- Home »

- Insights »

- Global CIO View »

- Investment Traffic Lights »

- Investment Traffic Lights

- Normally, now would be the season in which investors can start to relax and prepare for traditional events: Christmas and the year-end rally.

- Instead, markets are caught between economic slowdowns and central bank pivots.

- We remain cautious overall, even as we start to see some positive trends beginning to emerge, for example in individual corporate bond segments.

1 / Market overview

1.1 October’s UK outlier that wasn’t entirely an outlier

In October the United Kingdom once again managed to dominate global headlines. On the surface, the story seemed to be all about politics, as the third government under the third prime minister took the helm within a few weeks. But the roughly 7-week episode of Liz Truss also had something important to say to governments and investors: Capital markets are once again looking for fiscal discipline and political stability.

The turmoil in the currency and bond markets that followed, the so-called “mini budget” ultimately led to the fall of the government. But that furor - which culminated in highly unusual, very critical commentary on the budget from the IMF, the U.S. and some rating agencies - would have been a lot less furious if it had only been about specifically British problems. After all, many economies are currently struggling with similar issues. High inflation rates, a cooling economy, a monetary policy that has to change from extremely expansionary to significantly restrictive, and a fiscal policy that wants to cushion the downturn and the cost-of-living crisis without completely counteracting the monetary authorities' fight against inflation – none of these are particularly British problems. Losing the confidence of the capital markets in this struggle would be fatal for most governments and central banks.

But political stability can also be overdone if power is being concentrated and democracy and markets restricted. The market reaction to the party congress in China, in which the shift from leadership by a party to leadership by the incumbent person continued, was anything but gracious. However, tighter restrictions by the U.S. government, especially on exports of semiconductor technology to China, and the Chinese government’s lack of pronouncements on easing Covid lockdowns and modifying real estate market policy also contributed to the weakness.

