- Home »

- Insights »

- Global CIO View »

- Investment Traffic Lights »

- Investment Traffic Lights

- In the first two months of the second quarter the markets were friendly. Despite slightly rising bond yields, equities continued to rise, driven by dreams of artificial intelligence inspired growth.

- Central banks face the difficulty that both economic growth and core inflation are proving slow to decline.

- In our new 12-month targets we assume a mild economic cycle, which should be sufficient to provide positive real returns for many asset classes.

1 / Market overview

1.1 Central banks remain data dependent; data remains mixed

Our last quarterly strategy meeting, at the beginning of March, coincided with the beginning of the recent episode of turbulence in the U.S. banking sector. There was no domino effect and we continue not to expect a conflagration in the U.S. banking system for the time being – and yet the March episode is still having some impact.

Banks have become more cautious about lending and U.S. Treasury rates have fallen by up to half a percentage point (for 2-year paper). Risk premiums on U.S. corporate bonds, however, remain slightly above pre-bank turbulence levels, though they are moving back in the right direction. In short, the U.S. regional banking crisis has shaken the market but not provoked a monumental shock with serious economic implications.

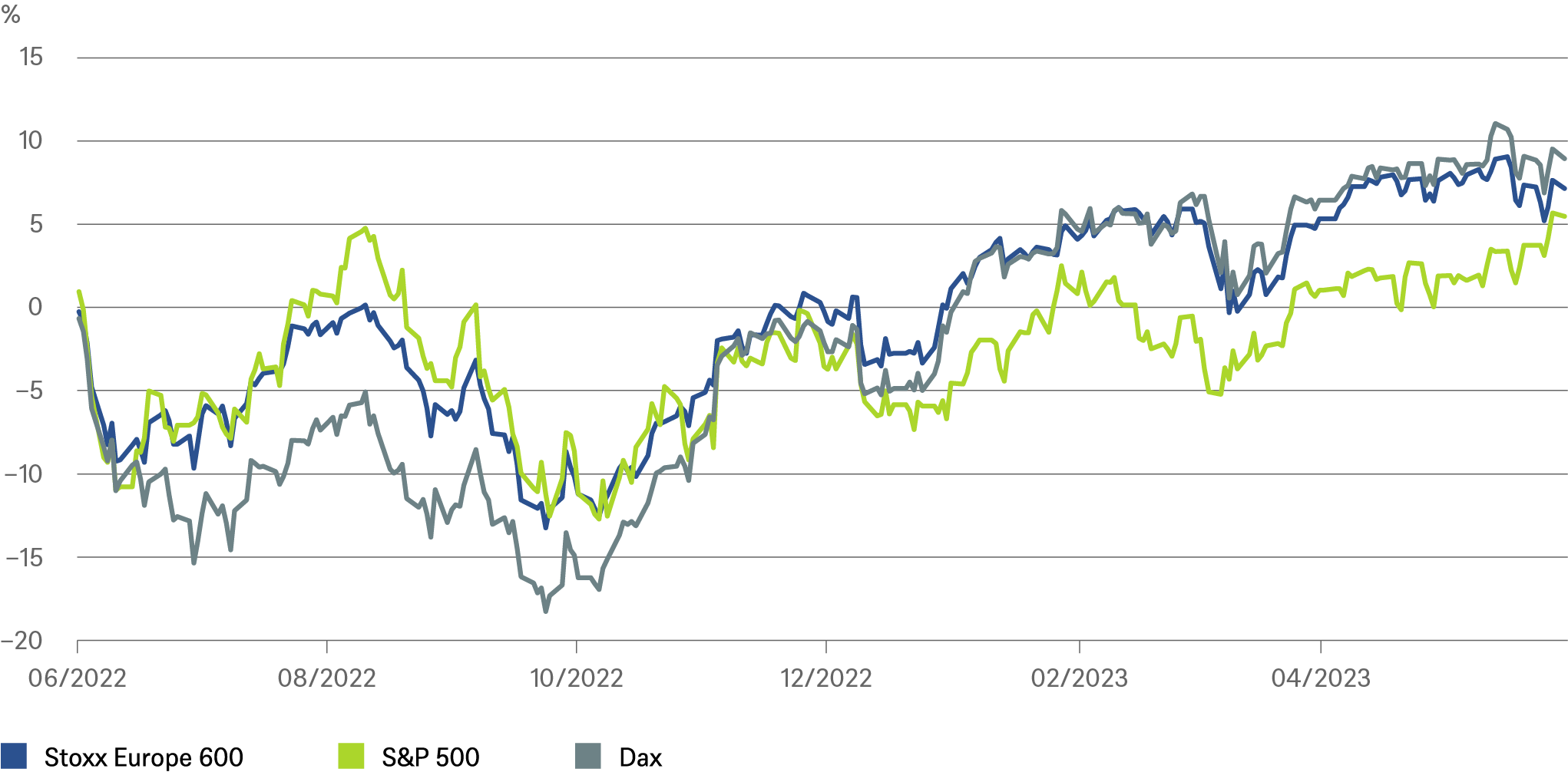

The hype around generative artificial intelligence has dominated almost all other macro themes on the stock markets in the second quarter. Even the Dax, which is not particularly spoilt with technology stocks, has benefited, rising in the first two months of the quarter, although a data revision made it official that Germany suffered negative economic growth in the fourth quarter of 2022 and the first quarter of 2023, i.e. the country slid into a technical recession.

And the German economy is indeed not sending only encouraging signals. We do, however, not expect further negative growth rates as companies’ order books are full and the supply side of the equation has improved, with natural gas prices back down to their end-2021 levels.

