- Home »

- Insights »

- Global CIO View »

- Investment Traffic Lights »

- Investment Traffic Lights

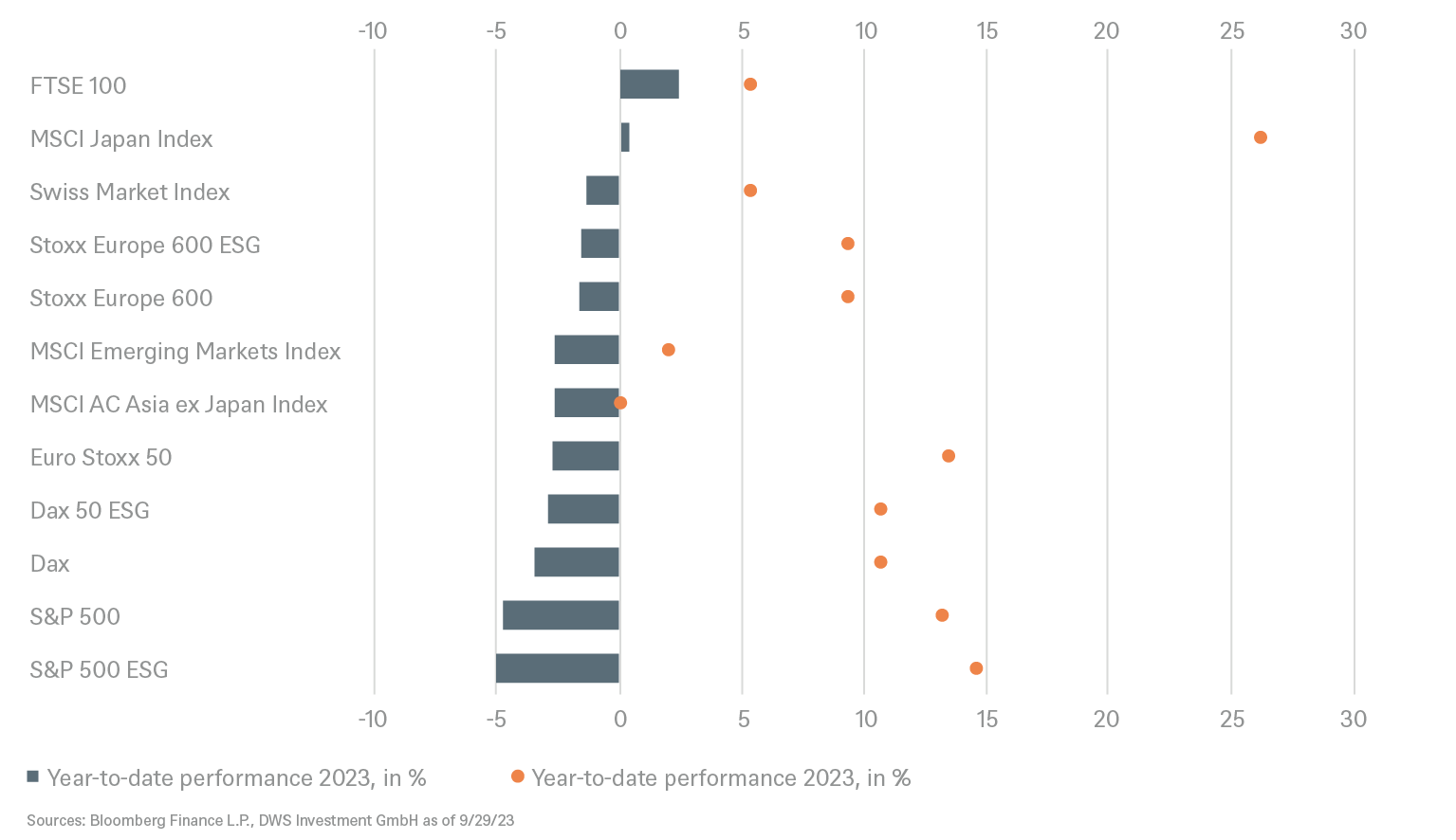

- September was the worst month of the year for many equity and government bond indices – some have lost their entire year-to-date performance.

- The concern is that, even with a weak economy, central banks will not cut interest rates as quickly as hoped in 2024.

- If longer-term interest rates also remain at high levels it will be difficult for many asset classes in 2024. In the current quarter we expect markets to remain volatile.