1.2 Markets caught between economic slowdown and central bank pivot

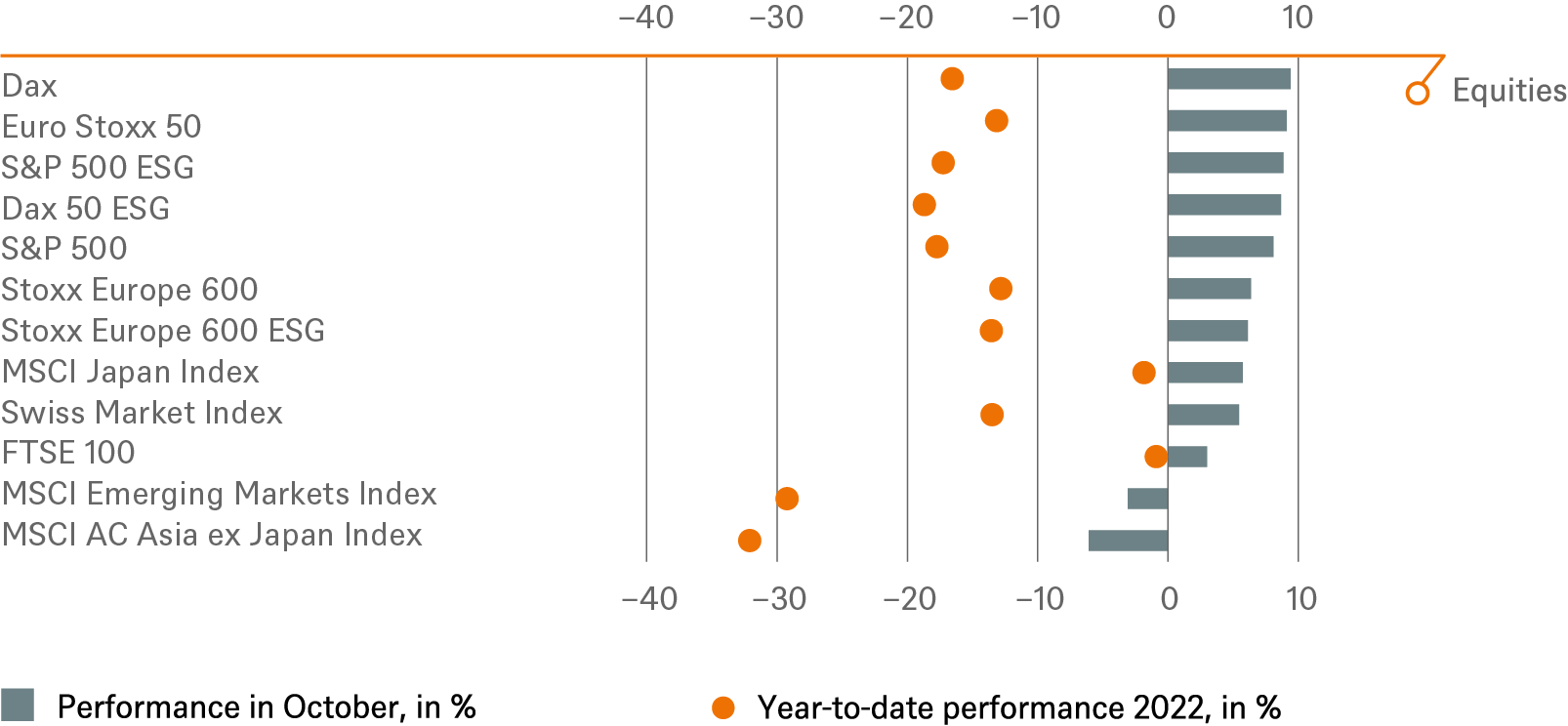

Concerns that the primacy of politics over the economy in China has grown still led to a further weakening of the renminbi, outflows of foreign capital, and a 16.6% drop in the MSCI China Index in October. That dragged the overall MSCI EM emerging market index down 3.1%, while nearly all other regions ended the month up. U.S. equities led the way, but again despite, rather than because of, their technology heavyweights. The more "old-fashioned" Dow, for example, achieved its best October since 1976 with a 14% gain, while the tech-heavy Nasdaq was up only 3.9%[1]. Further increases in bond yields, firmer oil prices and concerns about a potential deepening recession also drove the performance of other sectors. Financials and energy again performed well alongside the healthcare sector, while utilities, real estate and consumer stocks lagged. Overall, the reporting season was unspectacular, and the same was true for macroeconomic performance: both in Europe and in the U.S., the GDP figures for the third quarter surprised positively, while the leading indicators (such as purchasing managers' indices) disappointed negatively.

Although the UK led the spike in bond yields, it was again inflation figures (Eurozone consumer price inflation in October: 10.7%) and still quite strong labor markets that pushed many yields to new heights. U.S. Treasury yields all rose above 4%, and Bund yields above 2%. Corporate bond yields also scaled new heights, and in the high-yield segment yields of over 9% in the U.S. and over 8% in Europe were on offer[2]. The dollar index, by contrast, was unable to match its September highs. However, this did not help gold either. The precious metal closed in the red again, for the seventh month in a row, which has never happened in the last hundred years. Do not read too much into that, though: for much of the first half, the U.S. dollar, in which gold is denominated, was still on the gold standard. As with British politics, context certainly matters when it comes to these types of market stats.

2 / Outlook and changes

Usually, this would be the season when investors relax and begin to prepare for traditional events: Christmas and a year-end stock market rally. Whether the latter will happen this year depends on several factors, but overall, we think the headwinds are too strong. And that is even without an escalation of Russia’s war on Ukraine conflict or further energy export restrictions on the aggressor. There is the potential, for example, for other geopolitical conflicts to escalate, especially those between China and the U.S.. Taiwan is a point of contention and there is also the possibility of further U.S. trade restrictions (and countermeasures) by the end of the year. Also, China's Covid policy remains a risk, as investors’ hopes for an easing of pandemic control have been consistently disappointed, time after time.