There has been also a lot of uncertainty about the Chinese economy. The markets have issued a provisional judgement of their own in that the Hang Seng has so far lost more than 10% in April and May combined. But we see this more as disappointment following an excess of excitement about reopening and believe China will be able to grow by 6% this year.

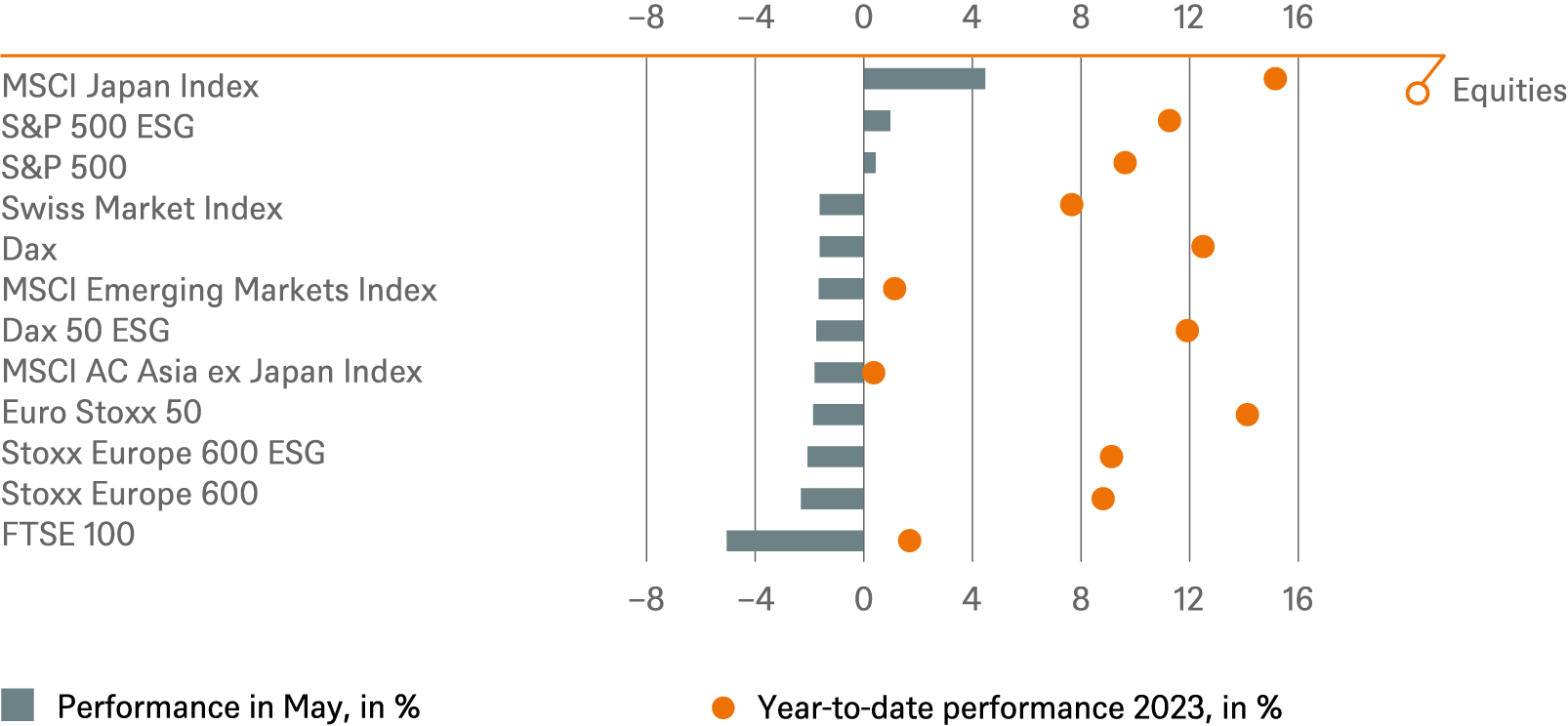

1.2 The technology rally gained momentum in May

Growth stocks enjoyed their revenge in May. Technology stocks raced far ahead of the rest of the market thanks to soaring hopes for everything related to generative artificial intelligence. The Nasdaq 100 rose by 7.6%, the Stoxx 600 Technology by 8.1% and the global semiconductor index SOX by 15.3%. And for the year to date the respective figures for these indices are 33%, 25% and 36%. Investors are expecting structural growth from these companies almost independently of global economic figures. It would certainly help if antitrust authorities stayed rather passive, as this has certainly contributed to the dominance of a good dozen technology stocks. However, this concentration is not only a thorn in the side of consumers, as they suffer higher prices, but now also of some investors. After all, what is the use of the broad diversification of the S&P - 500 companies after all - if the course of the index is determined almost exclusively by six companies, as was the case in May.