1 / Market overview

1.1 Worst month of the year, investors enter the fourth quarter nervously.

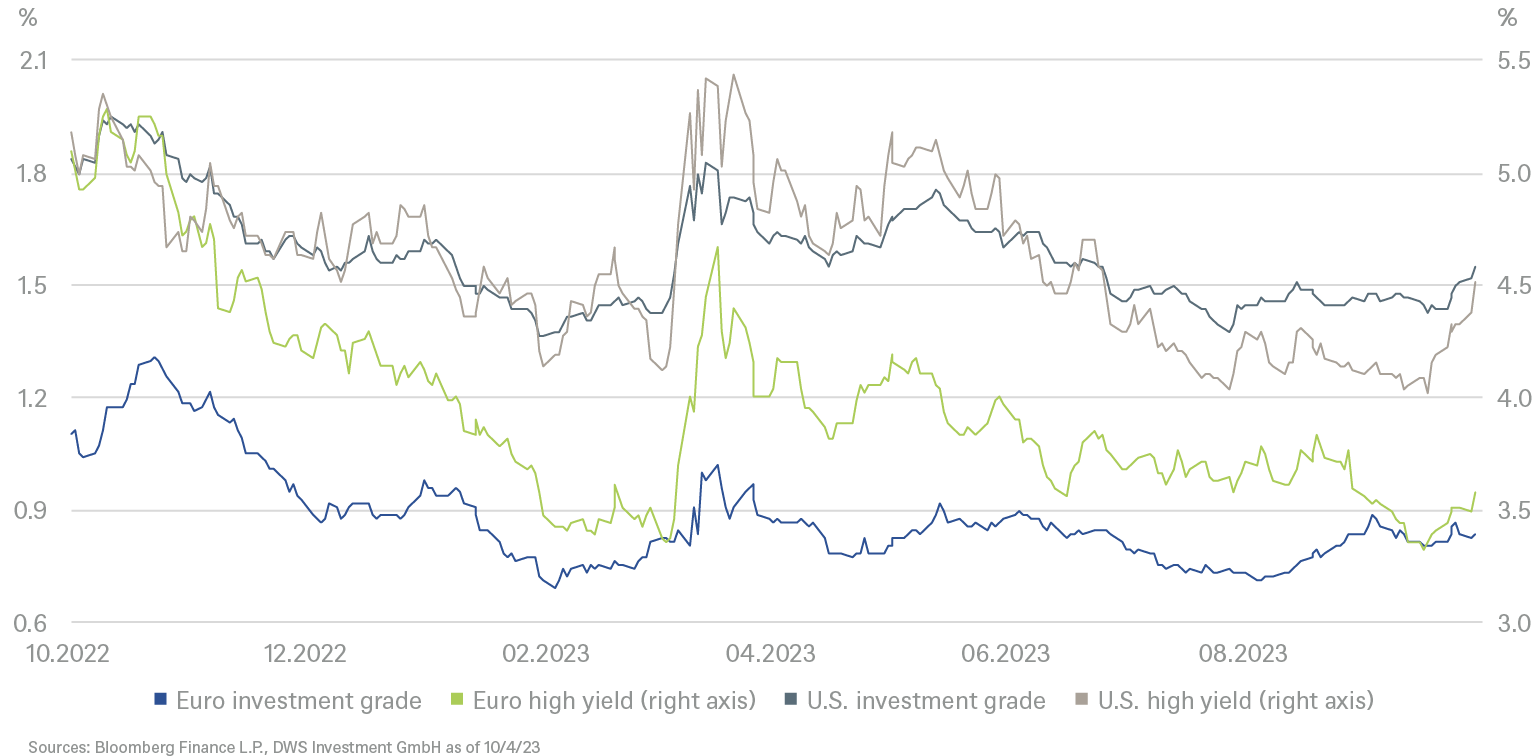

At least investors who look at history and place some reliance on average performances were warned. On average over the past 30 years the S&P 500 has fallen by 0.7% in September. This September it did rather worse, down by 4.9%, which makes it by far the worst month for the market this year - because most other stock markets didn't fare any better. Things were a bit more mixed in the bond markets, where government bonds suffered even larger losses than in February, while corporate bond risk spreads fared a little better than they did then. But anyone who hoped the bad news would be confined to September faced immediate disappointment in the first few days of October. Particularly in the case of corporate bonds in the U.S. and Europe, spreads widened faster. Volatilities, too, went up: Both the VIX, which applies to the S&P 500, and the MOVE Index relating to U.S. government bonds, exceeded their May peaks.

