- Home »

- Insights »

- Asset Class Perspectives »

- Residential: 2024 Outlook

While there has been a resurgence in renter demand to levels consistent with strong pre-pandemic years, the nation’s apartment market is still expected to see rising vacancies as it continues moderating into the close of 2023. Though there is still a lot of leasing demand, it’s just not enough to keep pace with the country’s largest apartment construction surge in 30 plus years.[1] Nationally, the vacancy rate among professionally managed apartments tracked by CBRE-EA rose to 5.1% in 3Q 2023, up from 3.9% a year earlier and in line with its long-term average. The overall average asking rent was essentially flat in September year-over-year, decelerating from the 6.9% and 13.6% growth posted in 2022 and 2021, respectively.[2] Prospects for weak rent growth are likely to carry into 2024 due largely to supply.

The strong performance of apartments coming out of the pandemic, coupled with the long-term need for housing, sparked a major development cycle. That said, we now anticipate a significant pullback in construction from current record highs. Our thesis relies on key forward-looking economic indicators for construction spending. These leading indicators include: the Fed’s Senior Loan Officer Opinion Survey (tightening lending standards), American Institute of Architects’ Architecture Billings Index (declining billings) and the National Association of Home Builders/Wells Fargo Housing Market Index (falling builder confidence). As a result, new multi-family construction starts were down 41% in August year-over-year to the lowest level since June 2020 during the height of the pandemic.[3]

While demographic growth will create a need for new housing, there is some evidence of a current shortage of housing as the construction market was slow to return after the 2008 Global Financial Crisis. Between 2015 and 2021, the average rate of household formation was 1.53 million households per year, while the average rate of housing starts was 889,000 homes per year.[4] Potential homebuyers are currently not finding much on the market with the available inventory of existing homes for sale in October representing a 3.6-month supply at the current sales pace – a six-month supply is considered a balanced market.[5] Despite an uncertain economic outlook, low supply will likely keep home price declines minimal in 2024.

That effect on limiting housing supply is amplified by another trend: Builders no longer are constructing the types of sub-1,400-square-foot homes that used to make up the starter home inventory, with fewer affordable entry points to homeownership for younger households.[6] In October, first-time homebuyers had a median age of 35 – up from 31 in 2013 and 29 in 1981.[7] The inability of the owner-occupied housing market to provide enough accessible, quality housing options supports sustained renter demand.