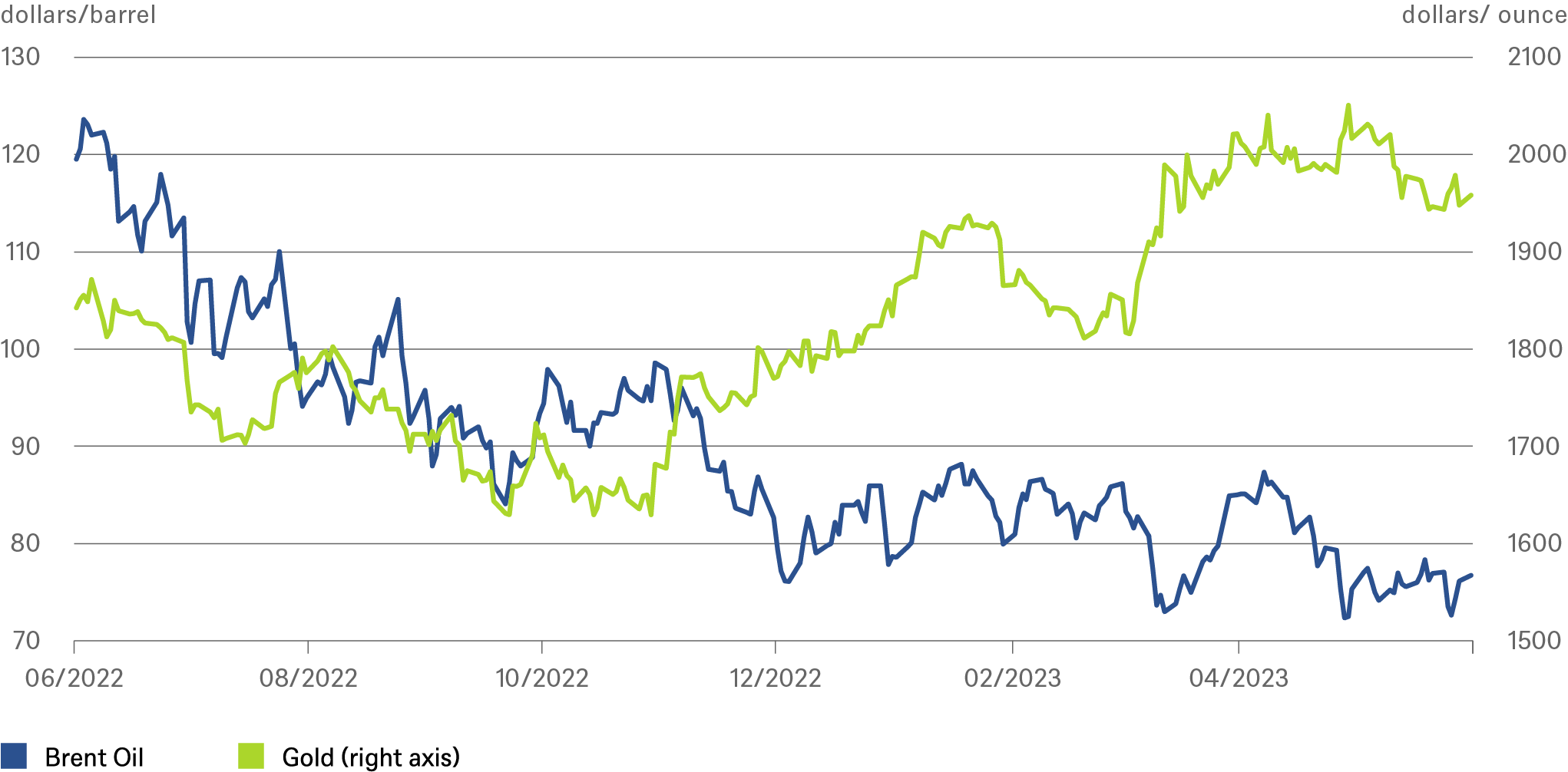

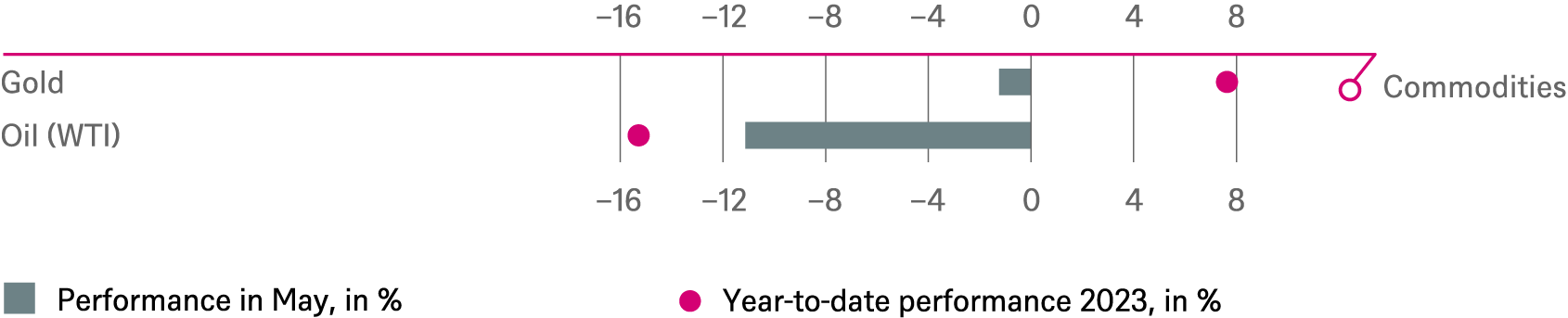

Other notable market movers in May were currencies, where the dollar index gained almost 3% while emerging market currencies lost a lot of ground, leading the Chinese yuan to again cross the 7 threshold against the dollar in mid-May. Equally noteworthy is the weakness in commodities. Brent fell for the fifth month in a row, dropping another almost 9% in May. Natural gas fell by about a third in May.

2 / Outlook and changes

2.1 Fixed Income

With the U.S. slowdown taking its time to arrive, and inflation stickier than forecasted, we see further hikes by the Fed and also the ECB. Only the Fed is likely to make its first rate cuts within the forecast period (to the end of the second quarter of 2024). This also means that government bond yields are likely to rise further, though not by enough to make corporate bonds unattractive.