Where is the nervousness coming from? After all, the Federal Reserve (Fed) did not raise interest rates further in September and the ECB suggested its rate hike might be the last. Nevertheless, both interest rate decisions were interpreted as hawkish as both central banks left no doubt that they would rather sustain the inflation fight for too long than risk giving up on it too soon. The market was also focused on the potential for rate cuts in the coming year. Market expectations for the first cut shifted back in September from the second to the third quarter of 2024 for the Fed. What may have further encouraged the impression that central banks will stay hawkish is the rise in energy prices. Brent crude shot up by 27% in the third quarter. Inflation dynamics also remained high for individual soft commodities. A government shutdown in Washington, once again averted only at the last second, also kept investors on edge. Relief was short-lived. The removal of the Speaker of the House of Representatives, Kevin McCarthy, at the beginning of October is unprecedented. A budget is in place now until November 17, but without a Speaker, Congress is incapable of making decisions.

On the macroeconomic side the third quarter as a whole contributed to the impression that central banks are now making significant progress in slowing economic momentum. Although individual data points such as the U.S. labor market and consumption in Europe surprised on the upside, overall most countries appear to be running out of economic steam as the year-end approaches. In China, on the other hand, there are signs of stabilization, at least. We think the country may be over the worst.

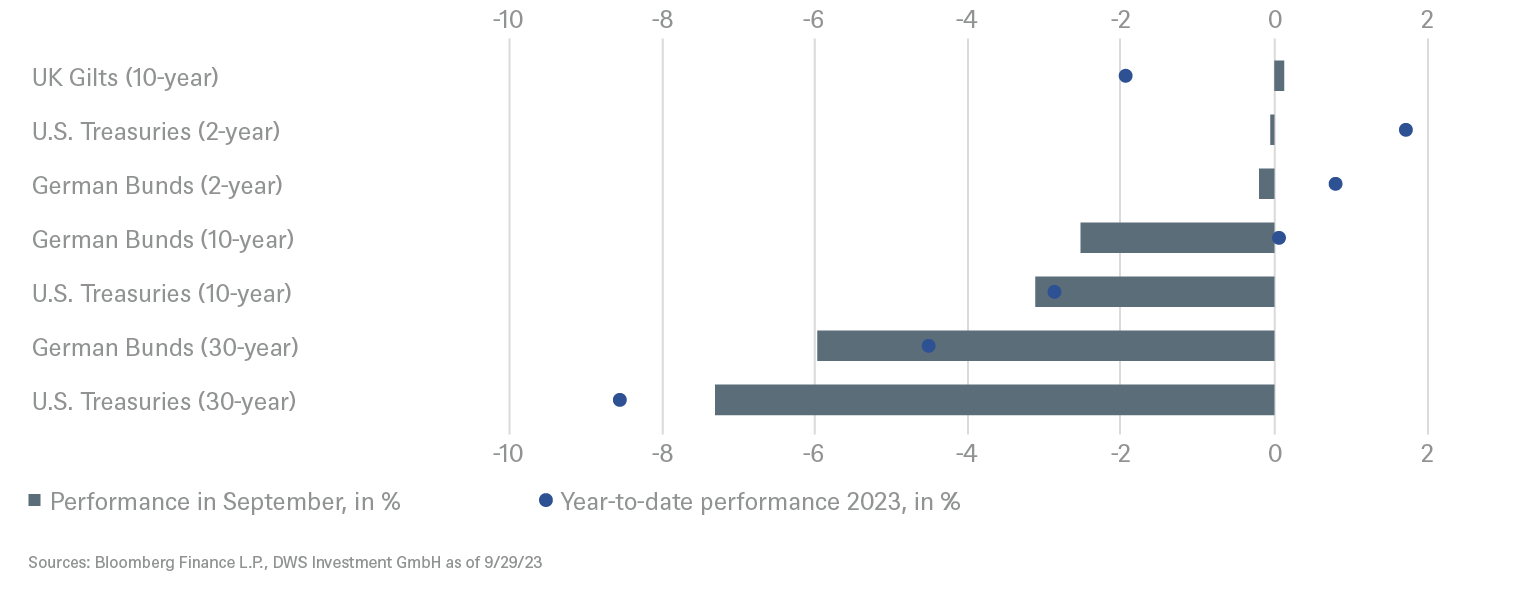

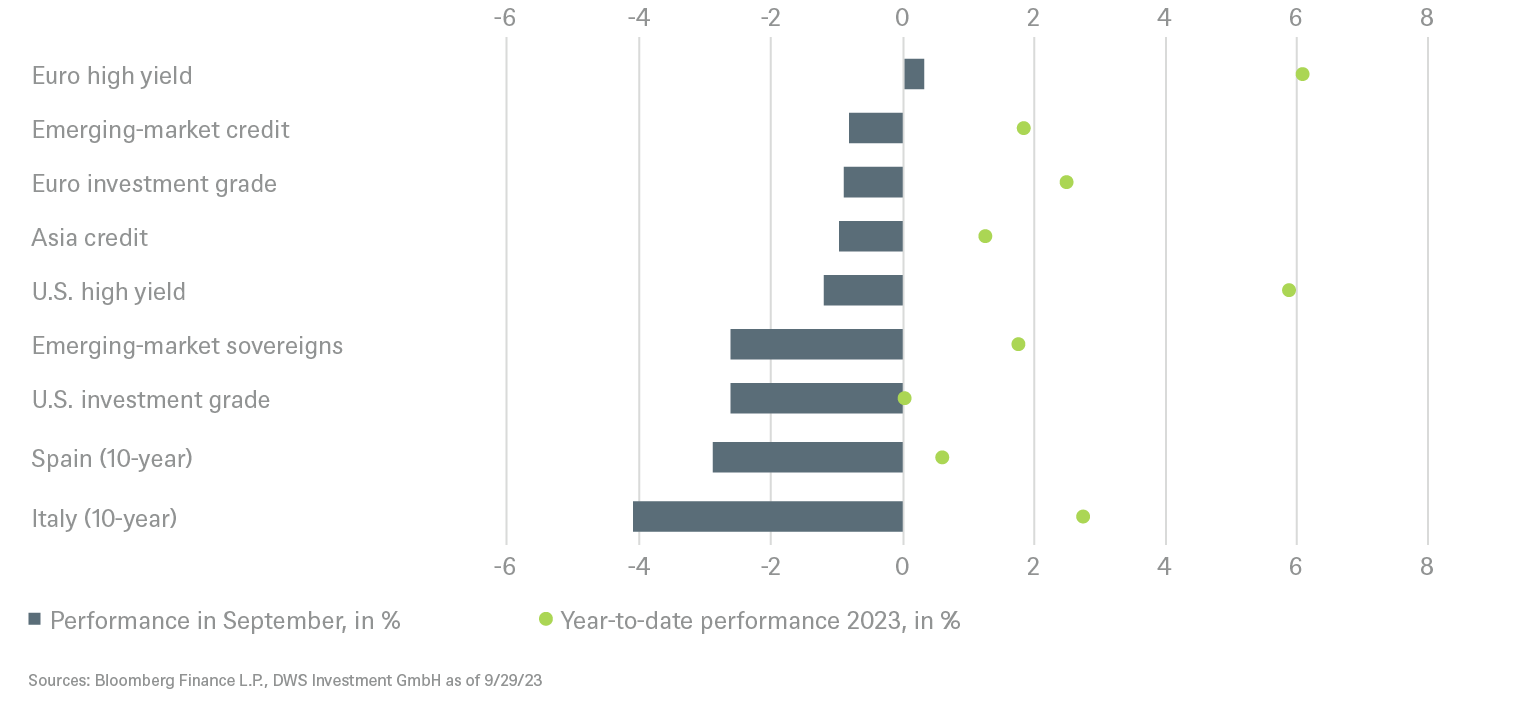

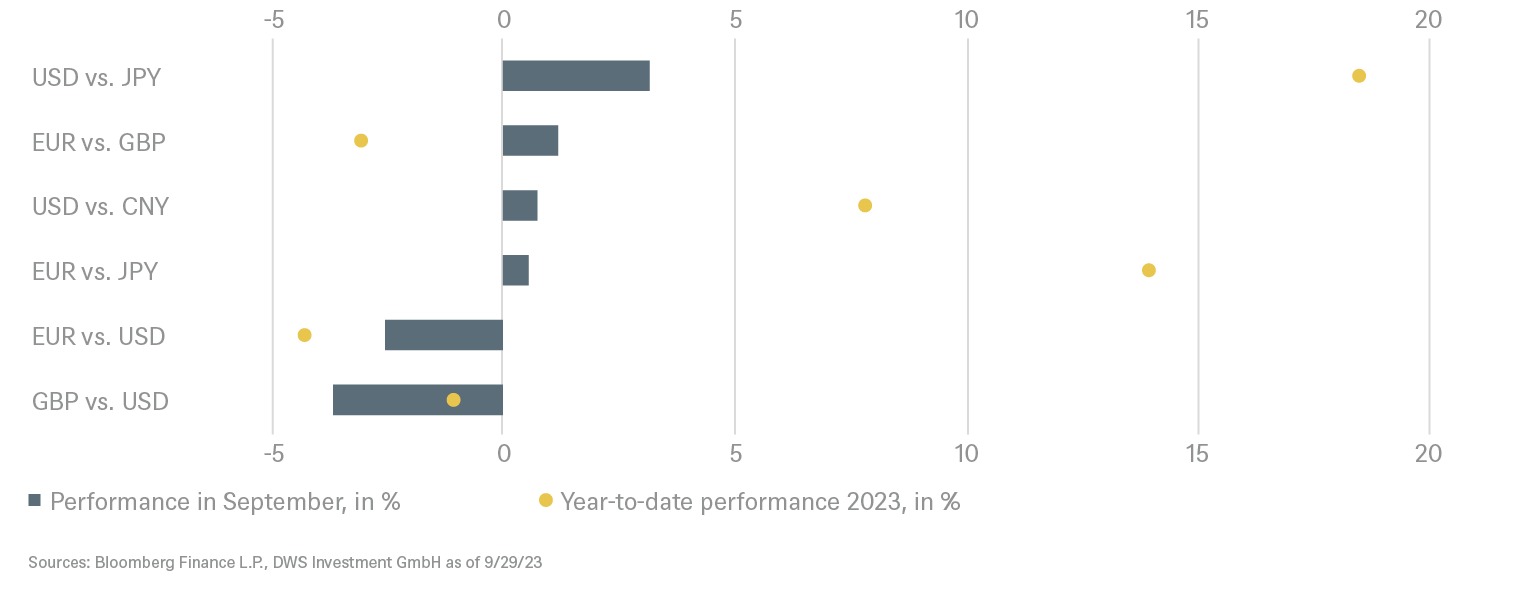

1.2 Some equity and bond indices lose YTD gains, yield curves steepen