This is also the case with the central bank ‘pivot’ that investors are longing for. Here, too, their hopes, which first appeared in the summer, of a central bank turnaround away from their restrictive monetary policy have so far been disappointed. Why is obvious – the sooner central banks fuel such hopes, the sooner financing conditions will improve, with the danger of fanning inflation that still remains extremely high. Indeed, we may not have seen yet its full impact on profit margins, although some companies could benefit from it.

There are plenty of other factors too, at the moment, that are important to markets, where it is unclear as to whether they will soon have a positive, negative or somewhere-in-between-impact. Take volatility. It has declined somewhat from its highs in various areas of the market, but especially in bonds and foreign exchange (FX), the upside trend still looks intact from a longer-term perspective. For equities, one could charitably speak of a sideways movement. For equity valuations, the real interest rate is just as important as volatility. In the U.S., 10-year real rates (TIPS) initially jumped from -1 to over zero this year, and then in a further leap to 1.5%, where they remain – and have done so for about six weeks already. To gain strength for the next jump? Or to go into reverse again soon? What remains is the mood and the so-called positioning of professional investors on the markets. Sentiment remains poor, which some would call a good contra indicator. The reporting season has been rather neutral so far. It has not yet caused the market to make a major correction to 2023 forecasts. The consensus still expects an 2023 earnings increase over 2022 for the U.S.. That may not be realistic. And of course, what doesn't help equities is the fact that they are no longer without alternative, as corporate bonds in particular, are again yielding decent returns

2.1 Fixed Income

Whisper it softly, at least for now. But it seems like markets are somewhat getting used to persistently high inflation prints and aggressive central bank monetary tightening. The problem is that we still think inflation will prove stickier than many investors assume and that their patience is likely to be tested along the way. For one thing, higher energy prices have only just started to feed through to most European consumers, though the speed will vary in a potentially quite hard to predict fashion from country to country and indeed household to household; there is a lot of diversity in regulations, government aid packages and, last but not least, contractual arrangements on a households can choose from, across the European Union’s 27 member states.

Meanwhile, Quantitative Tightening (QT), or at least fears over how smoothly central banks will be able to shrink their bloated balance sheets without volatility spiking, appears set to remain a persistent source of worry, especially in the U.S.. In the short-term and the short end, though, we think there might be some scope for U.S. Treasury yields to decline. For European government bond yields, we mostly expect range trading for now and hence stay on the sidelines. On Italy, we remain cautious not least as the new rightwing government has yet to prove it can work smoothly with its European partners.

As for the traditionally riskier parts of this asset class, we think that they are likely to remain volatile but are starting to see some positive trends beginning to emerge. Of course, setback risks remain, and we are still cautious on U.S. investment grade (IG) bonds. In European IG, we think that investors focus will increasingly shift towards asset class specific fundamentals, meaning there will be more differentiation between sectors and single name credits. Meanwhile, China’s economic we believe weakness for some might persist a while yet. As for other risky asset classes, including emerging market sovereigns and high-yield corporates in both Europe and the U.S., we currently view tactical risks and rewards as evenly balanced. In foreign exchange markets, we think the euro is likely to regain ground over time but may struggle to sustainably rise above parity with the dollar in the short-term.

2.2 Equities

Rising yields are changing the math for equity valuations, since stock markets compete with bonds for investor money. Throughout 2022, higher inflation expectations have led to volatile and rising interest rates which is putting pressure on price-to-earnings (PE) ratios, for long-duration stocks, in, for example, information technology, communication and e-commerce. The mood in October was not helped by a series of high-profile stumbles by US technology behemoths, highlighting that the earnings in the PE equation could also be at greater risk than expected during recessionary times.

In line with our economists, we assume a shallow and short winter-recession in Europe and in the U.S.. We believe the cyclical headwind, elevated energy- and commodity-prices, and deteriorating investor and consumer confidence should all result in lower corporate pricing power and weakening demand. We expect consensus earnings-per-share (EPS) expectations for 2023 to continue to drop for global equites until year end, with 0% earnings progression next year becoming our new baseline expectation.