Government Bonds

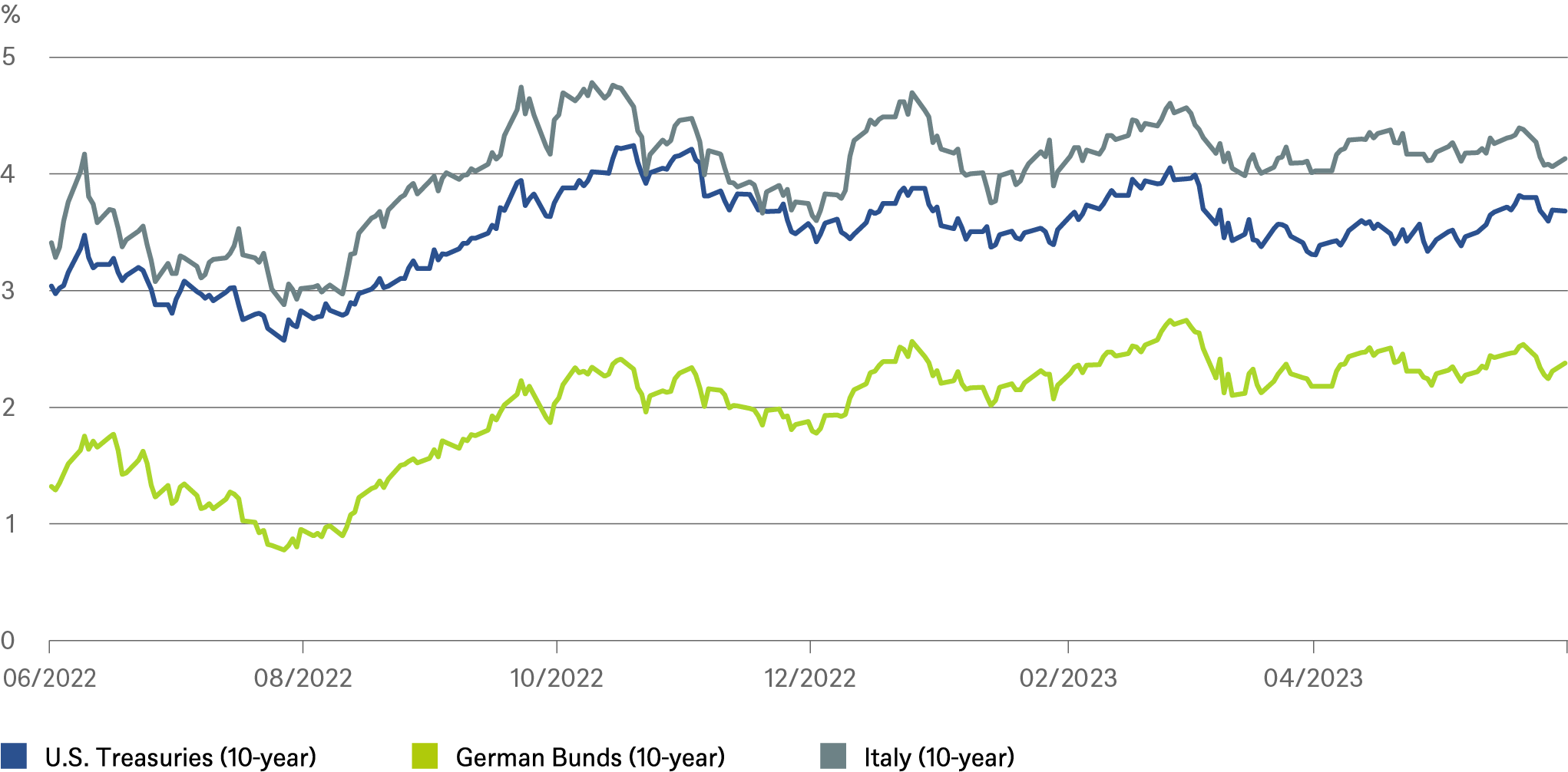

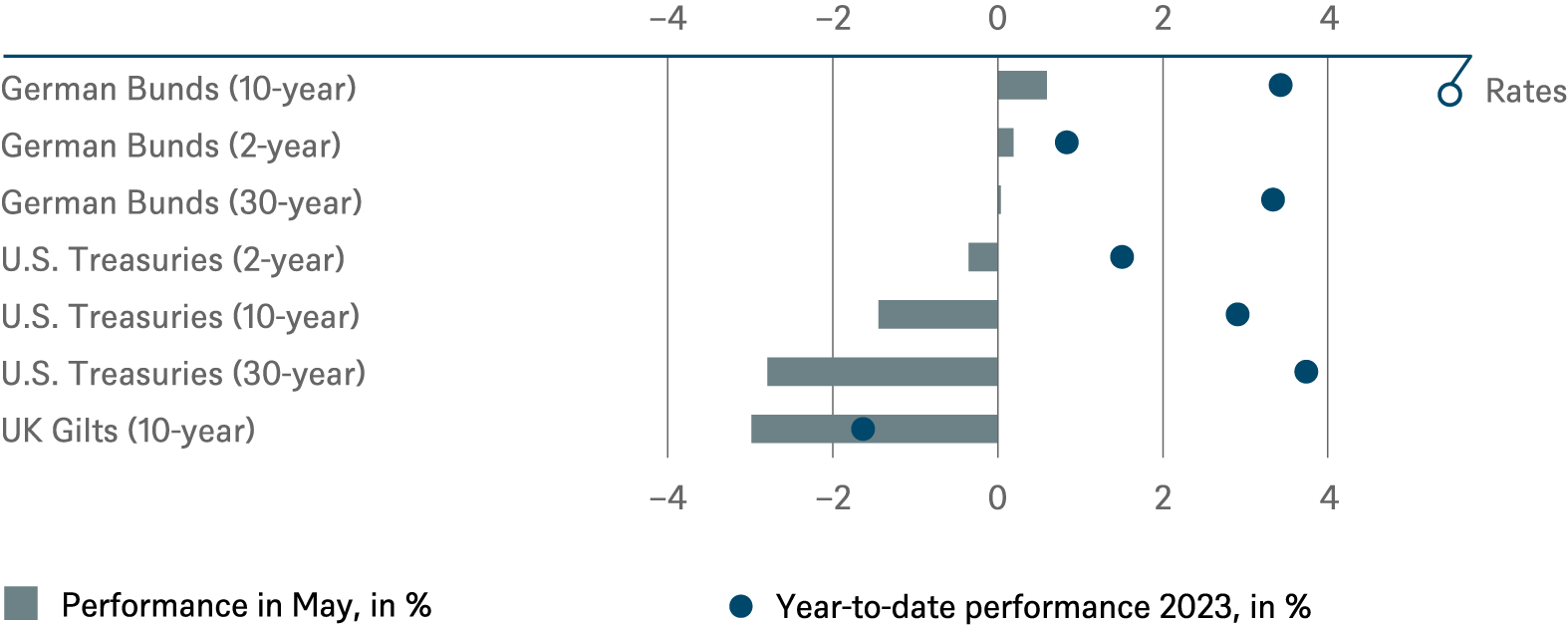

We prefer the short end of the yield curve right now as we believe it offers compelling returns at low risk. For longer rates we see the risk of setbacks unless there is a deep recession. 10-year and 30-year rates are likely to move higher again even if inflation comes down in the U.S. and Eurozone.

Sovereign yields on a sideways path since October 2022

Source: Bloomberg Finance L.P., DWS Investment GmbH as of 6/6/23

U.S.

We expect the Fed to reach its terminal rate (5.25-5.5%) in summer 2023, followed by a pause, and with the first rate cuts in Q2 2024. Unlike the market, we see no cut in 2023 unless there is a severe recession. We see U.S. Treasury 2-year paper at 4% by June 2024 (coming from 3.68% on June 7) given that the Fed cutting cycle is likely to start a bit later than currently expected by the market, most likely in Q2 2024. U.S. inflation is easing but this is not a one-way street. We have reduced our forecasts down a little for 10- and 30-year U.S. Treasuries to 4.2% and 4.3%, respectively. We expect the curve to re-steepen from the current strong curve inversion. In a very shallow recession for the U.S. (our baseline forecast) we see higher yields at the long end versus today.

Eurozone

Inflation remains sticky, but the worst should be over. We expect another 75bps worth of ECB hikes, which suggests there is limited downside potential in 2-year Bund yields from here. We also think that Eurozone core curves will become less inverse within our strategic forecast horizon, with a widely flat yield structure for Bunds from 2 to 30 years. We now forecast 2.8% & 2.9% for 10 & 30-year Bund yields given that inflation is more a structural problem given ongoing price pressure from labor markets.

EU Periphery: we expect Italian spreads to widen only slightly as the ECB’s mild quantitative tightening (with no more APP reinvestments from July onwards) should not pose a major risk. All is manageable for Italy. The level of debt to GDP is under control given high inflation and therefore high nominal (not real) GDP growth. Debt sustainability is not in danger on our 12-month forecast period and ratings should remain investment grade. The spreads for 10-year Spanish government bonds over Bunds are likely to remain unchanged.

Other Government Bonds

UK: The BoE is seen as likely making a final rate rise of 25 bp to 4.5%. The initial cut in rates is likely to be later than the U.S. Fed but earlier than the ECB, which is likely to stay on hold at least until end-2024.