The heavy bond selling in September caused the total return on government bonds with remaining maturities of five years or more to slip back into negative territory for the current year in many developed countries. So there is a threat of a third year of declines for bonds in many G7 countries. The price declines produced sharp increases in yields. For example, 10-year U.S. Treasury yields rose 74 basis points (bp) to 4.57% (we even saw 4.88% at the beginning of October), while Bund yields were up 45bp to 2.84%. The short end saw less of an uptick, causing yield curves to flatten somewhat, i.e., to be less negative. The spread between 10-year and 2-year Treasury yields, for example, melted from -92BP to -33BP most recently (as of October 3). The sharp rise in U.S. yields is also likely to be partly responsible for the appreciation of the dollar. In September the dollar index (DXY) gained 2.5%, and at 1.05 EUR/USD, the currency pair is approaching parity. In equities the recent sell-off - including the first days of October - has seen the Russell 2000 in the U.S., as well as the Dow Industrial and the S&P 500 Equal Weight index, lose all their returns since the start of the year and return to negative territory. Shareholders of Chinese equities are faring far worse: the MSCI China has lost almost a quarter of its value from its high in January to today (October 3).

Sovereign interest yields are entering the fourth quarter on new record highs

Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 10/4/23

2 / Outlook and changes

If this fourth quarter proves to be an average one, investors can look forward to it. On average, taking the example of the S&P 500, the return on the final quarter over the past 30 years has been 4.6%. That sounds excellent but you can lose a lot of money on capital markets if you rely on averages or on mean reversion over a certain time span. In the past 30 years there have seen six loss-making final quarters. In three of them the losses were hefty: -8% in 2000, -23% in 2008 and -14% in 2018.

