- Home »

- Insights »

- CIO View »

- Investment Traffic Lights »

- Investment Traffic Lights

- August started out quite hopefully but there was an abrupt change of mood in the middle of the month.

- The main cause is likely to have been renewed sharp rises in inflation expectations and in what the market expects from the central banks.

- For the time being there is little reason to hope that the rest of the year will be less turbulent.

1 / Market overview

A sunny first half of August….

These summer holidays were probably not very relaxing for most investors – unless they departed in mid-August and didn’t see the market data thereafter. It was another month of two halves. It started quite hopefully, with good U.S. labor market data coupled with a slight decline in inflation and a sharp fall in oil prices. Perhaps, the market thought, the Fed won’t have to tighten so much after all. Bond yields rose only moderately after their sharp decline in previous months, stock market volatility declined, and stocks moved up. But, as many had suspected, it turned out to be only a bear market rally. Stock prices started to fall again in the middle of the month while bond yields could not rise fast enough. Two-year Bund yields rose by almost 100 basis points in August, contributing to Europe's worst month for bonds in decades[1]. European inflation figures, skyrocketing gas and electricity prices, meagre purchasing managers' indices, continually disappointing news from China, and, above all, increasingly loud noises from troubled central bankers shifted the mood. The speeches by Fed chair Jerome Powell in Jackson Hole (25-27 August) and ECB Executive Board member Isabel Schnabel were the final straw, depriving investors of hope that the central banks might stop hiking interest rates earlier than at first expected in the face of a buckling economy. The month-end flash inflation figures for the EU for August did not help either. At 9.1%, they climbed to a new record high, with almost half of the EU member states reporting double-digit inflation figures in August. And the peak has probably not yet been reached.

