DWS is one of the world's largest and longest tenured managers of Liquid Real Assets, with $30.5bn in total assets under management (as of 9/30/24). We invest in real estate securities, infrastructure securities, commodities, and a best-ideas strategy that tactically invests across the liquid real assets spectrum (including natural resources and TIPS).

While each asset class entails a different approach, diligent fundamental research is embedded into our investment process throughout the platform. Our tenured investment teams combine top-down and bottom-up approaches, leveraging the proven process of the broader platform, to create a truly unique asset allocation framework on behalf of our clients.

Overview

DWS is one of the largest managers in Liquid Real Assets $30.5bn in assets under management as of 9/30/2024. While most of the assets are invested in infrastructure and real estate securities, we also offer investment capabilities in other real assets and commodities, such as gold and precious metals.

Strengths

Experienced Team: More than 30 investment specialists that have long tenures both with the firm and in the industry.

Multi- Strategy & Global Approach: Strategic allocation and risk management is based on an investment process focusing on active stock selection through regional investment teams with a global top-down approach.

Customization: Different investment solutions via funds, individual mandates or sub-advisory agreements allow for individual preferences.

Investment process

Each asset class entails a specific approach, but all share a common aspect: active stock selection based in fundamental research. A large international portfolio management and analyst team, supported by an integrated research & strategy team, allows us to continually analyze the investment universe with accuracy. We also access the global resources of the Alternatives platform specialists who invest directly in real estate and infrastructure.

Portfolio construction is based on bottom-up selection for which we use our own methodology.

Why liquid real assets?

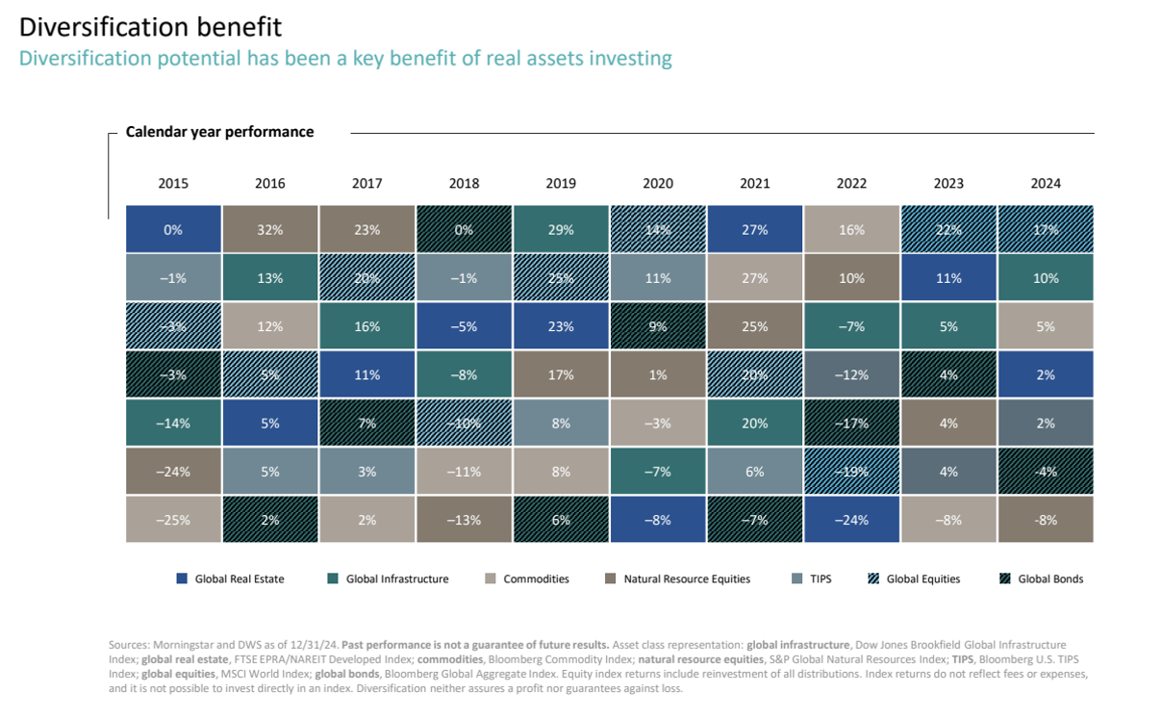

- Diversification potential: withstand changing economic/capital market conditions

- Competitive risk-return profile: Historically resilient through various market environments

- Inflation protection: has historically helped maintain purchasing power

Past performance is not indicative of future returns. There is no assurance that investment objectives can be achieved.

Real Estate Securities

We take a global perspective to research and decision making, with the goal of delivering attractive risk-adjusted returns.

- Fundamental real estate analysis and detailed bottom-up company valuation as well as careful consideration of economic and local property market dynamics

- A differentiated global portfolio construction process and dynamic pricing model

- Research by locally-based teams, a large in-house direct property business, and capital markets inputs

Infrastructure Securities

DWS’s dedicated team actively manages portfolios of securities in listed infrastructure companies around the world.

Our investment approach focuses on active stock selection, with an emphasis on underlying infrastructure fundamentals and stock valuation, and a global top-down overlay of strategic allocation and risk management. We focus on pure-play infrastructure companies where company value is largely derived from owning and operating assets that are essential for economic needs.

Commodities

The Commodity Investment team’s active approach is based on fundamental research, taking into account multiple earnings factors. Products and investment solutions are available in:

- Gold and precious metals

- Commodity stocks

- Commodity related securities

Real Assets

The Real Assets strategy is actively managed, seeking exposure to listed real estate, listed infrastructure, commodity futures and commodity equities, and Treasury Inflation Protected Securities (TIPS), and other asset classes that exhibit real asset characteristics.

- Custom Quadrant framework provides a macro process that is repeatable and actionable

- Tilt exposures within asset class as market conditions change

- Tactical Allocation amongst Real Assets classes is a function of subsector allocation decisions

- Leverages our expertise and experience in securities stock selection across several underlying real asset strategies