The expectation we formed in our last quarterly strategic CIO Day in September was that the final quarter of this year is likely to be rough. Despite that, our 12-month targets still show a slightly positive outturn for the period until September 2024. The reason is that we expect only a mild economic slowdown in Europe and the U.S. over the winter and positive GDP growth in 2024. But this growth won’t be very high (Eurozone 0.9%, U.S. 0.4%). Overall, a slight downturn and modest subsequent growth argue against a major market correction. On the other hand, we enter this nervous period with asset prices that are not particularly cheap. And financial tightening is ongoing, as interest rates push up and quantitative easing switches to quantitative tightening. Add to this heightened volatility on both the bond and the equity markets at the beginning of the new quarter and financial assets might thus perform worse than the economy in the coming quarters, especially if another financial accident (such as a major bankruptcy or collapse of a market segment) happens. Having said that, we believe that after the recent corrections, many markets are adequately priced given the different possible economic scenarios for 2024.

2.1 Fixed Income

Tactical recommendations don’t age well these days given the dramatic sell off in government bonds in the past couple of weeks. It is hard to pin down to a single event, but it seems that the Fed’s hawkish pause in September and the ECB’s “final hike for now” message got markets used to the idea that the Fed and ECB might ease monetary policy later and to a lesser extent than previously expected.

