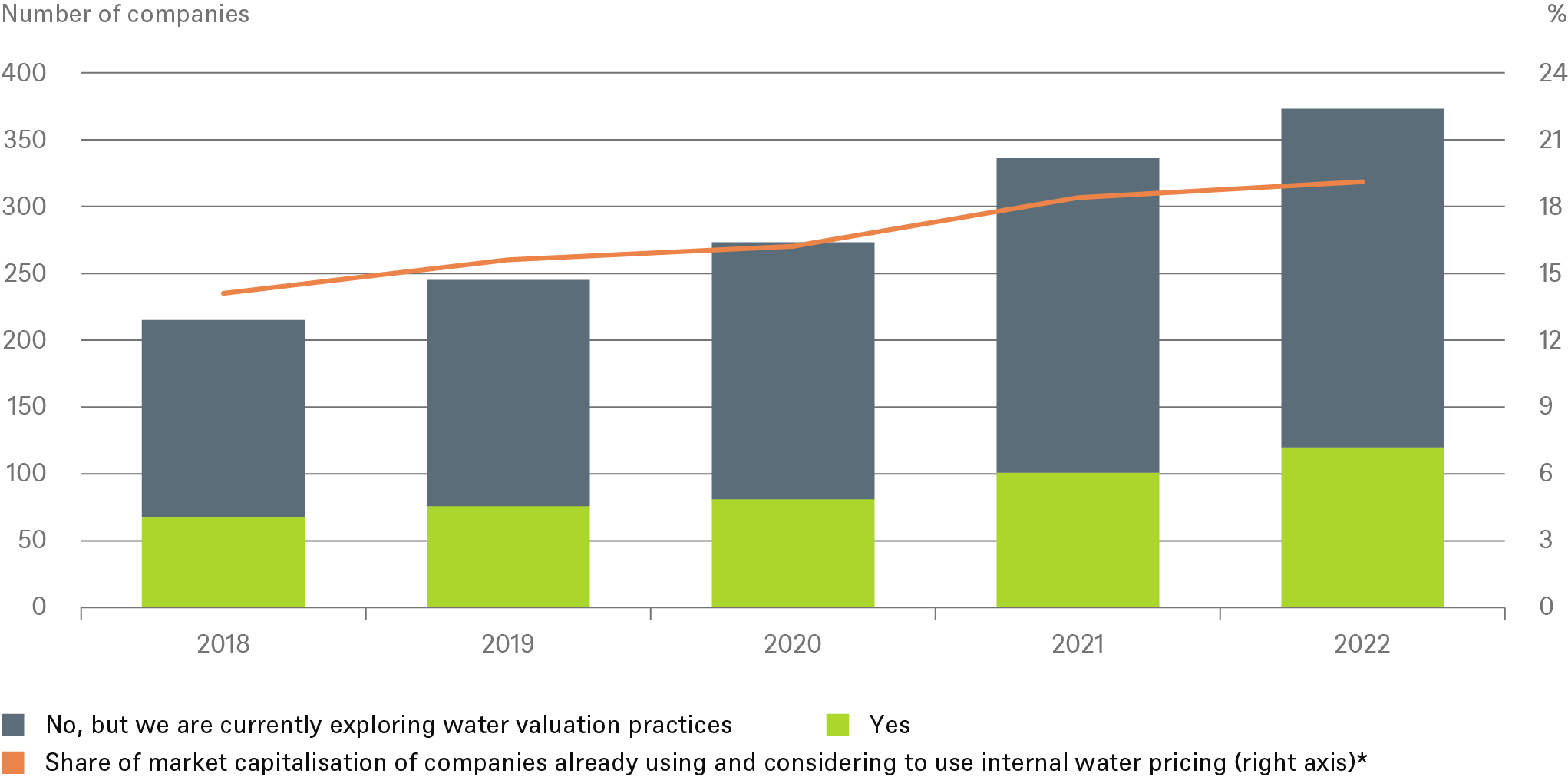

We find that out of the roughly 2,800 companies in the MSCI All Country World Index (ACWI), the number of companies using internal water pricing grew from just 68 to 120 companies, since 2018. Moreover, the number of companies planning to use internal water pricing grew from 147 to 253 companies during that time period. In total, these groups of companies represent 19% of the market capitalization of ACWI. In comparison, 700 companies are making water related disclosures to CDP[1]. Also, only thirty companies disclosed the internal water pricing that they use and for most companies the price appears very low and not reflective of environment externalities.

In comparison, 648 companies used internal carbon pricing last year and 396 companies plan to, representing 37% of ACWI market capitalization. The internal carbon prices used by companies are also much higher[2], ranging from 18-28 dollar per metric ton with some companies using multi-hundred-dollar carbon prices.

The investors (including DWS) participating in the Valuing Water Finance Initiative[3], expect companies to reduce water use and water pollution, as well as improve disclosure on the topic. To gain a rough idea of just how large the impact could be, Ceres[4], Bluerisk[5] and DWS have examined the financial implications of companies being required to clean up and reduce their water use[6]. For some large publicly traded packaged meat and apparel companies, the additional costs could range from 60 million dollars to 1.8 billion dollars annually, representing a material part of earnings of the businesses concerned. It is a topic we will no doubt return to.