...was followed by a crash in the second half

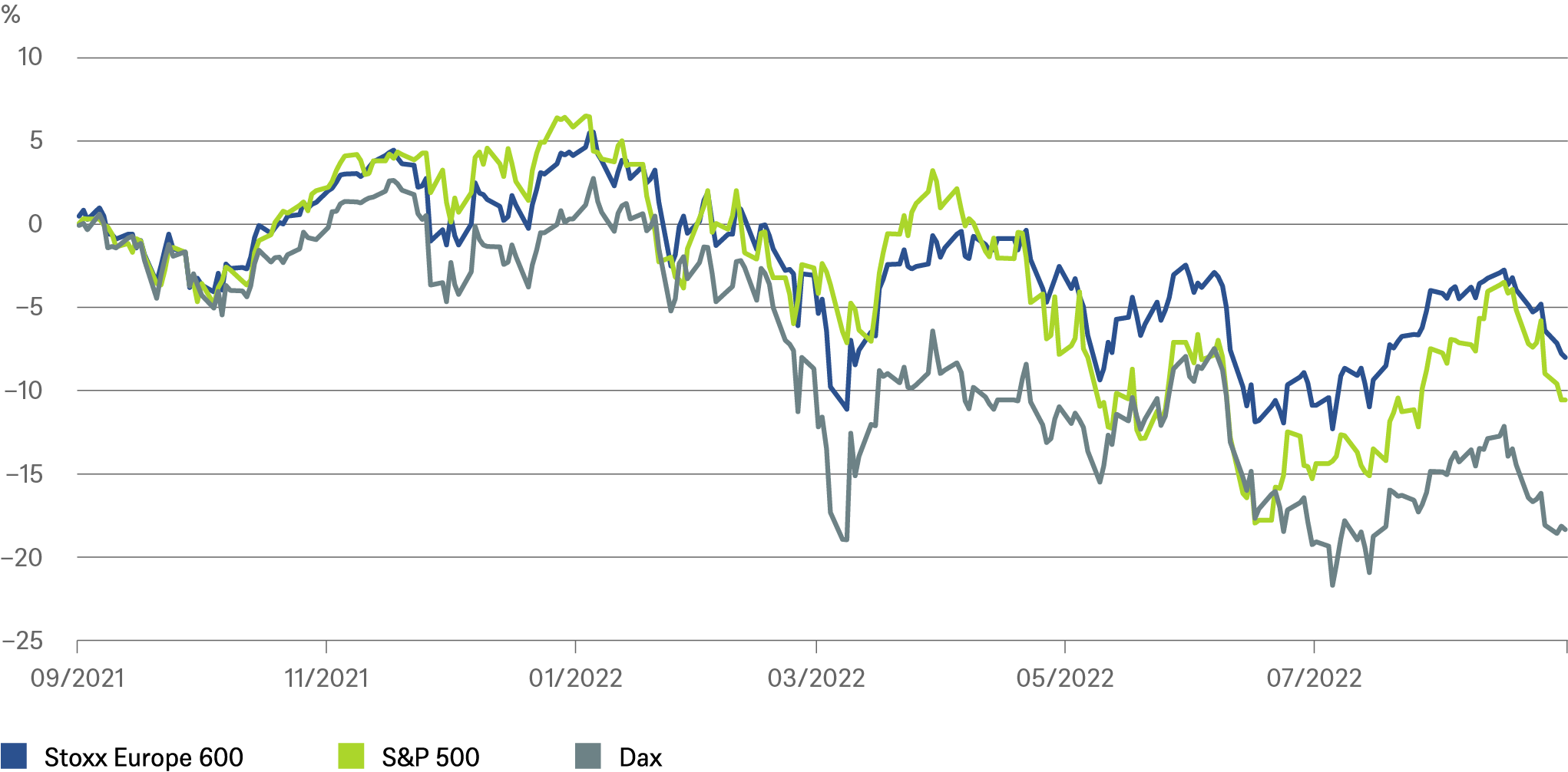

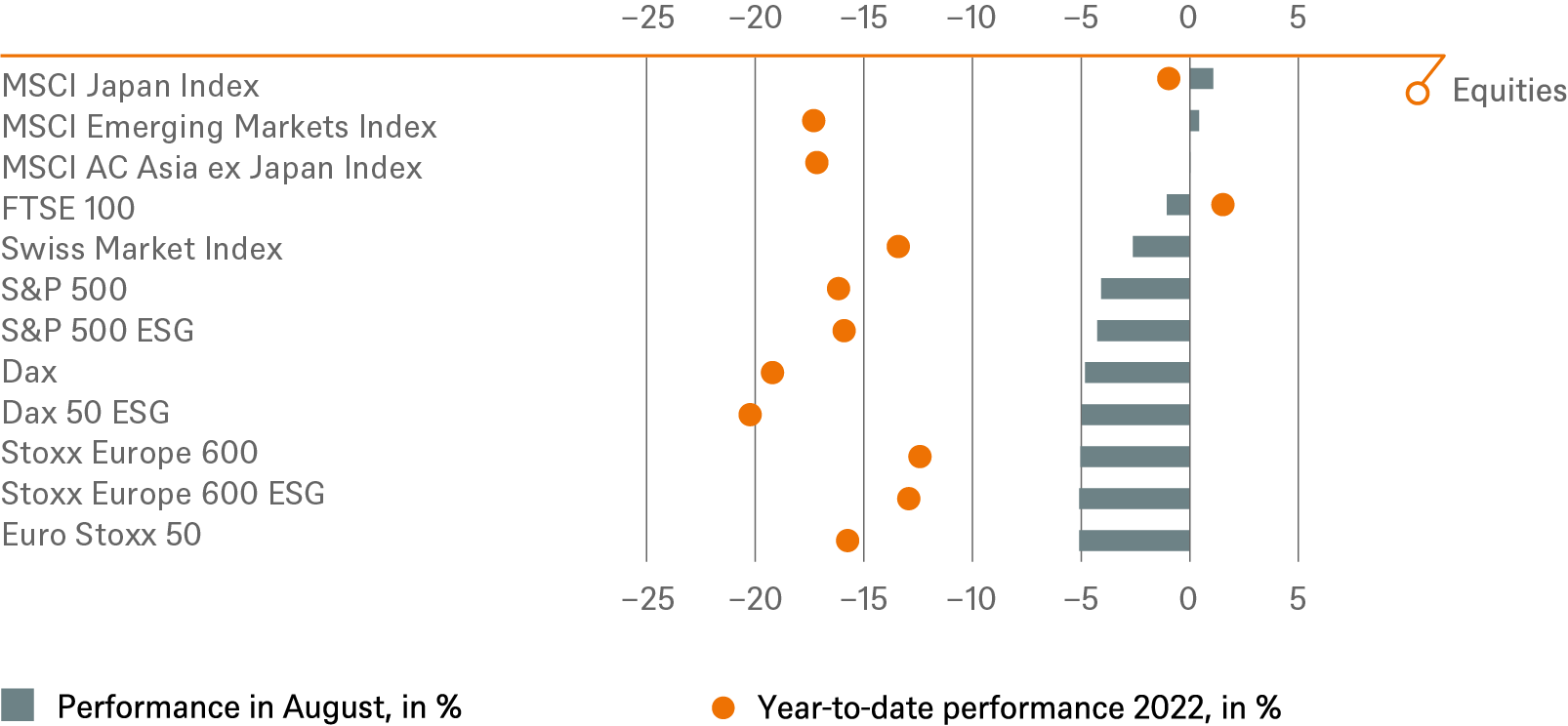

On the financial markets, this meant a big drop for most stock markets – the Euro Stoxx 600, for example, lost 5% and the MSCI AC World more than 7% within eleven trading days.[2] Only some emerging markets escaped, which meant that the MSCI EM index even managed a small gain. In terms of sectors, internet and technology stocks fell sharply again after a good start to the month, while energy stocks outperformed the market after a two-month period of weakness and were the only sector to post a gain.