Government Bonds

For the majority of the month, we were neutral on most government bonds given their recent upward yield momentum. The one exception being 10-year Treasuries where we stick to our positive view, even if markets are going against us right now. But based on our main economic scenario, we do not believe that 10-year yields can make another major upward step without evoking fears about how this will stoke the economy, which in turn will weigh on yields. We are ready to sit this one out, other than that we have yet to see where the new equilibrium will settle in the fourth quarter. Investors are still dealing with mixed economic signals. The U.S. job market is still holding up much better than weaker PMI, consumer sentiment and housing data might suggest. And headline inflation is poised to receive fresh impetus from rising oil prices. In Europe we reduced the outlook for Italian bonds to neutral from positive (measured by the spread from German Bunds). We think the positive sentiment after Giorgia Meloni’s government at first proved more pragmatic than expected is now past its peak and that Italy’s debt mountain and forecast budget deficit are back in full view.

Corporate Credit

We remain positive on the higher-grade segment of the corporate credit universe. New issuance is underwhelming, which is giving some support to prices, and we expect this to remain the case for the rest of the year. Hefty yield increases on government bonds, however, didn’t fail to make an impact on corporate credit spreads. We expect more pressure and volatility in the HY segment which is also liable to suffer attacks of bad nerves during the upcoming Q3 reporting season. We are therefore neutral on HYs, with a slight preference, as with IG, for Eurozone rather than U.S. names for valuation reasons.

Emerging Markets

We are neutral on EM Sovereigns and positive on EM and Asia Credit, as we believe that pessimism about China has passed its peak. But sentiment in this segment is also struggling because of an ever-strengthening dollar and increasing U.S. bond yields. Volatility is likely to persist until U.S. yields stabilize but we keep our positive stance on Credit as fundamentals are strong on average and new issuance is likely to be soft.

Currencies

We have dropped our positive EUR/USD view as the dollar has proven to be strong against all currencies on the back of increasing U.S. bond yields and a higher oil price.

Credit spreads have remained relatively stable so far

2.2 Equities

During our strategic meeting in early September, we concluded that equity markets had already discounted a goldilocks scenario in equity markets – falling inflation, a soft landing for the economy, lower Fed interest rates from mid-2024, reaccelerating EPS growth and rapid benefits from AI. That all this optimism was already onboard left no meaningful upside for the U.S. market. Since then, U.S. 10-year yields have risen above 4.8%, increasing the discount rate on the cash flows of all asset classes – including equities - and reducing their net present value. A reversal of the recent spike in the U.S. 10-year yield is a prerequisite for global equities to recover near-term, in our view. We have, however, recently upgraded Japan to Outperform, as we believe that the recent market correction and the weak yen offer a good entry point.

Sectorwise, Communication and Consumer Discretionary remain our key overweight recommendations while Real Estate stays underweight. Within global Financials (neutral) we still like pan-European Banks. This year their low valuations and strong EPS growth, driven by net interest income, argued for them. In 2024 their still low valuations and likely almost double-digit cash return to shareholders (dividends and share buy backs) makes them appealing. Recently announced bank taxes in Italy, Spain and Netherlands do not change our view materially.

We hear contradictory management comments from the Materials sector (neutral). European chemical companies are still complaining about high energy prices and weak demand on their home turf. But, more positively, some commodity chemicals and mining companies see green in China. We are sticking to industrial gases and gold mining stocks as defensive investment recommendations.

Industrials (neutral) are trading in line with their long-term PE-multiple relative to the market. We expect construction weakness to shift towards the non-residential market and airlines to struggle with higher oil prices and a decline in the post-pandemic holiday surge. All this makes us wait on the sidelines.

The Energy sector (neutral) has recently outperformed as oil prices rise. Crude supply is being managed tightly by OPEC+ while Western strategic and commercial inventories of oil remain low. This constellation makes oil prices above 100$ not unrealistic and poses risks to the global economic outlook. We see the oil service sector as an attractive investment alternative to global oil majors.

Finally, in Health Care (neutral) we notice that excitement about obesity and Alzheimer’s drug treatments has led to a bifurcation of valuations within pharma. We prefer Medtech and Lifescience Tools. These segments might be less exposed to the political debate on U.S. health care reform ahead of the upcoming presidential election.

U.S. Market

Although the no longer trades above our September 2024 target and at a price-earnings-ratio of slightly below 20, we still see little upside for now, given the continuous increase in bond yields and the fact that the markets are questioning more whether an economic soft landing is possible.