Japan: The BoJ is being closely monitored as it might change its yield curve control regime and reduce liquidity supply into financial markets within our strategic forecast horizon.

Credit

Risky asset markets such as corporate credit are challenged by the rates environment but, given corporate fundamentals, stay sound unless a severe recession takes place. We expect stable or even slightly lower spreads versus today. EUR Investment Grade remains our sweet spot from a risk/return perspective. High Yield offers attractive yield carry that compensates for slightly higher default rates.

Corporate bonds: between recovering from U.S. banking fallout in March and pricing in higher defaults.

Source: Bloomberg Finance L.P., DWS Investment GmbH as of 6/6/23

Investment Grade (IG) Credit

US IG: The spread of this bond segment is forecast to barely move on a 12-month horizon. Data is pointing to tightening credit conditions, but we think this will happen in the second half of 2023 and that recovery will be well under way by June 2024. Given that only a mild recession is expected for the U.S. economy, the possibility that the spread could widen significantly is low.

EUR IG: We are positive and expect the risk spread to tighten. We think that the banking crisis will be solved and contained within the forecast period while the economy walks its way out of the current slow growth/shallow recession in the second half of 2023. A persistent higher rates environment is manageable for the asset class so long as rate volatility comes further down.

High Yield (HY) Credit

US HY: We are positive given the yield carry and expect limited movement in index risk spread. The U.S. HY default rate by issuer over the past 12 months has increased to approximately 1.2%, below the historical average of 3.5%. We expect it to increase further to 3.0%. This is manageable and leaves attractive return potential for this asset class. We are overweight higher quality single Bs and select BBs, while underweight CCC.

EUR HY: The default rate has also started to increase to above 1% recently. Spreads are forecast to remain close to current levels. However, with higher uncertainty balanced against favorable credit quality, we expect EUR HY default rates above 2% over the next 12 months. As in the U.S., this is not too high and leaves returns in line with IG Credit. Overall, we expect ongoing volatility.

