- Home »

- Insights »

- Asset Class Perspectives »

- Breaking Down US Industrial Stock and the Record Construction Pipeline

The industrial property sector has had an extraordinary run in the past decade, exhibiting durable strength despite a few challenges along the way. After topping the NCREIF Property Index (NPI) in six of the seven years ending in 2020, the sector then posted all-time low vacancy rates and all-time high rental rate growth in 2021 and 2022, again providing outsized investor returns. The sector’s strong performance was fueled, in part by a one-billion square foot surge in logistics space demand in 2021 and 2022, amid Covid era lockdowns and our ‘do-everything’ from home lifestyles.

It appears we have emerged from the most extreme Pandemic-driven lifestyle impairments, but some aftershocks remain in place; inflation, elevated interest rates, a looming U.S. recession, and an outsized development pipeline that will come to fruition in coming quarters. It is likely that developers in the U.S. will deliver a record level of industrial space in 2023, potentially topping 1989’s 2.9% of total stock. This new competitive supply may be cause for concern in a few market locations but is not expected to disrupt overall market balance. We expect that the market will work through this new supply in relatively good form. We believe the U.S. is underserved by modern logistics facilities and logistics providers will continue to respond to the structural shift to online shopping and rapid home fulfillment, demanding new stock. Given the age and functionality of existing stock, there are efficiency gains yet to be captured.

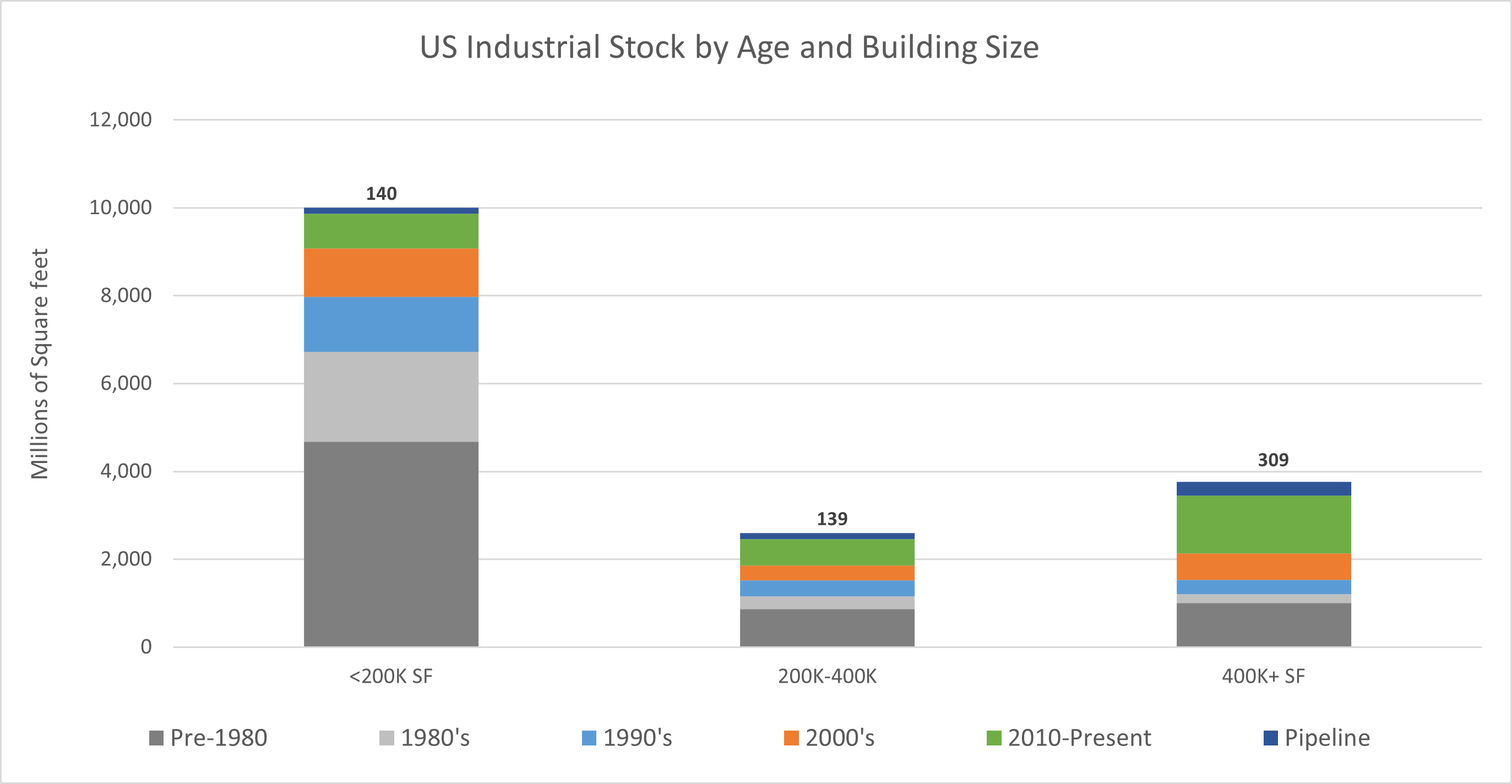

Even after two decades of healthy development activity, modern stock remains scarce in many of our major population centers. U.S. industrial stock has two dominant structural features, the buildings are old (70% built prior to 2000), and most stock resides in smaller buildings. In our view these features represent constraints on growth and supply chain efficiency. Much of the growth in logistics facilities since 2010 has occurred in buildings larger than 400,000 square feet. They offer benefits of scale and cost efficiency as local, regional, and national facilities. Viewed from this perspective, the looming development pipeline (dark blue) appears to be more of a complement to existing stock, and potentially as replacement stock, than a competitive threat. While this new supply could create some local imbalances in 2024, ultimately, over the longer-term, we view it as needed logistics infrastructure.

Source: CBRE-EA, CoStar and DWS, as of September 2023.