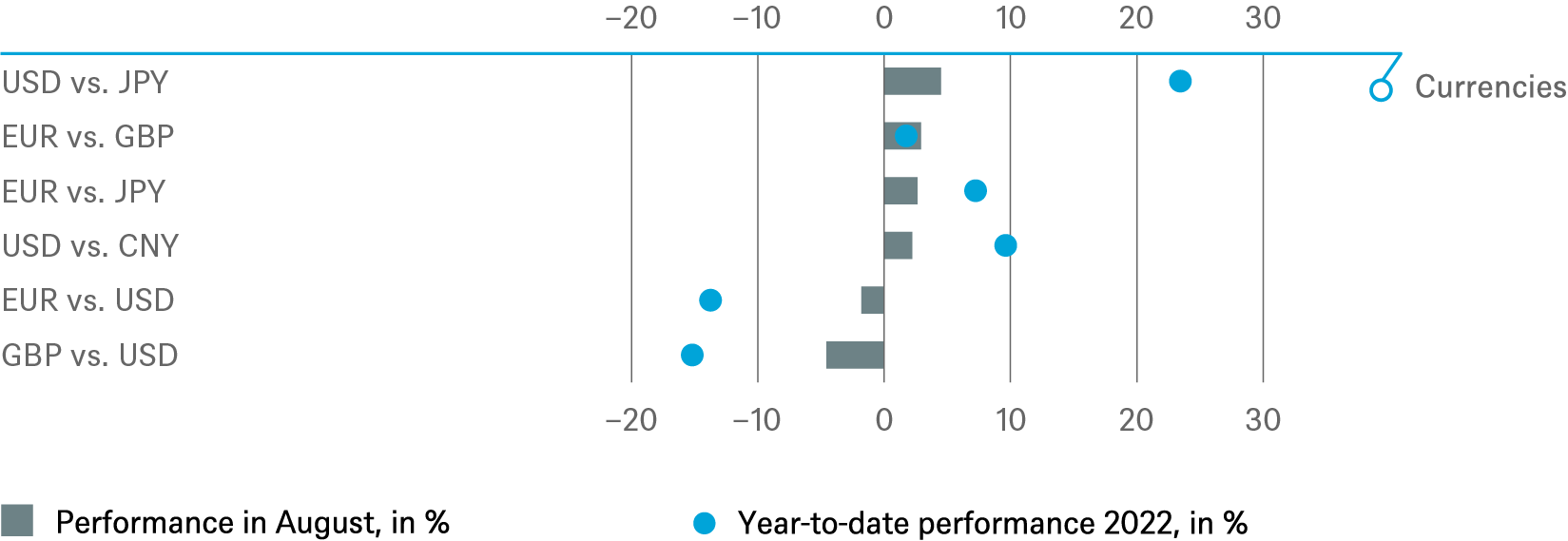

Bonds, also after a two-month recovery, retreated as yields listened to the central bankers. The currency market also saw big August moves. The euro fell below parity against the dollar for the first time since 2002, while the yen and the British pound fell to their lowest levels against the dollar in several decades. The dollar index (DXY) was therefore able to continue its upward trend, having already gained a whopping 14% this year.

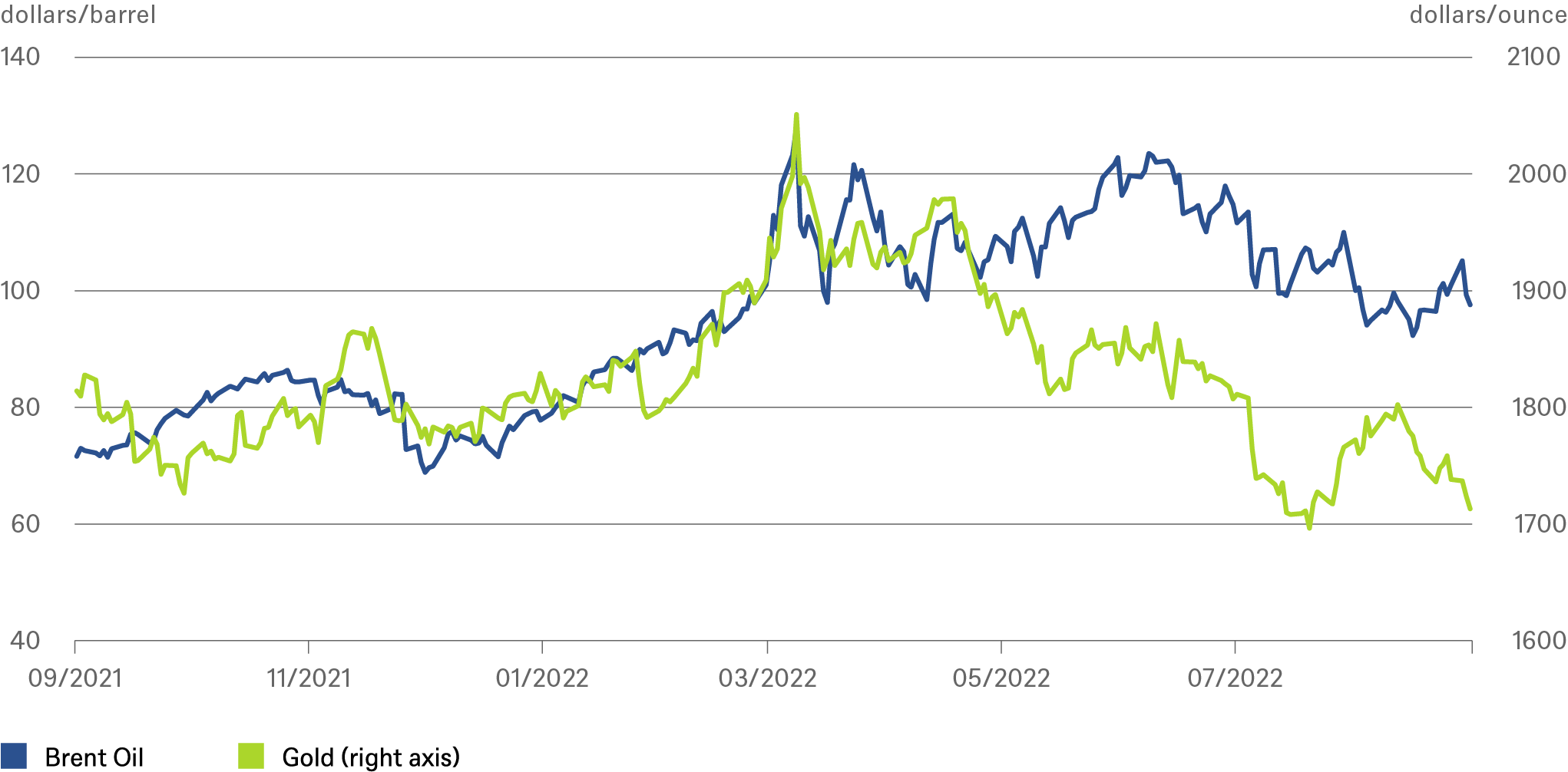

The turbulence in capital markets was almost matched by political drama. The most serious new scare for investors was probably the rising tension around Taiwan. A further escalation here would leave the world facing still more serious supply chain problems. The energy problems to be faced this autumn and winter are already grave. Amid all this geopolitical tension, it is perhaps surprising that gold lost ground, dropping by more than 3%. But real U.S. yields[3] rose from 0.1 to 0.7 percent in August, which does not favor gold.