Emerging Markets

EM Sovereign: Our 12-month spread forecast is 470 bps, roughly the same level as today. This leaves attractive yield carry. China’s cyclical recovery provides support. The main beneficiaries of China’s stronger growth after reopening are several commodity exporters (food, metals) and countries benefiting from sound recovery in China’s service sector. As usual in the EM space, thorough selection is needed, given persistent (geo-)political challenges. Meanwhile, net commodity importers are seeing mixed developments, depending on whether their economies benefit from recovery in tourism or rising demand from China or lower import/energy prices after supply chain disruptions have eased.

Currencies

EURUSD: We think a more hawkish ECB versus the Fed should drive the Euro to our new strategic target at 1.12 and that the current trend towards a stronger USD should end at some point.

USDCNY: Solid growth in China is expected to continue in spite of the latest weaker PMI data. Our strategic forecast for the Yuan is 6.90.

2.2 Equities

Reviewing year-to-date performance, most equity investors should be satisfied with rise in the MSCI AC World by almost 10% (total return in EUR or USD). Two aspects that support the long-term constructive investment thesis for equities should make them feel even more comfortable:

First, in our view equities offer inflation protection to portfolios. Strong business models (including sleepy antitrust bodies) mean that some companies have the pricing power to defend their margins in periods of weak volume demand. This is a trend we have seen throughout 2022 and also again during the first quarter of 2023. Despite a very weak economic environment, profits are expected to grow in 2023 for most sectors. For 2024 and beyond we expect approximately 5% EPS growth in Europe and the U.S.. The biggest portion of this EPS growth is likely to come (again) from continued price increases. Operating margins are already too high to offer additional potential and the expected economic recovery is probably too shallow to create a meaningful cyclical acceleration in earnings.

Second, equities embed the chance to benefit from innovation. Fresh evidence is offered by the success of new Alzheimer’s and obesity drugs but first and foremost by the amazing progress in artificial intelligence (AI). Given that today 5bn people have access to the internet, AI may be able to spread its benefits far more rapidly than the emergence of telephony did. Excitement about ChatGPT has already boosted the valuations of the most obvious winners in the technology sector (on which we are Neutral) towards scary levels. We stick to our preference for the communications sector (Outperform), where valuations are somewhat more reasonable in our view.

Despite the obvious structural benefits of equities, our S&P 500 target for June 2024 of 4,200 has no upside from here. We expect valuation multiples to be pressured by rising U.S. 10-year yields (DWS 12m forecast 4.2%); furthermore, we do not expect support from a further fall in the equity risk premium. Equity volatility[1] is now already below the average of 16 seen in the last period of low growth that lasted from 2012 to 2019. Many multi-asset investors are therefore likely to find the risk-reward of short-term bonds more attractive.

We stick to our view that ex-US equities offer most 12-month upside (12m targets Stoxx 600: 480; DAX40 17.000), as we forecast that the valuation gap to the U.S. will shrink. In Europe we highlight superior EPS revisions, in EM the expectation for double digit-EPS growth in 2024. We realize that Japanese equities offer an alternative to Chinese equities as an investment vehicle for the Asian growth theme. However, following the recent surge in the Nikkei we feel that switching out of EM into Japanese equities now would be poorly timed. Our dedicated European Small and Midcap team keeps highlighting the attractiveness of their asset class. Recent underperformance here offers an attractive entry point.

Persistent inflation and overshooting yields are probably the biggest downside risk factors for equities. On the other hand, a “the Fed is done” euphoria or further AI-hype might drive markets beyond our targets.

While Western markets are on the brink of entering bull markets, China has performed poorly

2.3 Alternatives

Real Estate

Unlisted real estate: Global real estate prices have been falling over the past year in response to higher interest rates. The price correction is most advanced in Europe and is laying the ground for value-add strategies, such as development of undersupplied next generation offices across major cities, as well as the growing living sector. Generally, we favor the industrial and residential sector, with logistics and single-family housing in the U.S. the top performers. Overall, occupier fundamentals remain in good shape given their resilience to recessions. We are seeing exceptionally high occupancy rates and rising rents across much of the industry, except for office space in the U.S. The pace of rental growth is expected to moderate over the coming twelve months, in line with economic growth and inflation. The investment market is difficult, although activity is improving tentatively as interest rates stabilize. Appraisal-based valuations are lagging behind market prices by 6-12 months.

Listed real estate: As we head further into the year, economic growth continues to slow. Across the real estate landscape, healthy but moderating fundamentals across select real estate sectors continue to be balanced by slowing global growth and higher costs of capital. Against this backdrop, we believe a balanced portfolio in terms of cyclicality is appropriate in the immediate term given the drawdown seen in 2022. We favor the industrial sector, with low levels of vacancies and strong private market bids. Conversely, we are most cautious on office, residential, healthcare, and retail/malls. We have moved further underweight retail and malls on concerns over slowing consumer demand, as well as on hotels where the outlook is clouded by dampened prospects for global growth. Finally, the office sector remains under significant pressure, negative absorption and market rent growth, combined with restrictive capital markets, mean we are particularly bearish on this space.

Listed Infrastructure

We remain focused on relative valuations and companies that can maintain and grow cash flows. Volatility will likely continue, given the current economic and political environment. Infrastructure should benefit from being both essential and able to pass on inflation. We expect performance dispersion to continue. In absolute terms, which considers both active management and market movements, the largest increases in portfolio weights were in European Transport, Americas Utilities, and European Communications while the largest decreases in portfolio weights were seen in Americas Communications, Japan infrastructure stocks, and Americas Transports.

