- Home »

- Insights »

- Asset Class Perspectives »

- Retail sector shines as the U.S. consumer remains resilient

The U.S. retail market enters 2024 with the tightest conditions on record. The vigorous post-pandemic rebound in retail fundamentals was aided by both supply- and demand-side factors, which should continue to play a role in solid sector performance in 2024 and beyond.

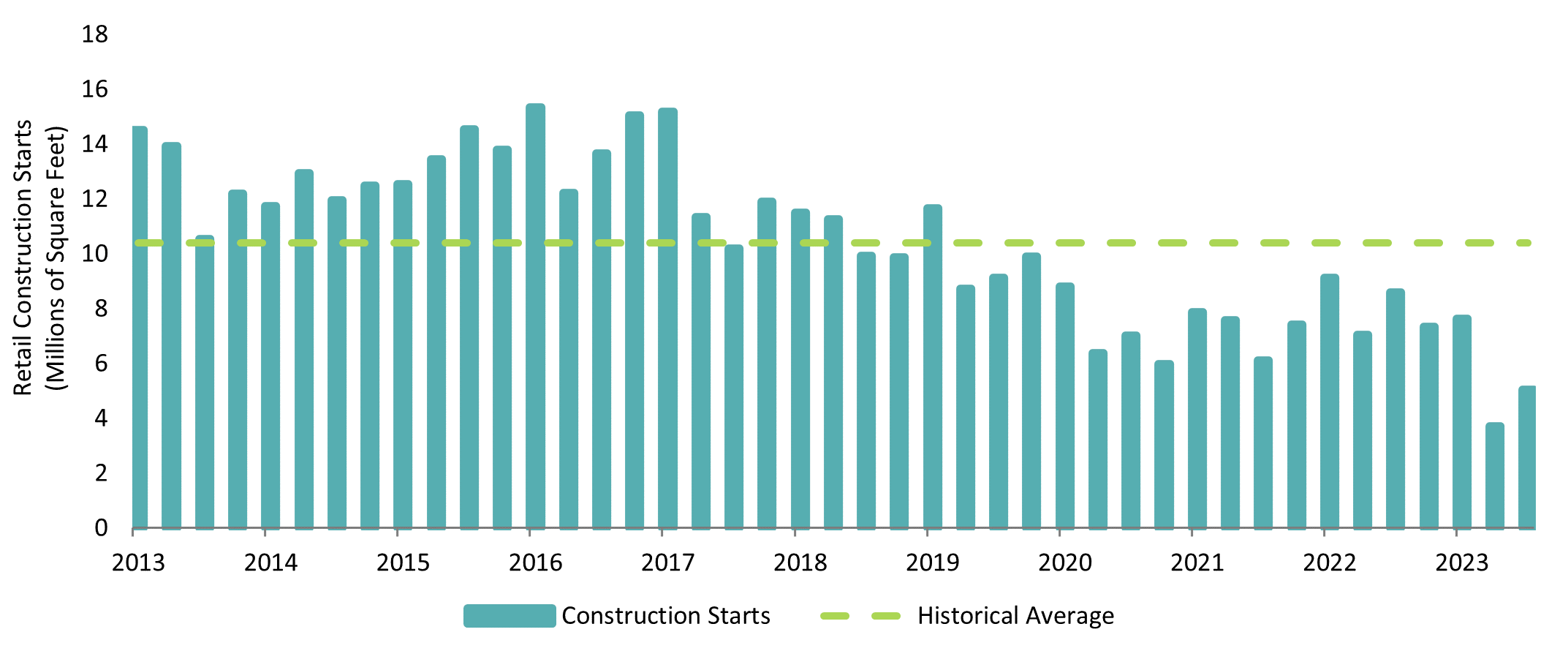

On the supply side, increased financing costs, coupled with reduced capital availability and still-elevated input costs, conspired to constrain retail construction. With construction starts continuing to fall and very little space remaining available in projects already underway, supply pressure is unlikely to be a problem near-term. On the demand side, steady new retail leasing activity, coupled with a long list of retailers announcing store opening plans, appears to position the sector for positive gains. In addition, plenty of demand exists in prime retail corridors, as retailers looking to expand have quickly snapped up spaces that have become available. Viewed in conjunction with the sparse supply outlook, the probability remains high that the U.S. retail space market will remain tight in the years ahead, a favorable outlook for retail investors.

Exhibit: Retail Construction Starts

Source: Costar and DWS. As of December 2023.

Consumer spending has been a key driver of economic and retail activity since the pandemic and, so far, has been resilient, especially given the headwinds that had been expected to weigh on consumers. These include the resumption of student loan interest payments and some indicators (such as loan delinquency rates) suggesting that household budgets are becoming stretched.[1] However, we believe the consumer spending will remain resilient, for two reasons.

First, a strong labor market continues to generate solid income flows. Although the labor market has gradually moderated since early-2023, it remains tight overall, supported by solid demand for workers. The tightness of the labor market is evidenced by the unemployment rate, which dropped to 3.7% in December 2023[2] despite a strong increase in labor-force participation, due to an even stronger increase in employment. The most recent labor market numbers imply a healthy tailwind to consumers from income, which should continue to support retail consumption.

Second, households have accumulated substantial wealth in recent years. The Fed's Q3 2023 Financial Accounts estimates show a $12.6trn gain in household wealth (inflation-adjusted) since the start of the pandemic.[3] In part, this increase reflects the excess savings that households accumulated during the pandemic, while they were benefiting from large fiscal transfers and were unable to spend.

To be sure, the lagged effects of higher interest rates may crimp consumer spending in 2024. However, we believe that structurally tight labor markets and robust household finances — together with low current vacancies and limited new construction — will continue to underpin healthy retail fundamentals for the foreseeable future.