2 / Outlook and changes

This being the quarterly edition of our Investment Traffic Lights, we’ll concentrate on the strategic rather than the tactical outlook for the different asset classes, as established in our strategy CIO Day meeting on August 18.

Over the next 12 months we expect high inflation to push major economies into a mild recession. While nominal spending has proved resilient so far, real spending has stalled already. We have a clear conviction that central banks will focus on fighting inflation even at the cost of an economic downturn. In Europe, the risk of a further deterioration in energy supply remains and therefore the peak in inflation might still lie ahead, while in the U.S. it looks like the annual inflation rate has already peaked. Nevertheless, we believe inflation will likely remain sticky given upward pressure in wages, energy and food prices.

We therefore expect the Fed to hike rates to a peak rate of 3.50-3.75% by Q3 2023 and to stand firm on rates unless labor markets show a clear sign of softening (which is not our base case). Inflationary pressures and the risk that inflation expectations will become de-anchored are expected to force the ECB to raise interest rates more aggressively than markets are currently expecting to a deposit rate of at least 2% by September 2023. In the Far East we consider the risk of a sudden turnaround of its dovish stance by the Bank of Japan (BoJ) to be low. In China, the lingering pandemic and restrictive measures still pose a risk to economic growth and supply chains. A further escalation of the Taiwan dispute, while currently unlikely, would present an incalculable risk to our growth forecasts. For global equity markets all this implies limited upside. But then again, they retain their relative attractiveness given that the continuing high inflation environment is making cash and most bonds unattractive.

2.1 Fixed Income

Jerome Powell’s speech in Jackson Hole in August was not, in our view, a game changer. But it further reduced the risk that the Fed might prove quick to pivot in the face of deteriorating economic momentum. ECB executive board member Isabel Schnabel also took the opportunity at Jackson Hole to stress that fighting inflation has become the paramount goal of the ECB for the time being. Markets had begun to shift at the beginning of August, well before the Jackson Hole meeting. Having been too optimistic in June and July, expecting the Fed to be quick to soften its stance, markets started to reprice bonds downwards, as we had forecast. But we remain less optimistic on bonds than the market as a whole. We don’t believe the Fed will start cutting rates again in the second half of 2023.