Gold

We expect the Fed to reach its terminal rate by the second half of 2023, and we may see rate cuts by the second half of 2024. We expect the USD to devalue against other currencies and EM central banks to continue to diversify their currency reserves with gold. These are all arguments in favor of the gold price which we expect to reach USD 2,200 per ounce by June 2024.

Oil

We are revising our forecast lower to account for much higher realized Russian output of crude oil and products, as sanctions are yet to have any material impact on Russian energy flows. Our forecast continues to reflect supply deficits developing towards the end of 2023, just as demand from emerging economies begins to reaccelerate. With the U.S. Strategic Petroleum Reserve (SPR) releases scheduled to finally come to an end, we expect prices to begin to recover in the second half of 2023. We are not modeling significant recession-driven demand slowdowns in the U.S. as demand trends continue to be strong, particularly in gasoline and jet fuel.

Gold is sought after, not only by central banks. Oil still doesn’t seem to have found a floor

Source: Bloomberg Finance L.P., DWS Investment GmbH as of 6/6/23

2.4 DWS High Conviction

Within equities we stick to our two main ideas of investing outside the U.S. with a special focus on Europe (small and mid-caps) and Emerging Markets. In terms of sectors, we are now concentrating on the Global communication sector.

Within fixed income we continue to like European corporate bonds that offer decent yields while we believe default rates should remain low. Covered bonds look attractive in the high-quality sector with a risk premium offered that is above historical average. Furthermore, we believe that many Emerging Market bonds offer attractive spreads given their solid fiscal positions, decreasing inflation rates and the prospect that the Fed hiking cycle will end.

Within alternatives, we believe that gold remains a suitable hedge, best acquired via gold mining shares. In real estate we stick to selected logistics and residential buildings while in infrastructure, we like three themes: everything energy related, transport (rail) and digital infrastructure, such as the fiber roll-out.