European Market

The excessive valuation discount to the U.S. is still present, and we still expect it to shrink: Therefore, our relative valuation is Overweight. But banks are unlikely to be the key contributor to EPS growth for another year and weak Chinese growth may weigh on European exports.

German Market

Like Europe as a whole the German equity market is trading at a record PE discount to the S&P 500. But we remain neutral on Germany. Energy supply is unlikely to be an issue this winter, but energy prices will be. Furthermore, the chemical sector is feeling the weak demand from China. Not all sectors, however, are complaining about weak order books. The Q3 reporting season may bring fresh insights.

Japan

The Japanese stock market has been in good shape for a long time this year. In our view, it offers a good opportunity to participate in Asian growth without having to be invested in China. It also offers some diversification from the European and the U.S. equity market. The recent slide of almost 10% from the high in early August and the very weak yen now offer a good entry point in our opinion. Fundamentally, Japan is also supported by good earnings growth, also driven by inflation, which has finally returned but is not exuberant; loose monetary policy; and robust domestic consumption, which is also driven by increasing foreign tourism. Finally, the relatively low positioning of foreign institutional investors also speaks in favor of the Japanese market.

Emerging Markets

Earnings revisions are still negative, while U.S.-China tensions continue and negative signals continue to emerge from China’s property market. While we think pessimism on China may have peaked, we remain neutral on EM.

Equities have lost momentum over the summer

Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 10/4/23

2.3 Alternatives

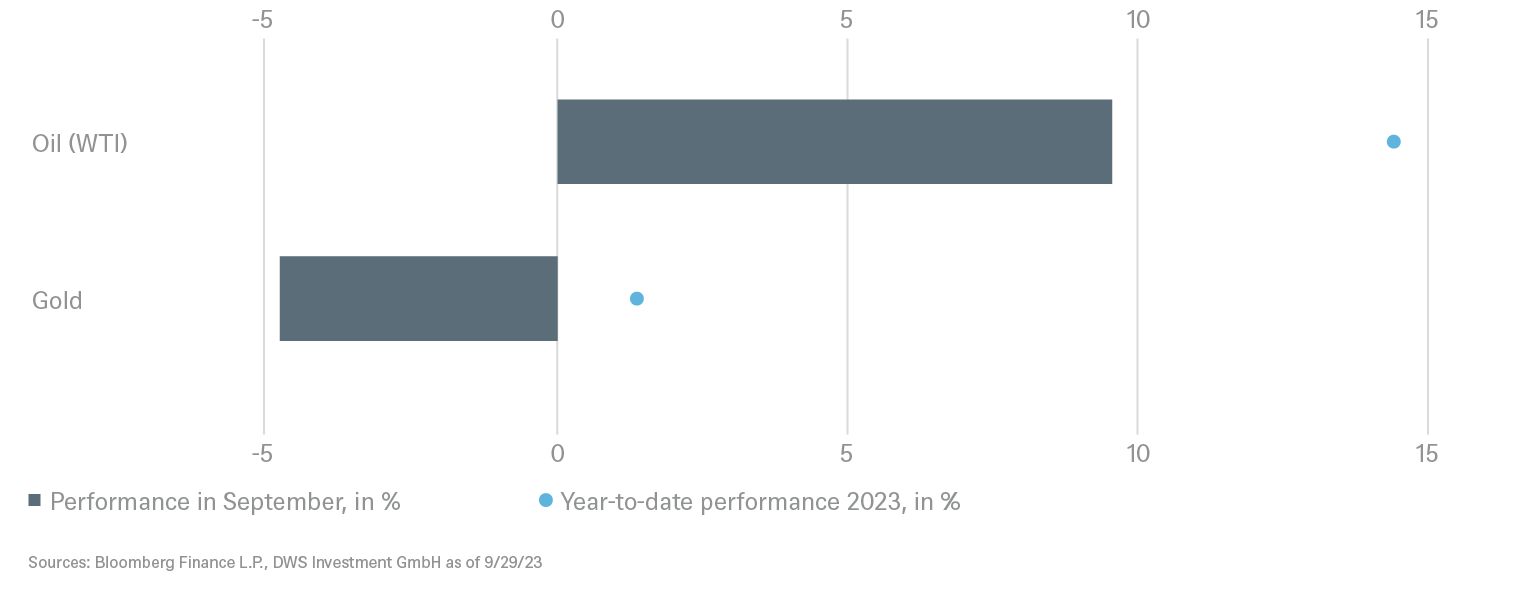

Gold

In the near-term headwinds abound for gold. The continuation of inflation concerns in U.S. has boosted both real yields and the U.S. dollar – both of them negatives for gold. Further outflows have been seen in physical ETFs. Fresh support for gold, on which we remain strategically positive, would require a deteriorating economic outlook or stabilization in U.S. yields.