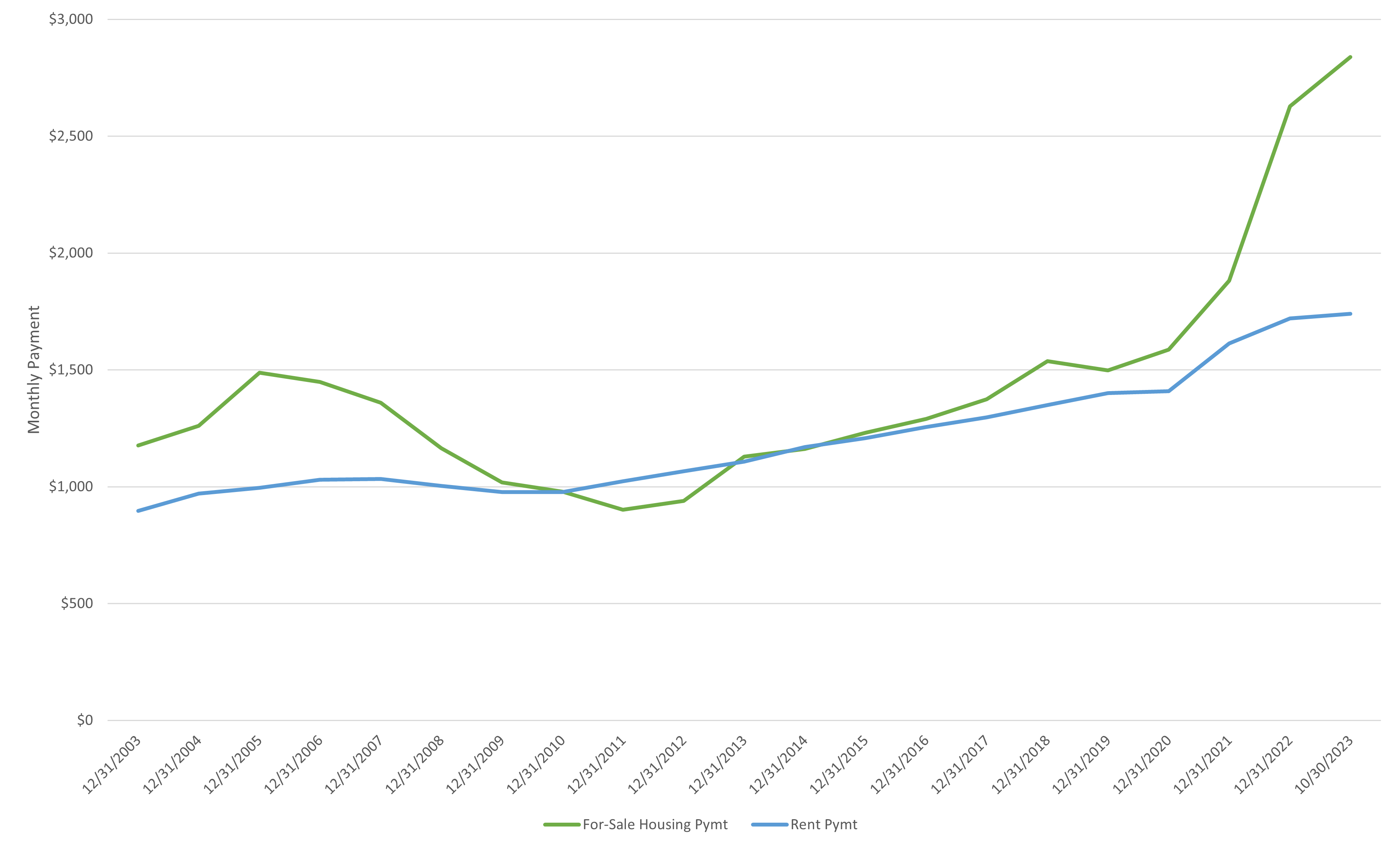

Tight supply is keeping pressure under home prices. The median price of an existing home sold in October was $391,800, an increase of 3.4% from a year ago.[8] While housing prices have surged, inflation and Fed hikes have pushed mortgage rates to 20-year highs.[9] Consequently, housing affordability keeps breaking records (in a bad way). Today, a typical home buyer spends 46% of their income on housing – the norm is 32%.[10] Keep in mind that the monthly housing payment on an existing median-priced home has risen from about $1,800 in October 2021 to about $2,800 in October 2023 – an increase of over 55%, or $1,000 per month.[11] By comparison, the average monthly apartment rent has only risen by 9.1% during that same two-year span, an increase of just $146 per month.[12]

The affordability spread between renting an apartment and buying a home grew to $1,099 per month in October.[13] The current monthly asking rent of $1,741 is approximately 38% cheaper than the monthly payment of buying a home, a gap that has rarely, if ever, been higher, which should keep households in apartments (see Exhibit).[14]

There is concern that an economic downturn in early 2024 could reduce renter activity. At the same time, apartment demand is boosted by long term structural influences that are not likely to fade. Positive demographic trends, lifestyle preferences and better relative affordability should significantly boost the need for apartments. It is important to note that the forward construction pipeline is materially smaller than the number of units expected to deliver over the next 12-18 months.[15] This fact, combined with the affordability spread that favors apartment demand relative to single-family home purchases, should provide a favorable environment for rent growth in late 2024 and beyond.

Affordability Gap: For-sale housing cost vs. rent payment

Note: For-sale housing payment includes an assumed 20% down payment, prevailing interest rate, property taxes, insurance, & HOA Fees. Sources: Yardi-Matrix, Moody’s and DWS. As of November 2023.