Sovereign bonds

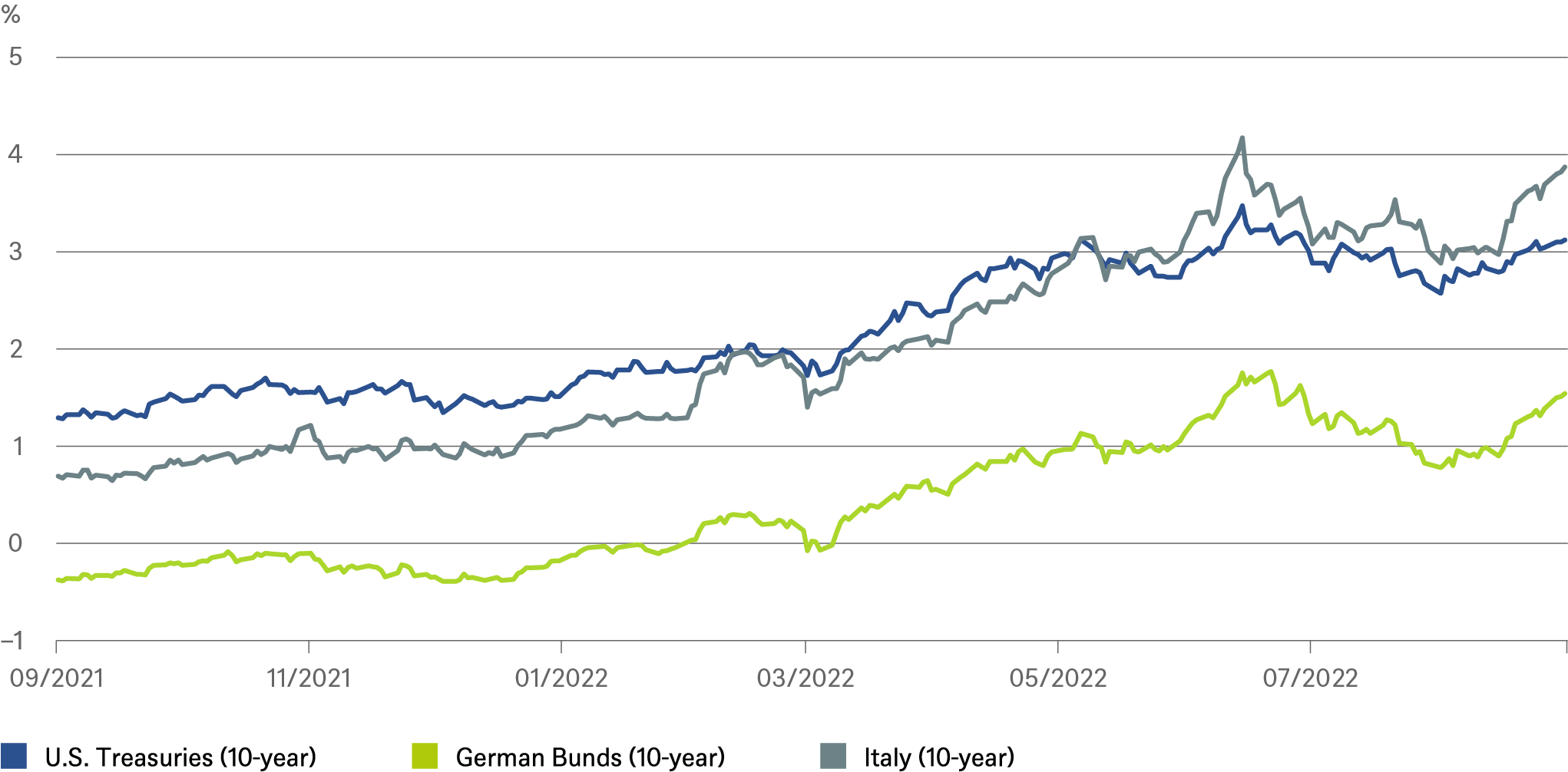

We believe that in the U.S. inflation may remain above the Fed’s 2% target for a longer period of time. Along with the ongoing mild impact of Quantitative Tightening, we expect some upward pressure on the yields of longer maturity Treasuries. We also expect the yield curve to move away from inversion and normalize, with a gentle upward slope. We expect 10-year real yields[4] will settle at around 50 basis points. This is also an important input for our equity targets, as we believe real yields are the best proxy for opportunity costs for equities. We expect Treasury yields to peak at approximately 3.50/3.75%, well above what we believe to be the inflation neutral rate of 2.75%. Increases in 2-year U.S. Treasury yields are likely to be limited by expectations of monetary policy easing in 2024. Thus, we expect an inverted curve at the very short end and moderate steepening on a 12-month horizon. The risk is of a recession without a concurrent reduction in inflation -- stagflation – which would leave the Fed in a dilemma.

In Europe we remain cautious on Bunds and expect higher yields than markets are pricing in, especially for shorter maturities, although the market has approached our targets swiftly in the past two weeks. We expect the ECB to front-load hikes and the curve should therefore flatten as the growth outlook is weak. We expect to see 2-year Bund yields at 1.65 %, 10-year at 1.75% and 3- year at 1.85% in one year’s time. For the EU periphery we believe the new Transmission Protection Instrument (TPI) should help to restrict rises in the spreads of Italian and Spanish government bonds, counteracting the impact of the resignation of Italy’s PM, Mario Draghi, and a more cautious growth outlook. We expect no significant widening from here.

Sovereign yields are on the up again

Source: Bloomberg Finance L.P., DWS Investment GmbH as of 8/31/22

Currencies – EUR vs. USD forecast 1.05

We believe that the global economic slowdown and energy crisis will keep the Euro under pressure. However, with the nominal yield differential the dollar is likely to play a more important role again going forward. As we believe we may have seen the peak in the spread differential, there should be some support for the Euro going forward, leading to our new forecast of EURUSD 1.05 in 12 months’ time. We see a slight recovery in the British Pound to GBPUSD 1.20 and an even slighter further weakening of the Renminbi (USDCNY: 6.95) versus the Dollar on a 12-months horizon.