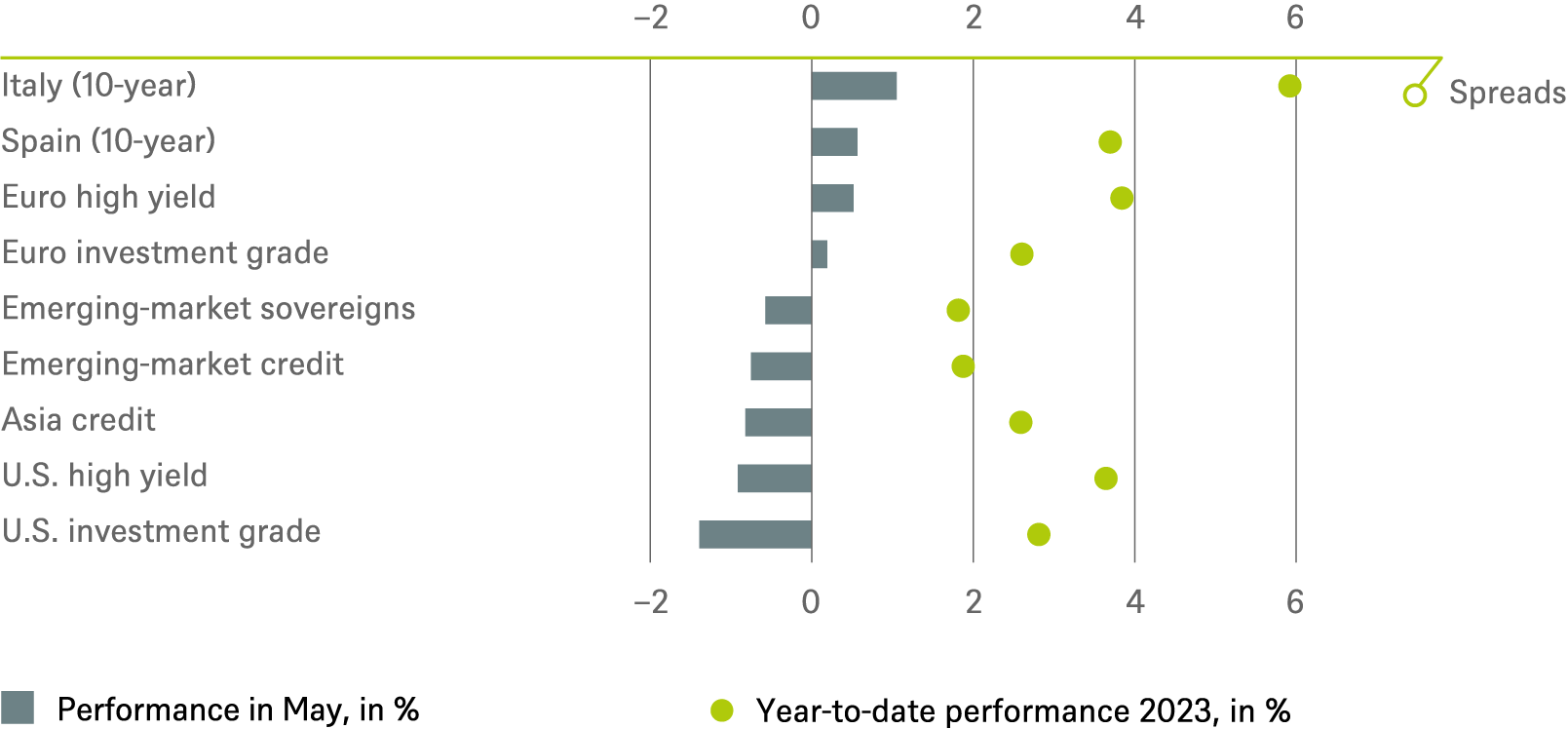

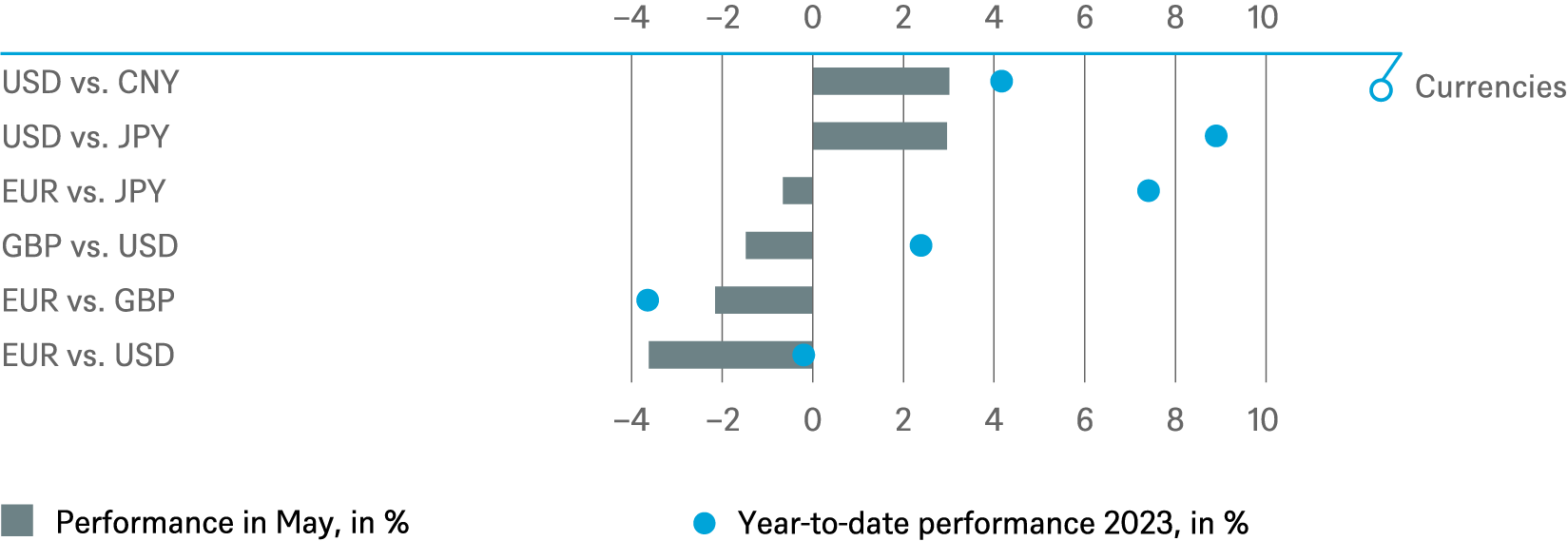

3 / Past performance of major financial assets

Total return of major financial assets year-to-date and past month

Past performance is not indicative of future returns.

Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 5/31/23

4 / Tactical and strategic signals

The following exhibit depicts our short-term and long-term positioning.

4.1 Fixed Income

Rates |

1 to 3 months |

until June 2024 |

|---|---|---|

| U.S. Treasuries (2-year) | ||

| U.S. Treasuries (10-year) | ||

| U.S. Treasuries (30-year) | ||

| German Bunds (2-year) | ||

| German Bunds (10-year) | ||

| German Bunds (30-year) | ||

| UK Gilts (10-year) | ||

| Japanese government bonds (2-year) | ||

| Japanese government bonds (10-year) |

Spreads |

1 to 3 months |

until June 2024 |

|---|---|---|

| Spain (10-year)[2] | ||

| Italy (10-year)[2] | ||

| U.S. investment grade | ||

| U.S. high yield | ||

| Euro investment grade[2] | ||

| Euro high yield[2] | ||

| Asia credit | ||

| Emerging-market credit | ||

| Emerging-market sovereigns |

Securitized / specialties |

1 to 3 months |

until June 2024 |

|---|---|---|

| Covered bonds[2] | ||

| U.S. municipal bonds | ||

| U.S. mortgage-backed securities |

Currencies |

1 to 3 months |

until June 2024 |

|---|---|---|

| EUR vs. USD | ||

| USD vs. JPY | ||

| EUR vs. JPY | ||

| EUR vs. GBP | ||

| GBP vs. USD | ||

| USD vs. CNY |

4.2 Equity

Regions |

1 to 3 months[3] |

until June 2024 |

|---|---|---|

| United States[4] | ||

| Europe[5] | ||

| Eurozone[6] | ||

| Germany[7] | ||

| Switzerland[8] | ||

| United Kingdom (UK)[9] | ||

| Emerging markets[10] | ||

| Asia ex Japan[11] | ||

| Japan[12] |

Style |

1 to 3 months |

|

|---|---|---|

| U.S. small caps[23] | ||

| European small caps[24] |

4.4 Legend

Tactical view (1 to 3 months)

The focus of our tactical view for fixed income is on trends in bond prices.Positive view

Neutral view

Negative view

Strategic view until June 2024

- The focus of our strategic view for sovereign bonds is on bond prices.

- For corporates, securitized/specialties and emerging-market bonds in U.S. dollars, the signals depict the option-adjusted spread over U.S. Treasuries. For bonds denominated in euros, the illustration depicts the spread in comparison with German Bunds. Both spread and sovereign-bond-yield trends influence the bond value. For investors seeking to profit only from spread trends, a hedge against changing interest rates may be a consideration.

- The colors illustrate the return opportunities for long-only investors.

Limited return opportunity as well as downside risk

Negative return potential for long-only investors