In the short-term, we are cautious about the prospects for U.S. stock markets and would not be surprised to see setbacks in the coming months. Looking further out, we are less concerned about the arrival of a severe recession, but more about the weakness of the light at the end of the tunnel. The global economy might be entering an extended period of weak growth below potential as some of the digitalization trends and Chinese growth seem to moderate. In addition, already elevated profitability margins look set to offer little operating leverage. And all this is before even taking into account the geopolitical risks mentioned above. Against this backdrop, we are leaving our tactical calls unchanged, retaining an overweight on health care and an underweight real estate. These calls have worked out very well so far this year.

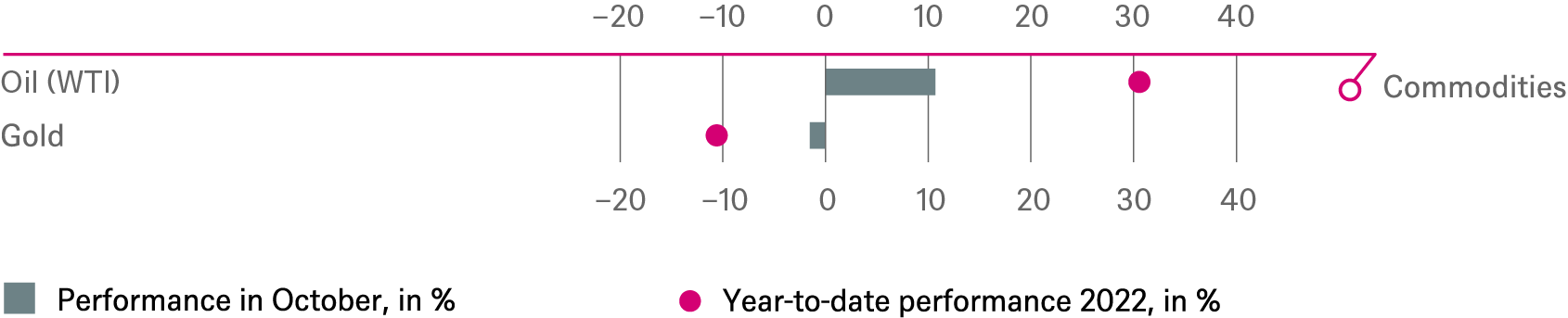

2.3 Alternatives

Energy markets remain physically tight across the board, but the outlook is starting to look less clear for oil prices, following last month’s gains. Supportive factors include OPEC+ production cuts, low inventories, and the potential for further EU and U.S. measures targeting Russian crude and refined products. Set against this, though, there are growing demand concerns due to slowing economic growth, seasonal refinery maintenance, and the ongoing releases of U.S. strategic oil reserves (SPR). Rather than replenishing them once the midterm elections are out of the way as some had hoped, the Biden administration looks set to continue drawing down reserves through December at a minimum.

As for gold, that supposed hedge against all sorts of disasters, we have already mentioned the disappointing price pattern since March, i.e. at a time of the largest war in Europe in 77 years and inflation rising far more quickly than most had expected. Dollar strength and the significant rise in real interest rates turned out to the more relevant drivers of the gold price and have already begun to stabilize. We expect gold to remain range bound, with strong support whenever gold dips towards 1600. In commodity markets as in politics, all losing streaks tend to end – eventually. And, as a portfolio diversifier, the precious metal probably still has its uses, perhaps at least for another 100 years.