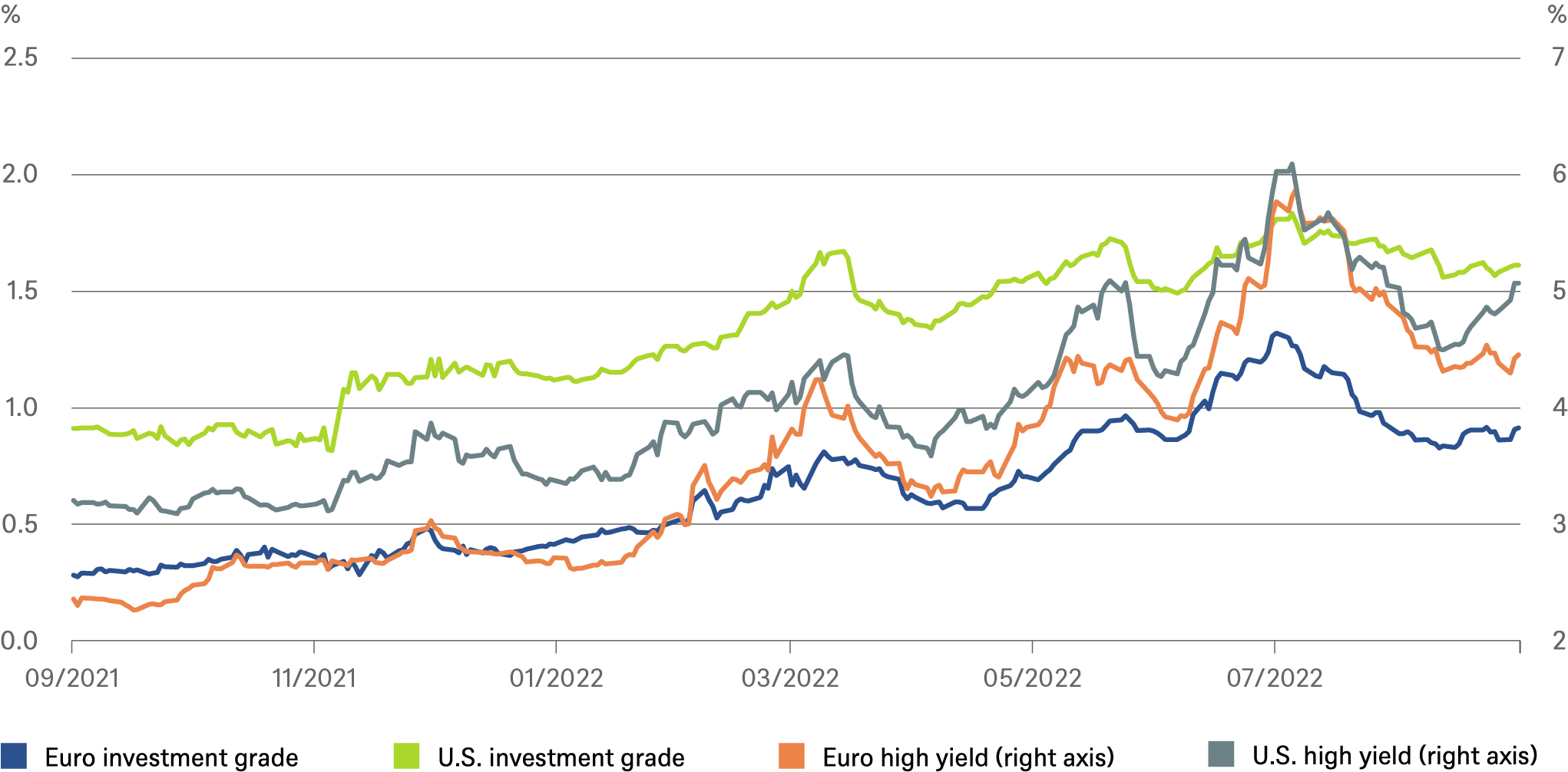

Credit

We see worsening structural problems impacting the U.S. Investment Grade (IG) market for the remainder of the year, including persistent inflation, geopolitical tensions, and more aggressive Central Bank policy -- both the policy rate and balance sheet reduction. Credit fundamentals remain relatively strong at this part of the cycle, as corporate treasurers had time to prepare for any impending storm. We see slightly increasing spreads (up to 150 basis points) over 12 months. For High Yields (HY) our new index spread forecast is 500 basis points. With the looming possibility of a recession, lower quality cyclical companies may see some credit strains. Fundamentals are relatively good for this part of the cycle, and we expect defaults to rise to a still historically moderate 3% rate. In the Eurozone, our spread forecast for IG remains unchanged. The outlook is becoming more positive after the massive sell off in the first half. We believe valuations reflect the expected slowdown. A less volatile market environment and a more moderate increase in risk-free rates should be supportive as well. For European High Yields we are also becoming more constructive as valuations have become more attractive. However, in the short term we expect volatility to stay high and spreads to remain under pressure due to the monetary and geopolitical uncertainty.

Most DM corporate bond markets have not yet felt the pain

Source: Bloomberg Finance L.P., DWS Investment GmbH as of 8/31/22

Emerging Markets

The global situation remains challenging, with a range of uncertainties persisting. Many commodity exporters have proven resilient. Strong credit fundamentals in the corporate space as well as robust cash balances and a low level of leverage should help provide a cushion against a potential slowdown. We prefer HY over IG as we believe the materially higher interest yield should more than compensate for expected credit losses.

2.2 Equities

Global equity markets have been on quite a rollercoaster this year. The short summer rally was triggered by market hopes that the Fed might stop hiking at around 3.75% in early 2023. Since early August, however, the market has again become more cautious about the inflation and growth outlook. We forecast inflation to remain stubbornly high – well above the ECB’s 2% target rate for the coming years. Therefore, market hopes for rate reductions in 2023 will be disappointed, in our view. On the contrary, we believe that the full impact of the Fed’s policy tightening has yet to hit the economy and corporate earnings and that a modest U.S. recession in H1 2023 will be required to tame consumer prices.

The rapid rise in prices has created some “nominal illusion” in macroeconomic and company data. We are forecasting an earnings increase of zero to 5% over the next 12 months. This might appear inconsistent with history as economic downturns have typically produced double-digit earnings per share (EPS) declines. In real terms, however, EPS should indeed decline over the next 12 months, given the poor outlook for growth.

In addition, we believe commodity and energy prices are likely to remain elevated for an extended period due to the combination of climate change, underinvestment in new capacity and rising geopolitical tensions. As a result, goods manufacturing has become more expensive, triggering a process in which relative prices are changing throughout the global economy. The shift in corporate margins and consumer preferences is far from complete and creates additional uncertainty for our earnings estimates.

Our updated September 2023 index targets (S&P 500: 4,200 / DAX 14,400) show very little return potential from current levels. Near-term, we see downside-risk for the S&P 500; it would be highly unusual for the market to bottom while the Fed is still hiking. Our market models show that volatility and real rates have already fallen back to normal levels. We therefore continue to target a 18x price/earnings ratio (based on the prior twelve month’ earnings) for the S&P 500 – close to where the market is currently trading. While the looming U.S. recession might be short-lived, we believe it is still too early to look through it. We fear that the following recovery might be weak and generate only limited earnings growth, given the already high level of profit margins.

As our 12-month house forecast for the EUR/USD moves to 1.05, we have adjusted index targets to adjust for the respective currency impacts.

We notice that the DAX and Stoxx600 continue to trade at record discounts to the U.S. market, despite considerable progress in Europe preparing for reduced gas supply from Russia. Valuations seem attractive but we do not want to become too bullish on European equities as we believe higher energy prices, rising interest rates and falling real wages are likely to harm the macro environment over the winter months.

In Japan the weakening yen has become the key market driver. Not until we see the return of domestic investors to the Japanese market and better growth in China will we take a more constructive view.

In China we are still concerned about the full impact of the housing crisis and see no clear way out of the zero-Covid policy. Flaring U.S.-China tensions pose a long-term question over how western economies can reduce their dependence on trade with China.

In sectors we make no changes; we remain overweight on healthcare and energy and underweight on real estate.