Oil

The main bullish drivers, Saudi and Russian output constraints, are still in place and there are no clear signs of demand destruction that would offset their efforts to push up prices. This is putting some kind of a floor under the crude price in the near term. However, the stronger U.S. dollar and elevated gasoline prices are capable of neutralizing the bullish rally as the weaker demand of the winter approaches.

Infrastructure (listed)

Fundamental headwinds are abating for Americas Midstream Energy, providing a set-up for potential continued outperformance. Americas Utilities and Towers appear stable but high interest rates remain a large headwind, leading to a neutral recommendation.

Real estate (listed)

The near-term outlook remains somewhat clouded by slowing global growth and higher costs of capital. Nonetheless, healthy fundamentals are providing support across selected sectors. An end to the U.S. tightening cycle should see a key headwind abate, but not, if long term interest yields don’t follow Fed fund rates.

Various headwinds for gold while oil has rallied

Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 10/4/23

2.4 DWS High Conviction

Within equities we prefer Communication which offers growth at a reasonable valuation and Consumer Discretionary as consumption is being supported by robust labor markets, rising automotive volumes and still solid pricing.

We like convertible bonds as an alternative to straight bonds or equities. European convertibles are pricing in low volatility as a result of steady outflows from this segment, making them especially attractive. In our view, in these volatile times they also offer better downside protection than equities and good entry points into interesting sectors such as Tech, Biotech and consumer discretionary. We prefer adding convertible bonds with positive carry and attractive convexity, especially in EMEA, where valuations are cheap; and we have a preference for investment grade over high yield and developed markets over emerging markets, not least because of better market liquidity.

3 / Past performance of major financial assets

Total return of major financial assets year-to-date and past month

Past performance is not indicative of future returns.

Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 9/29/23

4 / Tactical and strategic signals

The following exhibit depicts our short-term and long-term positioning.

4.1 Fixed Income

Rates |

1 to 3 months |

until Sept 2024 |

|---|---|---|

| U.S. Treasuries (2-year) | ||

| U.S. Treasuries (10-year) | ||

| U.S. Treasuries (30-year) | ||

| German Bunds (2-year) | ||

| German Bunds (10-year) | ||

| German Bunds (30-year) | ||

| UK Gilts (10-year) | ||

| Japanese government bonds (2-year) | ||

| Japanese government bonds (10-year) |

Spreads |

1 to 3 months |

until Sept 2024 |

|---|---|---|

| Spain (10-year)[1] | ||

| Italy (10-year)[1] | ||

| U.S. investment grade | ||

| U.S. high yield | ||

| Euro investment grade[1] | ||

| Euro high yield[1] | ||

| Asia credit | ||

| Emerging-market credit | ||

| Emerging-market sovereigns |

Securitized / specialties |

1 to 3 months |

until Sept 2024 |

|---|---|---|

| Covered bonds[1] | ||

| U.S. municipal bonds | ||

| U.S. mortgage-backed securities |

Currencies |

1 to 3 months |

until Sept 2024 |

|---|---|---|

| EUR vs. USD | ||

| USD vs. JPY | ||

| EUR vs. JPY | ||

| EUR vs. GBP | ||

| GBP vs. USD | ||

| USD vs. CNY |

4.2 Equity

Regions |

1 to 3 months[2] |

until Sept 2024 |

|---|---|---|

| United States[3] | ||

| Europe[4] | ||

| Eurozone[5] | ||

| Germany[6] | ||

| Switzerland[7] | ||

| United Kingdom (UK)[8] | ||

| Emerging markets[9] | ||

| Asia ex Japan[10] | ||

| Japan[11] |

Style |

1 to 3 months |

|

|---|---|---|

| U.S. small caps[22] | ||

| European small caps[23] |

4.4 Legend

Tactical view (1 to 3 months)

The focus of our tactical view for fixed income is on trends in bond prices.Positive view

Neutral view

Negative view

Strategic view until September 2024

- The focus of our strategic view for sovereign bonds is on bond prices.

- For corporates, securitized/specialties and emerging-market bonds in U.S. dollars, the signals depict the option-adjusted spread over U.S. Treasuries. For bonds denominated in euros, the illustration depicts the spread in comparison with German Bunds. Both spread and sovereign-bond-yield trends influence the bond value. For investors seeking to profit only from spread trends, a hedge against changing interest rates may be a consideration.

- The colors illustrate the return opportunities for long-only investors.

Limited return opportunity as well as downside risk

Negative return potential for long-only investors