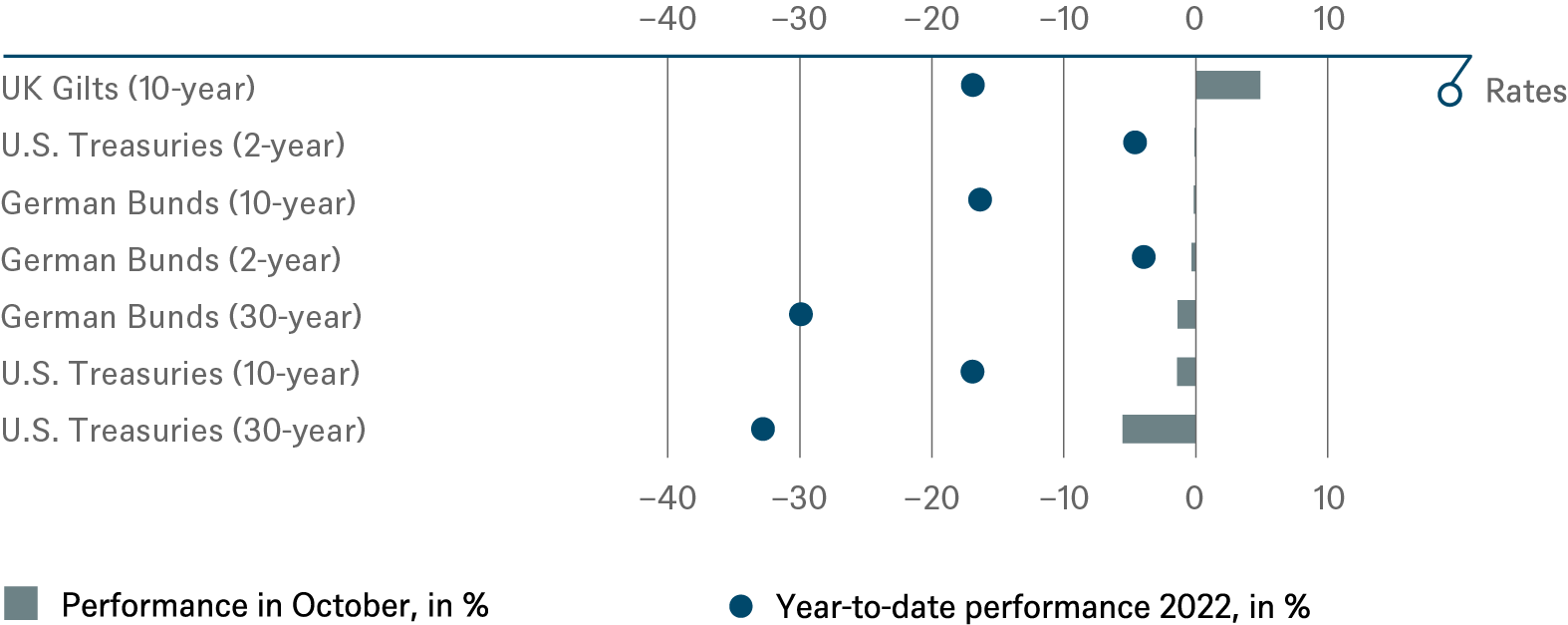

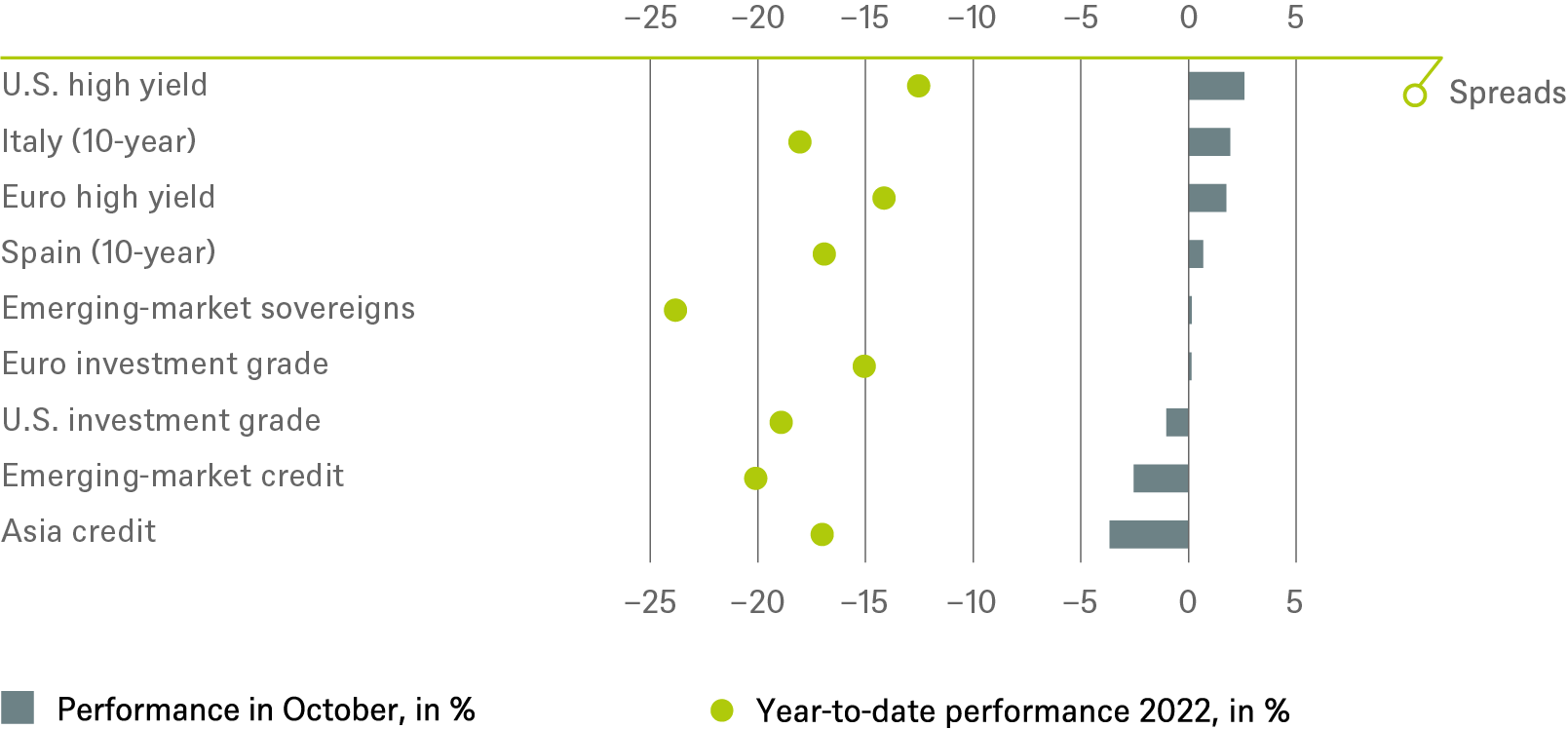

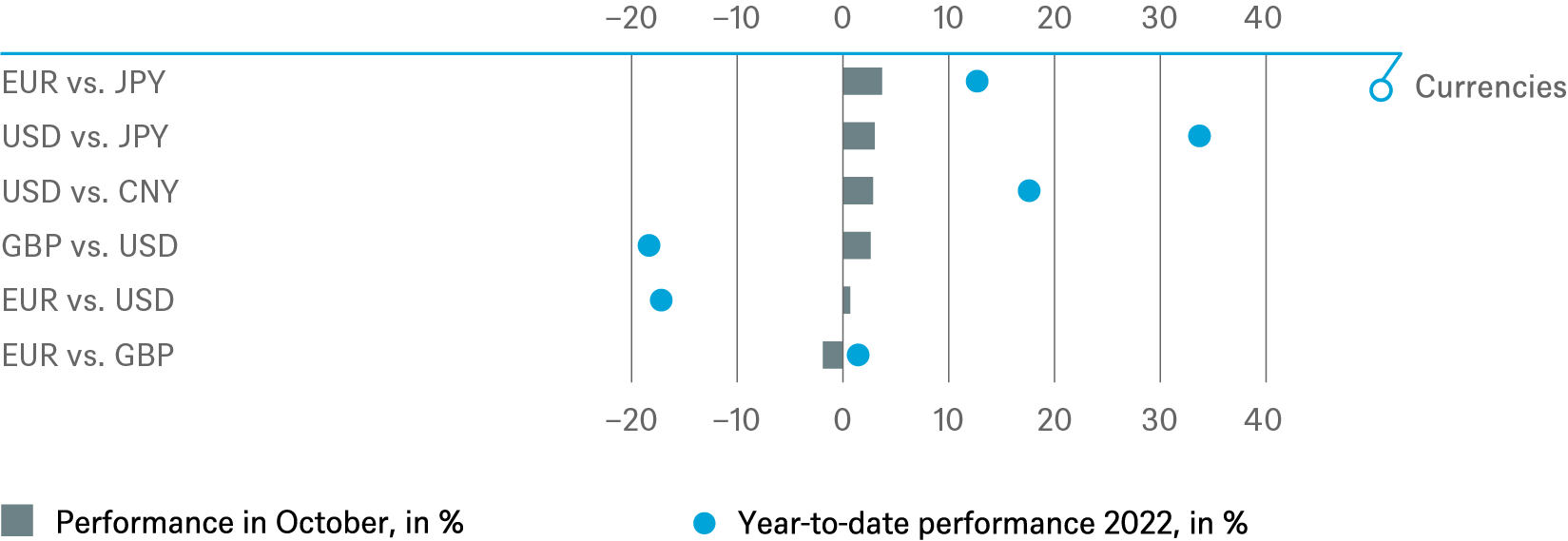

3 / Past performance of major financial assets

Total return of major financial assets year-to-date and past month

Past performance is not indicative of future returns.

Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 10/31/22

4 / Tactical and strategic signals

The following exhibit depicts our short-term and long-term positioning.

4.1 Fixed Income

Rates |

1 to 3 months |

until Sep 2023 |

|---|---|---|

| U.S. Treasuries (2-year) | ||

| U.S. Treasuries (10-year) | ||

| U.S. Treasuries (30-year) | ||

| German Bunds (2-year) | ||

| German Bunds (10-year) | ||

| German Bunds (30-year) | ||

| UK Gilts (10-year) | ||

| Japanese government bonds (2-year) | ||

| Japanese government bonds (10-year) |

Spreads |

1 to 3 months |

until Sep 2023 |

|---|---|---|

| Spain (10-year)[3] | ||