A month of two halves for equities

Source: Bloomberg Finance L.P., DWS Investment GmbH as of 8/31/22

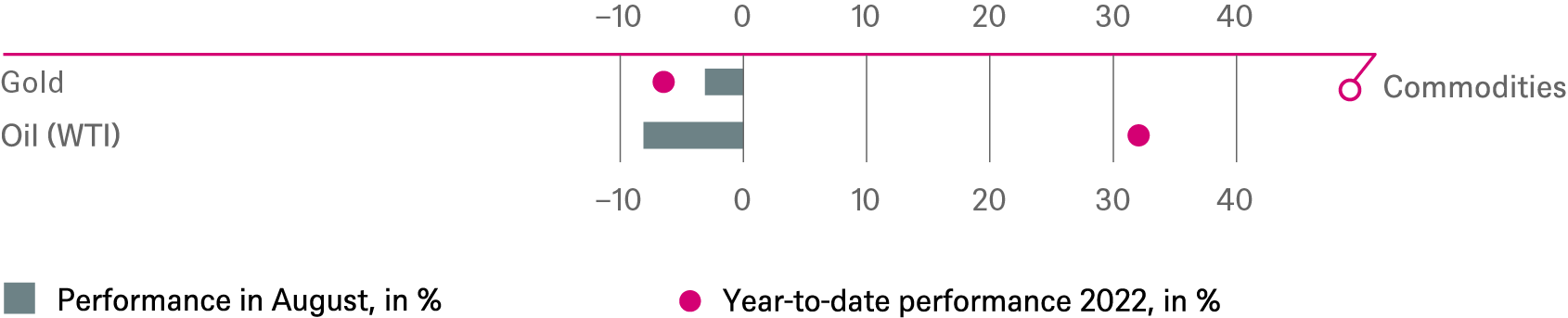

2.3 Alternatives

For gold we expect a price of USD 1,875 by Q3 2023, as demand should rise again over the next twelve months amid a more stable rate environment and with the Fed focusing on both aspects of its dual mandate. High geopolitical risks should also be supportive. Our forecast for Brent is USD 100 per barrel, implying a rather stable price from here on. Muted global growth should prevent a significant price increase. While interest rates and recession fears pose a risk to many alternative asset classes, the fundamentals remain broadly sound. We continue to prefer Infrastructure over real estate.

Gold has not been able to profit from geopolitical turmoil but suffered from increasing real yields