| Italy (10-year)[3] | ||

| U.S. investment grade | ||

| U.S. high yield | ||

| Euro investment grade[3] | ||

| Euro high yield[3] | ||

| Asia credit | ||

| Emerging-market credit | ||

| Emerging-market sovereigns |

Securitized / specialties |

1 to 3 months |

until Sep 2023 |

|---|---|---|

| Covered bonds[3] | ||

| U.S. municipal bonds | ||

| U.S. mortgage-backed securities |

Currencies |

|

|

|---|---|---|

| EUR vs. USD | ||

| USD vs. JPY | ||

| EUR vs. JPY | ||

| EUR vs. GBP | ||

| GBP vs. USD | ||

| USD vs. CNY |

4.2 Equity

Regions |

1 to 3 months[4] |

until Sep 2023 |

|---|---|---|

| United States[5] | ||

| Europe[6] | ||

| Eurozone[7] | ||

| Germany[8] | ||

| Switzerland[9] | ||

| United Kingdom (UK)[10] | ||

| Emerging markets[11] | ||

| Asia ex Japan[12] | ||

| Japan[13] |

Style |

1 to 3 months |

|

|---|---|---|

| U.S. small caps[24] | ||

| European small caps[25] |

4.4 Legend

Tactical view (1 to 3 months)

- The focus of our tactical view for fixed income is on trends in bond prices.

- Positive view

- Neutral view

- Negative view

Strategic view until September 2023

- The focus of our strategic view for sovereign bonds is on bond prices.

- For corporates, securitized/specialties and emerging-market bonds in U.S. dollars, the signals depict the option-adjusted spread over U.S. Treasuries. For bonds denominated in euros, the illustration depicts the spread in comparison with German Bunds. Both spread and sovereign-bond-yield trends influence the bond value. For investors seeking to profit only from spread trends, a hedge against changing interest rates may be a consideration.

- The colors illustrate the return opportunities for long-only investors.

- Positive return potential for long-only investors

- Limited return opportunity as well as downside risk

- Negative return potential for long-only investors