Source: Bloomberg Finance L.P., DWS Investment GmbH as of 8/31/22

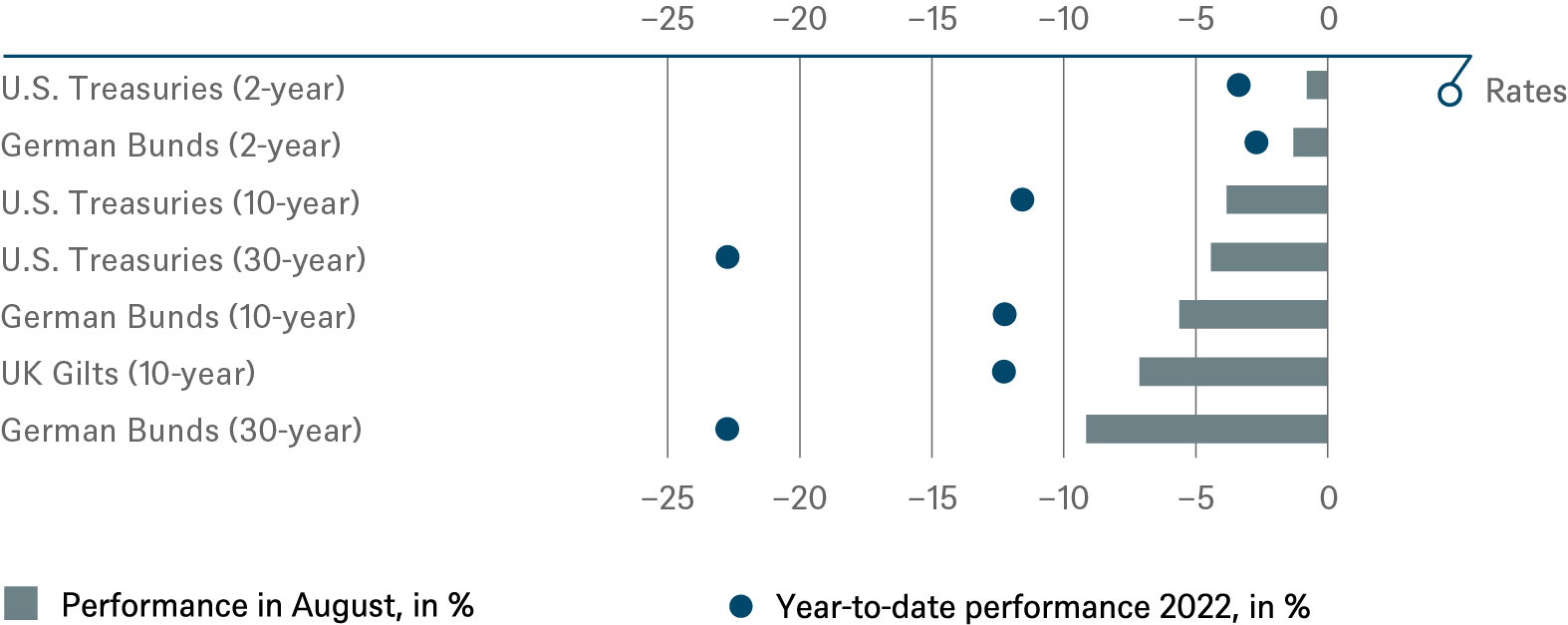

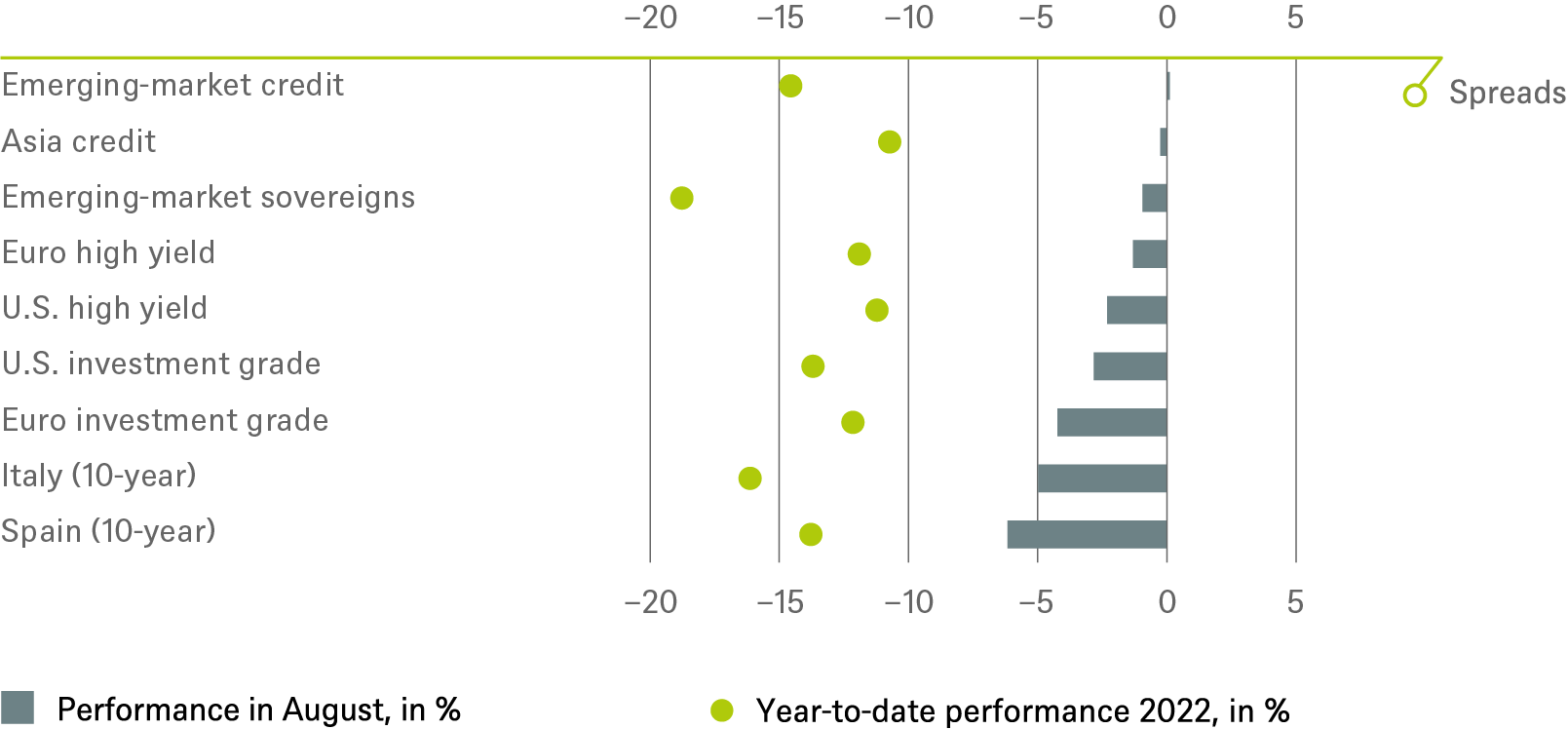

3 / Past performance of major financial assets

Total return of major financial assets year-to-date and past month

Past performance is not indicative of future returns.

Sources: Bloomberg Finance L.P. and DWS Investment GmbH as of 8/31/22

4 / Tactical and strategic signals

The following exhibit depicts our short-term and long-term positioning.

4.1 Fixed Income

Rates |

1 to 3 months |

until Sep 2023 |

|---|---|---|

| U.S. Treasuries (2-year) | ||

| U.S. Treasuries (10-year) | ||

| U.S. Treasuries (30-year) | ||

| German Bunds (2-year) | ||

| German Bunds (10-year) | ||

| German Bunds (30-year) | ||

| UK Gilts (10-year) | ||

| Japanese government bonds (2-year) | ||

| Japanese government bonds (10-year) |

Spreads |

1 to 3 months |

until Sep 2023 |

|---|---|---|

| Spain (10-year)[5] | ||

| Italy (10-year)[5] | ||

| U.S. investment grade | ||

| U.S. high yield | ||

| Euro investment grade[5] | ||

| Euro high yield[5] | ||

| Asia credit | ||

| Emerging-market credit | ||

| Emerging-market sovereigns |

Securitized / specialties |

1 to 3 months |

until Sep 2023 |

|---|---|---|

| Covered bonds[5] | ||

| U.S. municipal bonds | ||

| U.S. mortgage-backed securities |

Currencies |

||

|---|---|---|

| EUR vs. USD | ||

| USD vs. JPY | ||

| EUR vs. JPY | ||

| EUR vs. GBP | ||

| GBP vs. USD | ||

| USD vs. CNY |

4.2 Equity

Regions |

1 to 3 months[6] |

until Sep 2023 |

|---|---|---|

| United States[7] | ||

| Europe[8] | ||

| Eurozone[9] | ||

| Germany[10] | ||

| Switzerland[11] | ||

| United Kingdom (UK)[12] | ||

| Emerging markets[13] | ||

| Asia ex Japan[14] | ||

| Japan[15] |

Style |

1 to 3 months |

|

|---|---|---|

| U.S. small caps[26] | ||

| European small caps[27] |

4.4 Legend

Tactical view (1 to 3 months)

- The focus of our tactical view for fixed income is on trends in bond prices.

- Positive view

- Neutral view

- Negative view

Strategic view until Sep 2023

- The focus of our strategic view for sovereign bonds is on bond prices.

- For corporates, securitized/specialties and emerging-market bonds in U.S. dollars, the signals depict the option-adjusted spread over U.S. Treasuries. For bonds denominated in euros, the illustration depicts the spread in comparison with German Bunds. Both spread and sovereign-bond-yield trends influence the bond value. For investors seeking to profit only from spread trends, a hedge against changing interest rates may be a consideration.

- The colors illustrate the return opportunities for long-only investors.

- Positive return potential for long-only investors

- Limited return opportunity as well as downside risk

- Negative return potential for long-only investors